Transitory or Terminal? It depends on what the meaning of the word 'is' is

Definitions and accuracy matters... a lot

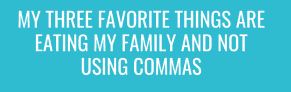

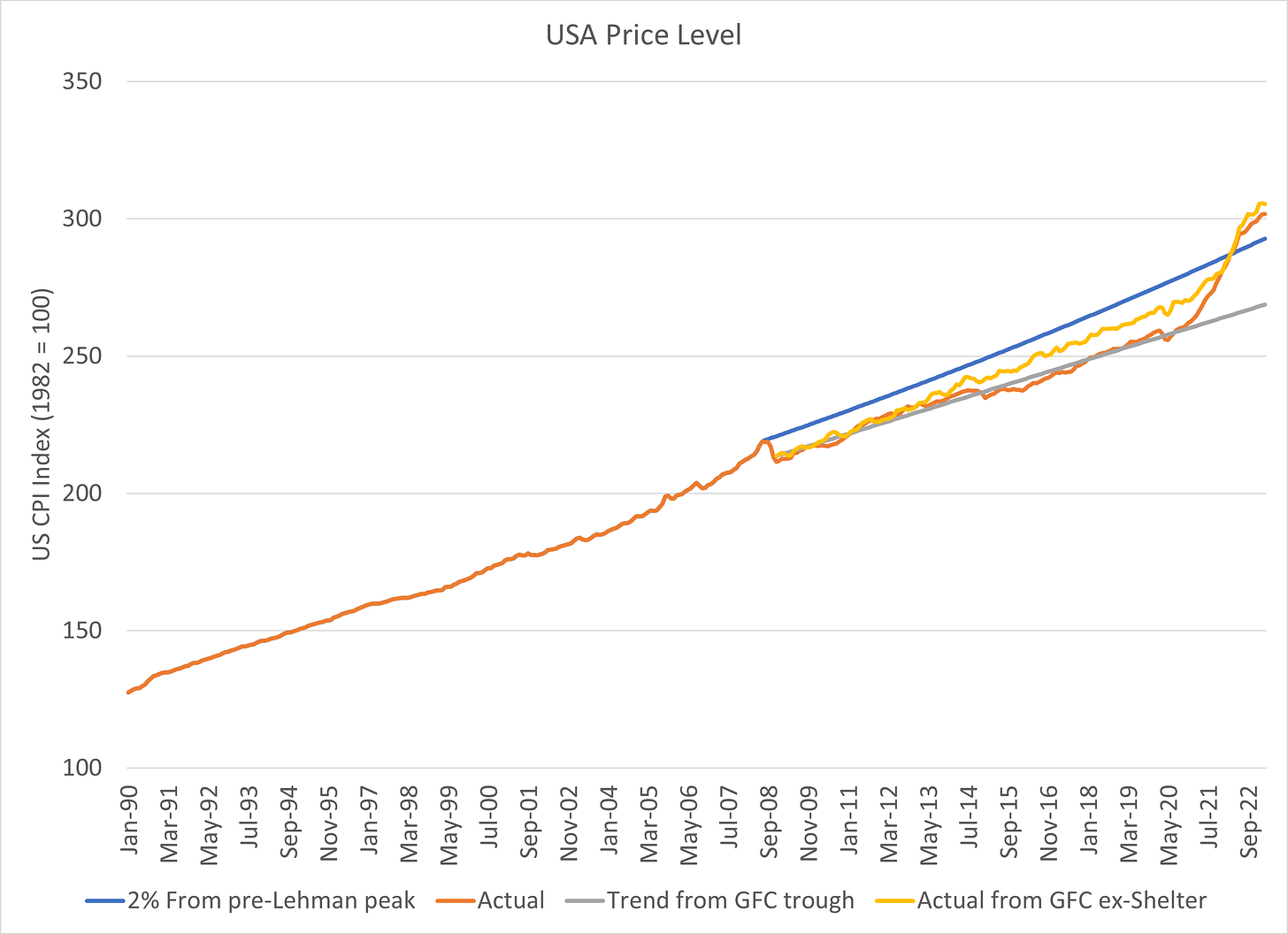

We’ve spent much of the last decade learning new economic terms. I still remember my first brush with the phrase “macroprudential” in 2010. The ease with which these words enter the financial lexicon never ceases to amaze me, but rarely do we stop to consider whether we are using them correctly. In the past three years, the phrase “transitory inflation” has become a perceived indicator of IQ — utter it, and you’re immediately maligned in roughly the same manner as those who refused to double-mask in 2020. And yet… much like an outbreak of chocolatey-goodness around Hershey, PA… the phrase seems, at least to me, to accurately describe the recent experience. From January 2022 until March 2023, a total of 13 months, we experienced elevated inflation excluding the shelter component:

OK… OK… I’ve excluded shelter… that’s simply unfair… or is it?

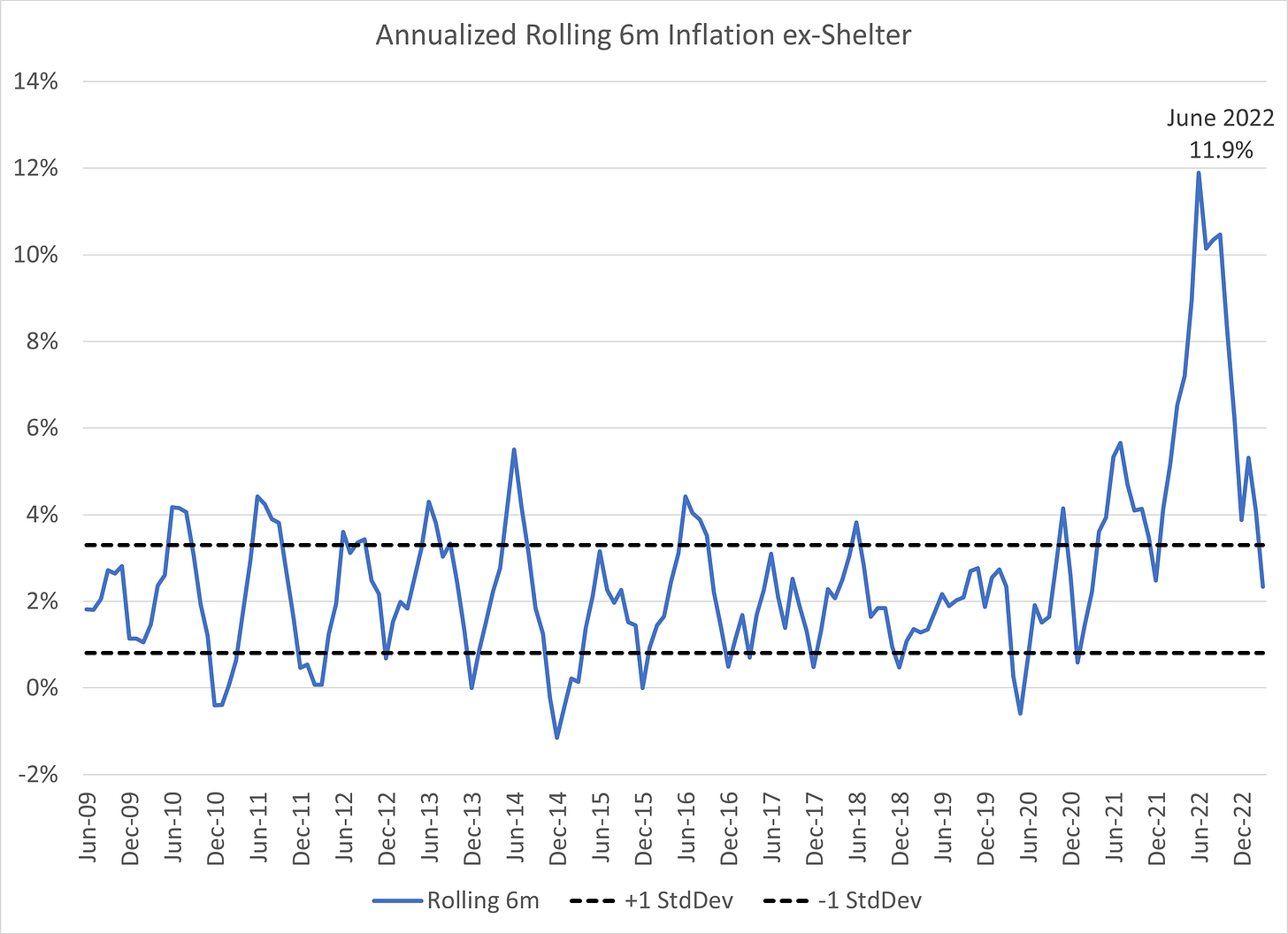

Over the last few years, the utility of the home has exploded as work-from-home became a reality. The San Francisco Fed examined the question of the impact of work-from-home on home values and found that over half the change in home prices over 2020-2022 was tied to the phenomenon:

We find that the shift to remote work accounts for more than half of overall house price growth over the pandemic. Our results suggest that rising house prices over the pandemic reflected a change in fundamentals rather than a speculative bubble.

