Trying to Be Better (again)

Part 1 of a Polite Rejoinder to Cliff Asness

My apologies for the delay in sending out this week’s note. I had a very busy weekend with three separate US Naval Academy events, two of which I cooked for. When given the choice between feeding hungry swimmers and feeding an intellectually curious readership, one can wait.

With that said, this week’s note went WAY over and I’ve split it into two separate pieces. This week, Part 1.

Summary

Market Efficiency Debate: Both Cliff and I agree that markets are becoming less efficient, but we disagree on why. Cliff blames social media; I highlight that his hypothesis lacks a mechanism. The correct answer is important because we agree that inefficient markets undermine capitalism by distorting price signals that allocate resources.

Impact of Fund Flows: The author argues that large concentrated funds like ARKK, driven by flows rather than skill, can artificially boost prices and create bubbles. The mechanism for passive index funds is the same. They also distort markets by continuously pushing prices higher through inflows.

Criticism of Passive Investing: The author critiques the notion of passive investing, pointing out that the regular trading from inflows challenges the traditional definition of passivity. He argues that passive funds are active market participants that influence prices, further breaking market efficiency.

Top Comment:

Leonard chimes on the subject of the propensity to spend interest income:

Anecdotally I can attest that my boomer relatives have been treating their "new" interest income as fun money. Powell will find himself pulling that money dollar for dollar out of the economy to "prop up the labor market".

And what I've heard less about of late is the windfall of silent Gen and oldest boomer inheritances to their later in life (and already financially secure children). Purchases with this money may be few, but I see them skewing LARGE.

MWG response:

Agree, Leonard. I hear the same from RIA clients and see it directly in both my behavior and that of well-off relatives. Spending the interest and NOT spending the principal is much easier than spending my “wealth.”

On the subject of inheritance, the fear that I have is once these bequests begin to be made in earnest, some of them will be spent. If the spending requires sales, the “wealth” can evaporate quickly.

The Main Event

Cliff Asness has written again on the subject of market efficiency. It is a paper worth reading even though I disagree with his conclusions. I responded to the paper with a dismissive tweet, reflecting both my disagreement with his paper and the extended animus between Cliff and me. But I also ended that tweet with the vital message that I would welcome Cliff as an ally in the fight against “passive” market concentration. His accomplishments in quant investing bring both financial and reputational resources that, frankly, I cannot match. I hope we can make some headway towards that, so I will write as politely as possible.

We are in the fight of our lives. By we, I do not mean “active managers,” I mean our capitalist system. As Cliff notes:

Stock prices should accurately reflect reality. That’s important, not just to investors and those who make their living from markets, but to society at large. A well-functioning free enterprise system needs a well functioning capital market. Why? Because the prices accorded to enterprises, be they very high or very low, provide direct incentives for how society allocates its resources. Enterprises raising capital from, and then distributing capital back to, investors, and at what prices this occurs is the circulatory system of the economy. The more efficiently that system operates, the more efficiently the economy functions, allocating resources to their best uses. Hence, if those prices don’t reflect reality, there are real consequences to long-term productivity and growth — Asness 2024

Cliff is right. My concerns are with the long-term implications of our reliance on an accepted and government-promoted Ponzi scheme. In case you think I use that term lightly, please check out J.P. Bouchaud’s latest piece:

Now, to be clear, Bouchaud is referring to concentrated ACTIVE funds that influence the price behavior of their holdings by virtue of their flows. This is the same argument I have raised around ARK Funds, noting that a traditional “CAPM”-type formulation disaggregating performance into alpha and beta would have suggested genius on the part of Cathie Wood in 2020 and an increasing beta to the QQQ as her picks slowly went awry:

But if we allow for the introduction of a new variable — flow — then we discover that the key contributor to the return of the ARKK fund in 2020 was actually the impact the fund flows had on the underlying securities. Retail investors contribute funds, illiquid shares are bought, prices are push upwards, performance ensues!

Reminds me a bit of the underwear gnomes…

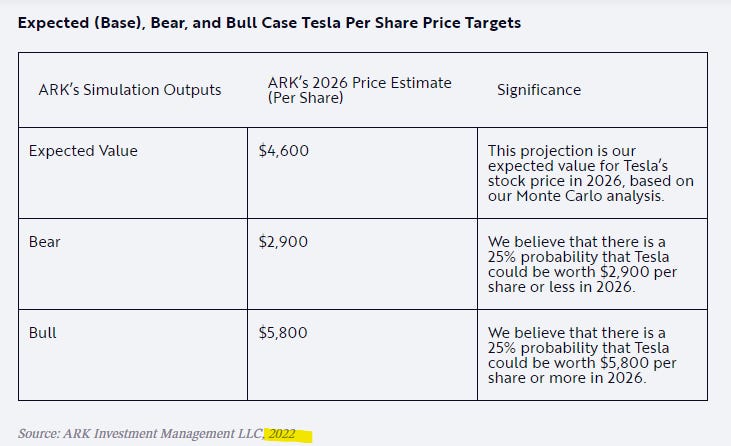

Bouchaud’s point is that investors cannot distinguish between skill-driven performance and flow-driven performance and that, as always, it’s the part in the middle that matters. Cathie Wood might have had a particular genius for identifying the forward trend in technology and building Monte Carlo-enhanced DCF models which more accurately capture the forward earnings potential:

If that were the case, then it should show up as “alpha” ex-flow in the return stream, reflecting her unique ability to identify changes in fundamentals which will attract outside investors to buy her stocks, leading to outperformance. There is no evidence of this skill. In fact, she appears to have strongly negative alpha.