The Dispersion Diaspora

Yes, the VIX hit 65, yes it was meaningful, yes it was contained.

Summary:

China's Economic Shift: The decline in foreign direct investment and capital flows into China further signal the "end of the China story" as economic conditions worsen despite rising productivity. The rest of the world will not absorb China’s domestic excess capacity and the unwind has the potential for a “Great Depression-style” event centered in China.

The recent VIX spike: However, the VIX spike was unlikely to be a precipitating event. This was the unwind of the crowded “dispersion trade” — a basis trade like any other. The discussion covers the implications of rising implied correlation and volatility in the U.S. markets, with particular focus on the potential warning signs of market instability, though not yet signaling a full-blown crisis.

Top Comment

Menachem took issue:

It's clear that your stance is that productive capacity is a national burden while [access to] consumption is an asset. This seems 180 degrees from the 'Austrian', or at least intuitive view of most. At some point, could you perhaps go into some detail in why you see it that way? I could see why excess production could be a negative if there were no customers for the product/service, but China's production is largely wholesale durables and consumables, so even if they have to do internal "clearance sales", there's an untapped improvement in their societal quality of life that comes from their excess productive capacity? Isn't a lack of overseas demand for said production, effectively just a way for the world to say "we're not keen on growing the asset side of your balance sheet anymore"? It's really hard to wrap my head around a concept like the US growing its production capacity to at least begin to return to the first or second industrial revolution styles being a bad thing domestically.

MWG response: [the first section of this post goes into more detail on the “societal quality of life” point] That's not my stance at all. The NEED to produce in order to consume IS a burden. Otherwise, why do people go on vacation and desire a life of relative leisure? To deny that "work is hard" is absurd. Without judgement, modern societies have a choice -- do we insist that all our productive goods are produced under conditions we demand for our own society? Safety, environmentalism, decent wages, etc? Or are we willing to outsource their production to those laboring under worse conditions? Choice #1 likely leads to underconsumption and overproduction as we create expensive goods few desire at those prices. Choice #2 likely leads to overconsumption and excess debt as those in our society deprived of incomes must consume via other means.

Once you leave subsistence behind, it's all a series of choices.

What I’m Reading and Listening To:

All work and no play makes Jack a dull boy — I really enjoyed Peter Thiel’s recent appearance on Joe Rogan and applaud his measured pushback against many conspiracy interpretations. I fundamentally disagree with Peter’s view that innovation in material form, rather than social communication technology, is impossible. For me it’s all about energy as discussed in a prior post. We are seeing remarkable advances in many energy technologies and even the progressive left is starting to shift its stance on nuclear, in particular. This is an underappreciated win in a sea of losses.

Peter’s take on AI is similar to mine. Yes, it’s a bubble. Yes, it’s much more important than we currently realize. And now that we’ve convincingly left the Turing Test behind, parlor trick or no, we’re artificially raising our standard for AI as we cross from the early adopters into demands for productivity enhancement evidence:

If you simply can’t get enough Mike Green(e), you can check out my long-form discussion with Barry Ritholz. As regular readers of my work (and tweets) know, I have had my issues with Barry’s team and snarky dismissals of my passive concerns. Occasionally, I’ve been forced to “be better.” To Barry’s credit, we aired it out in person (remarkable idea) before the podcast and he did a wonderful job of giving me both push back and acknowledgement in his latest Masters in Business.

The Main Event

"Gather together our Dispersion, set at liberty them that are in bondage among the heathen.” 2 Macc 1:27

I took a break from writing about volatility and systematic last week because I wanted to put a placeholder on China. Since I began writing this Substack, I have repeatedly emphasized the “closing” of China would be the biggest story of the next decade in macroeconomic terms while the implications of passive investing would be the biggest financial market story. I continue to believe both will be true.

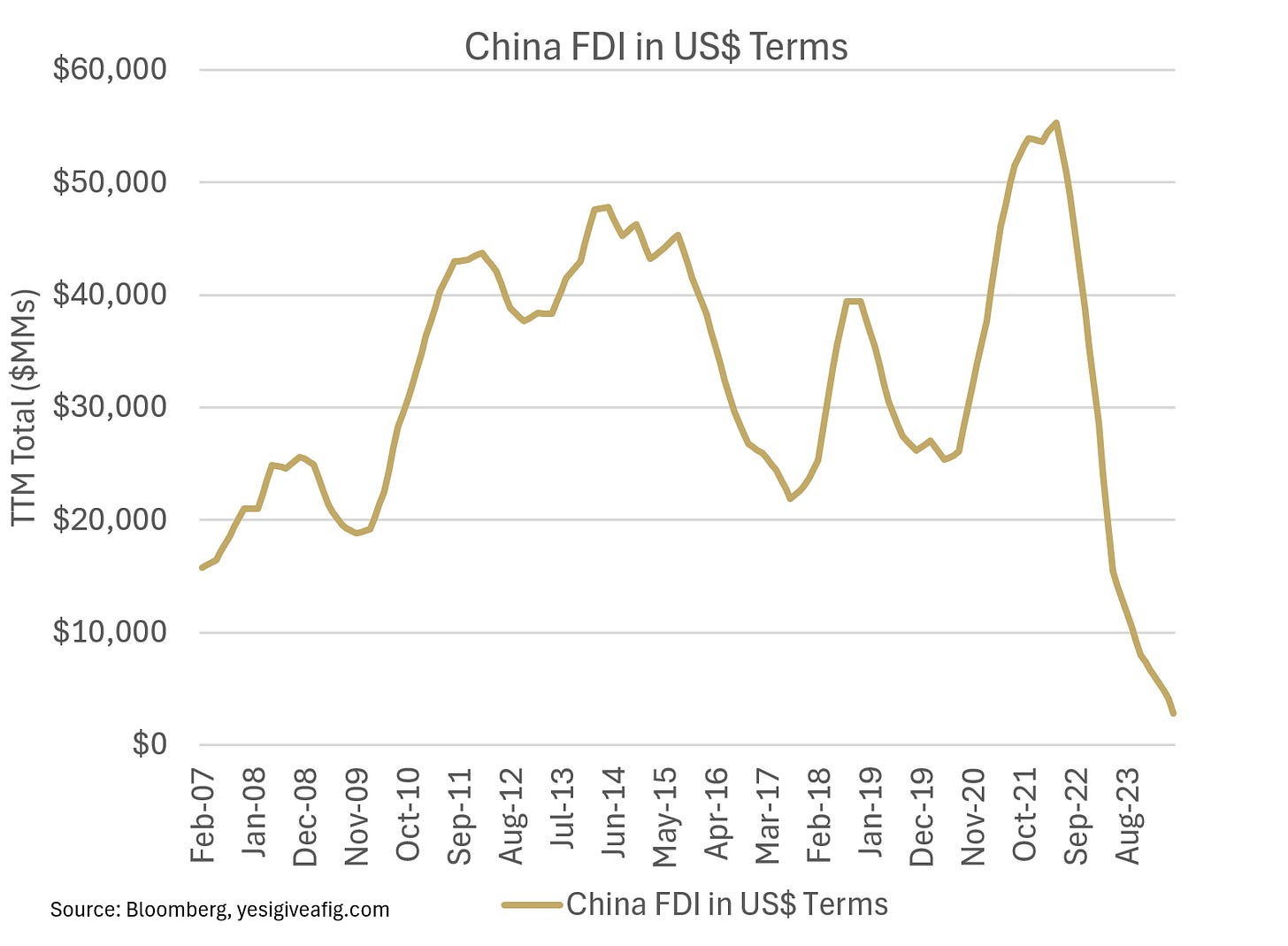

This past week, we got further information on the “end of the China story” with foreign direct investment and capital flows turning negative. Trailing twelve months, we’ve seen the number fall to the lowest level in history:

This has occurred as China’s GDP per Worker continues to push to new heights, implying ever rising productivity as the quantity of workers has begun to decline in absolute terms. All else equal, this would imply a flourishing of the Chinese consumer as rising living standards should accompany higher GDP/Capita. And yet disposable income per capita has stagnated, alongside metrics of consumer health like retail sales per capita.

While “savings” are a good thing, from a national accounting standpoint, these surpluses must be resolved elsewhere. And as Brad Setser and Michael Pettis have pointed out, this surplus resolves as Chinese exports to RoW. According to official data, this remains constrained. But Brad Setser did an excellent post highlighting that this is obviously not the case:

When adjusted for changes in methodology, China’s current account surplus is hitting record heights. As hopefully most learned in the Great Depression and the GFC, when a SURPLUS nation faces a global economic slowdown, the damage is most acute in the producer, not the consumer. If you decide to stop buying from Walmart because your pantry is overly full, YOU don’t suffer. Walmart does.