Where the Boys Are

Skating to where the puck will be

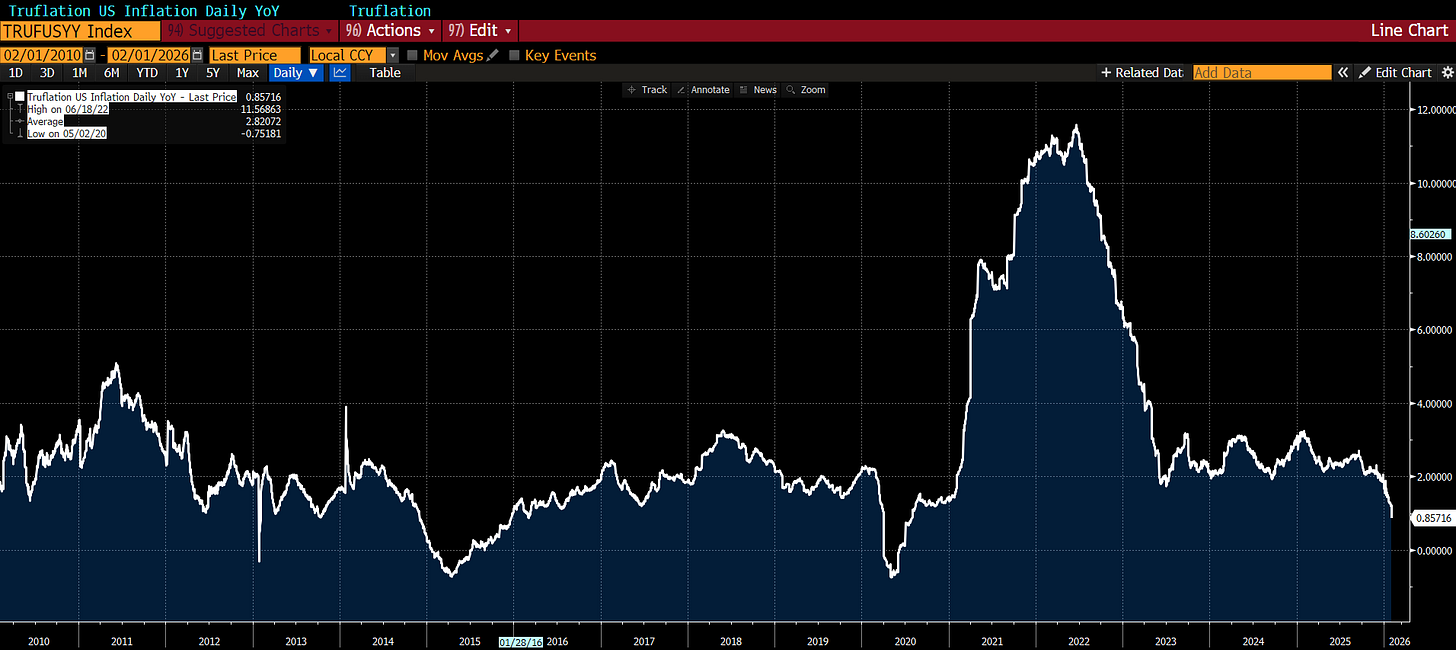

A few quick housekeeping items. Many have been following the Truflation plunge well below 2%. As of this morning it plunged below 1%. Even as speculation has taken (and given back) some extraordinary gains in commodities, the services sector, led by housing continues to decelerate:

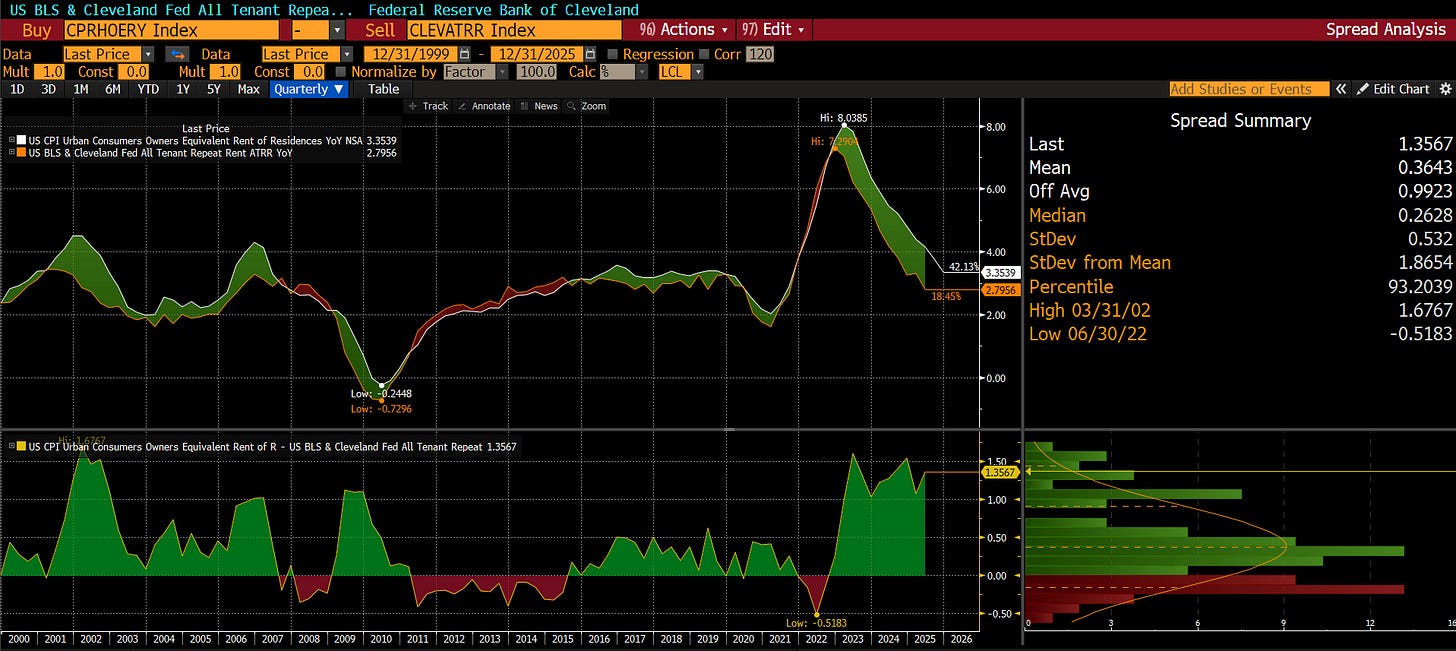

And while the Cleveland Fed “All Tenant Rent” index is no longer updating in a timely manner, it suggests that further declines are ahead:

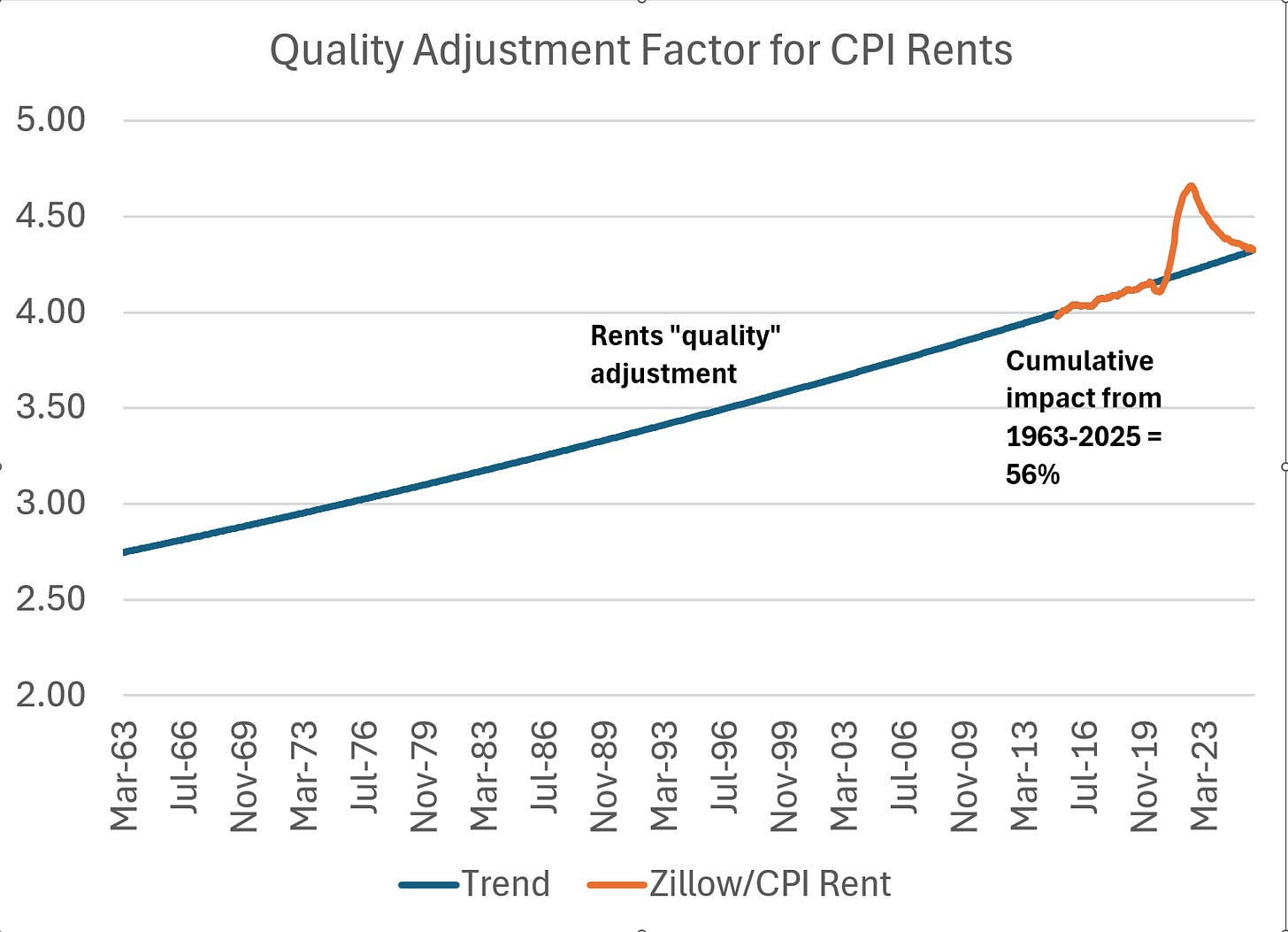

The hedonic deflation of the CPI rent factor has now normalized against private sector measures like Zillow rents. From here, we should expect Zillow rents to remain below CPI rents as an aging housing stock is “artificially” inflated with hedonics:

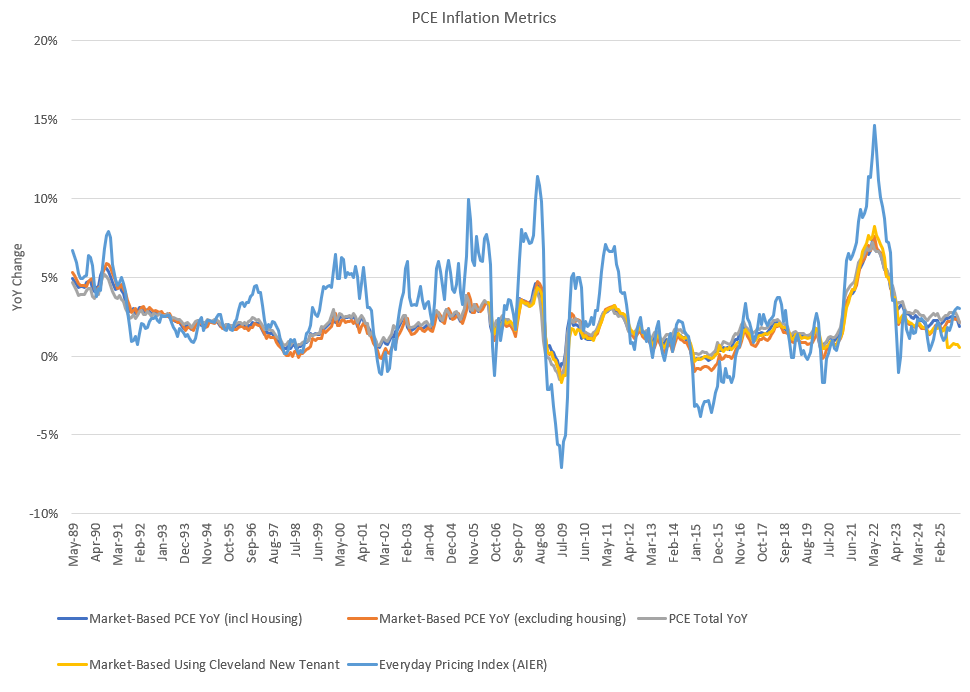

Adjusting PCE to exclude the POSITIVE impact of these hedonic adjustments again suggests that the near-term risk is deflationary, not inflationary:

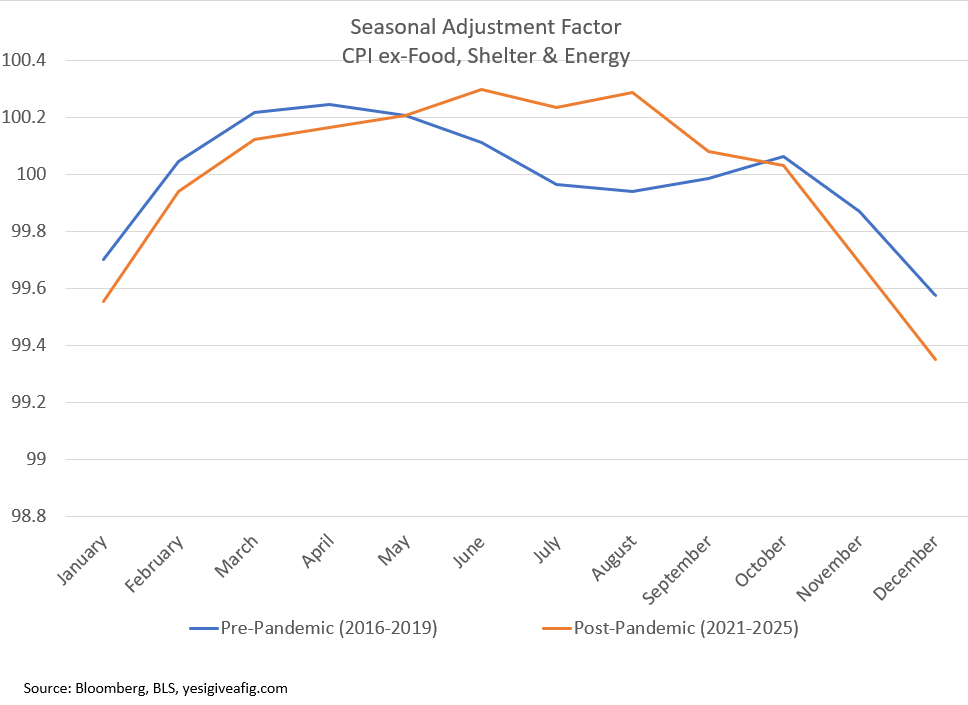

The pattern of RESIDUAL seasonality created by the pandemic and Russian invasion of Ukraine will continue for one more year (BLS uses 5-year trailing averages), and exactly as forecast, the Fed has once again abandoned rate cuts due to fears that inflation is not making progress towards the 2% goal, misled by the data adjustments. This residual seasonality is likely to reverse by May:

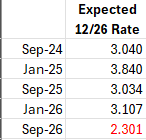

And as CPI prints “beat” to the downside, driven by seasonality, this is likely to lead to renewed discussions of rate cuts. My estimate is that we will get nearly three cuts priced in over 2026 as the seasonality gives way yet again. In other words, Waller was right to dissent:

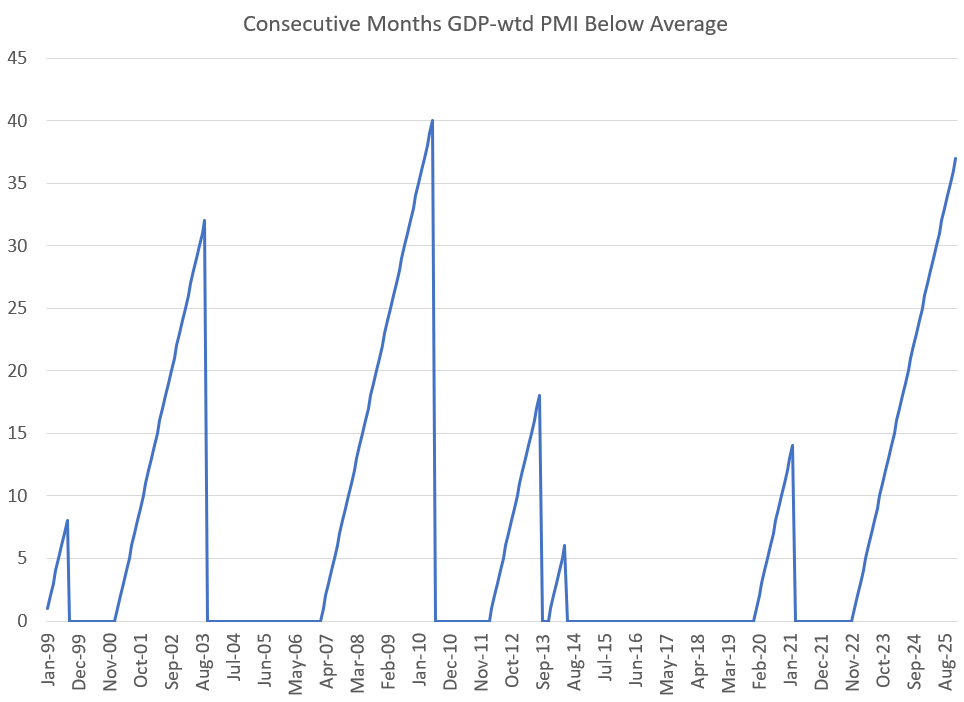

Could I be wrong? Of course. If I’m wrong, it will be because the private sector recession ends. We are absolutely seeing a rebound in the cyclical sectors, with a moderate rebound in new orders. We have been in the longest period of GDP-wtd PMI New Orders weakness since the GFC:

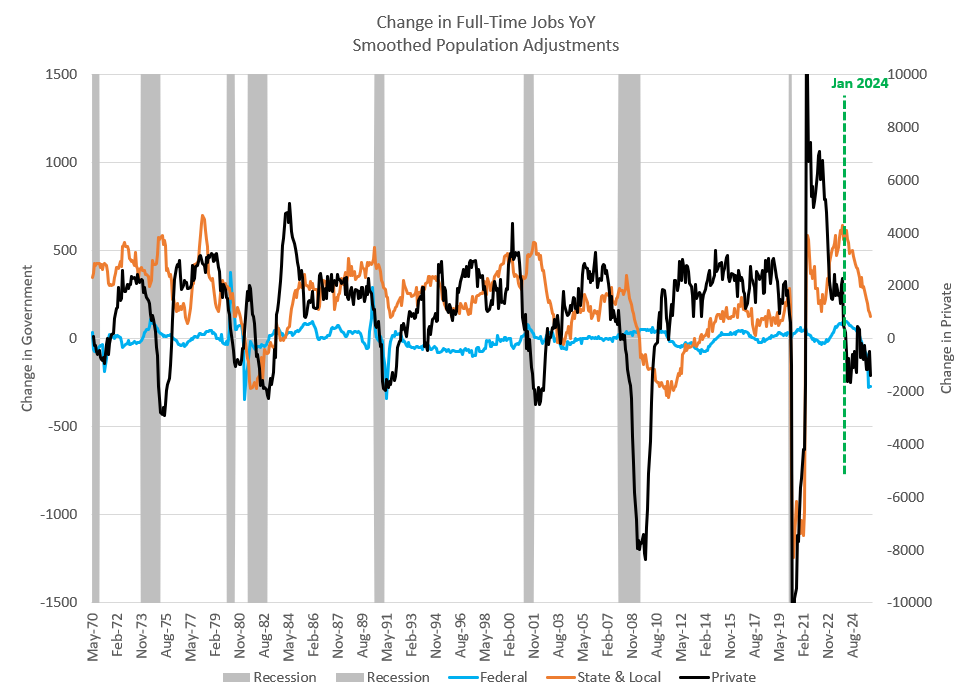

On the flip side, government employment is contracting at the Federal level; state and local seem not far behind:

Can the private sector pick up the handoff from government? Or perhaps more salient — does it even matter anymore? For the past three years, new orders have had remarkably little impact on GDP. Will this change? I don’t know. In prior periods, I would have expected downward GDP-revisions; under this administration, that seems unlikely. The BLS lost its head for revisions; will the BEA subject itself to the same?

A Blast from the Past

Occasionally, I go back and review what I wrote many moons ago. This past week, I found myself reviewing my thoughts at the start of 2008. It was illuminating:

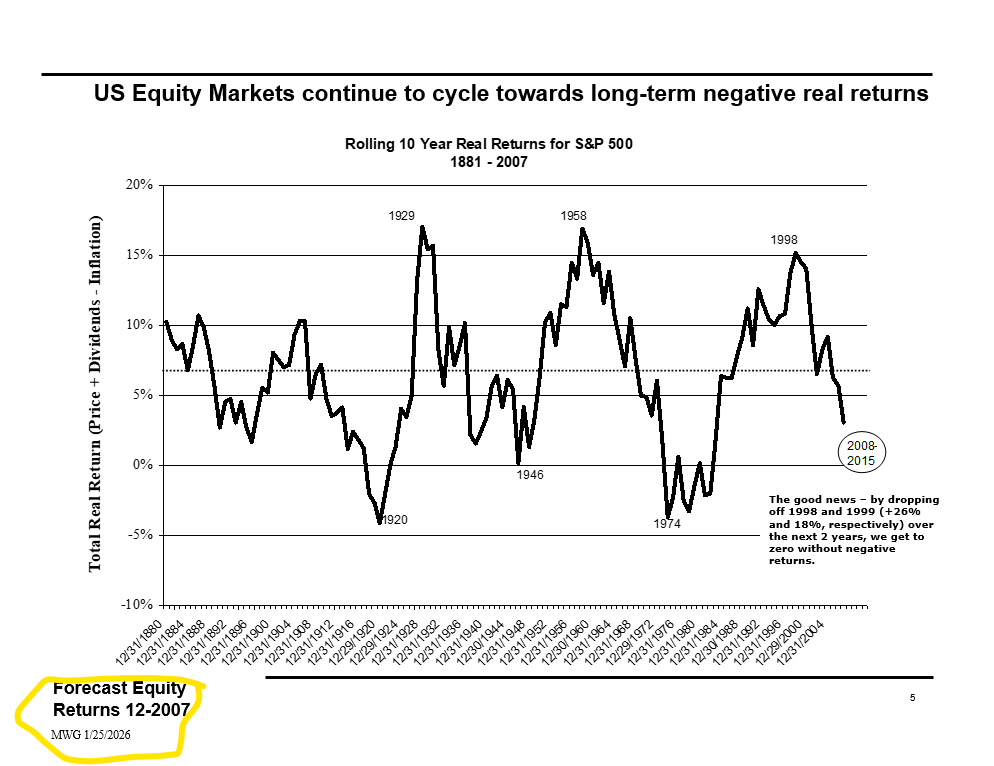

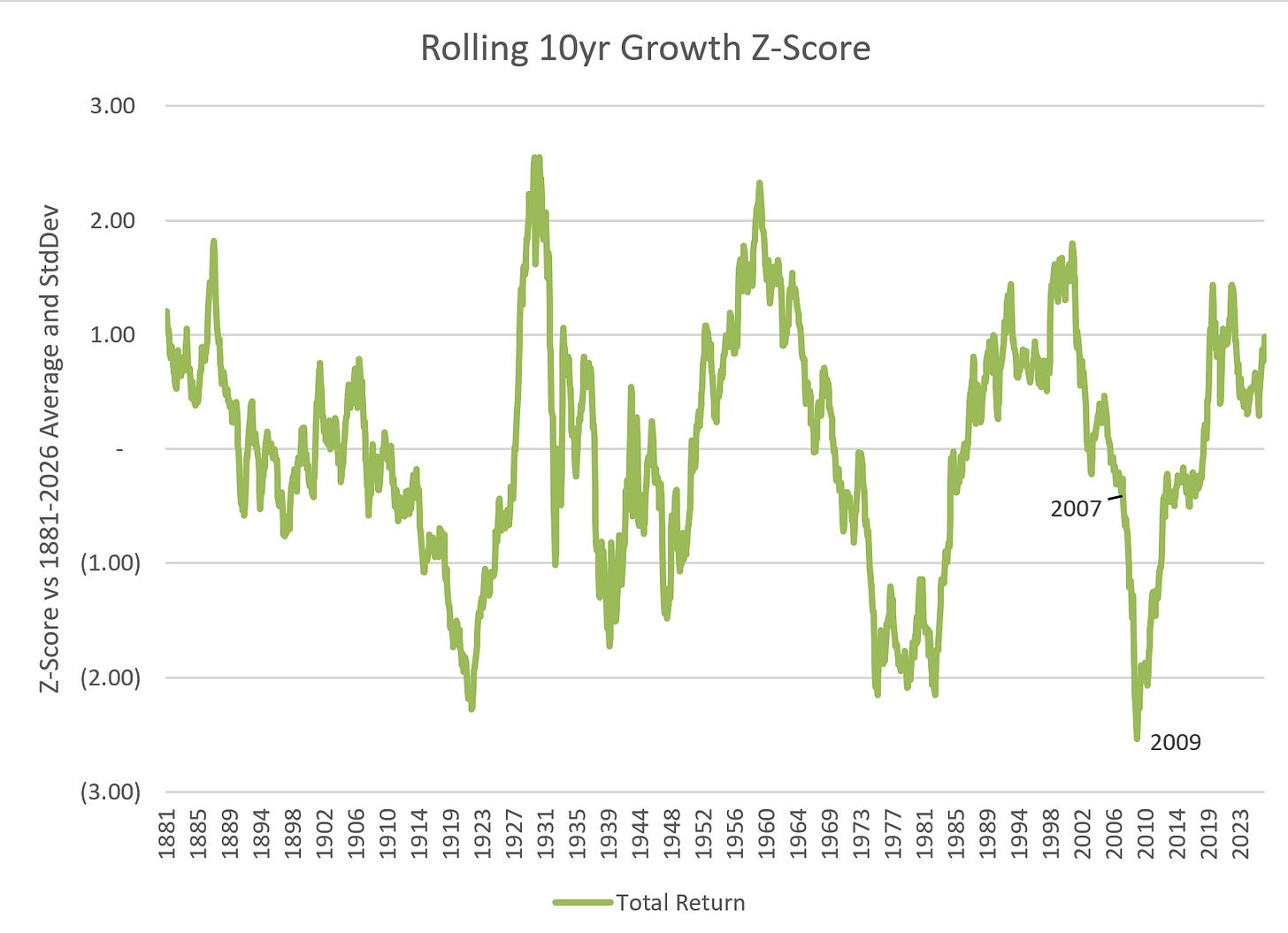

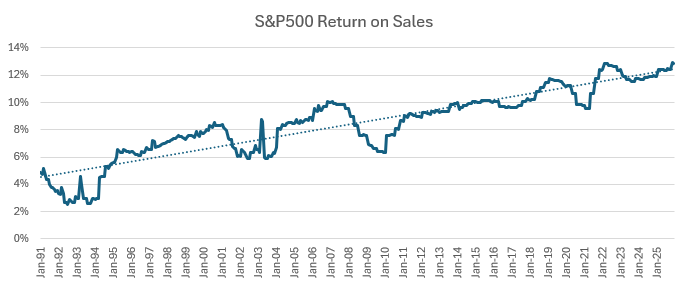

My expectation was that a cyclical peak in profitability (then driven by financials and energy) was turning lower and likely to result in much lower than expected EPS. Obviously, I was right in 2008, but it was nowhere near as smooth as my simple forecast implied. In fact, the total return for the S&P500 for the 10yr ended March 2009 was the worst in history, eclipsing the post-WW1 crash. As you might expect, given the mean-reverting nature of this series, we rebounded sharply in 2009.

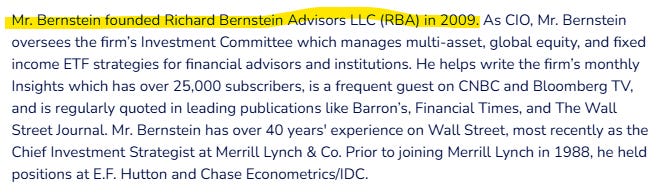

“Predictably,” few were bullish in 2009 — the start of another great investment period for US equities. One who was bullish was Rich Bernstein of Merrill Lynch:

Bernstein had been notably bearish throughout 2007 and, as late as Nov 2008, remained so:

In my contemporary discussions with him around this time, as I was starting to lean heavily bullish with my cyclical measures suggesting a turn was imminent (see above on trailing 10-year returns). Rich’s comment to me at the time — “I’ll tell you when to be bullish.” (He was arrogant if nothing else.) But he did in fact tell us when to buy:

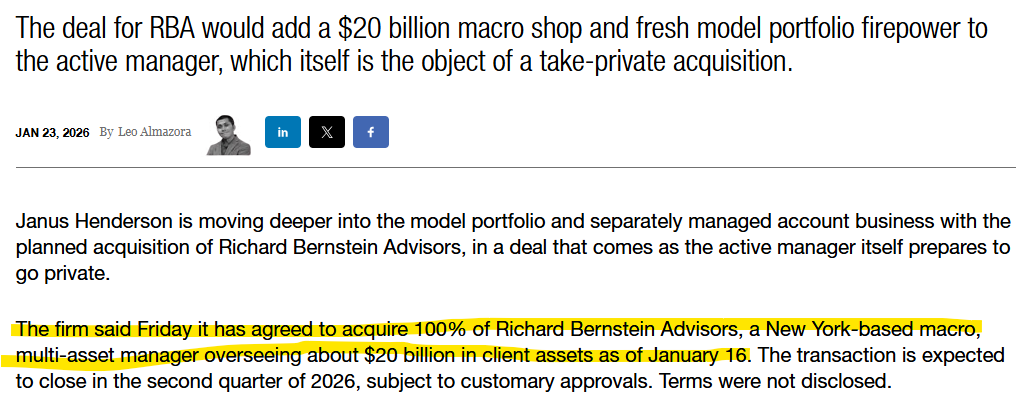

His clients have done exceptionally well. But Rich may have just rung the bell again:

The terms of the deal were not disclosed, but based on the pending acquisition of Janus Henderson itself, we can confidently assert that Rich will be pocketing between $500MM and $1B, alongside a multi-year compensation and earn-out package as Chief Strategist for the enlarged Janus Henderson. Congratulations to Rich. The well-timed bear-to-bull rotation likely made Rich a near-billionaire. And the rest of us should be wondering, “Why are ewe reading this now?”

The 2007-9 mean reversion in margins was brief and almost immediately reversed. By 2012, margins had already begun to recover from their 2008/9 plunge; while the S&P remained below its 2007 high (it exceeded it in 2013), profit margins never came close to historical levels on the downside excluding the write-offs that hit the over-earning financials:

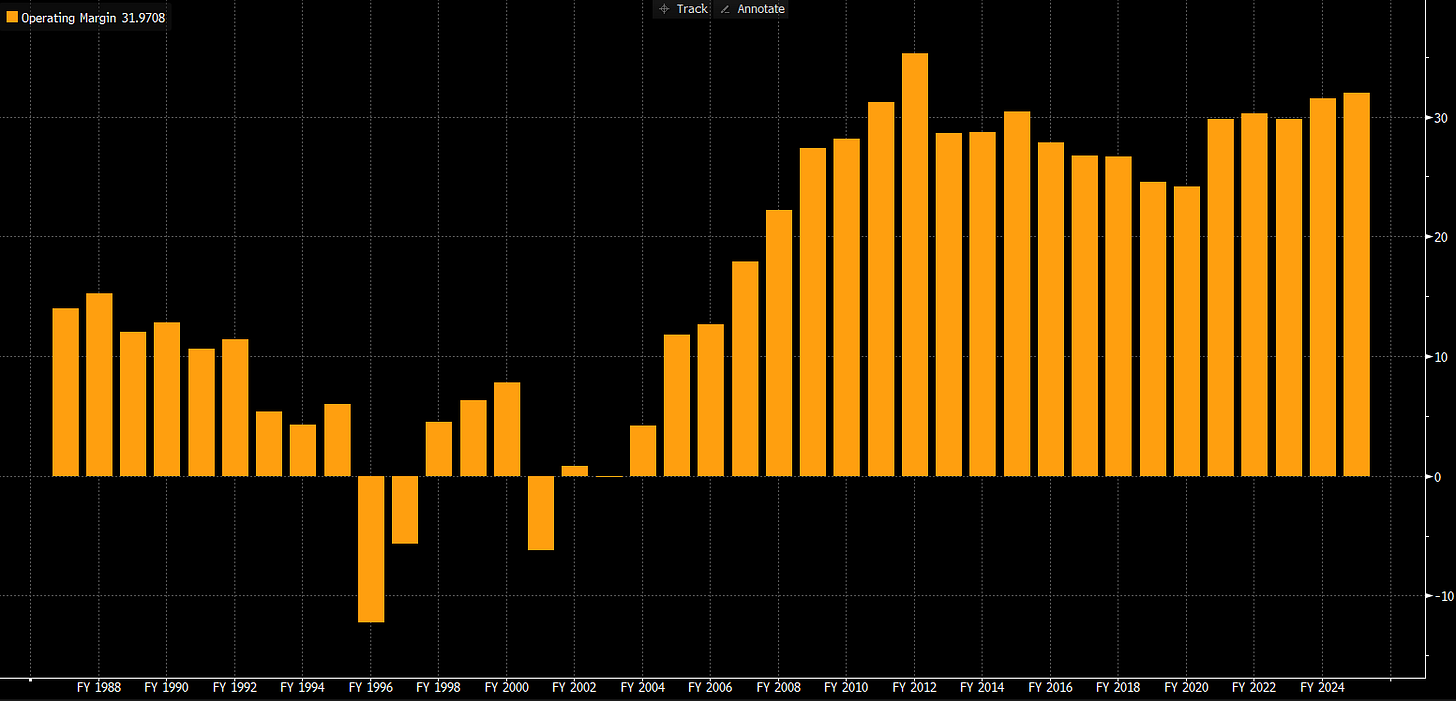

It’s possible you remember this time period. By December 2012, Apple’s revenues had risen 500% over the preceding three years, and earnings were up 10x. Multiples? AAPL P/E, unadjusted for the massive cash on its balance sheet, was single digits. Apple’s operating margin hit its all-time peak that year:

Few were paying attention. David Einhorn was, but his value discipline led him to sell too soon. Most were too busy preparing for the collapse of the EU, driven by Greek and Spanish defaults. The debate in 2026 seems very similar to the pre-2007 period, except this time it’s the tech co’s that are “overearning”; and like financials in 2007, we won’t know until the write-offs occur. The post-GFC era has been unique for the lack of write-offs. We can see this in the relationship between GAAP EPS (Generally Accepted Accounting Principals) and reported EPS from continuing operations. Write-offs cause the relationship to plunge, and there have been very few:

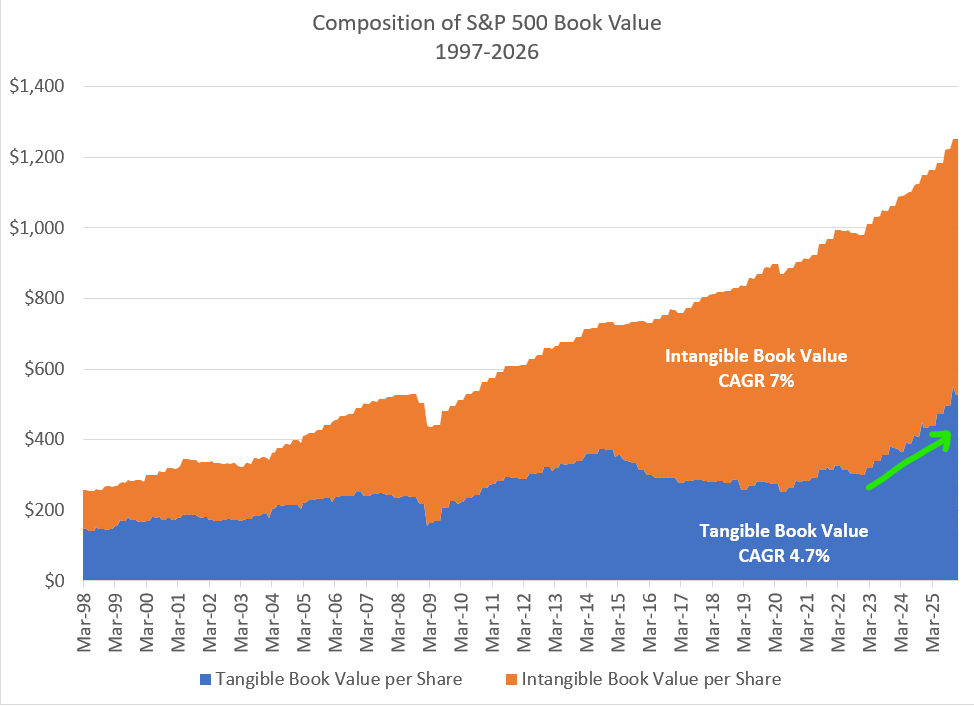

As a result, we’ve seen book value, largely in the form of intangibles, explode. But consistent with our writings over the past few weeks, the rate of TANGIBLE book value growth has accelerated sharply with the emergence of AI spending. Once again, an indication that the physical world is starting to intrude into our financialized fever dream: