Yes, I Voted For This (Small Part)

Why a $100,000 H-1B Fee Is Spectrum Logic, Not Xenophobia.

Free for All Readers

A $100,000 H-1B visa fee isn't a xenophobic policy—it's basic economics. The current system creates market distortions that hurt American workers, mislead policymakers, and ironically harm the very immigrants it claims to help.

I'm making this piece free because the underlying economics affect everyone, from recent graduates struggling to find work, to young families watching housing costs soar, to policymakers making decisions based on corrupted data. My subscribers subsidize this research (as does my firm, Simplify), but some insights are worth sharing beyond a paywall. I’ve added a “Subscribe” link with one month free at the end. If you struggle through, perhaps you will find it worth reading full pieces regularly.

What follows isn't immigration commentary—it's an analysis of how artificially cheap pricing creates systemic distortions in labor markets, housing markets, and economic data itself.

Quick Market Comment

The insanity is getting MOAR! But occasional insights emerge. The discount of Business Development Corps (BDCs) to their NAV is a reflection of the market pricing private credit at the discounts they deserve. Historically, these moves have matched high-yield credit spreads. As I have repeatedly emphasized, high-yield credit spreads are absurdly tight given realized bankruptcies:

In the chart below, we compare a relatively high-quality publicly traded BDC price/NAV (in white; again, a credit spread proxy) to inverted high yield credit spreads (orange). Notice that credit spreads have tightened even as the discount has grown. Sure, private credit is doing great and high yield should be at record tights (/s). Got popcorn?

A Fee That Shocked the Commentariat

When Donald Trump suggested a $100,000 application fee for H-1B visas, the reaction was swift and vitriolic. Technology firms warned of lost innovation. Economists framed it as a tax on growth. Advocacy groups and others screamed “Xenophobia!”

Yet the outrage overlooked a simple fact: American families already spend far more than $100K for their children to compete for the same jobs. A four-year degree from a state university costs roughly $ 120,000, including living expenses. Private universities run two to three times that. Student loans and interest can push the effective cost toward $200-500K. And after four (minimum) years of investment, new graduates are increasingly struggling to find employment.

By contrast, under today’s H-1B lottery, an employer pays just $10 to enter a foreign worker into consideration. American families invest hundreds of thousands of dollars; firms risk the price of a sandwich.

A $100,000 H-1B fee is not punitive. It recognizes that work permits are scarce public assets, not raffle tickets. We auction spectrum, carbon permits, and taxi medallions. The same logic should apply to foreign worker visas.

The $10 Lottery and Its Distortions – the ignored changes

Prior to 2021, companies could only file full petitions, with documentation and fees totaling $5,000–25,000 per worker. This discouraged frivolous filings. When petitions exceeded the cap (65,000 undergraduate plus 20,000 master’s degrees), USCIS ran a lottery. The net result was that roughly 200,000 petitions competed for 85,000 slots. The success rate — petitions accepted ÷ petitions filed — ran 30–40%. Because each petition represented a real investment, odds closely tracked the chance of obtaining a visa. Net cost to employers? $12,500-$75,000 for a successful hire, probability adjusted.

Under the Biden administration (MWG: note a reader corrected that the RULES were changed under Trump 1.0, but the observable effects did not begin until 2021. My original phrasing comes across as political which was not the intent). The rules changed in Dec 2019, taking effect in March 2020, impacting hiring beginning in Oct 2020. The effects became obvious in 2021. The new registration system reduced the entry fee to $10. Employers paid for applications only if selected, rather than preparing packages upfront. As you might expect, registrations surged:

• FY 2021: 269,000

• FY 2022: 301,000

• FY 2023: 474,000

• FY 2024: 759,000

To fill the 85,000 slots, USCIS over-selected because many $10 registrations were speculative and were abandoned after selection. In FY 2024, 188,000 were drawn, yielding a 25% chance of selection but only about an 11% chance of ultimately receiving a visa. Net cost to an employer dropped to ~$20,000 (application costs dropped as the process was institutionalized for large firms).

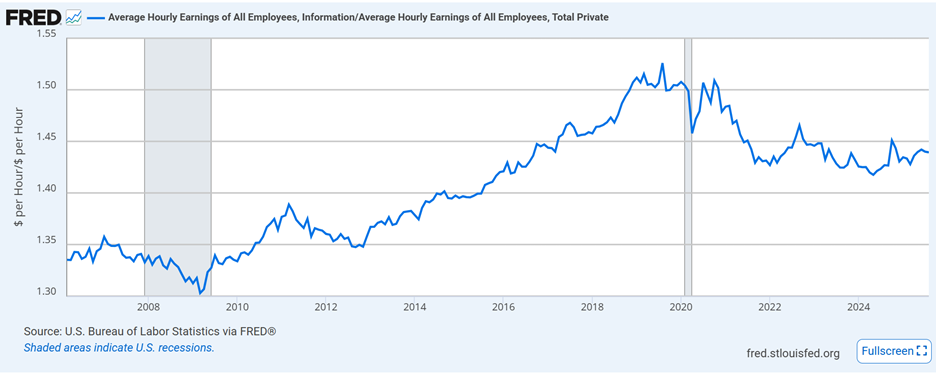

The definition of “success” thus changed. Pre-2021, success rates reflected petitions filed and visas granted. Post-2021, they measure registrations selected, while the true issuance rate is far lower. At $10, flooding the system makes sense, and a new business model dominated – low-wage tech workers. Predictably, relative wages in information industries began to fall:

Who Gains Under the Current Model

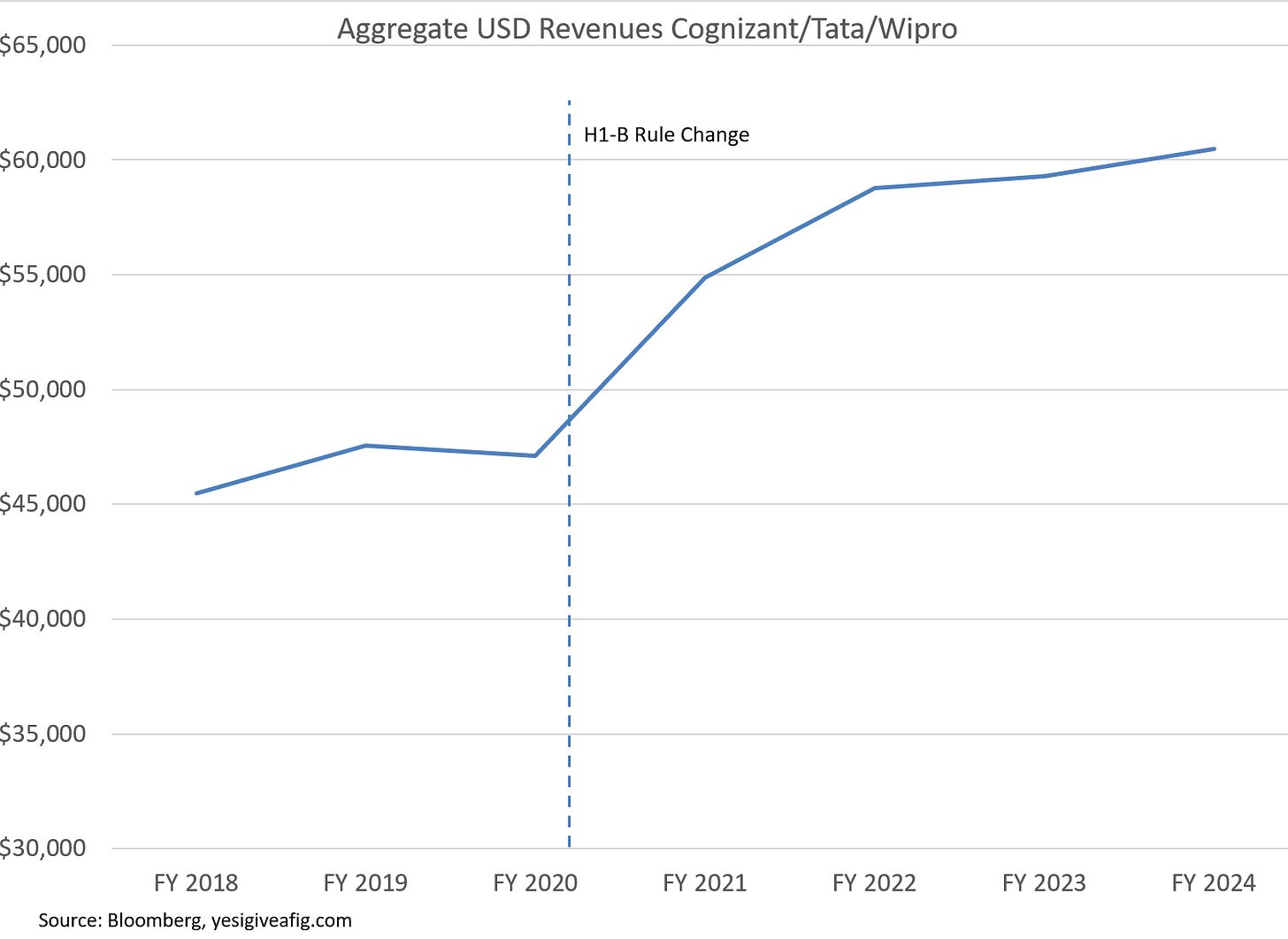

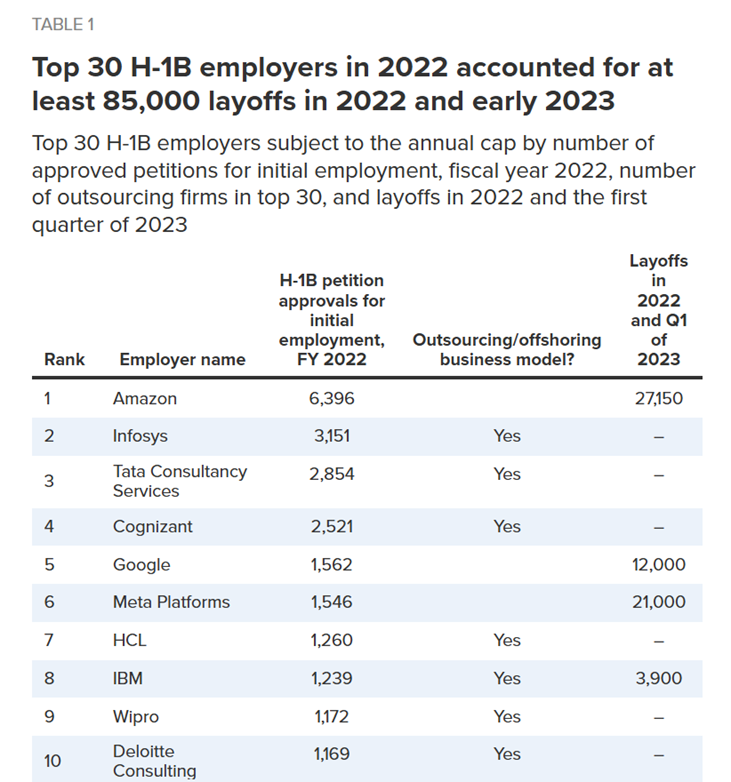

The mythology of the H-1B is that it powers startups and innovation. In reality, the largest users are outsourcing firms such as Infosys, Tata Consultancy Services, Cognizant, and Wipro.

Their model: import workers at prevailing-wage minimums, place them at client sites at a cost well below fully-loaded American worker costs, and pocket the difference. Client margins rise; skilled American worker wages fall in real-terms.

Housing follows: workers sharing small apartments near client hubs in Santa Clara, Dallas, and Jersey City drive housing costs near employment growth rapidly higher.

This suppresses wages, stresses housing, and discourages firms from training Americans.

The Unequal Entry Fee for American Families

American families bear heavy costs for their children’s entry into the labor market. Learn to code! A bachelor’s degree in a technical field runs $120,000–300,000. Student loans push effective costs well above these levels — and create life-changing, non-dischargeable debt incurred by 17-year-olds.

Graduates then compete with foreign workers whose employers paid $10 for access.

Raising the H-1B fee to $100,000 doesn’t close doors. It aligns costs, ensuring employers demonstrate genuine need rather than exploiting a subsidized lottery.

Likely Effects of a $100,000 Fee

There will obviously be fewer registrations as speculative filings collapse. Outsourcers cannot justify $100,000 per head for $65,000 roles. Registrations likely fall below the cap, eliminating the lottery. Those who choose to participate for the stated goal of the program (to obtain workers that truly cannot be obtained in the US) are virtually guaranteed success.

A Different Employer Mix

• High-margin firms (big tech, finance) still apply if productivity gains justify the cost.

• Hospitals and universities apply for rare research or medical roles.

• Low-margin contractors exit.

Visas shift to the most valued roles rather than the cheapest labor.

Labor Market Outcomes

With arbitrage gone, firms must pay competitive salaries. Wage floors strengthen, and U.S. college graduates gain bargaining power.

Removing low-paid worker visa inflows eases rental stress in Silicon Valley, Seattle, and Northern Virginia (and many other regions). Remaining H-1Bs are higher paid, supporting sustainable housing demand.

Critics warn that higher fees will push jobs overseas. Some work would move — primarily routine coding, IT support, and back-office functions. But these jobs already flow through outsourcing pipelines. Whether performed in Bangalore or in a crowded apartment in Jersey City, they add little to the U.S. economy as residual wages beyond subsistence are typically repatriated.

They are also the jobs most vulnerable to automation and AI. Extending their life with subsidized visas only delays the transition. Proper pricing accelerates adaptation: firms invest in productivity, adopt new tools, and train workers for higher-value roles.

Exceptional Talent

Another concern is that exceptional talent may choose to work in other countries. But genuinely scarce skills are precisely those worth paying for. For a top AI researcher, biotech innovator, or neurosurgeon, $100,000 is trivial relative to the value created. Leading firms will pay, because they cannot afford not to. Pricing visas properly does not deter exceptional talent — it ensures slots are reserved for them.

Data Distortion and Phantom Jobs

The H-1B process also requires employers to post job openings and certify that no acceptable U.S. applicants were available. In practice, many of these postings are pro forma: the employer already intends to hire a specific foreign worker, but compliance requires advertising.

These listings inflate the Bureau of Labor Statistics’ JOLTS job openings data, overstating true labor demand. Policymakers, including Jerome Powell, have cited openings relative to unemployment as evidence of a “tight” labor market. But unemployment is understated by gig work and labor force exits, while openings are overstated by phantom postings. The result is distorted policy signals.

The damage extends further. Students and early-career workers apply to thousands of these phantom jobs, receiving silence or rejection from positions never genuinely available. Each failed application compounds the sense of being unwanted. As I argued in Getting Sentimental, consumer sentiment has decoupled from economic data because trust itself has eroded. Phantom jobs feed that erosion, teaching young workers that effort and merit are irrelevant when opportunity is illusory.

Oh… and unemployment claims? The good news for state employment funds is that most of these H1-B workers are ineligible for unemployment insurance. Claims stay muted even as technology layoffs surge:

A properly priced visa system would reduce speculative filings and compliance theater. The result: cleaner data for policymakers and more honest signals for job seekers.

Education Renewal: From Arbitrage to Apprenticeship

The $10 system discourages firms from investing in U.S. talent. Why support apprenticeships or partner with universities when imported labor is so cheap?

A $100,000 fee reverses the incentives. Training an American student becomes less costly than relying on visas. Firms would:

• Partner with high schools, community colleges, and universities.

• Expand tuition reimbursement and internship programs.

• Invest in on-the-job training.

This mirrors the post-World War II era, when industry co-funded engineering programs to build domestic capacity. Pricing visas properly would restore that cooperative model. Make America Great Again… without irony.

Segmentation: Social Need vs. For-Profit

There is a genuine risk. A flat $100,000 fee risks placing hospitals in the same category as Google. Segmentation resolves this. The finer the segmentation, the better, but let’s start with two pools.

Pool A: Social Need

• Universities, hospitals, rural clinics, national labs.

• Roles that are genuinely hard to fill with domestic labor (although again, distortions exist due to underpriced visas).

• Modest fees initially ($5,000–15,000) shifting to a reverse Dutch auction to identify the true value of shortages.

• Priority selection.

Pool B: For-Profit

• Private corporations, consulting, finance, tech.

• Fees are high initially ($100,000+)

· Reverse Dutch auction to set clearing price.

This ensures essential institutions aren’t priced out while for-profit employers compete transparently.

Stress Testing the System

While the radical change will undoubtedly disrupt the process, a $100,000 fee serves as a stress test, much like raising interest rates shakes out zombie firms (see opening market comment). Cheap entry produces distortion. Higher costs flush speculation and reveal true demand.

At $10, speculative filings are rational. At $100,000, only real needs remain. Over time, policymakers see:

• Which industries rely on wage arbitrage?

• Which roles are truly scarce?

• Where domestic training should expand?

The fee restores price discovery.

Auction Logic: Spectrum, Carbon, and Medallions

Economists resist a $100,000 fee, assuming immigration always boosts growth. But we auction scarce public assets all the time and we have consistently found outcomes improve:

• Spectrum: In the 1990s, the FCC stopped giving away frequencies. Telecoms bid billions, and innovation continued.

• Carbon permits: Cap-and-trade prices emissions rights. Companies adapt.

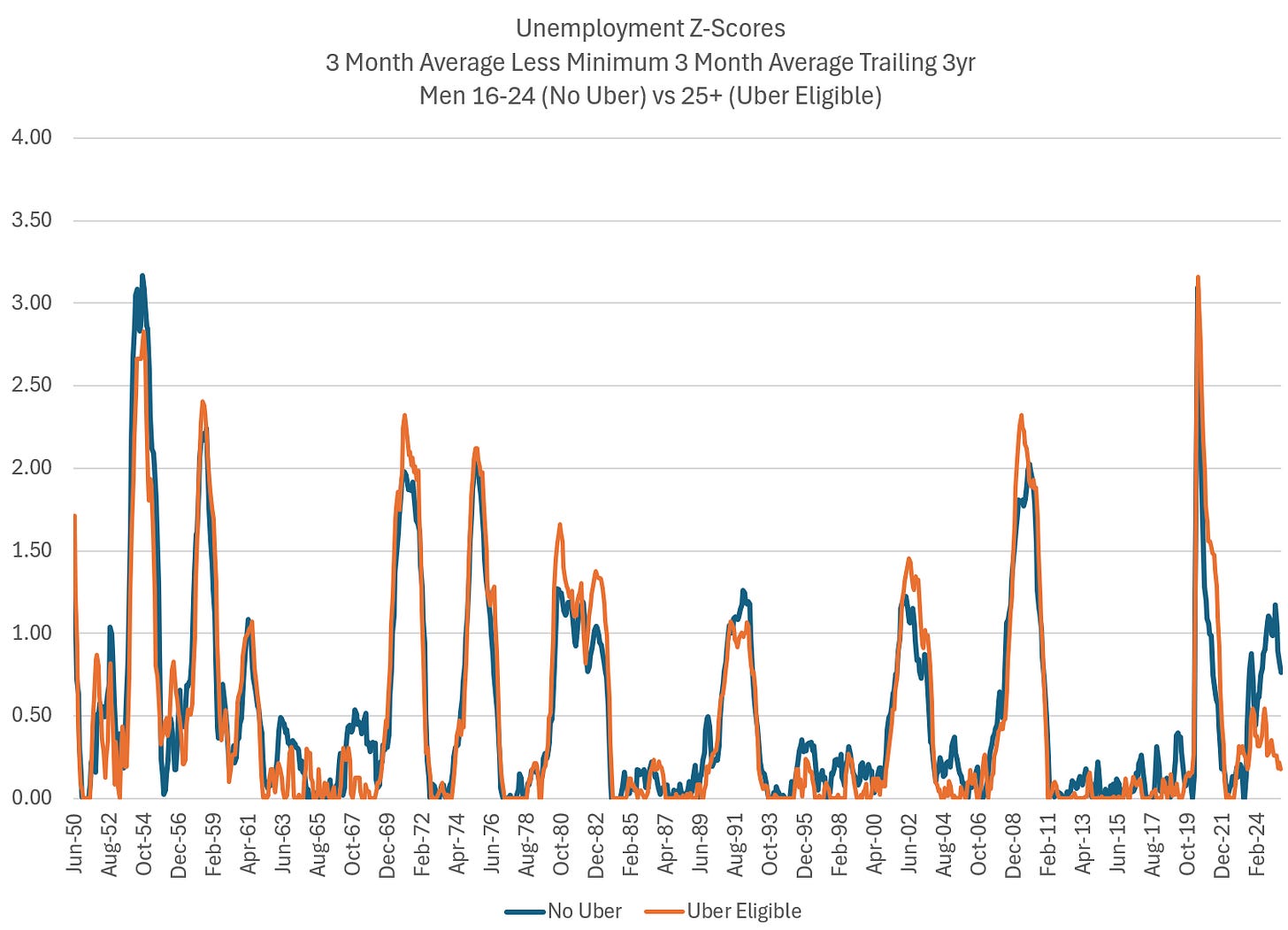

• Taxi medallions: Cities auctioned limited licenses, reflecting scarcity. Some of this was artificial and corrupt, but he emergence of Uber as an arbitrage to this system, and the failure to properly enforce legal frameworks, created the same dynamics in the car-for-hire industry as we have seen in information. Behind every great fortune lies a great crime.

Visas are no different. They are “rights to participate” in the U.S. labor market. Pricing them at $10 is inconsistent with how public assets should be managed. These belong to the American citizens, and they should be compensated adequately. Yes, now we have taxi services at (relatively) low cost available at the push of a button on our smartphones; we also have a newfound reliance on the gig economy and rising unemployment amongst those ineligible to participate due to auto insurance rules.

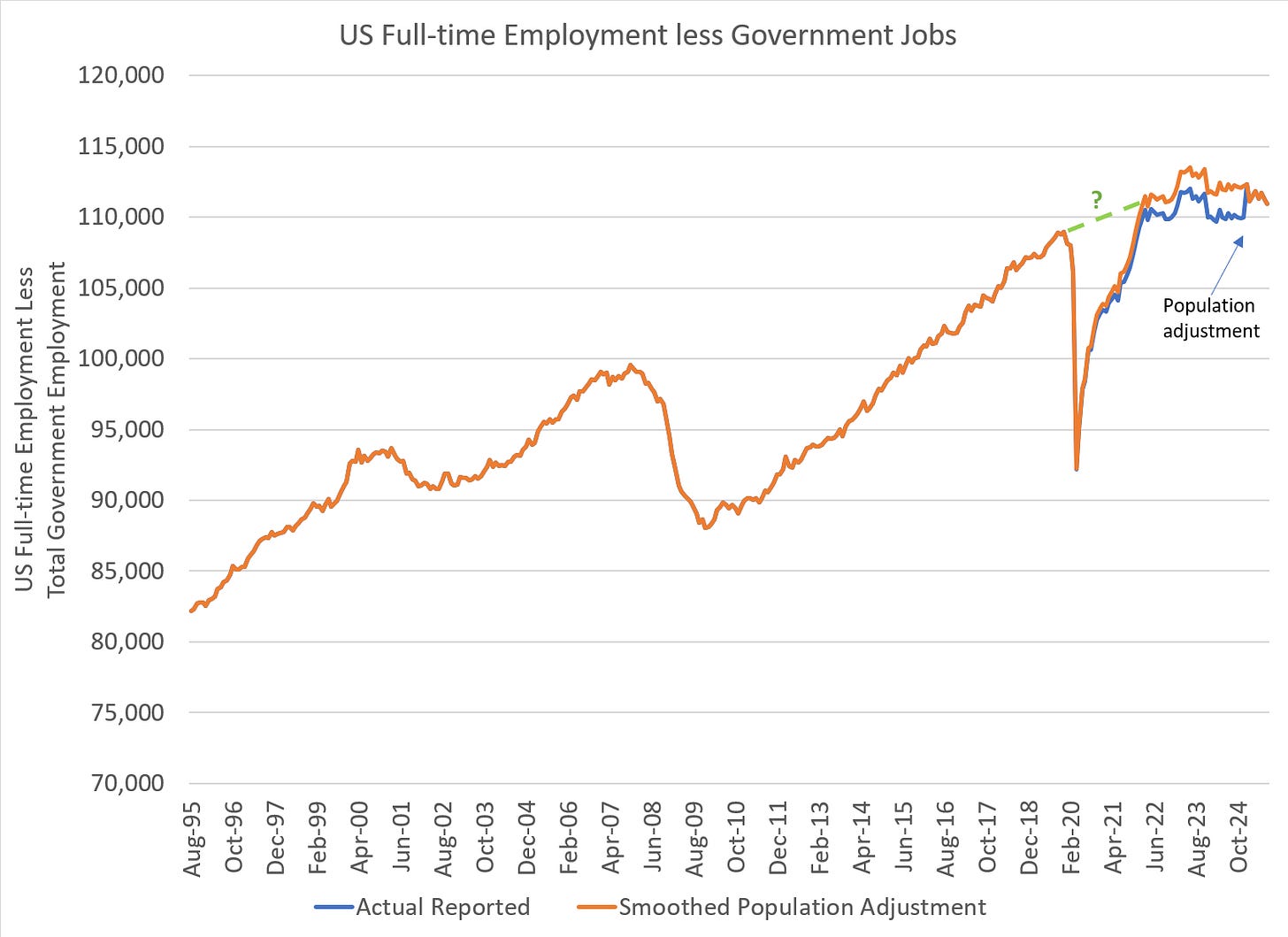

Full-time employment ex-government (btw, largely state and local rather than federal as has been discussed in prior writings), properly adjusted for population change (rather than a 1x impact in Jan 2025), has fallen for the longest period in US history ex the GFC. Is the recession in the room with you?

Reverse Dutch Auctions

Like many Trump policies, a flat $100,000 fee is blunt and deeply flawed, even while it contains a kernel of “truth”… and it’s subject to corruption as any arbitrary price level would be. A reverse Dutch auction is sharper.

• Employers bid the maximum they will pay.

• Slots are awarded from highest to lowest until the cap is reached.

• The clearing price becomes the fee for all.

Segmented pools refine further: social-need visas clear low; for-profit visas clear at market price. This yields real-time information about demand.

Corporate Impact: Margin Compression at the Top

Outsourcing firms and large technology platforms would feel the most impact. Their models rely on cheap labor arbitrage. Higher fees compress margins and end bulk contracting.

Smaller firms benefit. Competing on productivity, they can now hire talent without being undercut by subsidized inflows.

The result: less margin extraction at the top, broader distribution of income across workers and communities.

Revenue and Reinvestment

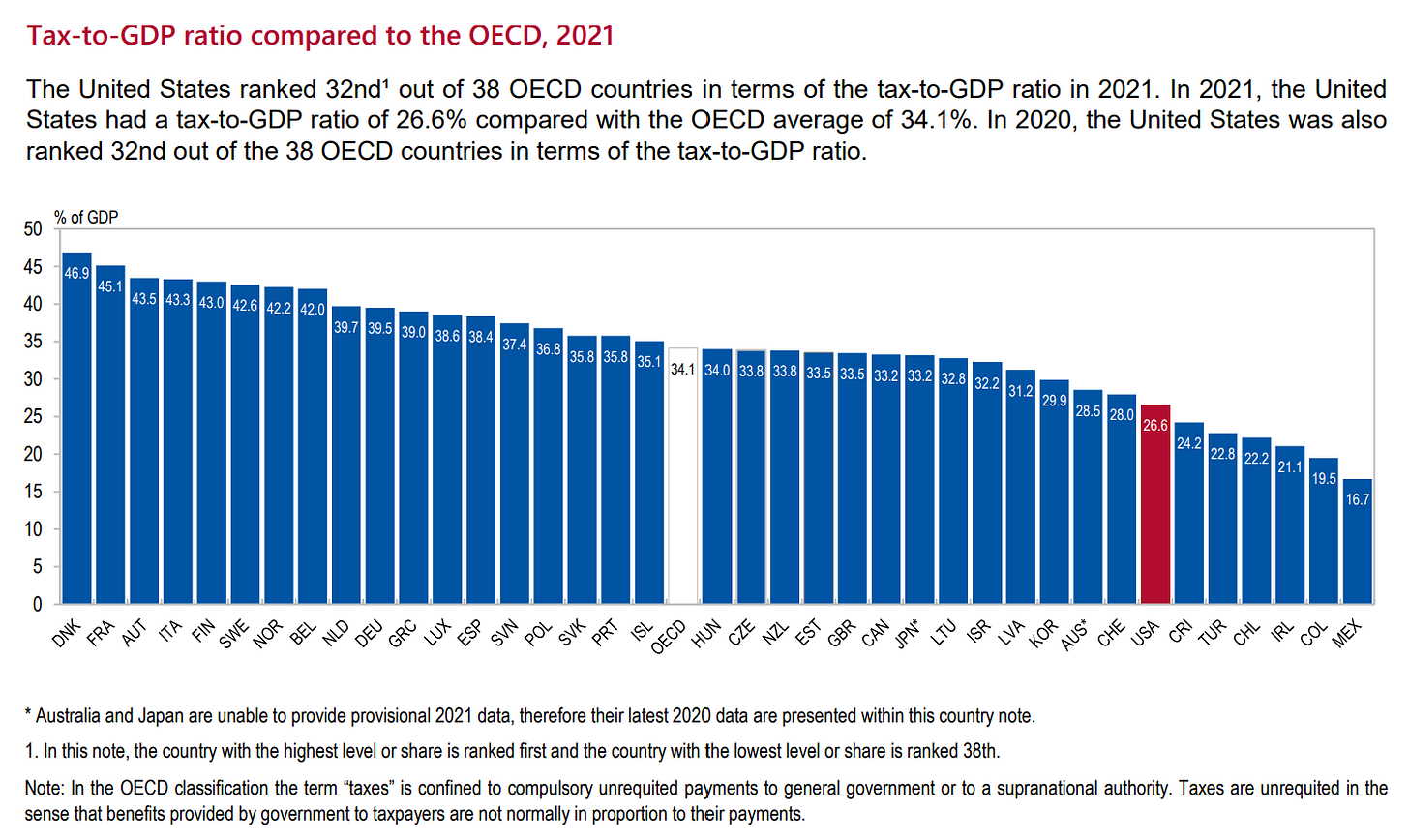

Eighty-five thousand slots at $100,000 each equals $8.5 billion annually. An auction could raise more. Current fees raise <$7.5MM – not even close to the costs of administering the program. As I have noted repeatedly, we have less of a spending problem than we have a revenue problem.

Funds could support STEM scholarships and tuition aid in industries with shortages, targeted student debt relief rather than a universal handout, reduced housing stress in metros strained by visa worker inflows, and the administration of the HB-1 program without subsidy from taxpayers, who ironically are paying for a program that diminishes their wages and inflates housing costs.

Every visa could directly fund American education, housing, and tax reduction if properly implemented. It could also be used to purchase $TRUMP coin if we’re so inclined (sarcasm people — get used to it… it’s default mode).

But Wait, There’s More

The benefits extend further:

• Immigrant dignity: A $10 lottery treats workers as interchangeable. Higher fees signal they are valued.

• Innovation vs. arbitrage: Subsidized headcount is not innovation. Auctions reward genuine productivity.

• Urban development: Reduced inflows ease housing stress in cities like Seattle and Austin.

• Fairness to U.S. minorities: domestic Black and Latino STEM graduates often lose out when employers default to H-1Bs. Fair pricing broadens opportunity and likely diminishes claims of racism against Indian immigrant-owned firms who are understandably exploiting a vulnerability in the current system.

• Data – layoffs again generate unemployment claims (Fed notices), job openings no longer artificially inflated by phantom job postings to qualify for HB-1, unemployed workers no longer demoralized by fake “opportunities”

• Dynamic competition: Outsourcers lose; small, productive firms gain.

• Moral clarity: Work authorization is a sovereign asset. Auctioning asserts democratic control.

The Soapbox: Capitalism and Price Discovery

At its core, capitalism is about price discovery. Prices transmit information about scarcity and value.

• Passive investing undermines it by allocating capital mechanically.

• Flat lotteries undermine it by treating all entries the same, encouraging speculation and arbitrage rather than innovation.

• Cheap H-1B registrations distort labor and housing, hiding true scarcity.

The strength of capitalism lies in aligning incentives and rewarding productivity through prices. That mechanism has been weakened — in markets AND in immigration.

Restoring it means recognizing that visas are not raffle tickets. They are scarce public assets whose price conveys critical information about labor, education, and national priorities.

Conclusion: Restoring Balance

We auction spectrum, carbon permits, and taxi medallions. Visas should be no different (this applies to Trump’s “Golden Visas” as well).

A $100,000 H-1B fee is not about closing doors. It is about aligning costs, restoring price discovery, and ensuring immigration serves the national interest. With segmentation, reverse Dutch auctions, and reinvestment of proceeds, the system could raise wages, ease housing stress, strengthen education, and renew cooperation between firms and schools.

Is it perfect? Absolutely not. But let’s not let the perfect be the enemy of the good.

Some low-value jobs would move abroad. That is not a loss — many would soon be automated anyway. What remains is high-value work worth paying for.

The current system subsidizes outsourcing and depresses both opportunity and worker sentiment. A properly priced system would raise dignity for immigrants, fairness for American families, and competitiveness for the nation.

Visas are not manna. They are scarce public assets. It is time to price them accordingly.

As always, comments, questions, and claims of Nazism will be processed in two weeks.

The spread (ratio) between book value of the loans (NAV) and the price is what is being measured here, not price decline.

That was an interesting piece for me to read. Gave me a much needed perspective on some aspects of the Trump admin I haven't considered could be positive. Actively trying to remove any partisan blinders as I dive deeper into finance so I can analyze everything from a more rational perspective.

Thanks Mike.