An Unannounced Snow Day!

An unexpected return to the Mid-Atlantic just in time for winter to finally arrive

Summary:

Market Irrationality and Missed Opportunities: Despite a softening economic landscape that has unquestionably SLOWED, but not yet entered recession, large cap equity indices are making new all-time highs. I feel compelled to emphasize that far more important price behavior has occurred in small stocks.

Early is wrong, but also not: The "return-free risk" of US bonds took over a decade to materialize while well-thought-out strategies designed to capitalize on the thesis ultimately died just before the thesis was borne out. Unfortunately, we are facing similar dynamics on the eventual comeuppance for the US equity market.

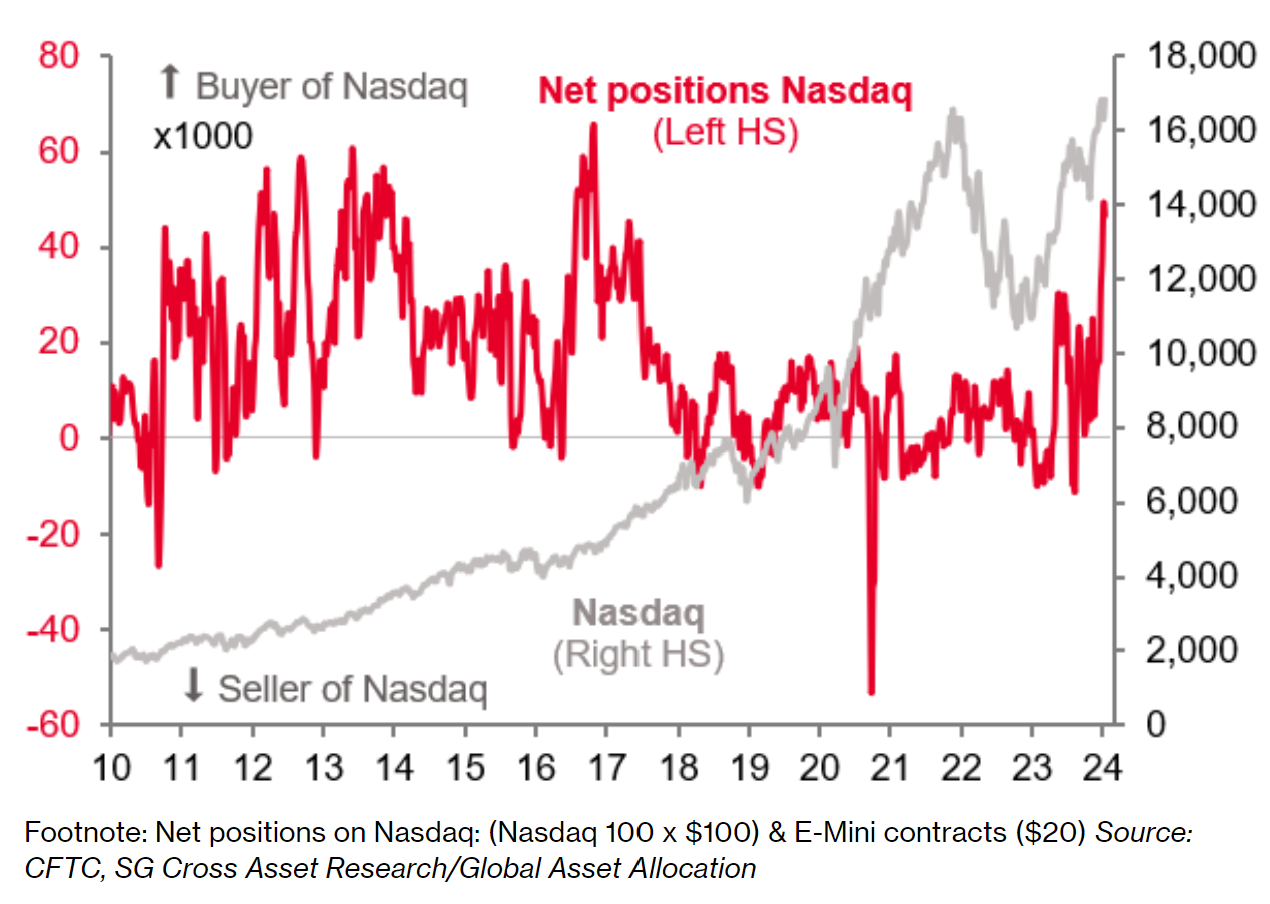

Did Hedge Fund re-entry drive YTD performance? The current market is characterized by a significant divide between high-quality and lower-quality ("junk") stocks, with poor performance in shorts driving returns more than the rise in S&P 500. Hedge funds have notably re-entered the Nasdaq 100, indicating a reset of positions. Despite the S&P 500 reaching new highs, the real story lies in the relative underperformance of small caps, especially considering hedge funds' large positioning moves. This historic underperformance in small caps suggests a potential shift in market dynamics, though a catalyst is needed to change the current trend.

Top Comment:

Andrew Schaefer writes: “Thanks for your insights Mike. Always though provoking and makes my Sunday morning that much better. Many folks and consensus outlook seem to have declared a “soft landing” with no recession in 2024. I am a little more convinced of this outcome than I was last year, but do not think we are out of the woods. This is anecdotal, but I know of multiple firms in commercial real estate and otherwise that are laying off sizable amounts of workers at the start of this year. I am really curious if this is a broader trend and will be looking for confirmation in the headlines and future jobs data. At minimum, it makes me hesitant to declare that we have skirted a recession.”

MWG: Andrew, appreciate the feedback. Sorry I skipped last Sunday, but I’m sure you handled it with aplomb. While I have to acknowledge that the DATA has been relatively positive to start the year, and certainly the celebrations of the bulls are well earned in the Nasdaq and S&P500, as discussed in today’s note the behavior of markets is anything but bullish under the surface. I understand the desire to embrace “hard” rather than soft (survey, sentiment) type data, but as I’ve hopefully demonstrated over the last year, the “hard” data is anything but. I remain of the view that we’re in a private sector recession that may be camouflaged by the profligacy of the public sector for a period of time; for some reason, this profligacy is not showing up in S&P500 earnings which raises my skepticism further:

What I’m Reading Now

I loved this video on private equity and housing by Kyla Scanlon. Kyla has become a bit of an epic poet for the Millenial Generation. She brings a remarkably balanced outlook to the combination of fact and fiction in the housing market.

The Main Event

My apologies for the unannounced vacancy in your inbox last week. During a wonderful visit to Fairhope, AL, my wife got “the call” that every mother dreams of from our swimmer at the US Naval Academy… “Can you guys come up for the weekend? I’d love to see you…” So much for Florida for the next six weeks!

All of which is to say, last week’s YIGAF disappeared into the ether of I-85:

Sixteen hours of driving later, we were ensconced back in Annapolis, MD, just in time for the season's biggest snowstorm to hit. And I couldn’t have been happier on Friday night as I hosted twelve midshipmen swimmers for a home-cooked meal of carnitas, chicken, and everything else I could find. I have never run out of food at an event before, but by my count, we had twelve larger-than-average young men consume nearly 50 servings of pork (12 lbs), another 24 servings of chicken (6lbs), 30 servings of rice and beans, 57 soft taco shells (they left 3… I counted), two “Party Size” bags of tortilla chips, roughly 24 avocados, 3lbs of shredded cabbage, 2lbs of cheese, salsa, crema, and 32 brownies. Within an hour, I was scrambling up two dozen eggs to further feed the ravenous beasts. With an experience like this, I now better understand the U.S. Navy maintenance issues:

The unexpected conclusion to my southern tour left me thinking about alternate endings. Markets have a long and storied history of remaining irrational longer than those who want to express a point of view can remain solvent. Watching US high quality, large-cap equities once again take global leadership even as evidence of a soft landing continues to build in headline data sets (jobless claims, consumer spending, etc.) reminded me of the post-GFC refrain that bonds represented “return-free risk.” I had the opportunity to sit down with Jeremy Siegel and Jeremy Schwartz of WisdomTree Funds last October, right near the lows in equities and highs in interest rates. My argument was that investors were missing an obvious opportunity to generate real returns from bonds for the first time in a decade. I clearly missed the opportunity to buy speculative small caps and ride them vertical for a quarter even as I was right about bonds (finally):

But the WisdomTree crowd was early to the “return-free risk” story way back in 2013, launching the WisdomTree Aggregate Negative Duration (AGND) ETF in December 2013 with 10yr yields at the nearly unprecedented level of 2.89%! Configured as a bet against bonds, it was well positioned to take advantage of record low yields and an inevitable turn higher:

Unfortunately, this eminently sensible product did not make it to the prom as the inverse returns to bonds caused both prices and assets under management to fade away slowly. The product was killed right after the events of Covid made it clear that rates would never rise again. To be clear, the last bear usually covers unwillingly:

There was definitely a whiff of that spirit with this week’s move to new all-time highs in the S&P500. Multiple press outlets called to ask for my reaction — “How do you feel about the S&P500 hitting new all-time highs?” Well, I think Chili Palmer said it best:

“What I'm not doing is feeling anything about it one way or the other.”

In my discussions, I noted that we’ve seen a remarkable spread open up between small & large, although that’s not really the spread. What we’ve seen is an incredible spread between high quality and “junk”:

The amazing part of these spreads is the source of the return. It’s not the S&P500 going to new highs that is driving markets, it’s the unbelievably terrible performance of the shorts:

Part of this I believe is being driven by the factors laid out in my analysis of the weakness in the R2000 as flows become increasingly challenged this year. Part of it is likely due to hedge funds resetting their positions in a new year. As SocGen pointed out Friday, hedge funds have stormed back into the Nasdaq 100; setting longs in NQs likely means shorts were reestablished as well:

Given the size of the positioning move, I have to confess that I’m more impressed with the relative LACK of move upwards in the Nasdaq than I am with the move to marginal new highs in the S&P500. Friday’s close, with further underperformance of small vs. large, has cemented the trailing one year as the bar-none worst performance for the size factor in recorded history. This is true WITHIN the R2000 and the S&P500 as well as between the indices:

Can small keep underperforming to this magnitude? It’s obviously unlikely. With that said, the catalyst for change will ultimately have to be a change in flows. With positioning now stretched into longs, my gut tells me the risk is to the bulls.

As always, comments are appreciated. And stay warm!

I think the deteriorating quality of the R2K universe is really just the root causal feature here to what you're seeing. It's not that small caps are lagging, its that junk is lagging and they are one and the same now, not separate themes.

Over the last 10-20 years, cash flow producing, stable, higher quality small and mid-cap companies have stayed private via Private Equity with excellent access to capital, while the IPO market, fueled by VCs eagerly exiting clownishly valued positions has consistently delivered "greater fool" garbage to public investors via small float listings & SPACs or via other mechanisms.

The # of unprofitable small caps is near an all time high at the PEAK of the economic cycle. What do you suppose will happen if the economy slows or ever is allowed to have a recession?

The R2K is not what it sued to be and so historical measures are tough to use and public markets are increasingly dominated by larger companies, because that's the only real investable part of the public market.

Nothing like trying to feed Mids. Congrats in Navy swimming for their win over Army this year! Go Navy! Beat Army! Bayly Taff '84