Something's Rotten in Data

I cannot make the glove fit...

Top Comment:

James Morrow comes in with a hypothesis on the R2K:

I think the deteriorating quality of the R2K universe is really just the root causal feature here to what you're seeing. It's not that small caps are lagging, its that junk is lagging and they are one and the same now, not separate themes.

Over the last 10-20 years, cash flow producing, stable, higher quality small and mid-cap companies have stayed private via Private Equity with excellent access to capital, while the IPO market, fueled by VCs eagerly exiting clownishly valued positions has consistently delivered "greater fool" garbage to public investors via small float listings & SPACs or via other mechanisms.

The # of unprofitable small caps is near an all-time high at the PEAK of the economic cycle. What do you suppose will happen if the economy slows or ever is allowed to have a recession?

The R2K is not what it used to be, and so historical measures are tough to use, and public markets are increasingly dominated by larger companies because that's the only real investable part of the public market.

MWG: James, there’s definitely some truth to what you are noting. The R2000 by construction is lower quality than the S&P500. However, we can test the hypothesis by isolating the Quality factor within the R2000 and comparing it to the Quality factor within the large cap R1000. Unfortunately, the same underperformance exists and while the alpha for the Quality factor in Small is higher than it is in large caps, it’s also far more variable:

Almost perfectly inline with your point, the Quality factor BOOMED in small caps in 2021/22 as the aftermath of the Cathie Wood/SPAC nonsense abated. But note that for 2023, it was indistinguishable. Small really was the problem:

However, your point is certainly valid, and I’ll reiterate again, it’s hard to see a catalyst that leads to Small meaningfully outperforming UNTIL active managers de-risk ahead of some uncertain event (like an election) and then try to buy back in to an increasingly inelastic market. The level of stock allocation has been an excellent predictor of moves in small vs large… until very recently. Perhaps this is a sign of change afoot, or perhaps it is a warning that even more pain is ahead for the low quality index:

The Main Event

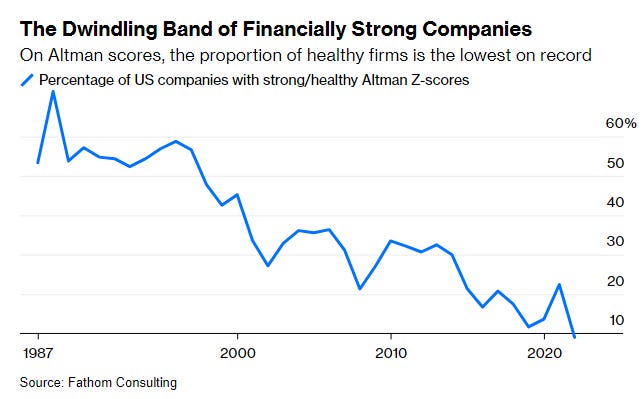

James’ observation has me thinking about this general issue of quality and its impact. It is unquestionably true that there is a “dwindling band of financially strong companies” as Bloomberg put it (click the graph for the article):

And as I have discussed ad nauseaum, the “rise of Zombie companies” threatens to upend the current mantra of “interest rates don’t matter!”

The “secret” of the resilience of the US economy has largely been about deferring the need to refinance wherever possible. We have not escaped the increase in the cost of financing; we have merely deferred it. And while credit spreads are tight (currently 20%ile for high yield), the real challenge is currently posed by risk-free rate increases. This is no different than any cycle in the last 60 years other than magnitude. Perhaps this cycle ends without a credit spread spike, but if it does, it will be a first:

All of which is to say, on my calculus credit spreads are way too tight, in a manner identical to the lead in to the GFC:

The Disconnect in Data

While headlines are full of “accelerating economy” narratives, there is something deeply off in the data sets. For example, Personal Interest Expense is rising at the fastest pace in history. While increases in interest income currently largely cancel it out, this is due to the relative size of the two pools — but more importantly, the narrative that “interest income is supporting the economy” appears to have very little support:

From 2022, NET interest income is down in total dollars as rising interest expense more than cancels out higher interest earnings:

If we look at BofA’s spending data, it doesn’t support the booming economy narrative either. In a month where retail sales supposedly grew by 4% yoy, according to the BEA, BofA shows spending up 2.0% in December.

Likewise, the acceleration in Wage & Salary data from the BEA is not at all matched by BofA aggregated data. Using BofA aggregated deposit data suggests incomes for all groups excluding GenZ rose less than 5% YoY. Remember that GenZ is just entering the labor force and earns less than other generations, so the growth for GenZ is a combination of more workers AND higher wages as they earn raises.

Using the Pew Center’s data, suggests the labor force should be weighted roughly:

If we ignore the growth in deposits tied to growth in the number of GenZ workers (in other words, give them FULL credit for the gains), applying the BofA data on growth in deposits weighted by labor force representation suggests wage income grew by 2.49% in 2023, almost exactly equal to BofA’s spending data. Meanwhile, the BEA estimates it grew by 6.4%???

I’m sorry, but the data just does NOT fit…

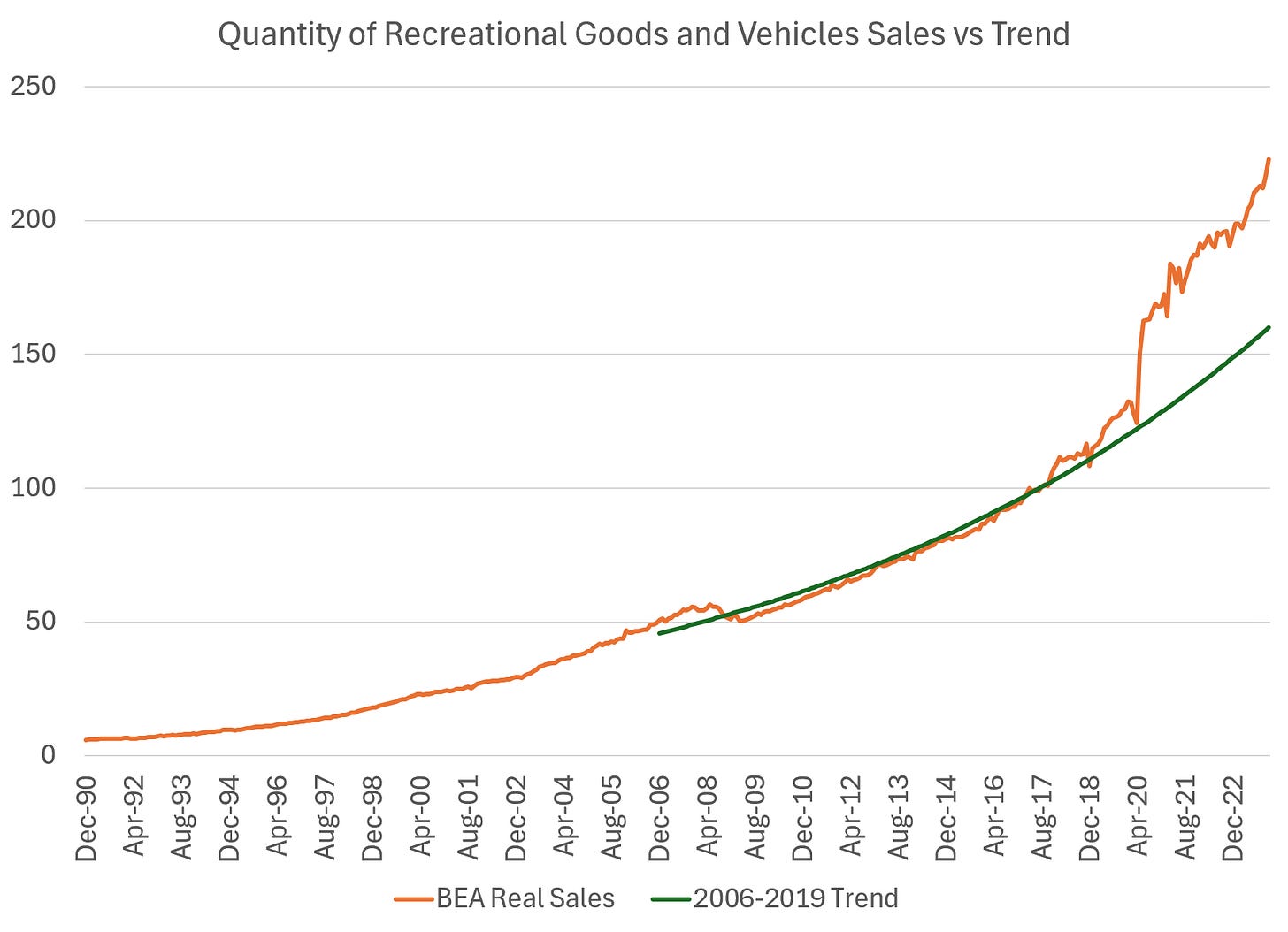

It gets MUCH worse when I try to reconcile the data we are getting from the BEA on GDP components with industry reports. For example, spending on Recreational Goods and Vehicles. According to the BEA, REAL sales of recreational goods and vehicles has continued to climb unabated in 2023. Remember that this feeds into the growth of GDP.

Meanwhile, according to industry reports, sales in September 2023 were down 21% YoY. The BEA estimates real sales were up 8.3% YoY in the same period:

What makes up “Recreational Goods”? Well, according to the BEA, in 2017 it was basically boats and RVs:

Perhaps sales of boats have exploded relative to…

Damn… that doesn’t work either… the BEA must be tracking an explosion in equestrians…

This disconnect calls into question the current narrative that “productivity has rebounded.” When BEA data diverges to this extreme from industry data, I’m going to go with industry data EVERY TIME. Unfortunately, the desire to believe is very strong, particularly for those with a tribal affiliation to Democrat administrations. While I have a ton of respect for Skanda Amaranth (@IrvingSwisher), I have to point out that his latest theory on rebounding productivity is deeply suspect.