Yeah... no

Q3 GDP print at 4.9% will ultimately be revised lower, but the good news is that productivity has rebounded. Fortunately, this confirms the fading of inflation.

Summary:

The Q3-2023 GDP growth came in at a surprising 4.9% QoQ, significantly rebounding from subdued levels in Q2-2023.

Alternative metrics such as the Philadelphia Fed’s GDPplus and the Aruoba-Diebold-Scotti Business Conditions Index suggest a more modest GDP growth in the 3.25-3.5% range. This is consistent with patterns of downward data revisions in recessionary conditions.

On the sunnier side, the data does indicate a positive trend in productivity. This could be due to data errors or a genuine uptick in productivity, making it an essential factor to monitor. An increase in productivity may help alleviate concerns of structural inflation increases.

Measures of inflation expectation have normalized, and the term structure suggests the Fed might soon be dealing with deflationary conditions rather than inflation. Real interest rates have spiked without modern precedent, making risk-free rates look empirically attractive, while equities appear less so, despite recent sell-offs.

What I’m Reading Now

This past week saw two fantastic Substack pieces by Noah Smith and Matt Stoller (guest writer, Lee Hepner to be totally accurate). Both are on the topic of “state capacity” — the ability of the state to effectively govern. Noah highlights the deterioration of US state capacity and Matt provides us with a flawless example in our inability to rationally regulate collusive pricing. A money quote from Hepner:

“how does one prove the existence of an agreement that is, for all intents and purposes, being made by a machine based on nonpublic information provided by the hotel chains? This isn’t exactly the olden days, when executives sat in smoke-filled rooms and agreed to set price floors for the mutually assured preservation of their respective profits. On the other hand, it might be something like the automated version of traditional trade associations, where competitors have long gathered to share industry standards and business strategies that, at best, protect members of the public from nascent harms and, at worst, enhance profits through unfair and anticompetitive means.” — Lee Hepner

Top Comment

A new reader, Daniel Bunning, chimes in with support for an appearance on the Rational Reminder podcast:

Daniel: New subscriber to you Mike, and spot listener of the rational reminder pod. I don’t normally comment on things in general, since I value anonymity, but breaking my rule for this.

Your mind might be made, but I think it would be an excellent episode and highly encourage you to do it. Selfishly, I think it would be informative and interesting. More altruistically, it might give some listeners needed alternate perspective and introduce you and your ideas to listeners.

For context, I found you through a recent Twitter post/ pod that had you and Bob Elliott and I follow Bob. I am very grateful you did that pod, because it became clear to me you are someone I should monitor and follow for perspective, much like Bob, Bill McBride, Cliff Asness, and a small handful of other individuals with an online presence, who seem to be solid critical thinkers and are willing to share their thoughts with the world.

The Rational Reminder guys might be lightweights, but they facilitate conversations with people who certainly aren’t and that’s the value I get from their pod.

Regardless, thanks for sharing your insights.

MWG: Dan, thanks for subscribing, and thank you for the reminder that value is generated in the exploration of ideas, not the articulation of “facts.” My objection to the Rational Reminder podcast is largely due to its smug satisfaction with a simplistic model of the world, but I agree with your assessment. Ben Felix and I have been corresponding over email, and I look forward to the possibility of a public discussion.

The Main Event

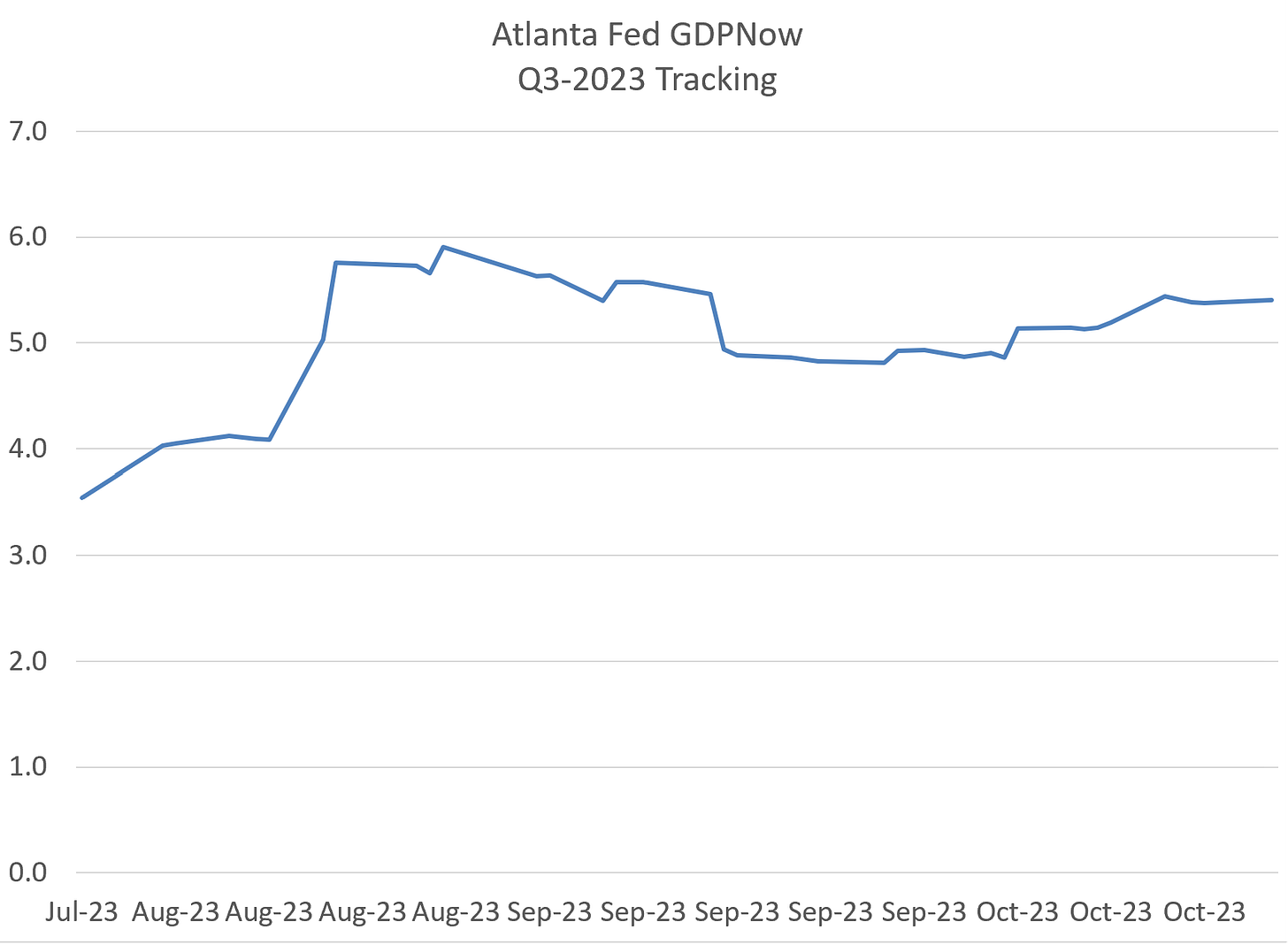

The unquestioned surprise of Q3-2023 has been the rebound in GDP from relatively subdued levels in Q2-2023 (and a near recession in Q1/Q2 2022) to a remarkable 4.9% QoQ growth in the first release this week. To be fair, Atlanta Fed’s GDP Now has been warning us for months that this was going to be a gangbuster report:

However, the composition of the first GDP release and the estimates the day prior suggest a number that is not nearly as clean as we’d like. Yes, consumer spending alone was impressive, but the real beat came from an unexpected build in private inventories (suggesting a production rebound greater than a consumption rebound) and a jump in government spending (largely tied to defense). Meanwhile, net exports disappointed, suggesting global growth is weak.

Consistent with this interpretation, multiple alternate approaches suggest the GDP growth over the quarter was most likely in the range of 3.5%. The Philadelphia Fed’s GDPplus metric, which combines both the expenditure (GDP) approach and the income (GDI) approach, suggests 3.26%.

Keep reading with a 7-day free trial

Subscribe to Yes, I give a fig... thoughts on markets from Michael Green to keep reading this post and get 7 days of free access to the full post archives.