You Said "JUST!"

Poorly received friendly fire

For what shall it profit a man, if he shall gain the whole world, and lose his own soul?

— Mark 8:32, King James Bible

I’m sure most readers of YIGAF have discovered that I am taking a Twitter break after a recent exchange turned personal and ugly. My Twitter account is protected during this break, not because I don’t want people reading my tweets, but because that is the only mechanism currently available to prevent people reposting my tweets while I am taking the break. I will unprotect and return ahead early September.

While I will add meat to the bone of the “discussion” here, I remind myself that there is no “winning” in a flame war. I am occasionally a bad actor on this front (as I have observed previously), although I’d emphasize that part of that is because I have been fighting an unpopular war.

The war is NOT to end passive investing or prevent people from accessing “cheap beta” in an attempt to defend underperforming active managers. I think “passive” is just another systematic factor investment strategy. In pseudo-BASIC programming (please focus on substance, not the existence of callable subroutines which are unsupported in BASIC), it would look something like this (I’m sure someone is going to freak out on this inaccuracy, but read my lips — “NOT THE POINT”) :

'===========================

' PASSIVE INDEX ENGINE

'===========================

CONST N = 500 ' Number of equities in index (e.g. S&P 500)

DIM MarketCap(N)

DIM Prices(N)

DIM Weights(N)

DIM Holdings(N)

CALL LoadMarketData(MarketCap(), Prices())

CALL NormalizeWeights(MarketCap(), Weights())

PRINT "Enter Cash Inflow (0 if none):"

INPUT CashInflow

IF CashInflow > 0 THEN

CALL ProcessInflow(CashInflow, Weights(), Prices(), Holdings())

END IF

PRINT "Enter Cash Outflow (0 if none):"

INPUT CashOutflow

IF CashOutflow > 0 THEN

CALL ProcessRedemption(CashOutflow, Prices(), Holdings())

END IF

CALL ReportPortfolio(Holdings(), Prices())

END

Now it would be pretty hard to convince yourself that you should ban an algorithm (unless of course you live in the UK). And if you LISTEN to what I say, that’s exactly the problem. From my Masters in Business podcast with Barry Ritholz:

Barry: If you are having a discussion with a fiduciary who runs a few billion dollars in client assets, convince me to shift those accounts away from either broad indexes or passive generally to something more active. Why should I move their accounts elsewhere?

Mike: Quick answer is you shouldn’t. And that’s actually a part of the problem — the individual choice should be to buy passive, right? The problem is, when all of the individuals buy passive, we actually change the structure of the market. And so it no longer represents what it historically did… So this is actually the core of the issue, and it’s part of the reason why I spend so much time talking about it. And it’s part of what I made David aware of in that conversation to go back to it, is there’s very little the individual or the individual RIA can do to change this. This is a regulatory framework and it is controlled by the Vanguards and BlackRocks who are spending far more on lobbying than the rest of the industry combined, right? So part of what’s really happening is the political choice to push you into these vehicles, the political choice to make it the only acceptable alternative under the rubric of offering safe, low cost investments to people is totally understandable. We all want that desire.

My focus has always been on educating people of the risks of what seems like a sure thing, because ultimately those risks WILL materialize:

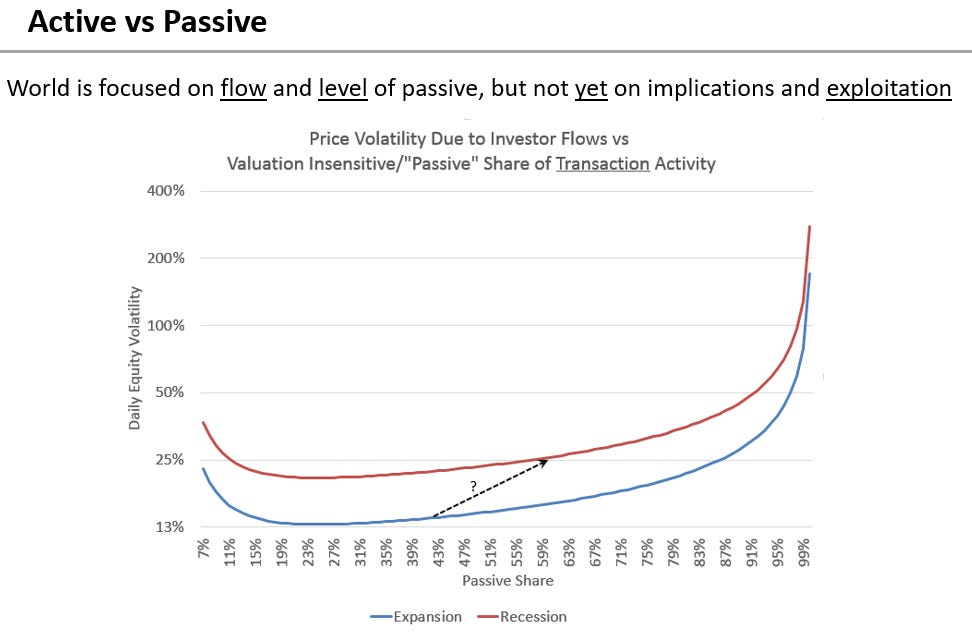

In fact, as I also often highlight, because “passive” investing is a very simple algorithm, at an appropriate scale it actually AIDS market functioning by introducing heterogeneity in buy/sell decisions. One of my early models demonstrated this:

This was an actual slide from my presentation to Peter Thiel, which served as the basis for the XIV trade. It explained that the extremely low volatility we experienced in 2016 and 2017 was a byproduct of the growing share of passive equity and systematic vol selling. I noted that equities at the time were around 25% passive (systematic allocation by market cap), but the VIX complex was already around 70% systematic, and the risks of an exogenous shock driving an extreme event were not only possible, but highly probable. Was I 100% sure? Absolutely not. I was 95% sure. And the market offered a trade that suggested a less than 3% chance I was right, where my risk was absolutely known (long-dated put options on XIV look-alike, SVXY). In May of 2017, I shared my thoughts at the EQD Conference in Las Vegas alongside Chris Cole of Artemis Capital. Another “discussion” ensued, and nine months later, my world got weird. I had spent 25 years in the industry and never spoke a word to the general public until my first appearance on RealVision in December 2016, where I shared some of my earliest thoughts on the topic. Sure, people in finance knew who I was (hence being asked to appear on RealVision or at EQD), but nobody else had any reason to. Suddenly, I was everywhere — “the crazy ‘bullish’ guy who thinks markets go up because of the flow of passive.” My work was originally targeted at regulators. In Q3-2018, I met with the BIS to share my analysis. I was shocked when they responded:

BIS: “We agree with you.”

MWG: “Oh, thank heavens! How can I help?”

BIS: “You misunderstand — there is nothing we can do. Blackrock and Vanguard control the regulatory apparatus. If we raise the alarm we get our boss fired and then we get fired. The only thing we can do is wait for the event and then try to clean up afterwards.”

Nearly a decade later, here we are. Now I’m the crazy BEARISH guy who thinks we are approaching Armageddon because “passive.” Or I’m just a huckster trying to convince people to “Buh ma fundz.”

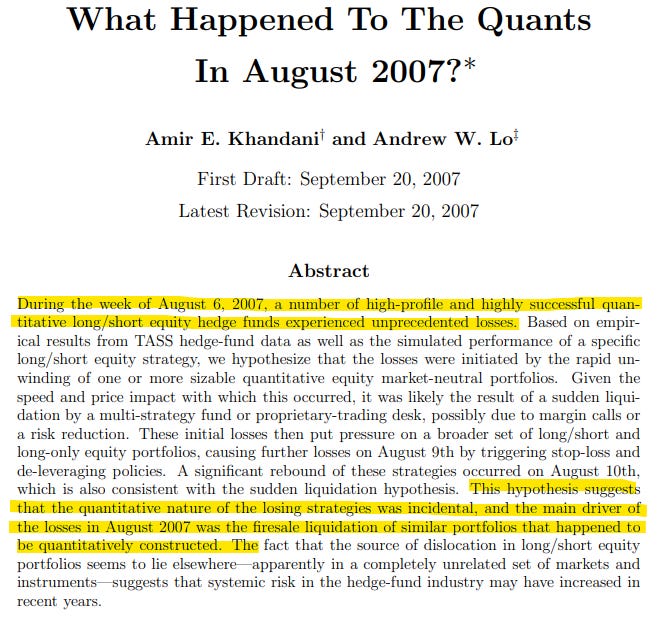

I’ll restate it in perfectly clear language. I am not against systematic investing. I am opposed to the government's actions that exacerbate the risk of any strategy becoming crowded and creating systematic risk, all while blessing the process. We’ve been here before on “crowding”:

This event was the warning cry for equities into the GFC. “Value,” the Dotcom hero to which I owe my career, betrayed investors by falling almost as much as the obvious shorts did in 2000. Far from protecting investors, the rationality of “sell rich, buy poor” turned into a trap:

Peter Thiel used to have a simple rule of thumb — “Last it was X, therefore this time it will be the opposite of X.” Now that’s obviously absurd if carried to the extreme, but boy, should the behavior of Value Longs and Value Shorts in a less than decade of difference have caused some soul searching. Fortunately, a decade later it did:

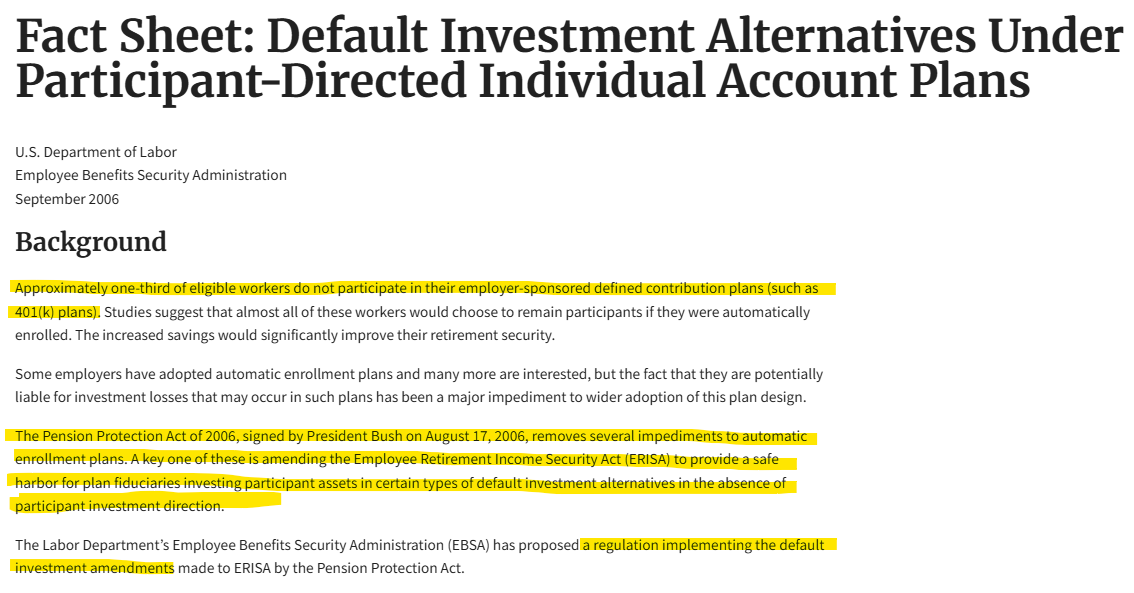

I digress. What do I mean by “government putting a thumb on the scale”?

We HAVE been here before with the government putting a thumb on the scale:

We're creating... an ownership society in this country, where more Americans than ever will be able to open up their door where they live and say, welcome to my house, welcome to my piece of property. – President George W. Bush, October 2004

Well, that turned out fine. Now go buh ma fundz.

You fortunate YIGAFers (yee Gaffers?) were not in the least surprised that the Biden-appointed Democratic head of the BLS lied in the latest job report and claimed the economy was slowing when it was really doing GREAT! How do I know this?

We YIGAFers know this is not what’s happening. It’s pretty straightforward: