Free post: What's Good for GM is Good for America...

The UAW wage negotiations reveal much about the state of America

Summary:

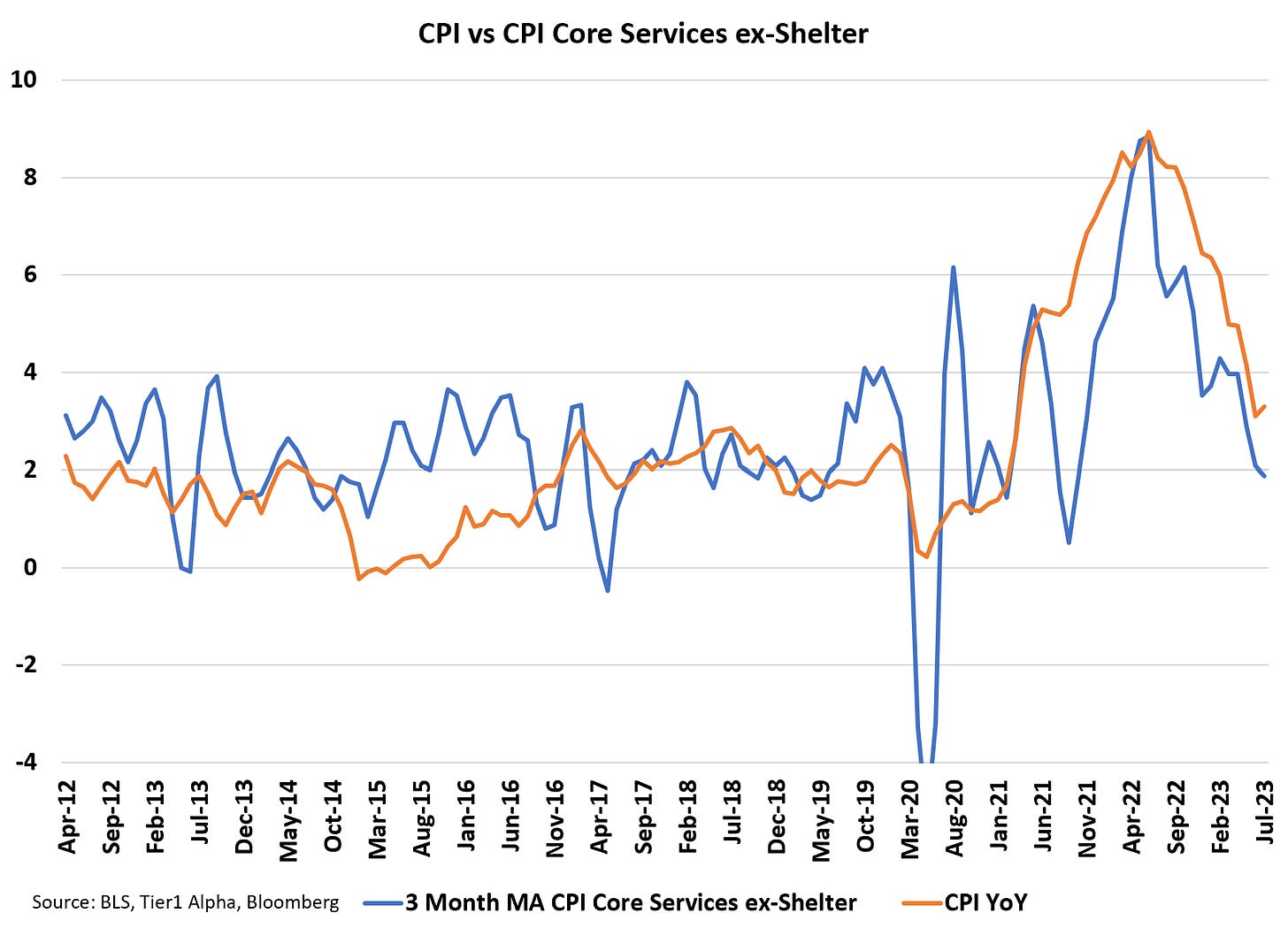

The case for a resurgence in inflation tied to US fiscal stimulus and high wage demands has limited support

U.S. Deficit Misconceptions: While the U.S. fiscal position appears to have deteriorated sharply, the actual debt to GDP ratio is falling again. Temporary tax delays in California have impacted federal receipts, but this is set to reverse soon.

Dept. of Education Spending Surge: The notable increase in the Department of Education's outlays reflects the accounting impact of student loan forgiveness, not actual overspending.

Labor Unions & Wage Dynamics: Labor unions, especially in the automobile sector, are pushing for substantial wage increases. However, their influence may not be as strong as perceived, and estimates on additional labor costs are clearly inflated.

Company Profitability at Labor's Expense: Examination of companies like Ford and GM suggests that recent profitability improvements are due to compromises from labor rather than genuine managerial success. Labor is likely to have better success on wages than benefits.

Top Comment

Dalton Brown: What if credit spreads never widen because nobody is willing to rollover debt at the rate they would have to? This is obviously a rhetorical question because someone somewhere will choose to transact but i’ve seen you make the case before that spreads should be wider given the risks the market seems to be ignoring. I’ve seen first hand on the private side risk spreads not widen but go bidless (clients have told me that with cash at 5+ and 30s at 4+ they’d want RE deals yielding 15% and nothing is so they hoard cash).

MWG: Dalton, unfortunately, I think you’ve answered your own question. This is exactly what we’re seeing and why we’re seeing “keys handed over” to lenders rather than auctions to maximize proceeds. The borrowers know there’s no bid anywhere near their debt breakeven and any attempt to force a transaction would drive all prices lower, impairing their remaining assets. So we wait. Somebody will blink.

The Main Event

This note is going to be split into two, relatively brief parts. Each of these parts will be explored individually in the next few notes rather than attempting resolution of all at once — a task I am simply not up to in a single week. For the structure of the note, I am indebted to Larry McDonald for framing the (incorrect) narrative:

The two parts:

Budget? We don’t need no stinkin’ budgets! What in the world is going on with the exploding US deficit? It’s not what you think,…

Wages. Will resurgent labor unions drive a wage-price spiral?

I’ll save a discussion for the “resilient” US economy and oil production cuts for another note, but just have to point out that initial jobless claims have been rising in a definable trend since September 2022. Yes, they remain low, but to deny this weakening trend is disingenuous.

On the oil story, I am neutral to positive on oil prices (for now) as I’ve discussed repeatedly. But remember that Saudi oil cuts are a sign of weakness, not strength. Now on with the show…

The Exploding US Deficit

By now, we’re all familiar with charts like the one below that emphasize the deteriorating fiscal position of the US government. I do not want to diminish the importance of these charts. However, I DO want to emphasize that using budgeted metrics, the debt is largely stable. Note that the $ value of the deficits for 2022-2028 are identical and that debt to GDP has been declining

Despite Debt/GDP declining (this is doubly true if we account for the cash held in the Treasury General Account), we are being treated to headlines about fiscal stimulus driven by equal parts excess spending and poor revenue generation. I discussed the revenue generation in last week’s note, but it’s worth reiterating the admittedly unclear point — the majority of the deterioration in Federal tax receipts for Fiscal Year 2023 can be explained by many California residents (including yours truly) getting to skip an entire tax cycle! The Federal government fiscal year runs from October 1 until September 30. Due to the state of emergency in California (largely flooding, but also Dianne Feinstein), California residents have not had to pay taxes since April 2022. They will have to make these payments on October 15, 2023. As a result, the 2023 fiscal year running from Oct 2022 until Sep 2023 has lower personal income taxes from California, while the 2024 budget will have 2x payments from California — a reminder California represents 15% of the Federal tax receipts in a normal year.

The more interesting observation comes from looking at outlays. On a TTM basis, we have seen notable but unsurprising increases in Social Security & Veteran spending (COLA adjustment explains 97% of it), interest expense (thanks, Jerome), “offsetting receipts” (again, Jerome, as the Fed is no longer returning income to Treasury), Medicare (decreases in premiums are a key driver here) and then of course the $450B increase in Education Department spending.

Oh yeah… you know… the Department of Education, whose $90B annual budget seems to have been the subject of cost overruns…

Now just hang on a second… that can’t be right… except it is. Do you know what that surge in taxpayer outlays from the Dept of Education is? The not-yet-reversed impact of Joe Biden’s student loan forgiveness with the ADDED impact of recent moves to cancel student loans that were not properly canceled already. In other words, fairy dust. These are NOT cash outlays, but due to the mechanics of government accounting, we have to recognize the present value impact of lower expected debt repayment. Even if the Supreme Court has said no. So guess what? That giant increase in deficit spending is a fugazi.

All of this left me very unsurprised that the inflation monster is not responding to this supposed surge.

I can’t wait to hear about all the reasons why it doesn’t matter next year when the Education Department saves $400B and the personal tax receipts explode on 2x California collections. It will, of course, be signs of a resilient economy and incipient inflation resurgence…

What about wages?

Shortly before the August CPI print, we learned that the wage-price spiral was on in earnest. Yes, in 2022, railway workers had negotiated a large increase in wages that captured America’s attention for a brief period of time, but that quickly faded from the headlines as rail transport prices failed to rise. Now, UPS drivers and airline pilots and UAW workers, oh my!

The UAW demands appear to take this to a new level, demanding a 46% pay hike and restoration of pre-GFC benefit levels. Predictably, this has led to howls from the wage-price spiral crowd.

We all know that labor is the single biggest cost, so these wage increases MUST lead to higher costs. The proverbial “insiders with knowledge” assure us this is the case:

New contract demands made by the United Auto Workers union would add more than $80 billion to each of the biggest US automakers’ labor costs, according to people familiar with the companies’ estimates.

That large an increase to labor costs over the contract’s four-year term could wipe out profits and threaten the carmakers’ futures, according to the people, who asked not to be named because the analysis has not been made public.

It would increase hourly labor costs to more than $150 per hour at Ford Motor Co. and General Motors Co., including wages and benefits, up from the $64 an hour GM, Ford and Stellantis NV workers make currently, the people said.

Let’s evaluate this claim. First, we have reasonable sources that allow us to look at each company individually, but let’s start with Ford which revealed data heading into earlier negotiations around EVs in June 2023:

Ford is hoping to convince the union to give it more flexibility by noting that it employs as many as 14,000 more US hourly workers than either General Motors Co. or Stellantis NV, parent company of Chrysler and Jeep. Having the biggest US hourly workforce costs Ford an extra $1 billion a year compared to its domestic competitors, the sources said.

Ford’s labor costs, including wages and benefits, are $64 an hour, compared to $55 an hour at the non-union assembly plants of international automakers such as Toyota Motor Corp. That creates a labor cost gap of $900 million with the international automakers, the people said. Labor costs at Tesla Inc. are even lower at $45-to-$50-an-hour.

So 14,000 extra workers at $64/hr is an extra $1B in costs gives us our first check on this $80B in additional labor costs claims.

On my calculations, an additional 14K workers at $64/hr is $1.8B, but I do come to a similar conclusion if I use the wage-only component. Either fewer hours or fewer workers have to be at the core of the difference, but I’ll let it slide as it suggests my approach is reasonable. Let’s move on.

Using Ford’s total labor force and applying the claimed metrics from the automaker insiders, I can’t come remotely close to the estimated impact of $80B for Ford (much less the other automakers, which Ford notes employ FEWER workers. And note that this assumes the $150/hr cost is correct and that hours worked remain the same despite a shift in hours worked from 40 to 32, which suggests that Ford’s non-wage prices TRIPLE over the next four years and there are zero productivity gains to be had.

There is no way the calculations “insiders” are sharing can be correct. I’d also note that the UAW wage demands don’t fully restore the UAW premium over the rest of the manufacturing sector from 2007. Assuming manufacturing wages rise 2% per year over the next four years (the 2009-2019 pace), that would suggest average hourly manufacturing wages at $35.30 ($32.61 x 1.02^4). The UAW is asking for $40.88/hr in wages, only a 16% premium to the average manufacturing wage versus the 31% premium in 2007.

And just a reminder (note that In-N-Out also pays full benefits)…

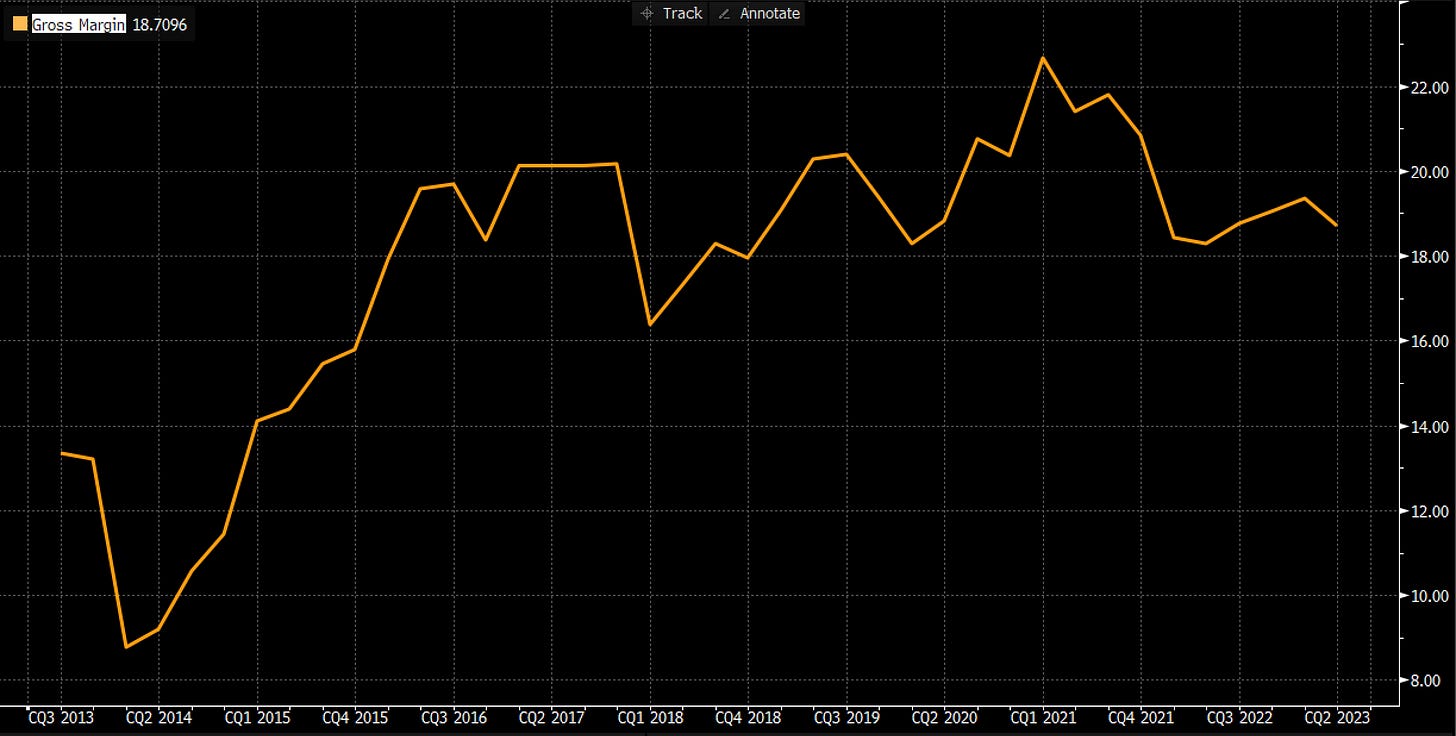

Let's look at Ford’s gross margin line. We discover a firmly deteriorating company with an unexplained short-term jump in profitability that almost perfectly matches what the UAW wants to reclaim.

Looking at the same chart for GM, we see a slightly better picture, but again this “strange” jump in gross margin versus historical levels. I hate to suggest it, but perhaps Mary Barra is snowing you — the profitability rebound has been built on the backs of GM workers, not management genius. But Elon Musk could have told you that.

And finally, will the workers win? I’m skeptical, guessing they’ll get their wage gains but not 100% of their benefit and hours requests. Why? Because among many other reasons, the idea that “unions are the most powerful in decades” is absurd:

So let’s make a reasonable estimate that the UAW gets its wage requests and splits the rest. Hours to 36 (from 40) and benefits appreciate proportionally to wages. If management can show just a modicum of talent, extracting 2% a year in productivity gains from their newly enriched labor force, this becomes a non-story:

It also highlights the importance of challenging the accepted wisdom that “Labor costs are the biggest cost for employers.” This hasn’t been true for decades. We’ll explore this myth in an upcoming YIGAF.

As always, comments and questions are appreciated!

Just wondering out loud... Debt/GDP coming off is probably due to the sharp increase in Nominal Growth, which in turn is due to the high inflation. If inflation comes off as you expect (leading to positive real rates currently), Govt interest exp will start bcoming higher than the nominal growth of economy. That would prob turn the Debt/GDP number higher... A recession & the subsequent stimulus probably will make the number worse? This is probably why Fitch did what they did...

If California is 15% of tax receipts and Federal Tax reciepts/GDP is about 20%, would be it fair to say the California situation let to 3% additioanl fiscal deficits. I believe we are running at 7-8% fiscal deficit/GDP currently, so adjusting for that we would be running at 3-4% ?? Isnt that considered high still?

So by that logic, we should start seeing faster cracks in the economy with California tax payments and the student debt situation...recession in Q1 2024?

Mike, your post presents a convincing argument that the debt doesn't matter right now, but what about in the future? I'm one of the many Boomers who is now on Medicare and have been fortunate enough financially to be able to wait to file for Social Security, but I'm going to do it when it doesn't make financial sense to wait anymore. Given the size of my demographic cohort won't this matter eventually?