Uber Alles

The gig economy sits at the heart of an impending scandal on government reporting

Summary

I apologize for the length of this note and issue a warning that it contains preliminary analysis based on new data sources, which have connected several disparate trends. The data presented is particularly alarming as it undermines previously held assumptions about economic reporting in the U.S., challenging the accuracy of such metrics.

In the last month, two key releases have substantiated my ongoing concerns about the state of economic reports. The first was the Quarterly Census of Employment and Wages (QCEW), which contradicted the Birth/Death model, highlighting significant misrepresentation often construed as a political conspiracy. Additionally, a note from Herb Greenberg on Tupperware's bankruptcy highlighted the competition for workers in a gig economy environment.

The discussed QCEW revisions and other data suggest a significant overstatement in employment and by extension GDP. Despite changes aimed at improving data accuracy, the real issue may lie deeper with structural biases and methodological flaws potentially skewing economic indicators, leading to a misleadingly optimistic portrayal of the economic landscape. This could be distorting crucial economic decisions and policies.

Top Comment

Andrew Schaefer asks:

Mike, your work on passive has been really eye opening for me. I think your effort to bring awareness is admirable and will hopefully make its way to better policy making (fingers crossed). Regardless, you make the concept easy to understand, which should help spread the word and get the right people thinking about the potential ramifications of passive selling.

One question to ask though…how much has passive affected major European and Asian equity markets?

MWG Response:

It has LESS of an impact on European and Asian markets because it is much less penetrated. There are a few exceptions to this -- Australia, for example, where indexing has become the national pasttime due to superannuation funds. There we can see the obvious impact as the largest stocks in the index are also trading at absurd valuations (their largest bank is 2x the multiple of JPM for example).

The Main Event

“Never assume conspiracy when incompetence will suffice” — Michael Green variant of Hanlon’s Razor

An apology for the length of this note. And also a warning that it is preliminary analysis done in real time as I uncovered a few data sources that I have not previously read that tied together a number of disparate trends. The data is disturbing.

In the past month, we saw two important releases that once again validated concerns I have been expressing about the state of economic reports in the United States. The first was, of course, the Quarterly Census of Employment and Wages (QCEW) which shattered the illusion of the Birth/Death model even as it was often reported as a political conspiracy by the BLS to support the current administration:

The second was the bankruptcy of Tupperware. Herb Greenberg wrote an excellent summary of the missed signals as Tupperware crashed. In his piece, there was a notable quote:

The Trouble was, Tupperware was trying to sell via parties and a creaky multi-level-marketing business model while facing increased competition at retail from the likes of Newell Brands' $NWL Rubbermaid, Clorox's $CLX Glad, and Helen of Troy's $HELE Oxo brand, among many others that are cheaper and more readily available.

But for a direct seller like Tupperware, even more worrisome: beyond the competition of selling products there was also competition for salespeople. That was especially tough in the "gig economy,” given the rise of companies like Uber $UBER , DoorDash $DASH , and Lyft $LYFT , but also continued competition from other direct sellers... including the Pampered Chef, Perfectly Posh, and Stella and Dot. — Herb Greenberg

Let’s annotate the Tupperware stock price chart for this insight and then return to the QCEW:

QCEW Payroll Revisions

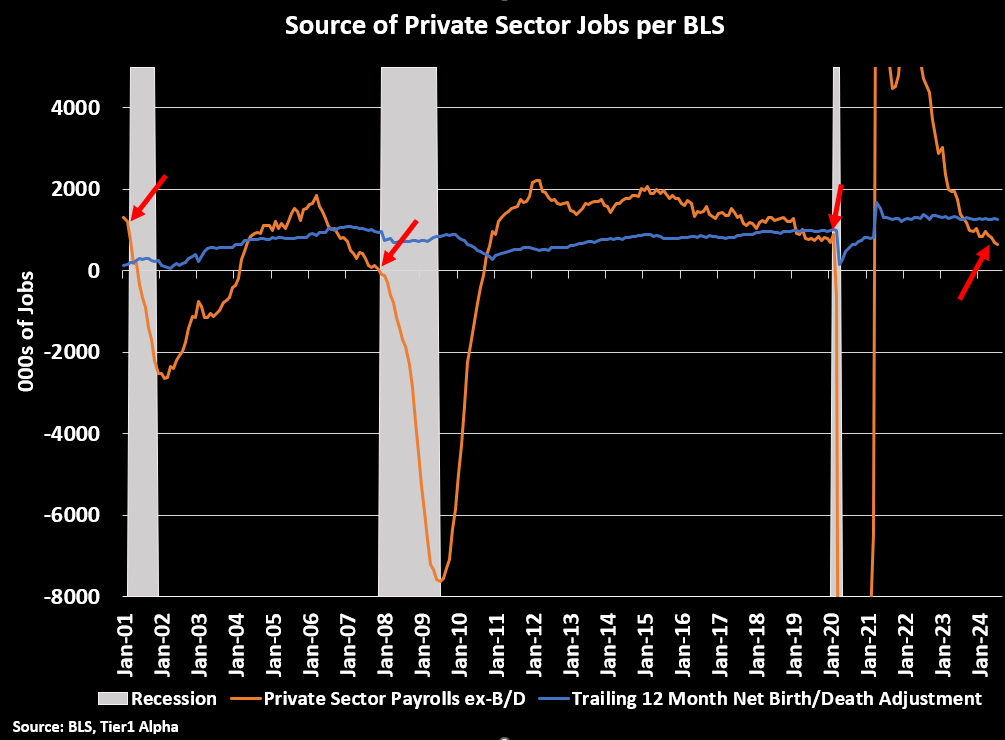

This, of course, was due to the Birth/Death model that has often graced these pages. As a quick reminder, the Birth/Death model is an adjustment to the establishment (“payrolls”) report that attempts to minimize subsequent revisions to payroll data by estimating the number of new businesses that were created and the estimated number of jobs created from these businesses. It has fared poorly in the past two years:

The Birth/Death relies upon estimates of new business formations calculated by the Business Employment Dynamics (BED) with interim projections based on applications for Employment Identification Numbers (EINs) with the IRS. As discussed at length in my January note, this has been corrupted irreparably by changes in the ease of EIN application (I received one in 15 minutes using online IRS tools last weekend, backdated to June 2023 btw, whereas pre-2004 this would have been a paper application requiring weeks to months), the advent of PPP/ERC which required EINs to participate in various pandemic related fraud, AND a change in reporting thresholds for EINs in 2021 from $20,000 to $600. Predictably, business formations soared taking Birth/Death estimates of job creation higher with them:

As I have pointed out, these Birth/Death adjustments now account for the VAST majority of private sector jobs being created and it is highly likely these jobs simply do not exist:

The obvious retort is, “Well even with the QCEW revisions, jobs are STILL growing.” This is true. Kinda. It turns out that once again, methodology matters. Let’s check with the BLS to figure out what QCEW actually is — it’s a survey of businesses reporting unemployment insurance data to the state unemployment bureaus.

Why do they do this? The rate that businesses pay into unemployment insurance is affected by the rate of claims.

As a result, this should be a pretty good metric, right? Well, note above that certain businesses do NOT have to report into UI, namely railroads and religious (and grant-making) organizations due to their nonprofit status. Perhaps we could do an out-of-sample test. Railroad employment as a percentage of total employment has been falling since the 19th century and in the past few years has been adversely affected by “precision rail scheduling.” As a result, the pattern of declining rail employment as a fraction of total employment likely tells us little. But to my knowledge, there has been no such change in “Religious and Grant-making Institutions.” And guess what, after rising as a fraction of employment from 1990-2009 (aided by the weak labor market from 2000-2006) inexplicably the fraction of employees in these institutions began to fall precipitously in 2009, consistent with the revisions of Birth/Death (and admittedly the recovery post-GFC):

Now this is a bit terrifying, because it suggests that actual employment in establishments could be overstated by as much as 25%. I think that’s wrong primarily because the share of employment represented by establishments rationally rose with the introduction of the Affordable Care Act of 2010, which mandated health care insurance and low tax rates for corporations (a historical pattern) which helped to drive employment towards larger corporate entities: