We're On a Road to No. Where?

Summary

NDFIs and Leverage Dynamics:

Non-deposit financial institutions (NDFIs) growing demand for leverage continues despite weak non-NDFI lending. The growing use of leverage in low Sharpe Ratio strategies, eg. 2x levered single stocks, suggests trouble is aheadMarket Concentration and Correlation Risks:

Owen Lamont is wrong. Decreasing correlation can offset increased concentration in hindsight, but forward-looking risks intensify if correlations normalize. Oh, and the cause IS passive.Seasonality and Structural Trends:

Seasonality adjustments in CPI may embed structural trends like corporate pricing power, distorting inflation measures and complicating the analysis of underlying economic factors and reinforcing inflationary pressures over time.

A Vignette

After letting my hair (what remains) get a little too long, I went for a haircut last week. The barber recognized me from Bloomberg TV: “Hey, I’ve seen you on TV… you’re one of those talking heads, aren’t you?”

“I guess so!”

“That’s awesome!” We proceeded to discuss markets for the remainder of the haircut.

I paid the man with a generous tip and walked out… he chased me into the frozen parking lot… “You forgot your coat!”

“I didn’t say I was a SMART talking head!”

Well, we know where we're goin'

But we don't know where we've been

And we know what we're knowin'

But we can't say what we've seen

And we're not little children

And we know what we want

And the future is certain

Give us time to work it out

The Talking Heads (appropriate, no?)

Regular readers will know that I relish the sobriquet “The Dumbest Man Alive.” For those unfamiliar with the story, in February of 2000, then a young small-cap value manager running separate accounts in Boston for Moody Aldrich Partners, I was tasked with defending our up 9% year (versus the R2000 value down 3%) against the overall markets. Suffice it to say, it did not go well. After extolling opportunities in SCV, especially homebuilders and gold stocks, and bemoaning the outrageous expectations for the Nasdaq, one of the client investment committee members stood up and declared, “This man is the dumbest man alive!” and proceeded to explain how it was inexcusable that, particularly at my young age, I would be talking about old economy stocks when an unparalleled opportunity existed in the New Economy. Needless to say, we did not retain the client. Within a month, the DotCom bubble came crashing down, my career was saved, and two years later the board member, Alberto Vilar, went to jail for fraud.

As Grant Williams would later note, “You don’t have to worry about being the dumbest man alive — I know a guy in Phoenix.”

But the good news is that there is again a growing consensus that I am the dumbest man alive. It makes for exciting times!

With my presidential pick demonstrating the greatest of grift this weekend with the exploitative TRUMP coin, I am feeling a bit despondent. He didn’t have to do that. Why he did is beyond my comprehension. I often say, “I hope I’m wrong, but I think I’m right.” Now, I just don’t know.

Today’s note is going to split into a few parts:

A brief update on NDFI’s

“Dear, Owen Lamont”

Some final thoughts on seasonality

Out of Sight, Out of Loan got a fair bit of interest, and Adam Josephson shared some updated charts. To say non-NDFI lending is weak is an understatement, but the demand for leverage for non-bank financial institutions continues to grow. Eventually, someone says, “No” and the music stops. But where (and when) that is will only be known in hindsight.

The addition of leverage to funds appears straightforward, particularly in the case of strategies like futures or forwards where the cost of financing is embedded in the underlying forward price. A good example is a strategy of levering returns on the S&P 500 futures using rolling contracts. For futures, once you’ve been approved for a margin account, you do not need to “pay” financing costs as they are embedded in the price of the future (along with expected dividends, which are very stable at a quarterly pace). As you roll the future contracts, you pay a higher price for the next contract which rolls down at the implicit financing rate (risk-free less dividends):

It is easy shorthand to think of the returns of 3x funds as simply 3 times 1x funds; in fact, if we look at average daily returns for the 1x, 2x, and 3x S&P500 ETFs ($SPXL, $SPXU, and $SPY), we get almost exactly this result — both daily returns and volatility scale almost linearly:

But note that CAGR (compound annual growth rate) returns do NOT scale linearly and realized Sharpe ratios fall sharply. Mathematically, this can be expressed as:

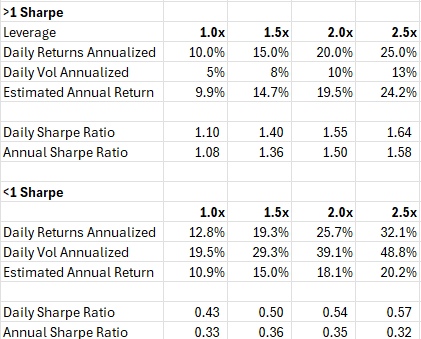

The arithmetic returns and volatility metrics scale linearly with leverage while the geometric (CAGR) returns scale linearly with arithmetic returns but negatively with the square of volatility. We get an interesting conclusion — if the EXCESS return of the strategy (Rs - Rf) exceeds the increase in volatility, i.e., Sharpe Ratio >1.0, then leveraging the strategy can increase both return AND Sharpe. But if the Sharpe Ratio <1.0, then leveraging the strategy increases compound returns LESS than volatility and Sharpe Ratios fall:

Extending out the table graphically: