A Truly Awful ETF Launch

For all the hoopla, net of Grayscale redemptions the Bitcoin ETFs are disappointing

Summary:

Inflation Dynamics and Forecasts: The Federal Reserve's recent stance was hawkish without increasing rates, reflecting positive economic data on inflation and growth. The debate between "Team Transitory" and its critics, like Larry Summers, revolves around the sources of inflation, with recent analysis suggesting a mix of demand (two-thirds) and supply (one-third) factors. Current trends and real-time metrics, such as Truflation, indicate a broad-based decline in inflation, challenging earlier fears of a resurgence. This suggests that previous concerns over persistent inflation may have been overstated, with both demand and supply issues expected to normalize.

Bitcoin ETFs and Cryptocurrency Market Developments: The introduction of Bitcoin ETFs didn't meet the high expectations set by market enthusiasts, with Blackrock's ETF gathering significantly less capital than anticipated. This underperformance, compared to the initial success of gold ETFs and the ongoing scrutiny of crypto ETFs by institutions, highlights the challenges within the cryptocurrency market. Additionally, the sector faces issues with Bitcoin's utility due to increased transaction fees and the controversial use of "Ordinals" for creating NFT-like assets on the Bitcoin blockchain, which complicates its role as a payment platform.

Skeptical Outlook on Bitcoin's Future: The critique extends to the broader cryptocurrency industry's struggles, such as the diminishing returns for miners due to the upcoming "halving" and the potential loss of revenue from Ordinals. These developments suggest a consolidation and centralization trend within the Bitcoin mining community, raising concerns about the decentralization ethos of cryptocurrency. The article concludes with a skeptical view of Bitcoin's stock-to-flow model and the overall speculative nature of the crypto market, echoing sentiments of caution and skepticism towards the future of Bitcoin and its role as a financial asset.

Top Comment:

Thomas chimes in: “I think I can tell you why the Rec vehicle data is the way it is.

A client of mine purchased an RV a little over 2 years ago. In fact, it might have been longer ago than that. He contacted me last week and is finally taking delivery in the next month or so. There has been a huge backlog industry wide. They made a relatively small deposit when they purchased, but now need to come up with the rest of the $.

That would explain the data assuming one is based on actual sales and the other on delivery.

Another example. I have a buddy in high-end landscaping/hardscaping, pool installation. Projects are well into the hundreds of thousands of dollars. Saw him this past fall and their backlog, again from a couple years ago, was finally running dry. Uncertain as to the future.

Personally, I just completed a rooftop terrace project before Christmas that was in the works for well over a year. Took a while to get the tiles and components...”

MWG: Thomas, I agree that delays have played a critical role in the slow bleed impact of these events. Multi-family currently under construction is another great example. However, I’m not convinced that’s 100% of the issue. I’ll return to it in subsequent notes.

A Quick Review of Inflation

This has been a busy week with new data on subjects I have written about extensively. The Fed surprised no one with no hike but a hawkish message. As I noted in various media appearances this week, Jerome Powell had a “free option” to be more hawkish than he was in December. Data has been favorable on the economic front with both inflation and growth surprising favorably. Inflation forecasts made on these pages earlier in the year now look far more accurate than possibly believable just a few months ago when “resurgent inflation!” was the immediate reply to “Well, sure looks transitory…”

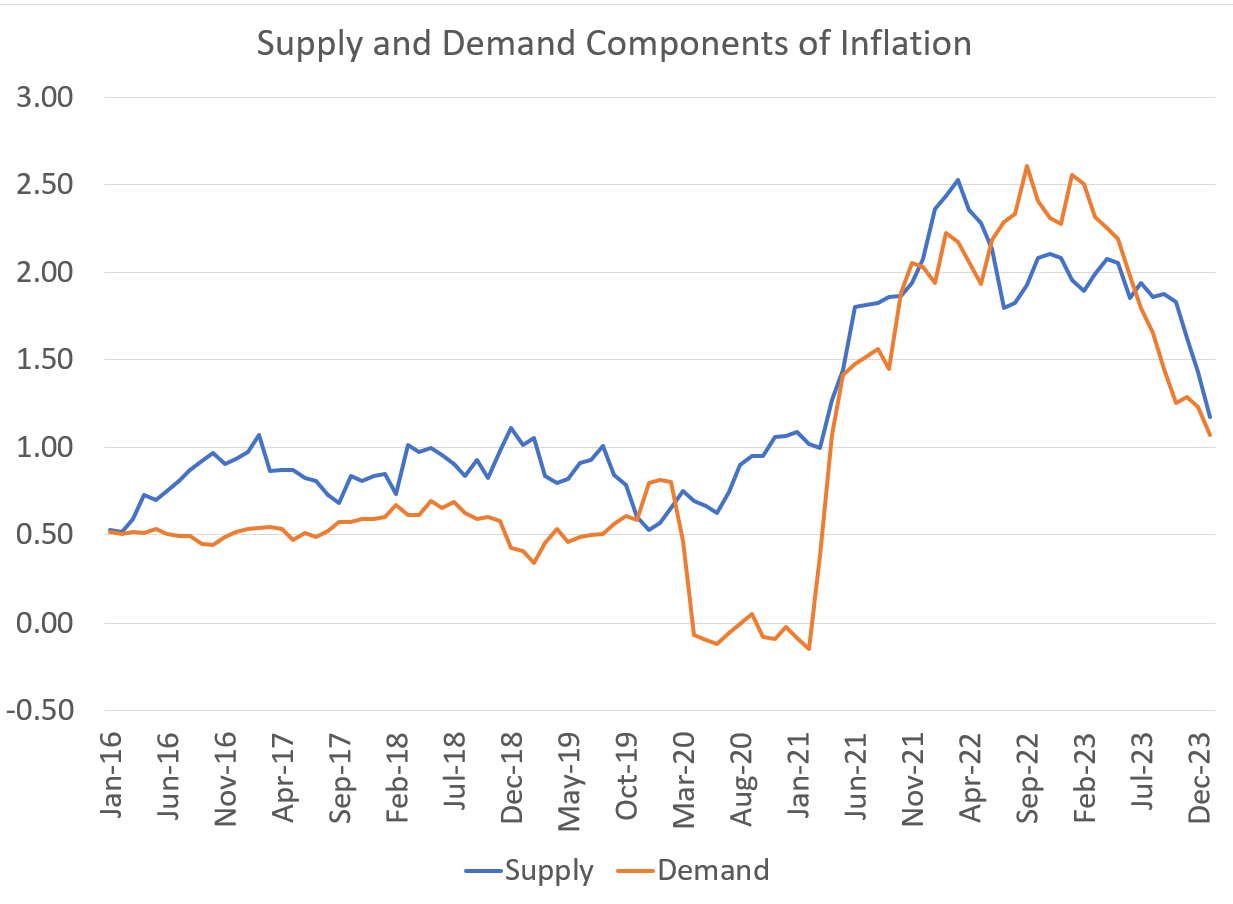

While many were dismissive of the “supply-driven explanation”, given the extreme monetary and fiscal policy, this was always a disingenuous argument. Everyone in Team Transitory acknowledged that demand played a significant role. In fact, as far back as mid-2022, the NY Fed had calibrated the source of inflation as roughly 2/3rd demand and 1/3rd supply. But with BOTH the demand surge and the supply constraints unsustainable, it was always obvious that inflation would retreat. Please do not allow those like Larry Summers or Harley Bassman (I love one of these two and it isn’t the former), who argued otherwise, to escape. Unfortunately, demand-side measures are now decelerating even more rapidly than supply-side:

And real-time metrics like Truflation are warning that we are not going to escape without a trip well below target. Speaking with their team, the decline in the last few days was quite broad-based:

While many are trying to draw attention to the surge in container costs, the simple reality is that these play a de minimus role in total shipping costs. Should we see supply disruptions continue, we are almost certain to get some renewal of goods inflation. But please, let’s put things in perspective: