Well, that was sad...

Roaring Kitty reveals much about the state of affairs

Summary

Impact of Passive Investing on Short Sellers:

This note examines how passive investing has influenced short-selling dynamics, particularly highlighting unusual occurrences of stocks with over 100% short interest. Examples like Gamestop and Dillard’s are discussed, showing how passive funds’ activities and company buybacks impacted short sellers and stock prices.

Case Studies of Gamestop and Dillard's:

Gamestop and Dillard's are used as case studies to illustrate the effects of passive investing and buybacks on stock prices. Both companies had significant share buybacks that led to passive funds like Vanguard and Blackrock becoming net sellers. This selling, combined with buybacks, created opportunities for significant price movements, as seen with Gamestop's short squeeze driven by retail investors.

Reducing estimated float by passive ownership helps to understand the violence of the subsequent rallies.

Top Comment

Jason appreciated the option-based analysis: “I like the call illustration focused on the implied forward level. Turning it around it would seem to suggest that long-dated puts may be extremely attractive.”

MWG: They are “cheap”, but only because the embedded bond

Stock = Call - Put + pv(Divs) + pv(Strike)

Put = Call + pv(Divs) + pv(Strike) - Stock

Since we already established the Call is “expensive” you want to short that out to leave the attractive part. This has added benefit ending volatility discussion:

Put - Call = pv(Divs) + pv(Strike) - Stock

This leaves three options

1) Dividends massively underestimated (this is plausible)

2) Stock price too high (duh)

3) PV function too high (buy bonds)

The Main Event

Was Anyone Else Sad?

I have to confess that I tuned into Keith Gill on Friday… and waited 25 minutes for him to show up late to his own party. I briefly watched a few of his videos during the meme stock craze in 2020-2021. I concluded that his fundamental thesis on Gamestop (GME) was flawed, but this took a backseat to the dynamics highlighted on short selling in the presence of passive.

I’m going to split today’s note into three pieces. The first addresses the mechanics of how passive investing has changed the game for short sellers. The second (next week) attempts to address the reveal of the matrix that this episode entailed. Finally, part three attempts to integrate my emotional reaction to Keith Gill, the saddest newly minted centimillionaire I’ve ever seen.

Shorting in the Presence of Passive

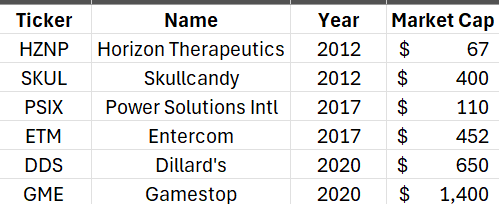

The existence of a stock with greater than 100% short interest is unusual. The Managed Fund Association claims that this has only occurred 14 times in total since 2012, and notes that 8 of the 14 companies were very small. The remaining six examples they cite are interesting:

Four of the six were resolved with no adverse impact on short sellers. In fact, most instances of excessive shorting were in response to imminent share issuance and VERY brief in duration. Horizon Therapeutics is an example where serial share issuance during pharmaceutical product development “protected” the shorts:

This is the typical pattern where shorting is in response to a catalyst reasonably well-telegraphed by underlying fundamentals. In 2012, investors in the new secondary reduced their exposure and captured the new issue discount by shorting shares ahead of the offering.

The last two, Gamestop and Dillard’s were obviously different, with both market caps among the largest and both shorted in expectation of likely bankruptcy filings due to a combination of failing business models and the impact of the pandemic. Gamestop’s business was extremely cash rich, but burning cash rapidly through a combination of share buybacks in 2019 (they repurchased 34% of shares outstanding) and losses in 2019, 2020 and 2021. Well, before the pandemic, these were businesses apparently in terminal decline.

Let’s hit Dillard’s first…