Sahm Rules are Better Than Others

Reframing the terrible data quality of recent government reports helps understand how late in the game we are

Summary:

The quality of economic data has deteriorated sharply. Low response rates and the Birth/Death adjustment method used by the Bureau of Labor Statistics (BLS) are likely introducing significant bias and errors into the employment numbers

The Federal Reserve's focus on metrics like the JOLTS (Job Openings and Labor Turnover Survey) is misguided. The low response rates to these surveys make the data unreliable, especially when used to inform decisions like interest rate hikes

Alternative metrics should be considered for a more accurate picture of the economy. For example, replacing the unemployment rate in Claudia Sahm’s "The Sahm Rule" with the Michigan "Jobs Hard - Jobs Plentiful" metric might be a better indicator of economic health

The real economy is showing signs of strain with rising delinquencies, defaults, and bankruptcies. Market-derived Wall Street metrics may not be giving a full picture and properly evaluated inflation metrics suggest we are already below the Fed’s 2% target

What I’m Reading/Listening to:

Reader Sergey Alexashenko shared some links that work well with my theories on healthcare breakthroughs tied to obesity treatments:

Both are excellent, but I’d encourage you to re-read my post on penicillin after reading them. The cost of these treatments will fall to nothing over time.

David Beckworth had an excellent podcast with John Coates of Harvard Law. John’s new book, The Problem of Twelve, is loaded onto my Kindle. If anyone in my readership knows David or John, I’d love an introduction to further their knowledge off passive investing.

Top Comment:

James Robertson came in with a Substack of his own. I have edited it for brevity:

Mike, I agree with you, but wonder how long it will take for generational change to occur in Congress to adopt more creative solutions to our nation's fiscal issues that you describe in today's piece. If you look at the average age of Congress, Boomers (my demographic cohort) still dominate. When I talk with my Millennial family members and their friends, they don't seem to have any interest in politics or voting and just think the "system" is rigged against them. Also given the current very polarized politics today, I find it ironic that I can hear a polictician, particularly the populists on the right and on the left seem to say the same thing at times, but can't envision either side crossing over the aisle to make a deal. But what I do observe is that both sides seem willing to spend money when they both think it will improve their chances at getting reelected. I agree with you that a crisis can historically change this kind of situation, as World War II did, by bringing what most people fail to remember was a pretty divided polity some of whom were entertaining both socialist and fascist solutions to the economic problems of the Great Depression.

It seems to me that a lot of people today feel that some sort of crisis is coming, but are kind of fatalistic about it, because they can't either see, or believe we as a nation can agree on what should be done to avert the crisis or that the pols will just do something to make the crisis worse. So I'm pessimistic that such creative solutions will be adopted in the foreseeable future.

Could be that my pessimism is just because of my age, because even when I was searching for a job in the '82 recession caused by Volcker, I was very optimistic even though there were very few opportunties available for all us Boomers looking for a job with ridiculously low salaries that employers could offer, given the competition for those positions.

MWG: James, I am sympathetic to your concerns. Adam Smith is known for saying, “There is a great deal of ruin in a nation.” He was referring to the UK in correspondence with a young analyst who was convinced that the defeat at Saratoga would be the end of the British Empire. He was right, of course, just 140 years early.

The US has failed to address substantial concerns on education, healthcare, inequality, race, sexuality, etc for much of its history. The nihilism of the younger generation is tangible (Bitcoin does NOT fix this). We WILL have a crisis and there may be very hard times ahead. But as I hopefully made clear, we are so very, very close to world-changing breakthroughs in energy and healthcare that if we can chewing gum & bailing wire for a bit more, I am confident a better future awaits. I’d prefer us to substantively reform, and like you, I have been horribly disappointed with our leadership (and see NO ONE in the current crop of candidates that is suitable). But, and here’s where I’m either going to send you over the edge or help you frame the next steps:

Ultimately it doesn’t matter. These events are beyond our control.

Epictetus taught that the path to a happy life, a life of what the Stoics called Eudaimonia, was found in two things:

Correctly identifying what is within our control, and what is not.

Focusing our effort on the things within our control and learning to accept what is not.

Or, if you prefer the religious angle of Reinhold Niebuhr’s “Serenity Prayer”:

“God grant me the serenity to accept the things I cannot change, courage to change the things I can, and wisdom to know the difference.”

I wish you the best.

The Main Event:

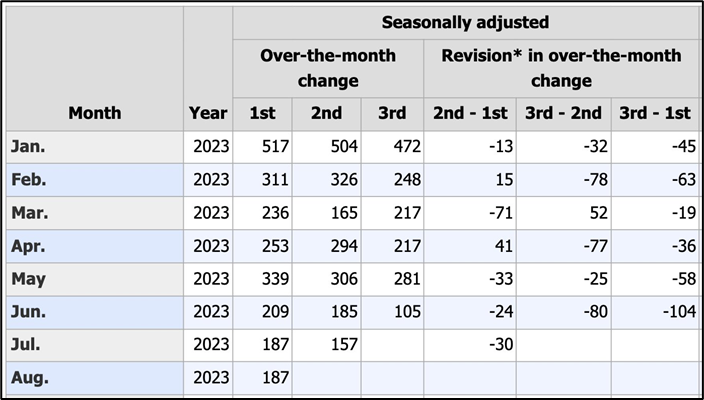

This week’s post will be relatively brief due to the US holiday weekend. I’m going to try to think less about markets and the economy and more about perfecting a keto deep-dish pizza. And unfortunately, some of this week’s analysis thunder was stolen by Friday’s employment report which highlighted many of the concerns I have noted about poor data quality. While the employment headline was a modest beat, the revisions lower for prior months have become substantial:

We’d be hard-pressed to defend the durability of August’s number, as the Birth/Death adjustment accounts for the majority of the estimated private sector gains at this point. As a reminder, Birth/Death assumes positive net job creation over every twelve-month period and attempts to correct for new businesses not included in the survey by assuming that businesses that DON’T respond to the survey are growing at the same rate as businesses that do respond. This might not have been a terrible assumption when response rates to the survey were over 70%, but not when initiation response rates (used to establish participants in the monthly release) have fallen below 30%! The data released in the initial reports have seen response rates fall by roughly 15%, from the mid-80s to the high-60s. While they have also fallen, final response rates (used for revised data) remain far more robust. So in the post-Covid world, pay attention to the revisions

There’s a second issue with low response rates. As the BLS themselves noted in their 2013 analysis of the issues of “non-response”:

The response rates should be evaluated and monitored to make sure the trend holds and that corrective measures are implemented in a timely manner if response rates drop. As Thompson (2009) points out, monitoring response and assessing the potential for nonresponse bias should be on-going, under the domain of a statistical control process.

The BLS response to non-response? They have expanded the sample size by 50%. Guess what happens when they expand a sample of businesses by 50%? You get a lot more small businesses. You know what small businesses don’t have time to do? You guessed it! Respond to BLS surveys!

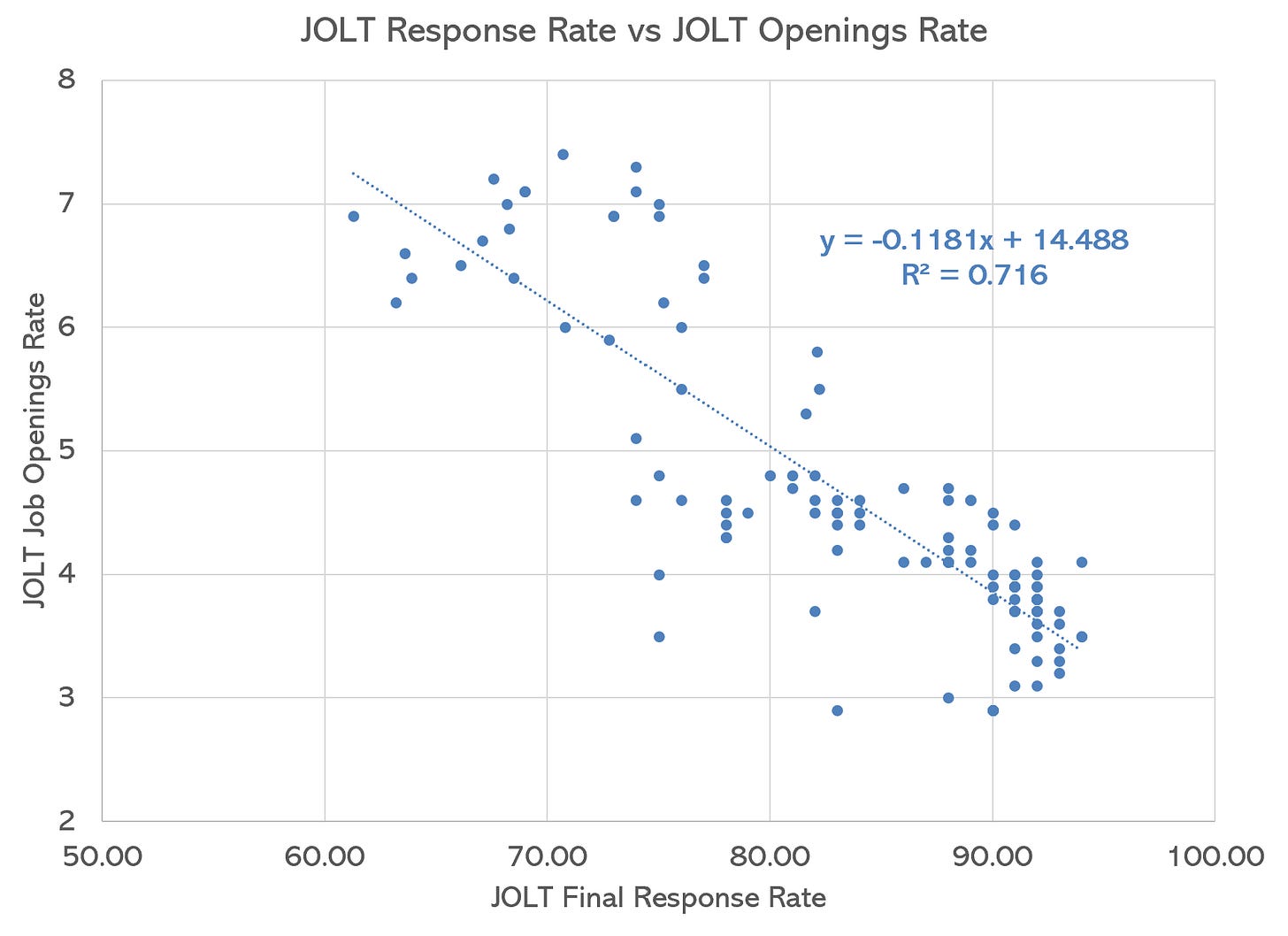

FWIW, the only data set with WORSE response rates than CES? JOLTS. Which is a wonderful illustration of potential response bias.

Quick question: Which firm is more likely to respond to surveys about job growth and hiring? A shrinking business that is firing people or one that is growing and hiring? Let’s try out a poll (we’re working on our democracy skills at YIGAF):

Well, if you answered “Growing and Hiring”, the odds are ever in your favor. Because the single best predictor of the “strong labor market metric” called Job Openings? You guessed it — the response rate to the JOLT survey. The lower it is, the more jobs being created:

Which of course provides a very interesting empirical test of Goodhart’s Law (yes, that same Goodhart who has graced these pages with his nonsensical claims that shrinking labor forces are inflationary) — “once a measure becomes a target, it ceases to be a good measure”