Hard Cope

Does Bitcoin higher mean it's working?

Summary

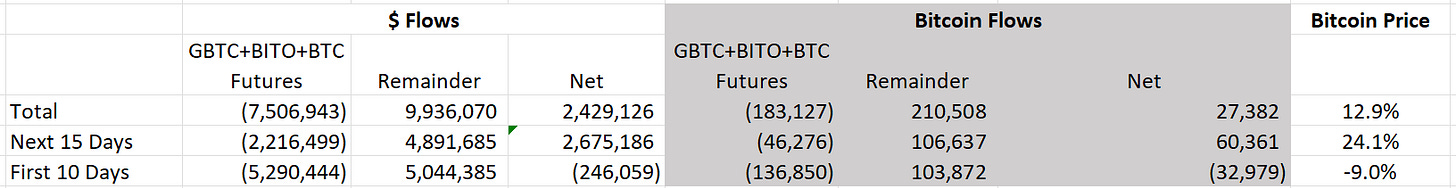

Misconception of Bitcoin ETF Launch Success: The narrative of the Bitcoin ETF launch as the most successful requires overlooking the significant role of Grayscale's GBTC conversion and the modest actual net inflows into Bitcoin ETFs. The initial outflows from traditional finance holdings of Bitcoin exceeded the inflows into spot Bitcoin ETFs, although this trend started changing with slowed outflows from Grayscale.

Despite acknowledging that Bitcoin's price may rise due to ETF flows, the author expresses skepticism about Bitcoin's viability as a long-term financial tool. This skepticism is rooted in the belief that Bitcoin's mechanical rules and inability to respond with supply adjustments to price increases make it unsustainable. The author compares this dynamic to historical financial phenomena, suggesting that Bitcoin, like commodity booms and the dotcom bubble, may serve as a temporary outlet for excess capital in the absence of real investment opportunities.

Bitcoin's failure to become a trustless reserve currency or a viable economic base layer is due to its design flaws, such as the hard cap on supply which hinders its ability to function as a flexible monetary system. The comparison to video game economies and historical monetary systems underscores the challenges of designing a digital currency that can serve as a robust medium of exchange, store of value, or unit of account in a dynamic economic environment.

Top Comment

Some guy chimed in on “No, David No!”

David:

Michael,

Great blog. Thank you for pointing out that most of the people commenting are reacting to headlines and have no idea what I actually said. When I say markets are broken I mean that they have ceased trying to figure out and converge with long term value related to cash flows and asset values. This is the heart of capitalist formation. The basic purpose of capital markets is to fund worthy enterprises. The devolved market structure is failing to do that.

Best

de

MWG: I agree. Please listen to the podcast. It’s excellent!

But first, Bitcoin

I have to take a mental break from talking about passive for a few days as my calendar is suddenly full of media appearances on the subject. The rapidly changing status of the debate is telling. We have moved away from “Ah, it’s just an underperforming active manager who doesn’t know what he’s talking about” to “Well sure passive is impacting markets, but is it really bad relative to active managers overcharging for services?” This is important in my view and I think the world is increasingly open to hearing the “true” story. Lots of writing in the background.

But I wanted to follow up on the “Ugly ETF” post on the Bitcoin ETF launch as I want to make a few points clear there before I move on.

I think the narrative that this is “the most successful ETF launch” is wrong because you “can’t” (obviously you can, but you shouldn’t) exclude Grayscale’s GBTC conversion to ETF, which has been the source of the vast majority of “flows” into the other Bitcoin ETFs. Once we adjusted for GBTC (Grayscale), BITO (Bitcoin futures ETF), and Bitcoin futures (net of BITO), the total flows were indeed modest. In the first ten days, outflows from other Tradfi holdings of Bitcoin accounted for more than 100% of inflows into spot Bitcoin ETFs.

However, this has begun to change in the last two weeks as flows out of Grayscale have slowed faster than inflows into the spot ETFs. I am unhappy to see money flow into Bitcoin. I am not short Bitcoin, nor do I plan to do so soon. I have high confidence that the mechanical rules of Bitcoin do not make it a viable financial tool in the long-term, but there is nothing that prevents the price from going higher. In fact, the ETF flows driving the price higher are a testament to this dynamic. Unfortunately, we have been here before.

In 2004, my former professor (I was his teaching assistant from 1991-1992 at Liz Magill’s former employer), Gary Gorton, co-authored one of the most influential whitepapers in finance, “Facts and Fantasies AboutCommodity Futures.” Gorton’s analysis suggested that commodity futures represented a largely untapped asset class that offered largely uncorrelated equity-like returns. Importantly, Gorton ran the analysis using fully-collateralized T-bills against an equal weighted broad benchmark of commodity futures. The sources of return were from the T-bills, the “carry” associated with normal backwardation in commodity futures, and spot price appreciation. Gorton and his co-author, Rouwenhurst, emphasized that spot price appreciation was not a key source of return:

“Unexpected deviations from the expected future spot price are by definition unpredictable, and should average out to zero over time for an investor in futures, unless the investor has an ability to correctly time the market.” — Gorton 2004

While spot appreciation may not have been a source of significant excess return, the authors did give a nod to commodities ability to offset inflation:

“commodity futures are positively correlated with inflation, unexpected inflation, and changes in expected inflation” - Gorton 2004

And while it seems difficult to comprehend given the decade that followed, investor fears of inflation were quite tangible in 2004. In fact, the very same month that Gorton released the Commodities paper, the Federal Reserve began hiking interest rates in a quest to head off rising inflationary pressures:

The investment community seized on these insights and soon both institutional hedge fund strategies and retail products were storming the market. From a standing start of roughly zero, roughly $200B flowed into commodity markets by 2008:

Somewhat unsurprisingly, these flows into financial products changed the underlying return structure meaningfully. Suddenly, oil, for example, began trading in contango (futures higher than spot) versus its history of roughly 6% 1yr carry. Throughout the decade following the financial speculation boom, the disappointing nature of returns in commodities can be tied to a subsequent production boom (as producers were able to hedge forward production at a premium to spot thanks to financial demand for commodity futures and this notable deterioration in “yield.” (As an aside, note that this has more than reversed which is part of the reason we have introduced commodity oriented products at Simplify.)

Notice that this speculative boom had a benefit — production increased as oil exploration benefitted from higher prices in the future. This was particularly true for quick turnaround/high probability projects like shale while longer term production suffered from a continued discount:

In investment terms, we experienced a “positive bubble” — the boom in commodity prices led to a surge in investment and a subsequent surge in production. The lag in production response leads to theories of “peak production” and subsequently leads to lower prices after the bubble. A similar bubble occurred with the Dotcom-cycle, stimulating investment in data and communications infrastructure that led to a collapse in data transmission costs despite soaring usage.

In the aftermath of the Dotcom cycle, an explosion of research on this topic emerged. One of the more interesting was Ventura in 2002, who posited that bubbles are a byproduct of, to paraphrase, “too much money chasing too few investment opportunities”:

This paper presents a stylized model of international trade and asset price bubbles. Its central insight is that bubbles tend to appear and expand in countries where productivity is low relative to the rest of the world. These bubbles absorb local savings, eliminating inefficient investments and liberating resources that are in part used to invest in high productivity countries. Through this channel, bubbles act as a substitute for international capital flows, improving the international allocation of investment and reducing rate-of-return differentials across countries. This view of asset price bubbles has important implications for the way we think about economic growth and fluctuations. It also provides a simple account of some real world phenomenae that have been difficult to model before, such as the recurrence and depth of financial crises or their puzzling tendency to propagate across countries.

