People Are Crazy? Part 1

Why rising wages are not an inflationary fear

But God is great, beer is good

And people are crazy

Billy Currington, 2008

Today’s note has (of course) run on too long, so I will be splitting it into (at least) two parts.

I also want to take a moment to highlight my FIRST book, coauthored with Simplify’s CIO, David Berns. Dave and I decided to write this book after watching the 2021 explosion of retail short-dated option BUYING. While I tend to run portfolios with a long vol bias (about as wrong as possible in the last year), I want to emphasize that the “pro” trade is to SELL options. Explaining that to a retail audience is no mean feat and I hope a few of my readers on this Substack take the opportunity to read/review the book. It’s available on Amazon.

If you have a copy and would like to get it signed, please look for me in airports across America.

Summary:

Disappointing GDP Growth: The recent GDP report showed real growth at 1.6%, substantially below the expected 2.5% and a decline from the previous quarter’s growth of 4.9%.

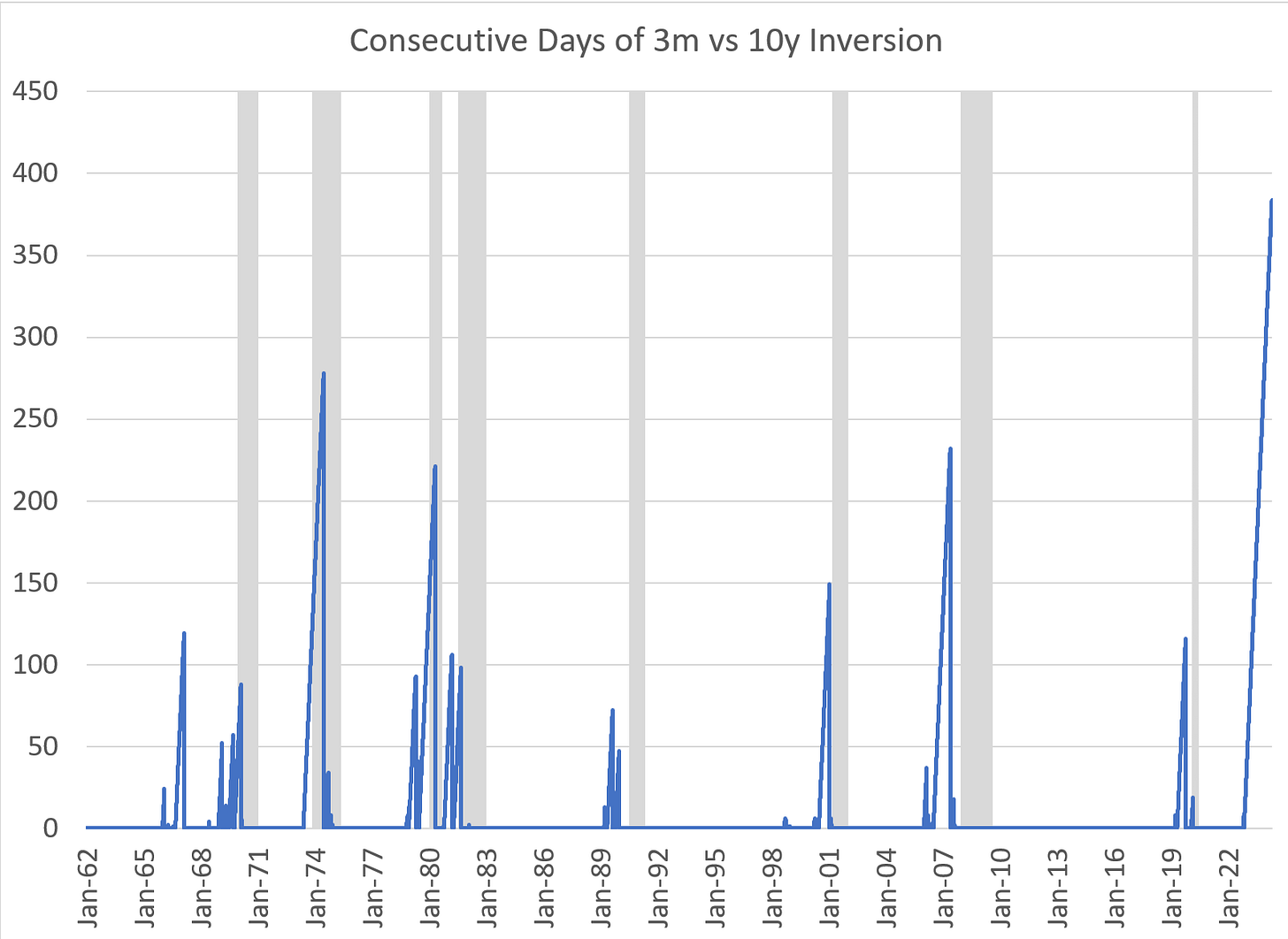

Bond Market Reaction: The bond market reacted with further selling of 2-year bonds, pushing yields above 5%. The longest yield inversion in history continues. Why this persists without a recession is an important question and I begin to explore “Why?” in this piece

Economic Interpretations and Speculations: Differing economic conditions between the U.S. and China highlight disconnects in the inflationary narrative and an overly long discussion of productivity ensues.

Top Comment

David Bradshaw offers a personal insight:

The CPI print is still not close to reality - 3% sounds dreamy. Sorry Mike, I'm with Harley based on my shrinking wallet.

Here are my actual dynamics:

Car Insurance - up 19% in 2023 and another 13% in 2024 - same cars - just older.

Health Insurance - up 14% in 2023 and another 9% in 2024 - I'm not 9% or 14% older and service is worse.

Real Property Taxes - up 11% in 2023 and another 18% in 2024

Property Insurance - up 17% in 2023 and 5% in 2024

Food is for sure over 10% both years.

Services - jeez, hard to calculate because the service is so much worse everywhere, but the prices for rental houses, eating out and plane tickets are all up double digits as well - with terrible service most places.

And these are the dynamics of every employee I have - who then all need raises, as do I, and therefore I have to raise prices on customers. Business expenses are up even more for many things.

Thank goodness the mortgage is locked, unfortunately all other home expenses are not.

We still have a lot of catching up to do before CPI looks close to reality and that is before interest expense inflation is included. Therefore, I think the echo effect of prices already already raised is going to continue a lot further down the road with more prices raised.

MWG: David, I really do sympathize, but you are mixing an AGGREGATE price level change versus the YoY dynamics. You give the example of food. While I don’t know your personal food consumption patterns, the CPI is pretty in sync with your views. Food at home is up 25% since Feb 2020 (now over four years ago, btw) for an annual rate of gain of 5.65%.

BUT… in the last year, it’s only up 1%. This, fortunately, matches my anecdotal experience. You are correct that there are continuing “ripples” of inflation that will pass through, but they are getting smaller, not larger.

The question of POLICY, however, is about what we do going forward. We can’t change the past, but boy can we make the future quite ugly if we keep worrying about the past… especially if we misattribute the causes of current “problems.”

A Few Questions:

Friday’s GDP report was obviously disappointing, with real growth coming in at 1.6% versus expectations of 2.5%. This was obviously well below the heady 5% growth of Q3-2023 (quietly revised to 4.9%), and of course, the narrative immediately came out, “Well, the guts of the report were better than the headline with private final sales to domestic purchasers a robust 2.8%. Decreases in inventory and weakness in exports are to be ignored.” Accordingly, 2yr bonds sold off further, briefly moving back above 5%. The 10yr bond was muted, with inversion persisting, at 4.7%. We are now far and away the longest inversion in history:

Let’s try to understand, “Why?” But first, a couple of quiz questions as a service from my readers. I have a hypothesis I’d like to test. Please try not to cheat by looking up the answers:

Second, what was the level of this metric for the March time period?

Finally, how much did this metric increase in March?

Thank you!

The Main Event (part 1 of ?)

I’ve been wrong on the price behavior of bonds. I can’t say it any more clearly. “Why?” I’ve been wrong is much more interesting, and I think there are a few points worth emphasizing. This is not a rationalization, it’s an attempt to frame my thinking and open it up to critique. As noted, this will be split into multiple parts.

First, it is empirically clear that this is NOT a US problem. The total quantity of US bonds has grown only marginally relative to the rest of the world:

Second, the problem is not the “supply” of government bonds. The SUPPLY of 10-year bonds has been falling since July 2021. And yet yields have surged over that time period:

Third, under every possible metric, the US is issuing similar amounts of debt to China AND has a lower Debt/GDP. Yet Chinese interest rates are falling while US interest rates are rising.

Fourth, of course, the argument will be that China did not experience the inflationary wave that occurred in the United States (and RoW), and therefore, its bond market should not have sold off. But remember in 2021, the arguments were that China would be LEADING the vanguard of aging economies and that aging populations were inflationary:

This was ALWAYS crap, as I have highlighted ad nauseaum. Inflation is NOT the problem.

Here is our first detour…

Yes, all else equal, aging populations are inflationary. But all else is NEVER equal. To control for aging, all the studies cited by Goodhart et al must control for slowing population growth — by far the most important driver of aging populations. Population growth also turns out to be the largest source of inflation. More people, more demand. Less people, less demand. Is there an impact on production (supply)? “Yes” — but not nearly as much as there is on demand, as Matthew Klein helpfully points out in China:

Like agriculture, the world is now SHEDDING manufacturing jobs (and has been for nearly a decade) while producing more and more goods. The example of agriculture is an important segue, because it helps to explain BOTH the current worker shortage AND the “inflationary” pressures we might well experience in the form of higher wages (which are not really inflationary). A key starting point is to remember that one of the world’s largest wheat-producing regions is currently in the middle of a meat grinder war, and wheat prices are at the same level as 50 years ago in nominal USD terms.