Scarcity Destroys Value

Our current fascination with scarcity as a driver of asset appreciation is a deep misunderstanding of value creation.

Summary:

The scarcity theory of value has driven the rise of strategies designed to hoard commodities like gold and bitcoin in hopes that speculation will be rewarded. However, this absolute scarcity or "shortage" can destroy value, and leads to manipulative marketing tactics designed to artificially inflate demand.

Bitcoin, as a case study, illustrates this. Its supply is artificially restricted and nearly perfectly inelastic, meaning any increase in demand leads to a rise in price. This benefits existing Bitcoin holders and those managing Bitcoin assets.

Value is derived from abundance, not scarcity, as abundance fuels network effects. This is not achieved by Bitcoin's divisibility, as it doesn't equate to ubiquity - an important factor in creating value.

The rise in scarcity-fueled speculative assets like Bitcoin reflects a decline in "trust" as conceptualized by Robert Putnam, as traditional social capital declines and elites attempt to preserve their privileges across generations. This shift is notably visible in the financial industry's embrace of Bitcoin and other cryptocurrencies.

Top Comment:

Peter Harris: “HY spreads are particularly perplexing in that credit availability, notably from regional banks, is already quite low and probably heading lower. Money supply has started to shrink, which feels very likely to increase the probability of recession. As near term economic outlook becomes less clear and liquidity drain as you mention shifts market capital, one would think that demand for non-senior credit would increase in a way that supported higher pricing (returns/yields) for issuers. Perhaps this is something akin to what is happening in the residential real estate market in which prices are sustained but transaction volumes are very low. I know this is true in the private equity markets where good deals are still getting done, but overall transaction volume is still quite low because the bid/ask spread (read seller expectations) are pretty slow to adjust to the new set of pricing conditions...”

MWG: I believe this is a primary reason HY secondary markets in higher quality credits is where the only trading is taking place (and driving "perception" of tight yields). Buyers of floating rate debt have rotated to fixed rate, biasing towards tightening in loan/bond spreads. It’s interesting to note that my models of credit spreads match realized bankruptcies almost perfectly, while credit spreads remain disconnected

The Main Event:

Scarcity, as an economic term, became central to many in economics with the work of Lionel Robbins:

“Economics is the science which studies human behavior as a relationship between ends and scarce means which have alternative uses." — Lionel Robbins, The Nature, and Significance of Economic Science, 1932, pg 26

However, Robbins’ argument is about relative scarcity, not absolute scarcity. Absolute scarcity, technically referred to as “shortage,” destroys value by forcing those who desire a good or service to forgo that good while transferring a larger-than-normal share of value to the producers of the good or service or the speculators who hoard the good. It is an attempt to capture this unearned value share that incentivizes the proposal that scarcity creates value and leads to deceptive marketing techniques around scarcity.

In simplistic economic terms, absolute scarcity can be modeled with the intersection of supply and demand curves:

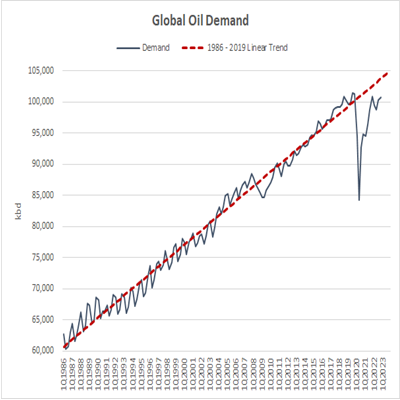

When a monopoly artificially limits the supply response, say intellectual property protection or a programmatic algorithm, the price must rise in response to stable demand. All else equal, the price increase destroys demand even as it increases profits. How can profits rise even further with supply restricted? Encourage growth in demand by marketing the asset as “limited in supply” or as likely to gain value in the future due to scarcity against inelastic or inevitably increasing demand. This is not simply a critique of Bitcoin, although that will come; the same pitch was used earlier this year to explain why oil price was destined to rise:

This scarcity theory of value has led to the growth of strategies explicitly designed to hoard commodities in the hopes that speculation will be rewarded. Pierre Andurand’s oil-based hedge fund is an obvious example. Gold remains the dominant hoarded asset, but similar dynamics exist in the uranium market, with the Sprott Uranium Trust hoarding physical uranium for future price gains. This fund is roughly 2x the size of the equivalent funds directed to investment in uranium producers. However, the theory that scarce assets derive value from their scarcity is perhaps best encapsulated in the modern day with the language of Bitcoin maximalists. From a 2021 discussion with Captain Stonk, Dave Portnoy:

“the same qualities that make gold valuable, the fact that it’s scarce… bitcoin is gold for the internet… Bitcoin is the only fixed asset in the galaxy.” — Cameron and Tyler Winklevoss (I can’t distinguish) in conversation with Dave Portnoy