Part 2: The Land of Milk and "No, Honey"

Why it feels like "CPI Lie"

I seem to have a knack for inviting controversy. For newer readers, you may be unaware of my decade long effort to raise awareness of the systemic risks associated with the growth of “passive” investing. And for regular readers, you know that this is a war I have fought and largely won, with the academic literature beginning to rapidly validate nearly all of the hypotheses I laid out a decade ago:

Unfortunately, against the advice of my Twitter avatar, I have unintentionally found myself in a land war in Asia. By Asia, of course, I metaphorically mean the discussion of what ails the middle class in America. Once again, the mockery machine is being deployed. This week, The Atlantic provided the following pithy quote:

“Under modest examination, Green’s empirical claims fall apart. But they bespeak a troubling trend among the commentariat—and even some scholars—of exaggerating the extent of poverty in America. Social-justice discourse, whether about environmentalism, racism, sexism, or poverty, has a tendency to advance maximalist claims as a sign of maximal concern. The intention is usually to express solidarity with the oppressed. But collapsing the distinction between the actual poor and the lower-middle class obscures more than it helps. And talking about poverty as intractable or unfixable is a kind of demotivational speaking.” — Idrees Kahloon

If they SAY the claims fall apart enough, then they must be right. Wouldn’t want to demotivate the loyal workers! But you needn’t worry… Scott Winship was kind enough to inform me that my 15 minutes are up — five minutes ago:

And I’m devastated. I was enjoying the opportunity to appear on TV for the first time (/s):

It’s true what they say… the camera adds five pounds.

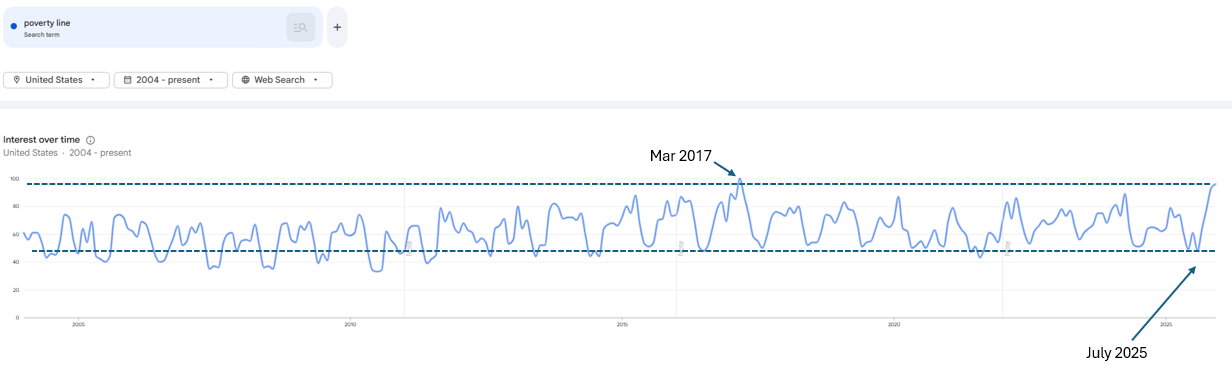

I’m being silly, of course, but I’m also employing a tool that I would encourage my readers to adopt — “ownership.” Not of your house, but of your convictions and your messaging. I am just as prone as anyone to getting angry (probably slightly more so) and speaking unkindly of opponents (see here… and here… and here). It’s a “gift” born of Irish/Scottish heritage. But when I do analysis and come to a non-consensus opinion, the analysis comes before conformity. For my work on passive, those who know me personally know that I traveled the world in 2016 and 2017 asking, “How am I wrong?” A decade later, no one can dispute my analysis even as they may (understandably) dispute some of my conclusions. Until a SUBSTANTIVE rebuttal exists for my work on precarity/poverty, my hunch is that, like my work on “passive” index investing, this topic will only continue to grow in awareness and concern. We (and I include my readers who forwarded an unreal 1MM copies of “My Life is A Lie”) have had a remarkable impact on a much needed discussion. From non-existent to “nearing breakout”, the topic of the poverty line is on America’s mind:

And if my fifteen minutes are up, I’d be glad to get back to work doing what I love — asking questions and trying to understand problems. These will MOSTLY be in financial markets, and as a full warning, next week there will be NOTHING but market and economic commentary as I put my thinking cap towards 2026. That means the first note of January will be the final installment of “My Life is A Lie” and we’ll return to our regularly scheduled programming with the addition of interviews of political candidates. Paywalls will be put back into “normal” positioning, and I’ll forgive anyone who wants to cancel their subscription because somewhat esoteric discussions of economics and finance, interspersed with various rants on subjects rattling around in my increasingly mediocre brain, is not their cup of tea. Just do me a favor and “cancel” — don’t pretend you don’t know YIGAF when you are billed as that adds surcharges from Stripe and Substack. I appreciate all the additional interest in my work and hope many of you stick around.

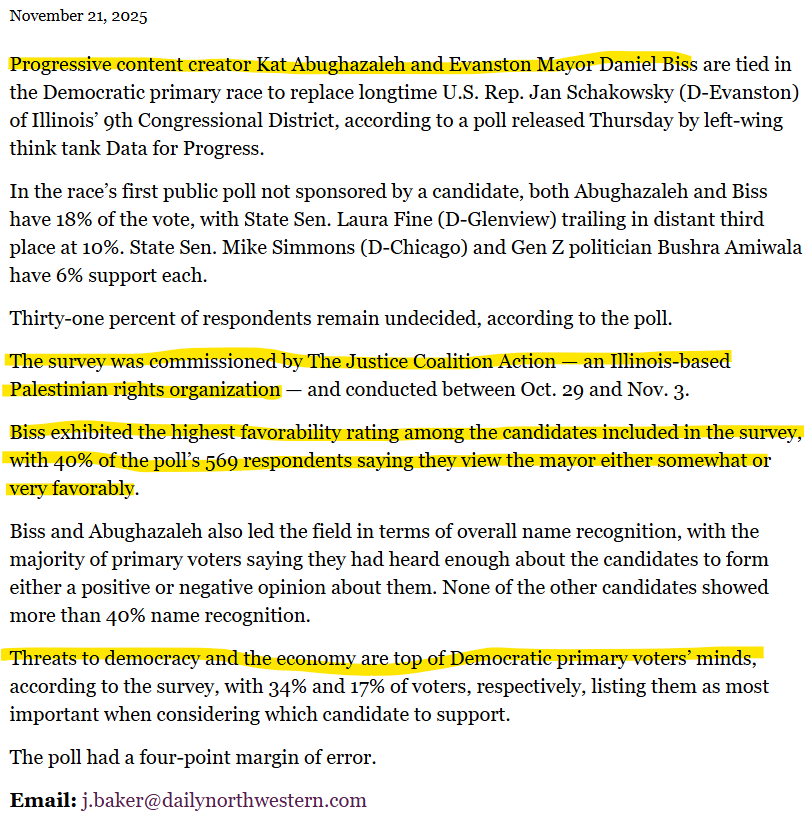

I’m going to order this document to highlight a path forward. The primary for Illinois congressional candidates is March 17th. In the 9th District, voters will have a choice — a journalist whose primary qualification is a tag line "I watch Tucker Carlson so you don't have to", a career politician whose primary “fix” for the economy is an illegal (takings clause) wealth tax, and, of course, my dark horse candidate, Phil Andrew, a former FBI hostage negotiator, small business man, and outstanding individual.

Phil has a rough road because his primary shortfall is in name recognition. “Independent” polling highlights the challenge:

But I HOPE we can change that. Please take the time to watch my discussion with Phil. I am framing his candidacy in the context of how we ended this discussion — “more listening, less shouting.” Perhaps it’s a motto we can adopt in our collective hunt for candidates. My apologies for my first attempt at uploading videos to Substack. Hopefully it works! With that said, here it is:

And now, for something completely the same… but hopefully clearer:

The Rule of 65: Part 2, The Land of Milk and “No, Honey”

The Crime Scene

We didn’t drift here. We reasoned ourselves here, much like “passive” index investing, we were following economic theories that turned out to be catastrophically wrong.

In Part 1, we established the physics of the trap: an economy that naturally concentrates wealth (the Equation of Life) requires active re-allocation (Positive Tau) to remain stable. When that re-allocation stops, the middle class isn’t just unlucky. It is mathematically prohibited from thriving.

But math doesn’t pass laws. People do.

The transition from a Pursuit (of happiness) economy (growth-focused) to a Property economy (extraction) wasn’t a conspiracy. It was something more tragic: a series of intellectual errors, made in good faith, by serious people following serious theories.

Public unions. Milton Friedman’s shareholder primacy. Bork’s consumer welfare standard. The Washington Consensus on trade, eliminating tariffs and removing constraints on capital. These weren’t fringe ideas. They were economic orthodoxy. Taught at the best universities. Adopted by administrations of both parties.

And they were wrong.

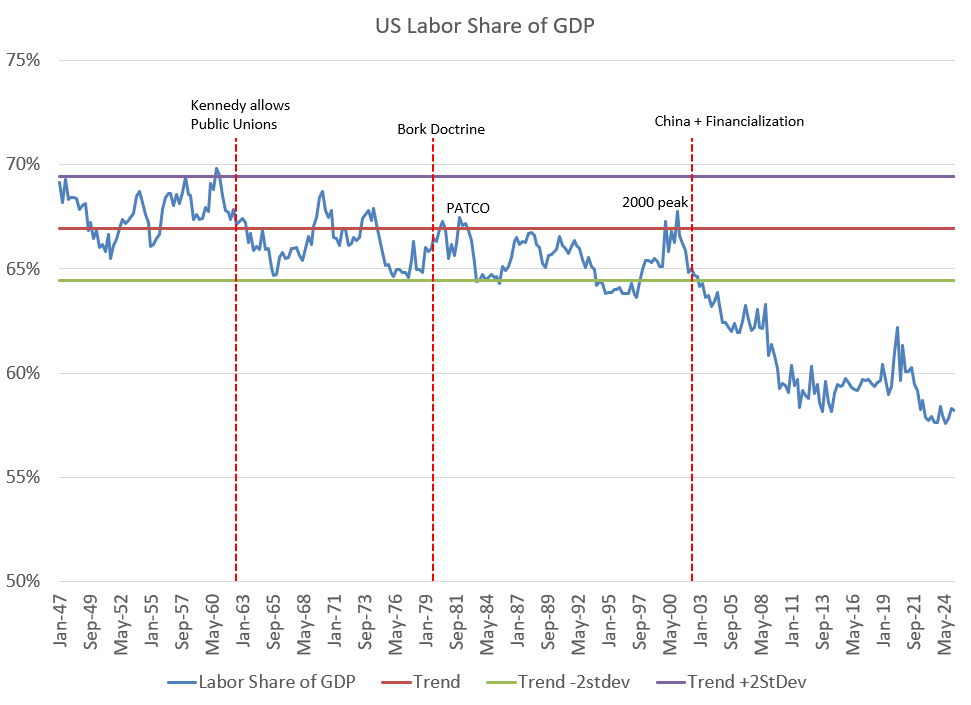

Phase 1: The Three Structural Breaks

If you look at a chart of the Labor Share of GDP, it doesn’t just drift downward. It breaks at three specific moments in history, each tied to a policy decision that seemed reasonable at the time.

Break 1: The Public Sector Bargain (1962)

The Decision: President Kennedy’s Executive Order 10988 allowed public sector workers to unionize.

The Logic: Private sector workers had won collective bargaining rights. Why should government employees be denied the same protections? It seemed only fair.

The Unintended Consequence: This created what economists call a Double Monopoly (or Soft Budget Constraint). In the private sector, a union is constrained by bankruptcy. If they demand too much, the company dies. In the public sector, the government cannot go bankrupt; it simply raises taxes. The consumer (taxpayer) is captive.

The Result: We broke the feedback loop between cost and value. Politicians, needing votes, granted concessions that future taxpayers couldn’t afford. This contributed to the urban fiscal crises of the 1970s and the erosion of trust in government capacity. Today, municipalities and states are overwhelmed by the deferred costs, contributing to the perception that reform is impossible.

