What Happens to Oil if China Re-opens?

Thoughts on a Tweet from Pierre Andurand

One of the best oil traders in the world put some thoughts into a Twitter thread this past week. Unfortunately, I happen to disagree with his analysis and wanted to share what I see differently in the hopes of feedback from my readers. I disagree with respect. Pierre has run circles around almost everyone in the oil space over the past decade, and certainly in the last year, he has made remarkable gains. So my questions come from genuine curiosity. My experience has been that oil traders are GREAT on the supply story, but relatively weak on the macro demand story. I regularly get calls from oil traders asking for a macro perspective for precisely this reason.

As a result, I was relatively surprised to see Pierre focus on the demand side of the equation:

Now, I’ve got many concerns about a linear projection of global demand for a variety of reasons, but the most obvious one is that there is not ONE demand curve, but many:

If I look at OECD countries, demand has been falling on a per capita basis since 2008. China growth has continued while Non-OECD ex-China has largely flatlined since 2017. As a result, global (World) demand per capita appears to now be falling in aggregate rather than rising. Pierre acknowledges one source of this demand destruction:

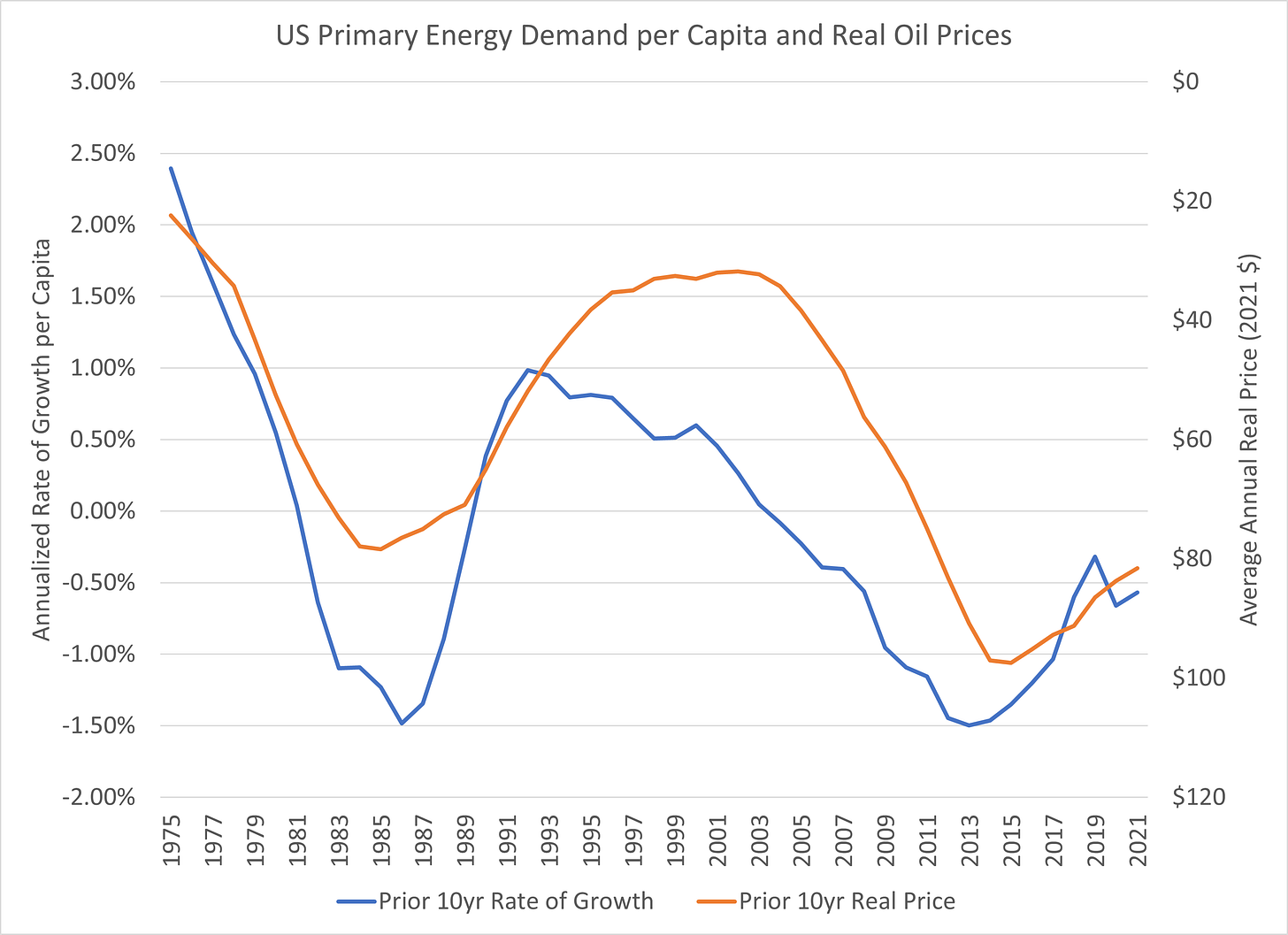

But another source of demand destruction is the impact of oil prices themselves. While many suggest that energy demand is inelastic, that largely reflects a failure to compare apples:apples. In fact, energy demand is quite elastic over time. If I look forward, it is difficult for me to reconcile calls for much higher oil prices with stable demand:

Another issue is rapidly slowing, and in fact negative, population growth. Rather than the population growth that has characterized the 20th century, we are seeing a very rapid retreat — historically these have been poor conditions for commodity demand. An interesting way to test this thesis is through the use of Google’s nGram — a tool that tracks the frequency of words in books. The use of the phrase “commodity” almost perfectly matches the historical pattern of population growth. We can call it the Malthusian Revenge:

And these population growth estimates, using the UN Medium Variant approach, have been fantastically overstated in the 21st century. We are slowing rapidly in global population growth, and the most recent estimates suggest China’s population is overstated by over 100 million.

When I combine these multiple curves with population forecasts, we get a VERY different picture:

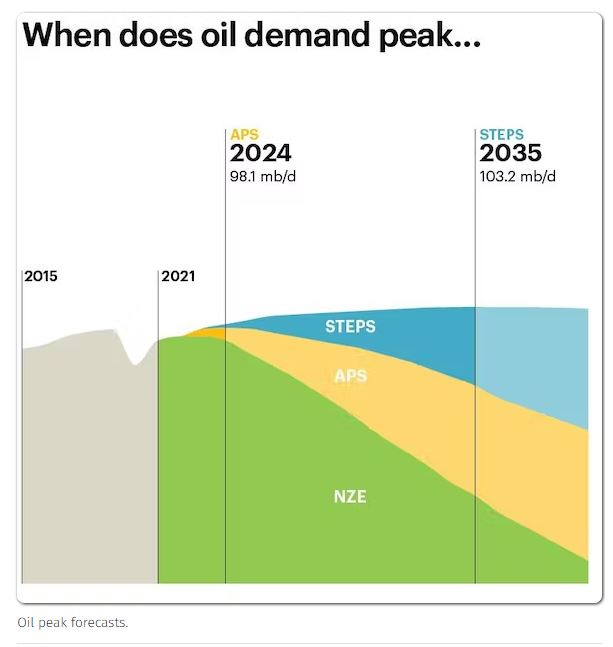

This would suggest we are permanently below the oil demand trend that Pierre highlights, and, in fact, we are rapidly approaching peak oil demand. Using this approach, we’ll hit 101MM barrels in 2025, not 2023, and absolute demand peaks around 2035 at only 106MM barrels per day. Interestingly, these levels are above IEA forecasts but well below the levels implied by Pierre’s linear trend.

If my forecast is correct, it becomes very hard to envision the “energy supercycle” narrative. Interested in reader thoughts.

Thank you,

Mike

I think the analysis misses the fact that the green transition requires huge amounts of materials, new roads and bridges, machinery etc.. Currently everything that is mined, smelted, transported etc requires a lot of diesel and in general oil products. We need e.g. a large amount of copper, bauxite, cement, sand, plastics …to electrify the world. Those mines consume huge amounts of diesel and energy in general. We will have peak oil at 125 million bpd, not 105. Still 15-20 years to go.

Not at all