Let's Put a Fork in it...

Like 2023, the first wave of inflation is done. Now we find out what we broke.

Summary:

Inflation Trends and Projections: The note discusses recent data indicating that inflation is decreasing, potentially falling below the Federal Reserve's 2% target. Despite high shelter inflation, overall levels have normalized to pre-Covid trends. Private sector measures, like Truflation, even suggest deflation since September due to falling oil prices.

Challenges in Predicting Inflation: Inflation is a complex topic that is not due to any “one” factor. Models of inflation based on unemployment, however, have NEVER offered meaningful predictive value.

Inflation Measurement and Causes: The note emphasizes the importance of accurately measuring inflation and understanding its causes, which go beyond monetary factors. It considers factors like population growth, competition, and societal income/wealth/time use structures. The author also points out the reduced volatility in inflation over time and the challenges in policy responses due to lagging data and measurement inaccuracies.

The Main Event:

This is going to be a short note given the holiday. You don’t want to read it and I don’t want to write it. But there is important data that should be discussed:

Friday’s PCE report contained yet more “good” news on inflation. As I’ve argued all year, the level of inflation leaving 2023 would likely be at or even slightly below the Fed’s 2% target. And despite the large shelter component of PCE inflation coming in close to 7%, the overall level of inflation has now fallen well below the Fed’s target and post-June 2022 has now “normalized” to the pre-Covid trend:

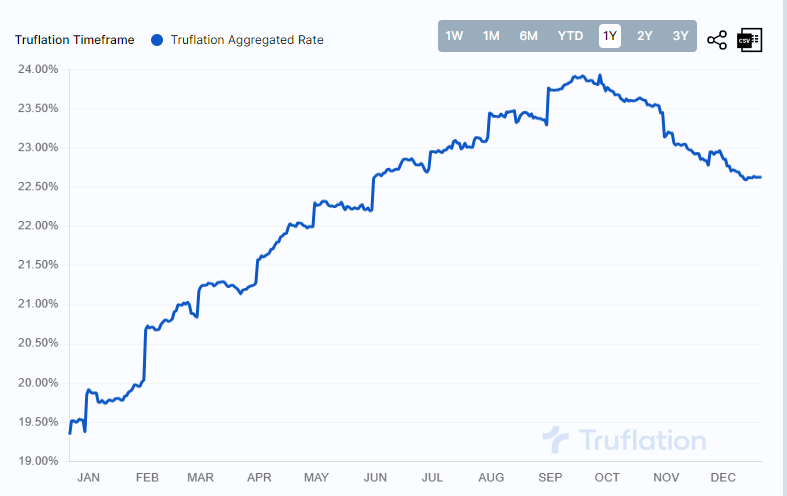

Private sector measures of inflation, e.g. Truflation, are showing outright DEFLATION from September as oil prices retreated:

While I do not expect the trend to be maintained far into 2024, the combination of supply chain improvement and weak global demand suggests that keeping inflation above the 2% target is going to be a bigger challenge.

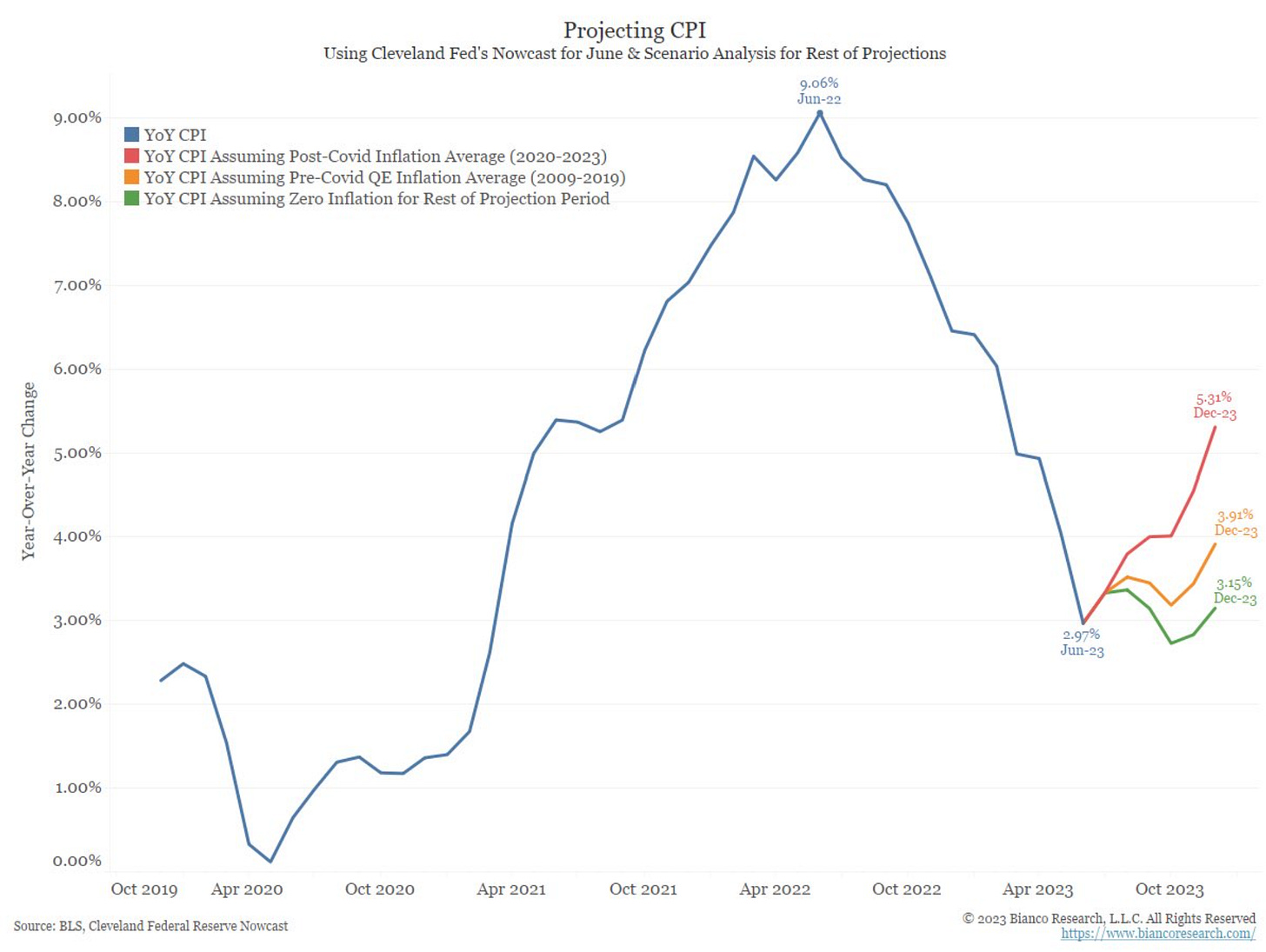

It’s easy to forget that the narrative just a few months ago was “inflation was going to accelerate into the end of 2023 due to ‘easy compares’”:

The math was irrefutable… “look, even if we get 0% inflation for the rest of the projection period” we’ll STILL end up at 3.15% (3.2% rounded).

And yet oddly, we DIDN’T get 0% inflation over the period and we still got decelerating inflation overall. It’s easy to forget the huge prints in August and September as oil prices rose sharply on yet another OPEC oil cut:

The average change in CPI MoM from May 2023 was 0.25%, a 3% annualized rate of gain, which obviously exceeds 0% monthly (supposedly required to get to 3.15% by EOY) and also exceeds the 2009-2019 “pre-COVID QE Inflation” average of 1.6% which was theoretically going to leave us at 3.91%. So HOW could we possibly end the year with inflation close to 3% if we more than doubled the 2009-2019 average on a monthly basis. I honestly don’t know. It becomes one of the many mysteries in CPI for 2023. Given the MTD decline in gasoline prices, we should expect a muted print for December and we’ll likely end 2023 with CPI headline at 3.2%, down from a peak of 9.1% in June 2022 and 6.5% since Dec 2022. This might seem anomalous — after all, everyone from Larry Summers to Jerome Powell assured us there would be pain and that it was necessary to hike interest rates. Unfortunately, the relationship between changes in unemployment and inflation is essentially non-existent. Where strong evidence exists, it’s that inflation Granger causes unemployment in future periods, not the reverse.

What causes inflation? Well, obviously, the level of a price is determined by the intersection of supply and demand. The level of supply is determined by capacity and competition (competitive markets will produce at higher levels than monopolistic markets) and the aggregate level of demand for each good/service is determined by a combination of the number of people and the individual resources (income and wealth) available to each person, combined with their individual utilities for each good/service and the degree of substitution from leisure (I can lower my food costs by substituting cooking at home for dining out). From this very detailed (far more complicated than “inflation is always and everywhere a monetary phenomenon”) description, it should be clear that "INFLATION” the sociological phenomenon has to consider explanations that:

Consider the growth in the number of people, particularly growth in those who wish to consumer MORE than they are currently consuming (e.g. new labor force entrants)

Consider the level of competition

Consider the income/wealth/time use structure of a society

And equally important, we must consider how we are MEASURING inflation. This last point seems to be the subject of particular types of ridicule, but is perhaps the most important. Imagine a country which has experienced mean reverting, but volatile inflation in the past. Let’s call that country, “the United States.” The natural conclusion given lagging data is that an activist monetary policy is counterproductive — by the time you respond to higher inflation, it’s likely falling already. As a result, you should probably focus your efforts on “more accurately” measuring TREND inflation and minimizing the volatility of measured inflation. We don’t want to get those policy makers so excited that they aggressively respond! And this is the unique feature of measured inflation over the past 100+ years — it’s not that the average inflation has risen since the abandonment of the gold standard. It’s the absolute COLLAPSE in inflation volatility:

While many, myself included, like to draw comparisons with prior periods of inflation, particularly the 1940s given the “war-like” adjustments the US economy experienced in the Covid shutdown and reopening, the simple “reality” is that the surprise was not the average inflation realized over the past three years (at 4.68%, the post-COVID inflation is only 75%ile over the 1900-2019 time period), but the inflation in the context of the stability that preceded it.

Now it’s possible that all the forces highlighted at the start of 2023 that were supposedly going to prevent the disinflation (de-globalization, China re-opening, underinvestment in oil & gas, little green men, etc) will rear their heads in 2024 and we’ll see an explosion of inflation in the proverbial “inflation comes in three waves” (source historical data with two observations). I’ll place the odds at Slim and Nun:

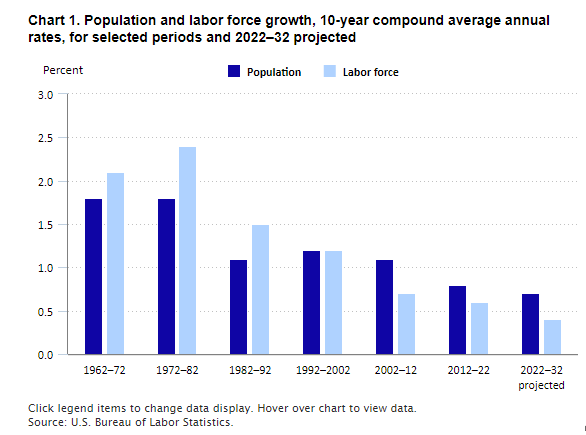

This is sarcasm, but remember that the models of inflation that DO offer insight would highlight that the lack of REAL growth is the key factor to consider. And that begins and ends with demographics:

Maybe it’s just me, but a model that predicted the “immaculate” disinflation as a function of slow growth in underlying demand tied with unsnarling of supply chains might be a better model than one that offers zero predictive power. Did the transitory take longer than expected? Depends on what you expected. What I didn’t expect was the absolute panic about a “NEW CYCLE OF HIGHER INFLATION” with ZERO evidence. I mean, for heaven’s sake — gasoline prices are unchanged for 15 years!

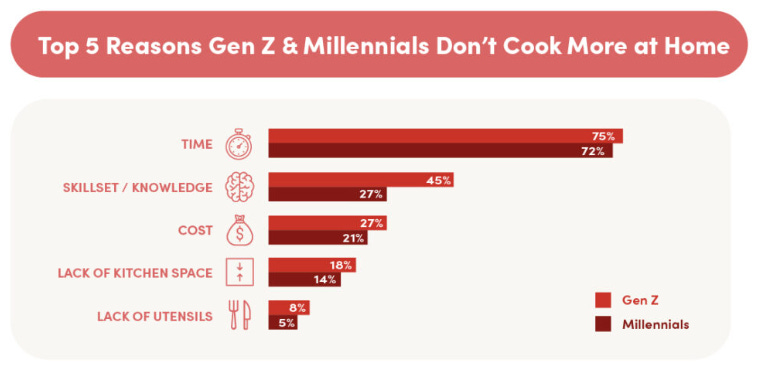

Are other prices higher? Yes, Virginia, they are. And we know why:

and…

As noted above, overall inflation volatility has collapsed over time. This has facilitated comparison shopping and consumer price sensitivity. A lack of competition and an unexpected burst of inflation volatility upended this regime momentarily. In periods of price uncertainty, comparison shopping becomes more challenging… “Maybe eggs should cost $135/dozen… after all, one egg is one egg” say the Bitcoiners. And the growing cohort of adult Millenials are simply TOO BUSY to cook at home supporting demand for ridiculously expensive dining away from home… and tipping… good lord the tipping:

I mean… there’s exciting stuff to do online… who has time to cook?

Well, me… and that’s what I’m doing now. Feast of the Seven Fishes and a Christmas ham (a break from my traditional Beef Wellington given the surging price of filet mignon — we can indeed fight back!)

Wishing you all a very happy holidays and I’m looking forward to my traditional “after Xmas” holiday silence when I can put on my thinking cap for 2024.

Merry Xmas to all, and to all a good night!

Kind of off topic but arguably related to "post-Christmas reflections...", how did the Feast of the Seven Fishes turn out? Sounds deliciously awesome, but like a ton of work. On my bucket list...

I do a lot of the cooking at home because I enjoy it (cathartic) and it helps share the family chore load. You’ve highlighted one of the bizarre ironies at work in the culinary world today (which interestingly almost analogs the rise in literacy rates – many more people can read, but many more choose not to be informed) we have never been in a better position to make restaurant ready food at home – easily and quickly – with Youtube, blogs, etc. Yet SO MANY people my age (40s) and younger order food online. All the time. For most meals. Many never make anything beyond a take and bake pizza or scrambled eggs. Mercy.

The unfortunate piece about all this, besides missing out on eating great food, is what cooking at home can do to bring people together. We chat while we make dinner, and we chat while we eat dinner. The kids get to see how the sausage is made (which buys me equity for cleanup time), and the cook gets to share some love by making what their family loves to eat.

A charge for 2024: cook at home and often and involve other people in the process. An ordinary Tuesday dinner can be transformed into something so much more. Mike and everyone in the FIG community – Happy New Year!

Merry Christmas Mike and thanks for the LOL memes with Slim Pickens' famous scene at the end of Dr. Strangelove and Sally Field as the Flying Nun.