Why We Fight...

Don't Listen to Larry... or Jerome... or Christine...

Thank you for all the comments on the Silicon Valley Bank narrative. To be very clear, I do not hold SIVB management blameless, nor do I believe that the Fed should not be able to react to events like the Great-But-Transitory-Inflation of 2021-22 (GBTI2122 hence forward). But the narrative that the Fed is blameless or that Jerome Powell is making some great, grand gesture on behalf of thoughtful central planners everywhere, simply holds no water. That we emerge from these events more focused than ever on the shimmer of smoke emerging from the volcanic cracks in the floor of the Temple of Eccles as a guide to the future of our economy is intensely saddening to me. Candidly, I’m disgusted.

While we may blame Greg Becker, former CEO of SIVB, for lax management and poor risk choices, and that certainly seems to be the case, the reality that this banking crisis is spreading rapidly supports the claim that this was something different. We’ve had Joe Biden inform us that our deposits were safe, Janet Yellen assure us that only systemically important banks qualify for extended deposit insurance, and Larry Summers talk to anyone who will listen. Now I’ll be honest, I don’t like Larry Summers. I’ve only met him a few times. One was in the early fall of 2013, where I spoke to him after listening to him speak about the puzzling slow recovery from the Global Financial Crisis. I explained to him my view that it was largely a demographic feature, tied to both slowing population growth and excess support for long-term unemployment that was keeping lower-income workers out of the system and depressing job search intensity. I sent him a presentation on the topic. Feel free to review it yourself. Needless to say, I was not surprised by the movie, The Social Network.

In the last week, Christine Lagarde chose to raise rates again despite the turmoil in the banking sector. Larry Summers was pleased:

Three very important things, according to Darryl & Darryl’s sibling:

You can carry through a necessary anti-inflation monetary policy even when there are financial strains

You can use two different instruments to tackle problems

End forward guidance

Genius. We’ll come back to this later.

No sooner did the ECB hike rates than Credit Suisse was forced into the arms of the Swiss state. Unlike Silicon Valley Bank (or First Republic or…), Credit Suisse is a far more complex takeover involving significant unknown derivative and credit risks. Like Bear Stearns, Wamu, etc, from the Global Financial Crisis, no acquirer will buy this entity without iron-clad guarantees that limit their liability. In other words, “We’ll take the assets, you, Swiss taxpayers, take the liabilities.” All else equal, this is the start of the bailouts, not the end.

German 2yr bonds, rallying sharply like two-year bonds globally, briefly sold off on the ECB hike and then rallied further. German 2s-10s is more inverted than any time since the early 1990s reunification. For non-German readers (most of you), while the 1990s were a period of affluence and grunge in the USA, they saw German unemployment double. A good read can be found here. With China slowing rapidly and Germany suddenly forced to confront the reality that they have built an industrial export powerhouse based on cheap fossil fuels that they cannot produce themselves, it’s not unreasonable to expect another challenging decade for German kinder.

Unfortunately, the entire process will be for naught. The brute force tool of risk-free interest rates is simply the wrong tool for tackling inflation, as the brilliant economist Robert Hall described in 1988 (yes, you read that correctly).

In English, raising interest rates does not cause people to raise their savings level and defer consumption. The mechanism that Jerome Powell has chosen to pursue, when done with this level of debt in the system, ends in a credit crisis as collateral values plummet and debt servicing costs on existing debt surge upon refinance. We have stopped transferring funds to women, infants and children and begun transferring them to owners of short-dated treasuries. You know, the tired, poor, huddled masses waiting to be free of the lines at the Prada store.

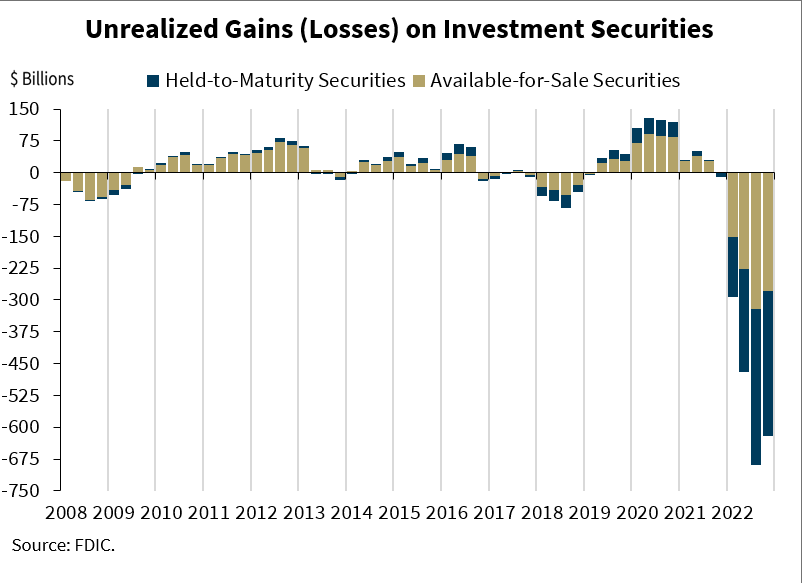

We have created a (no longer) hidden iceberg in the global banking system as an unprecedented change (higher) in risk-free interest rates destroyed a near-record amount of assets. Did you really think we would come out of this event with a modest decline in the stock market and no real-world ramifications?

The actions of Central Bankers (forced to chase the Fed) allowed the banking system to report near-record profits:

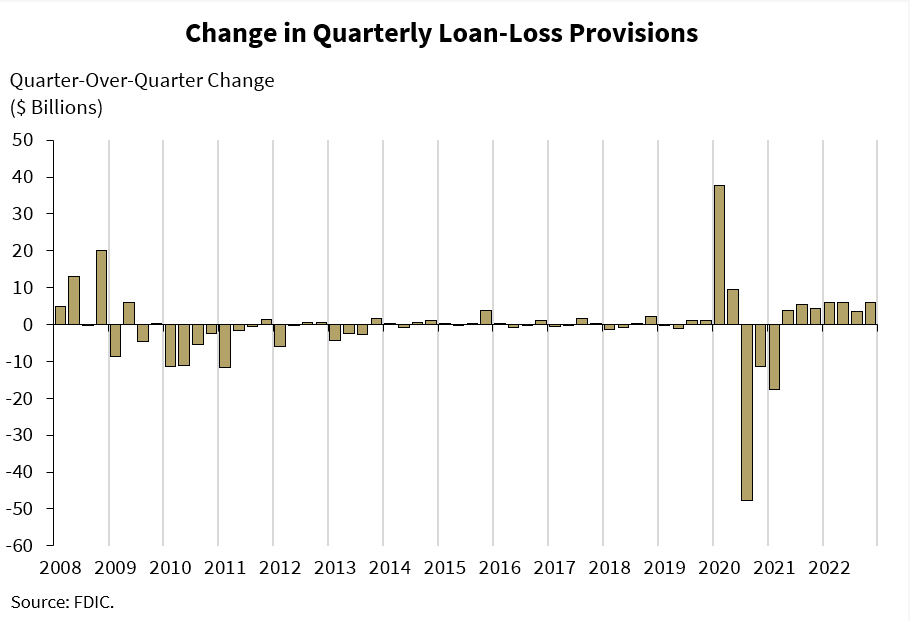

Lower loan-loss provisions as credit was extended to everyone alongside moratoriums on repayment and collections. If a rolling loan gathers no loss, what does an uncollected rent do?

All while printing unfathomable losses on high-quality liquid instruments.

As I had forecast in the March 13th Tier1Alpha letter, the actions to bail out SVB and SBNY did not stop the run on local banks — instead, they only served to accelerate it:

With money market mutual funds offering yields in the 5s, bank deposits simply can't compete. As a result, the largest decline in bank deposits since 1981 is likely to continue. Note the chart does not include March and as a result this does not factor in the run on Silicon Valley Bank. Yes, we've stopped the panicked safety run, but stopping greed has become even harder as this weekend's events have likely driven a Barbara Streisand-effect on the public's awareness of the spread between low-yielding bank deposits and higher-yielding CDs and money-market funds.

The collapse in banking deposits highlighted last week has accelerated, and credit conditions will likely tighten rapidly. Several comments on last week’s note questioned whether the “right” way to present this chart is “from peak” given the deposits had grown so rapidly in 2020 or from trend. In other words, does the “right” chart highlight the excessive growth of bank deposits well above trend in 2020? Better one…

or two…

Anyone, and I repeat ANYONE, who suggests the right answer is #1 does not understand banking systems. The flip side of the Modern Monetary Theory (MMT) framework that “loans create deposits” is that excess deposits MUST create loans — or, more accurately, bank cash does not sit in a vault in the bank earning nothing. It must be deployed. Always. When the government stuffs the system with deposits by printing money (yes, they did that) and distributing it without a mechanism to reclaim it (like maybe a “war tax” if we’re actually fighting a “war” against a virus), those funds had to buy SOMETHING. SVB, and apparently 186 other banks, made the mistake of buying the paper the Fed itself was buying. The difference? The banks didn’t have a captive financier:

"The Federal Reserve Act requires Reserve Banks to remit excess earnings to the U.S. Treasury after providing for operating costs, payments of dividends, and any amount necessary to maintain surplus. During a period when earnings are not sufficient to provide for those costs, a deferred asset is recorded. The deferred asset is the amount of net earnings the Reserve Banks will need to realize before their remittances to the U.S. Treasury resume."

Imagine the chaos if the private banking system said:

“We’ll gladly pay you your money back… after we’ve recouped all our losses on how we invested it.”

Yeah, nicht so güt, Michael. It’s not just about deposit insurance for all, although that’s coming. It’s about a level of rates that is simply too high, too fast.

But Jerome doesn’t see it:

“What we see in the markets is far from a shortage of collateral. There seems to be… is far from a shortage of collateral. There seems to be ample collateral, if you just look at the rates that are being paid.” — Jerome Powell, February 23, 2023

Getting back to Larry Summers and the “necessary” fight on inflation, Jerome Powell provided an animated defense of the 2% inflation target:

“It’s become the globally agreed… essentially… it’s obviously not… it’s not obvious… the evidence is… the modern belief is… if you expect inflation to go up 5%… if EVERYONE expects 2%… so having a 2%….”

You know who that sounds like?

“And now all of a sudden everyone's like, wow, people just decide to put $200 million in the box. This is a pretty cool box, right? Like this is a valuable box as demonstrated by all the money that people have apparently decided should be in the box. And who are we to say that they're wrong about that?” - Sam Bankman-Fried with Matt Levine

I’m sorry, but it’s not quite Frank Capra…

And yet, fight on we will, though our general be lacking in inspirational tone. Because clearly the war on inflation has not yet been won. True that oil and natural gas prices have collapsed back to the 10yr average:

Lumber as well…

And even copper, despite the “green revolution” narrative, is essentially unchanged for a decade:

The war on inflation is over. It ended because of human innovation and because we stopped sending ridiculous checks to people to stay home. Other than holders of Treasury bills, of course. In fact, the only metrics that are still rising are essentially the Fed’s horribly lagging Owner’s Equivalent Rent. Strip that out, and even the “sticky” portions of CPI have turned lower:

What’s rising? Assets viewed as a bet against Jerome Powell. Gold and Bitcoin.

I’m reminded of Jim Grant’s view on gold:

“The price of gold is 1/n, where n is faith in Central Bankers.” — Jim Grant

Meanwhile, Robert Hall, the economist highlighted above, has come out with a paper explaining what’s really happened with inflation. Hat tip to boy wonder, @srivatsprakash for the link:

Hall’s hypothesis is convincing. While many have dismissed the “corporate profit margin” side of the inflation story with a dismissive, “Oh, so corporations SUDDENLY got greedy?” the story is a bit more complicated than they would like to admit.

“The logic of the New Keynesian model of the Phillips curve links inflation to volatility, because a larger fraction of sellers are pushed out of their regions of inaction when volatility is elevated. The New Keynesian Phillips curve becomes much steeper in volatile times.”

Hall’s hypothesis is simply that the costs of resetting “sticky” prices outweigh the benefits in normal times. Customers may choose competitors, brand loyalty may be damaged, etc. However, during periods of volatility, price-setting decisions are shaken out of this zone, leading to larger than normally expected price shocks.

And as Hall points out, the period we just experienced offered plenty of this volatility:

Now a more nuanced version of the inflation story is that “supply chains can never normalize given deteriorating US vs China relations.” And this may be true. But I fail to see how hiking interest rates to create a recession leads to the investments required to rebuild those supply chains using different actors. So again, we’re left fighting a battle that cannot be won with the tools we are deploying, and we’ll likely find that we are materially worse off after the fight than before. Pocahontas is right, Jerome Powell should be fired.

And in the meantime, please remember to be skeptical when great and glorious leaders tell you sacrifices must be made in a war effort:

If you could hear, at every jolt, the blood

Come gargling from the froth-corrupted lungs,

Obscene as cancer, bitter as the cud

Of vile, incurable sores on innocent tongues,—

My friend, you would not tell with such high zest

To children ardent for some desperate glory,

The old Lie: Dulce et decorum est

Pro patria more.

Wilfred Owen, Dulce et Decorum Est

Thanks for yet another great post Michael.

I am not sure if this is relevant, but reading this note made me think of a tweet I saw yesterday. As for what Mr. Powell does or does not to see, I don’t know, but in the Open Market Committee meeting in 2012 he said the following :

"I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy."

Jerome Powell, Chairman of the Federal Reserve, then member of the Board of Governors, Oct 2012 Federal Open Market Committee Meeting.

https://twitter.com/memeatball/status/1637439922326863876?s=46&t=-6ei2FgIdSLjiKYY-s7mRA

Nice essay. Thesis is that a significant part of the problems (in not all) are due to Fed actions. It sounds similar to iatrogenic actions by physicians, who's misguided actions kill patients, because the physician's have poor, or limited understanding both of the problem and of their tools.