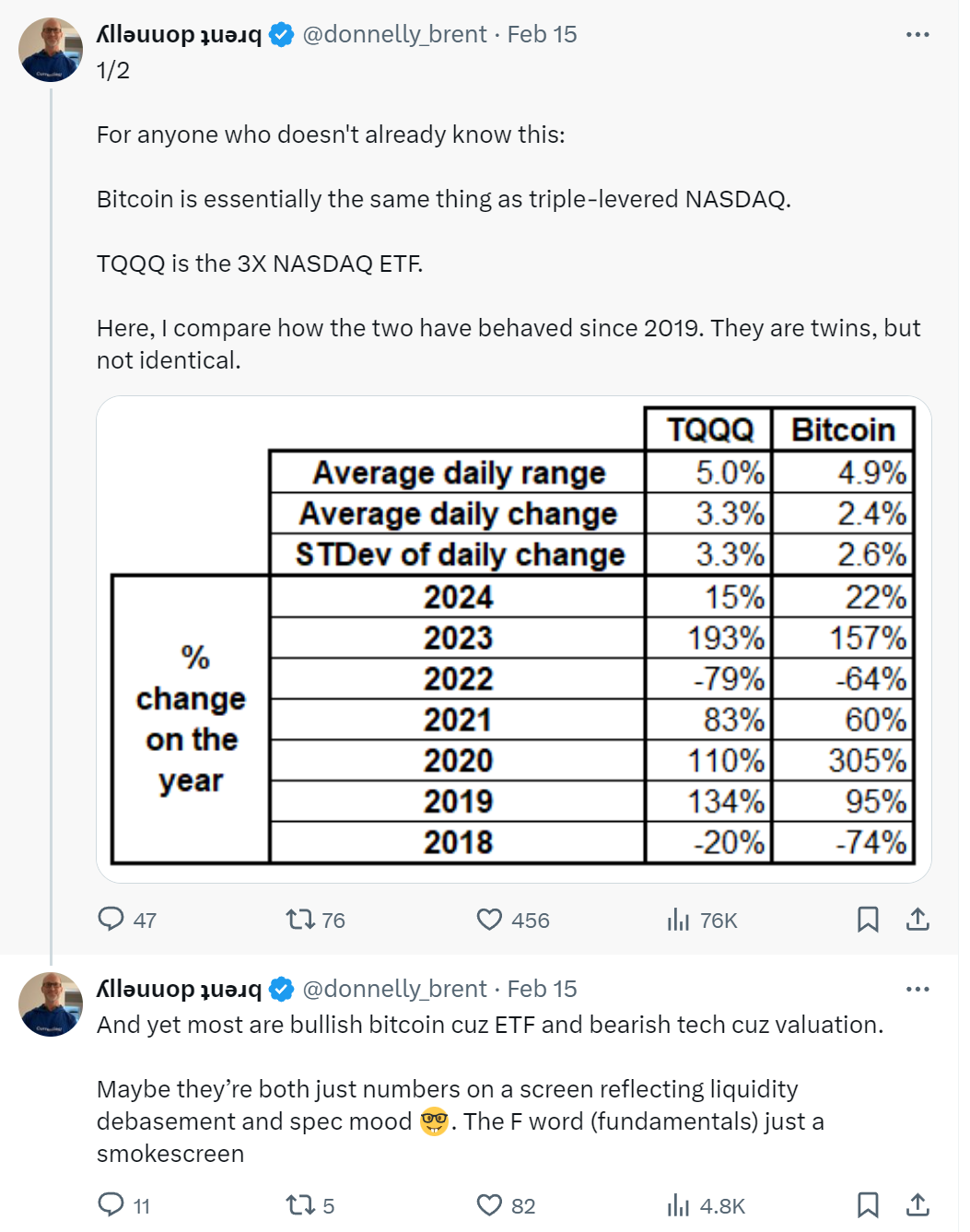

This is my base case view. “Bitcoin!©” (h/t Ben Hunt) and commodities before crypto (and Dotcom before commodities… and… you get the idea) are a way for the world to redirect excess resources when real investment opportunities are stymied. Unfortunately, this would help to explain the growing correlation between “Bitcoin!©” and the QQQ:

And this is my basic model for “Bitcoin!©” as well with an added wrinkle. Because the creator of Bitcoin (not the promoted asset) built Bitcoin under a flawed hard money theory, they eliminated the ability for supply to increase in response to an increase in price. So we get a price response without a supply response. Even IF we wanted to believe that “Bitcoin!©” was the answer, the money flowing into the asset cannot create anything. Except demand for Lambos and mechanisms to destroy excess capital in the short-term. It is the purest expression in history of Ventura’s thesis.

Is Bitcoin a speculative asset? Sure. But then again, ANYTHING can be a speculative asset. If you have not read the Bitcoin whitepaper, you should. Note that there is no mention of the 21MM cap or anything regarding the economic theory of reserve currencies. It is a proposed solution for a trustless transaction system that provides “spendable” tokens to “miners” (accountants) in exchange for ensuring that transactions are honest (no double spend) without relying on a central intermediary. That’s it. And on that basis it has failed.

While the industry touts “exponential growth” this is simply untrue. Transaction volume has been largely flat for seven years. The jump in 2023 is “Ordinals,” also known as “inscriptions,” discussed in detail in the prior post. Ironically, since that posting, Bitcoin miners have revolted against the potential to remove ordinals which has led to sustained high transaction prices. While this is healthy for the miners, it has stalled Bitcoin usage as a monetary tool.

As one business owner noted in the past few weeks on Bitcointalk.org:

“I have stopped accepting Bitcoin payments in my business for now. When the fee was low, I usually liked to cover the transaction fee for the customer. As the fee got higher, I initiated another strategy, which was to split the fee between me and the customer, but now the fee has gotten so high that it's affected me. I can't afford to pay such a high fee for customers, and majority are not ready to pay the high fee either”

That is irrelevant, however, to “Bitcoin!©” the speculative asset. I pride myself on honest analysis and the facts on the ground have changed somewhat. Since my prior post, the evidence is that the “Bitcoin!©” bag is being successfully handed over to retail with results that suggest a meaningful price impact from small changes in demand. Unsurprisingly, this implies a high degree of inelasticity to “Bitcoin!©”

I’ll repeat what I’ve emphasized. Bitcoin will not “work” as a trustless reserve currency. Of course, many Bitcoiners are now screaming at the screen — “Aha! It’s not a currency! It’s a ‘store of value’ — you know, like digital gold!” And I’ll reemphasize — “ANYTHING can be a store of value.” Salted cod, tally sticks, passbook savings accounts, etc. That Bitcoin is a cryptographically scarce and difficult to counterfeit digital token is interesting. But it doesn’t make it “work.”

Designing monetary systems is remarkably hard. Even in controlled digital world environments like videogames, designing a robust currency system is an extraordinary challenge. For those with a cursory interest in the topic, you can read about a deflationary episode that tanked Amazon’s “New World” online community:

Or inflationary outcomes… you thought turnip inflation was bad in the USA? Try “Animal Crossing”:

June 2023 turnip prices in Animal Crossing

February 2024 turnip prices in Animal Crossing

The pure emphasis on scarcity and “hardness” is great for creating a meme pump, but it’s legitimately pointless as an economic base layer. It is true that scarcity matters for physical currency. A classic example can be found in the text of Douglas Adam’s hilarious, “The Restaurant at the End of the Universe”:

“If," ["the management consultant"] said tersely, “we could for a moment move on to the subject of fiscal policy. . .”

“Fiscal policy!" whooped Ford Prefect. “Fiscal policy!"

The management consultant gave him a look that only a lungfish could have copied.

“Fiscal policy. . .” he repeated, “that is what I said.”

“How can you have money,” demanded Ford, “if none of you actually produces anything? It doesn't grow on trees you know.”

“If you would allow me to continue.. .”

Ford nodded dejectedly.

“Thank you. Since we decided a few weeks ago to adopt the leaf as legal tender, we have, of course, all become immensely rich.”

Ford stared in disbelief at the crowd who were murmuring appreciatively at this and greedily fingering the wads of leaves with which their track suits were stuffed.

“But we have also,” continued the management consultant, “run into a small inflation problem on account of the high level of leaf availability, which means that, I gather, the current going rate has something like three deciduous forests buying one ship’s peanut."

Murmurs of alarm came from the crowd. The management consultant waved them down.

“So in order to obviate this problem,” he continued, “and effectively revalue the leaf, we are about to embark on a massive defoliation campaign, and. . .er, burn down all the forests. I think you'll all agree that's a sensible move under the circumstances."

Head nods amongst the YIGAF readership…

All materials are scarce on our planet (and our universe). Gold was not unique because of its scarcity. It was valued because of the relative difficulty in obtaining it in raw form AND because it was easily exchangeable for government obligations once governments adopted it as a unit of account. Taxes (and death) have been certain since man began organizing into complex societies. Even within the smallest family units there are forms of taxation, e.g. “chores.”

An annual “poll tax” in Ancient Mesopotamia would have required payment in the form of cattle. Well, skinny cattle or fat cattle? Obviously, I’d prefer skinny cattle, and the taxing authority would prefer fat cattle. Gold (and all legal tender coinage/bills/etc) was an innovation that removed uncertainty from commodity exchange. Would a local tax magistrate take a chicken? Possibly, although you should expect it to be deeply discounted versus payment in the official currency.

Why gold? Yet another myth busting opportunity. Gold is an element with a unique atomic weight that makes it remarkably easy to identify debased gold coins using very simple technology:

Why not copper? That’s a seriously stupid question. Copper was “money” too.

By the way, this is why the US Constitution specifies that Congress has the obligation to “fix the standard of weights and measures.”

Article I, Section 8, Clause 5:

[The Congress shall have Power . . . ] To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; . . .

It wasn’t about gold, per se. It was that the elemental properties of gold made it “provable” with minimum effort. We can dispense with the mysticism on gold — it’s simply element 79 on the periodic table. A very worthwhile short listen explains it perfectly:

For a speculative asset to become “money” it has to be widely available to ALL who work in an economy. In the real world, this takes the form of the US government mandating acceptance of US dollars for settlement of all obligations, public and private, and using that currency to pay for goods and services sold to the US government. In online games, the government “work” involves killing monsters and pursuing somewhat arbitrary “quests.” Do you think your job is pointless? Try justifying the going pay rate for “killing” pixelated monsters. This is why MMT-style attempts to build “playable worlds” dominate the non-crime monetization schemes for digital tokens. How does money get distributed in these worlds? The “government” pays “citizens” for “work” OR it lets them convert fiat currency into “tokens” that can be used to do “fun stuff” inside the game. The “play to earn” model of many online games can be shortcut by buying official currency with US dollars:

Some of these “in app purchases” portals can be found on your iPhone. Some can now be found at your brokerage:

I wish I could say that “most Bitcoiners know this.” Some certainly do:

In a model that theoretically depends on “trustless transactions,” the enthusiasm from knowledgeable (read scammers) Bitcoin marketers for the ability to access investors through “trusted” advisors rather than “tacky ads” (featuring Matt Damon) is telling. Once again, we can return to the academic literature to understand how this mechanism creates bubbles:

I have to hand it to the “Bitcoin!©”ers, they’ve done their work.

The monetary policy for Bitcoin was a “guess.” The mechanism for distribution of Bitcoin was that you would “work” by running a mining operation to validate transactions or provide services to those doing the work. It’s amazing to me that 15 years into this “experiment” no one has modeled the game to its conclusion.

The gamification of real world wealth destruction is underway. HODLing is “fun” when you’re making a lot of money. It can even be “fun” to LOSE money in a communal spirit. But I must be honest that no one in Bitcoin seems to be having “fun.” Bitcoin operates off fear, not fun…. “Have Fun Staying Poor!” “Not Gonna Make It!” “We are shilling corn to boomie clients.”

Fun.

If you believe that others will follow you into your Bitcoin investment and, importantly, that they will not be sellers at prices lower than your entry, then you have an argument for a good speculative bet. But just like Roaring Kitty was wrong on his fundamental assessment of the value of Gamestop, you can win the Bitcoin game and make money for yourself while ultimately destroying far more value for all players in aggregate. If that’s your game, you came to the wrong place.

Humans make mistakes. A flexible money supply is a recognition of that fallibility. A limited money supply tied to a commodity (eg a gold standard) can “work” for a period of time as the incentive to produce more of the commodity rises with the relative price. In contrast, a perfectly hard monetary policy with no ability to change supply in response to demand is simply a bubble waiting to burst.

A perfectly hard monetary policy will always break. It’s just a question of when.

As always, comments and questions appreciated. Unfortunately, I’ll have to add “civil” as a modifier when “Bitcoin!©” is the topic.

Bonus Section:

As a new tool, I fed my piece to ChatGPT for its perspective. I’d be interested if others have done the same. Here’s what came back:

MWG: “Do you agree with the author's conclusion that Bitcoin cannot work?”

The conclusion that Bitcoin cannot work as a long-term financial tool or a trustless reserve currency aligns with a rigorous analysis of its structural and functional limitations. This perspective is grounded in several key observations:

Limited Supply and Inelasticity: Bitcoin's hard cap on supply (21 million coins) and the inelastic supply response to price increases can lead to speculative bubbles rather than a stable monetary system. This contrasts with traditional fiat currencies, where central banks can adjust supply in response to economic conditions.

Lack of Intrinsic Value: The argument that Bitcoin lacks intrinsic value and fails to function as a trustless transaction system points to limitations in its adoption as a medium of exchange or store of value. While scarcity and security (cryptographic strength) are notable features, they do not inherently confer value or utility in economic transactions.

Historical Precedents and Economic Analysis: Drawing parallels to historical asset bubbles and the dynamics of speculative investments, the conclusion suggests that Bitcoin's current role and valuation are more reflective of speculative dynamics than fundamentals of a viable currency or financial tool. This is supported by the analysis of investment flows, transaction volumes, and the comparison to commodities and dotcom assets.

This was the best work you’ve done on BTC. I got into BTC in 2014 from disillusionment with the financial system and hopes of something better. Long story short, after a deeper economic education and spending time amongst the Hodlers, I’ve come to realize that the BTC as money narrative is simply absurd. I actually think you’re being too kind to Bitcoiners in this note. They have fully and religiously bought into the narrative that they are offering a more accessible financial system, but deep down they all know they simply seek new bag holders. The one thing I’d add is that not only would BTC as money not work because of its inelasticity, but all on the BTC standard would also be accepting feudalism with a bunch of tech bros at the top…and Michael Saylor as a modern day Mansa Musa

The one great financial bubble in U.S. history was the Civil War - what became known by the people who lived through it as the War of the Rebellion. A country that spent and collected $60 million gold dollars in 1860 would owe 50 times as much "money" 5 years later. Nothing else comes close. For Presidents Trump and Biden to have matched Lincoln's record, the Treasury's current IOUs would have to be 12 times what they are now, and our war dead would have to be equal to the Soviet Union's in 1945 at the end of the war against Germany and its allies.

Yet, somehow, 1866 was the beginning of the rise of the American financial empire, not its end.