Break 2: The Efficiency Bargain (1982)

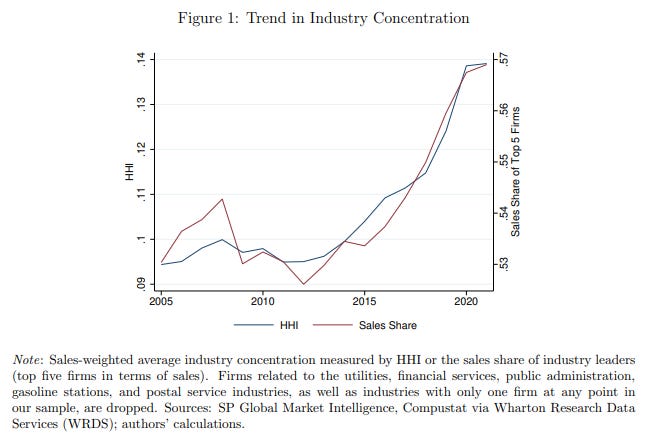

The Decision: The adoption of Robert Bork’s Consumer Welfare standard for antitrust enforcement.

The Logic: Bork’s insight was elegant. If a merger produces lower prices for consumers, why stop it? Efficiency should be the goal, not some abstract notion of “too big.”

The Unintended Consequence: We legalized consolidation. Massive corporations bought up competitors as long as they promised efficiency gains. We traded Structure (competitive markets where new entrants could challenge incumbents) for Price (cheap TVs and electronics).

The Result: We crushed the Pursuit (new entrants, entrepreneurship, creative destruction) to protect the Property (incumbent firms, existing market positions). THIS is where the artificially low interest rate policy post-GFC really mattered. When demand returned post-COVID, those consolidated industries had the pricing power to gouge consumers. The efficiency gains went to shareholders. The bill went to you. Oh, and now they want you to bail them out with your 401 (k).

Break 3: The China Bargain (2001)

The Decision: Granting China entry into the WTO.

The Logic: Free trade makes everyone richer. This was Economics 101: comparative advantage. We assumed American capital would flow to China to access Chinese consumers, and that prosperity would make China more democratic.

The Unintended Consequence: Capital didn’t flow to China to sell goods. It went there to arbitrage labor. American corporations bought cheap labor and imported the products back home.

The Result: The greatest labor arbitrage in history. We sold our factories (production) to buy cheap debt (Treasuries), hollowing out the American working class to pad corporate balance sheets. The China Shock decimated manufacturing communities in ways that economists are still measuring. The promised democratization never came. And the workers who lost their jobs never found equivalent ones.

Phase 2: The Tax Shift

While these structural breaks were happening, we also rewired who pays for the country. This wasn’t sold as a transfer. It was sold as Supply Side stimulation.

The Great Reversal (1955 vs. 2024)

The Logic: Lowering corporate taxes would spur investment. Growth would benefit everyone. Trickle down.

The Reality: We swapped a tax on Profits for a tax on Wages.

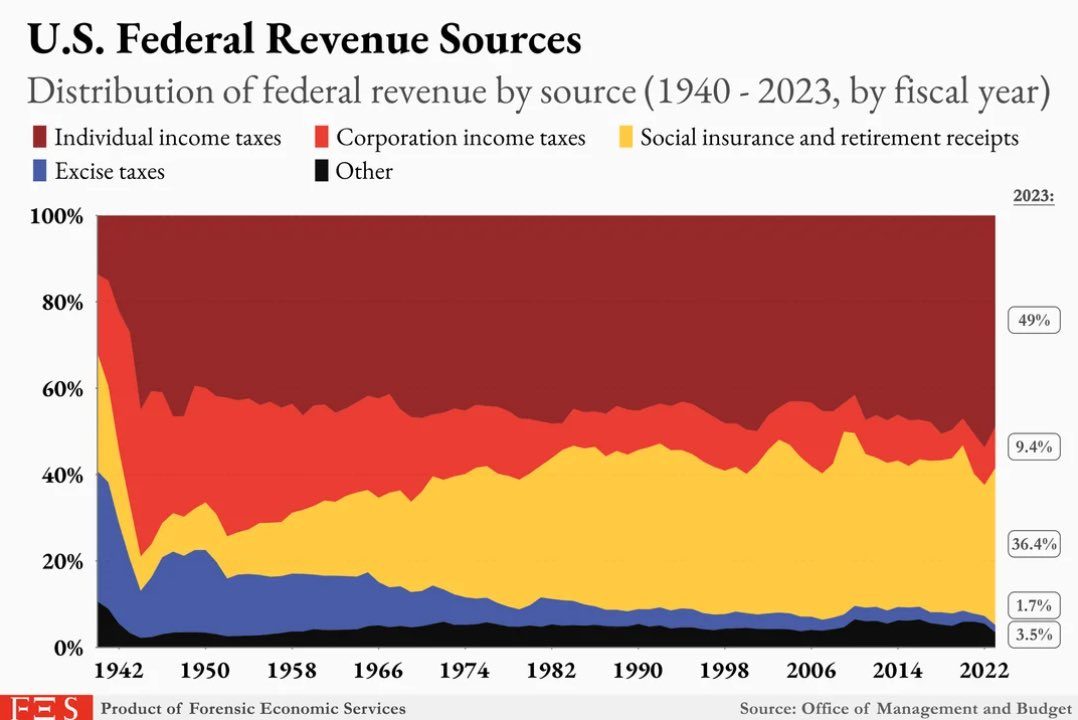

1955 (The Golden Age): The Corporate Tax generated 28% of federal revenue. The rich paid indirectly via ownership of these assets. The Payroll Tax was a modest 8% of revenues.

2024 (The Malpractice): The Corporate Tax has collapsed to 10% of revenue. To fill the hole even as corporate profits as a share of GDP exploded, the Payroll Tax (which hits every worker from their first dollar) has exploded to 36%.

The capital didn’t trickle down. It pooled at the top. The Top 1% owns roughly 87% of corporate equity but pays a fraction of the historical burden, while the working class shoulders the cost.

Phase 3: The Inflation Gap (The Invisible Divergence)

The technocratic class loves to tell you that you’ve never had it better. They point to the Average Inflation Rate and say wages have kept up.

They are averaging away suffering.

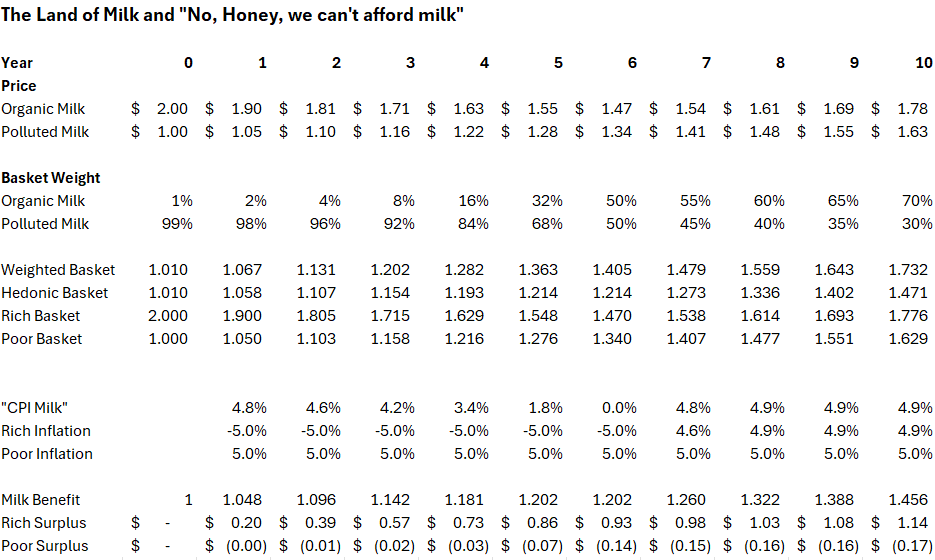

As discussed last week, research by Xavier Jaravel proves we have different CPIs for “poor” and “rich”. I’ve modeled this as “The Land of Milk and ‘No, Honey, we can’t afford milk.’”

Consider two products over a 10-year period:

Organic Milk (The Rich Basket): Innovation drives the price down. The wealthy experience deflation (-5%).

Polluted Milk (The Poor Basket): Consolidation and scarcity drive the price up. The poor experience inflation (+5%).

The Malpractice of Averages: If you average these numbers, the CPI looks stable (around 2-3%). Using “Laspeyres” indices, which weight products by market share and price change lowers it further. The technocrats look at the spreadsheet and say, “Inflation is low!”

But look at the bottom rows of the model:

The Rich: Because costs are falling, they accumulate a Surplus. If their incomes rise at CPI inflation they gain additional surplus because THEIR milk is falling in price.

The Poor: Because costs are rising, they accumulate a Deficit even if we increase their incomes by that same CPI.

The Average CPI hides the suffering of the working class behind the deflation enjoyed by the Gwyneth Paltrow-class. This isn’t a “CPI-lie”. It’s a blind spot in methodology that we understand and should correct.

Phase 4: The Body Count (The Lost Einsteins)

The defenders of this system will tell you inequality is the price of progress. We must protect the Innovators and Job Creators.

The research says otherwise.

Recent work on Inequality and Creative Destruction proves that extreme inequality doesn’t fuel innovation. It suffocates it. Children born to parents in the Top 1% are ten times more likely to become inventors than those born below the median income.

This isn’t because rich kids are smarter. It is NOT explained by IQ. Even among children who score in the top 5% of math tests in 3rd grade, the rich kids become inventors and the poor kids do not. The authors suggest 75% of the potential innovation is being left on the table.

We have built an economy of incumbency, where opportunity is hoarded. By locking the next generation of geniuses out of the lab (because their parents couldn’t afford the entry fee), we are leaving thousands of Lost Einsteins on the table. We chose to protect the assets of the past rather than fund the inventors of the future.

The Proof of Concept: Coney Island Prep

We know this Innovation Gap is solvable because we are seeing it solved in real-time.

Coney Island Prep (CI Prep), a K-12 charter school serving students in Brooklyn, NY, has proven that Exposure is a resource just as critical as electricity or textbooks. Unlike traditional schools that assume students will obtain “exposure” to “Why college matters” or even “Why behaviors matter” outside of school, CI Prep operationalizes the “hidden curriculum” of the wealthy. They use school vacations not for downtime, but to bridge the exposure gap, sending scholars to study abroad in Europe or tour college campuses they never knew existed. All for significantly lower cost than traditional schools.

The result? By manufacturing the cultural capital that rich kids get for free, CI Prep has achieved a 100% college acceptance rate for eight consecutive years, with their scholars graduating at rates five times the national average for their socioeconomic strata. It is a template for success.

My firm, Simplify Asset Management, supports CI Prep with our annual “Entering the Fall” conference supporting CIPrep’s “dream” services: the internships, travel, and college matching that transform a student’s trajectory. Unfortunately, this year we remain behind our target and I’d encourage you to consider adding to CI Prep’s student experiences. I will donate 100% of the subscription fees raised by this post to the cause. Regardless of whether you join me, I encourage you to take advantage of the opportunity to find similar examples of excellence and support them.

The Diagnosis

The autopsy is complete. The cause of death was malpractice and neglect.

An entire generation of credentialed experts, acting in good faith, publishing in peer-reviewed journals, advising presidents of both parties, built a machine that extracts from the many to protect the few. They weren’t evil. Their theories were wrong.

We allowed Monopolies (because we thought efficiency was more important than competition).

We allowed Labor Arbitrage (because we thought trade was always win-win).

We shifted the Tax Burden (because we thought it would trickle down).

We ignored the Cost of Living (because we trusted the Average).

The result is a system where the Physics are set to Extract. And the intellectual immune system that built it has spent forty years rejecting the correct diagnosis.

That’s harder to fix than catching a thief. But it’s not impossible.

In Part 3, we will lay out the Escape Plan, the Rule of 65, and the specific policy levers we can pull to turn the machine back on.

END