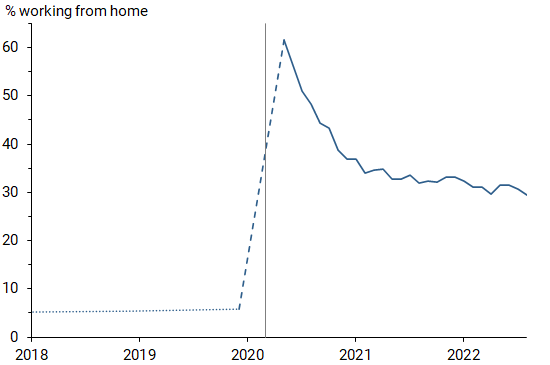

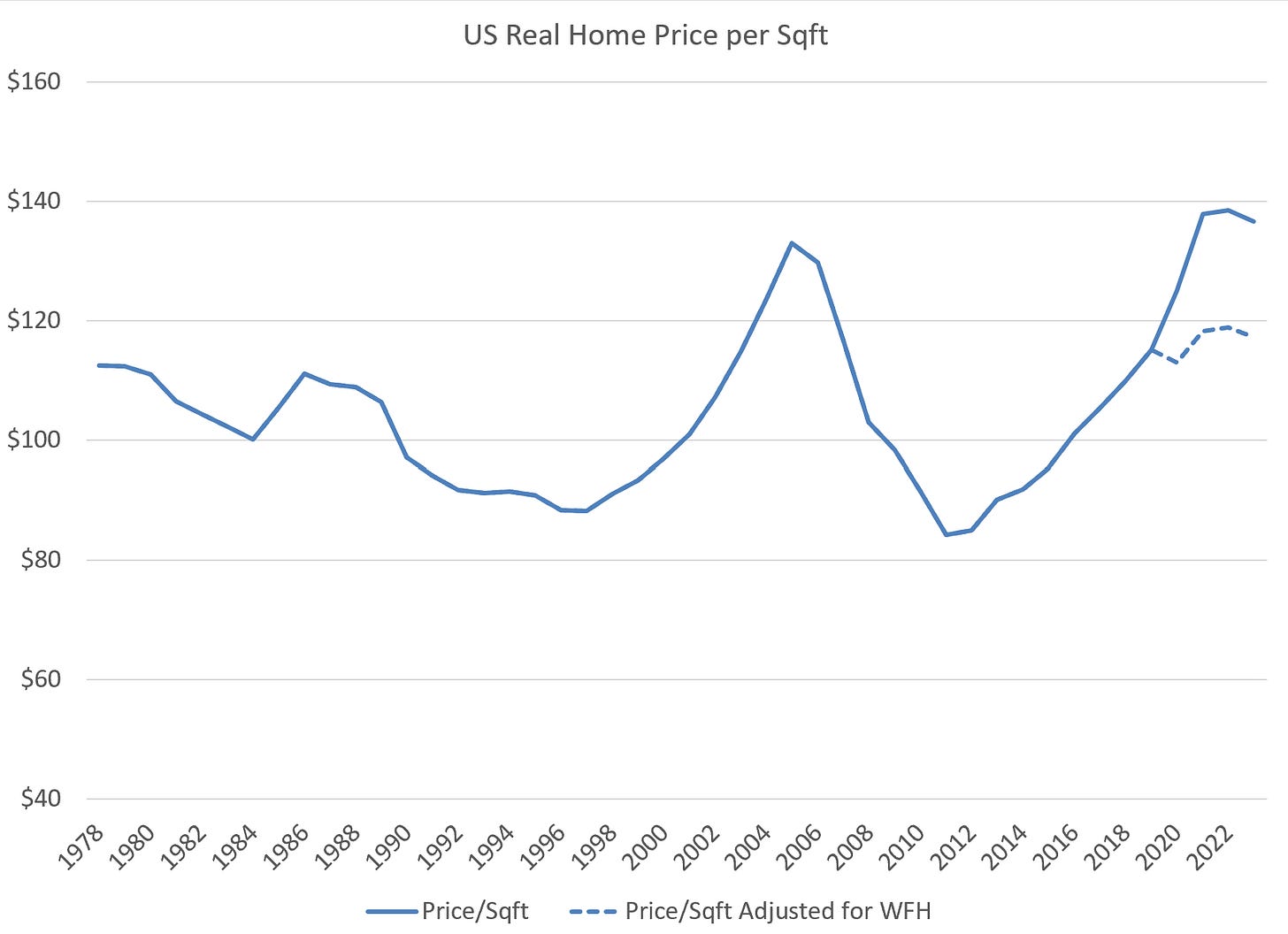

This dynamic is further illustrated by the change in real home price per square foot — bigger homes SHOULD be more expensive — and the USA has collectively invested in home SIZE inflation to an extraordinary degree over the last century. Controlling for this factor meaningfully changes our perception of housing costs:

And if we properly adjust for this dynamic, home prices are ALREADY falling substantially. Rents follow a similar dynamic with fundamental changes driving the vast majority of the price change — in this case, both SIZE and MARKET POWER are driving price behavior rather than “inflation.” To say the least, these are not issues the Federal Reserve should attempt to address through interest rates.

Welcome to “Yes, I give a FIG” — where simplistic narratives do not cut it.

In the December 2020 press conference, Powell explicitly laid out that the Fed would NOT respond to one-time price increases coming from temporary shocks… like from an oil shock or a global shutdown and reopening:

CHAIR POWELL: And the persistence of inflation, if you—if you get a—for example, oil prices go up, and that’ll send a temporary shock through the economy. The persistence of that into, into inflation over time is just not there. So they— what you describe may happen, and, of course, we would watch it very carefully. We, we understand that we will always be learning new things from the economy about how it will behave in certain cases. But I would—I would expect, though, going in that that would be a one-time price increase rather than an increase in underlying inflation that would be persistent.

SCOTT HORSLEY: So not the kind of thing that the Fed would, would be trigger-happy to, to…

CHAIR POWELL: No.

SCOTT HORSLEY: —respond to?

CHAIR POWELL: No, no. Definitely not.

By April 2021, the use of “persistent” had transitioned to “transitory” — the first use of the phrase appears at this point:

“Inflation has risen, largely reflecting transitory factors.” FOMC statement, April 2021

In the April 2021 FOMC press conference, the word inflation appeared 71 times, accompanied by “transitory” in nine instances. By November 2022, in perfect “wrong at every turn” mode, the word transitory was banished. I wonder why?

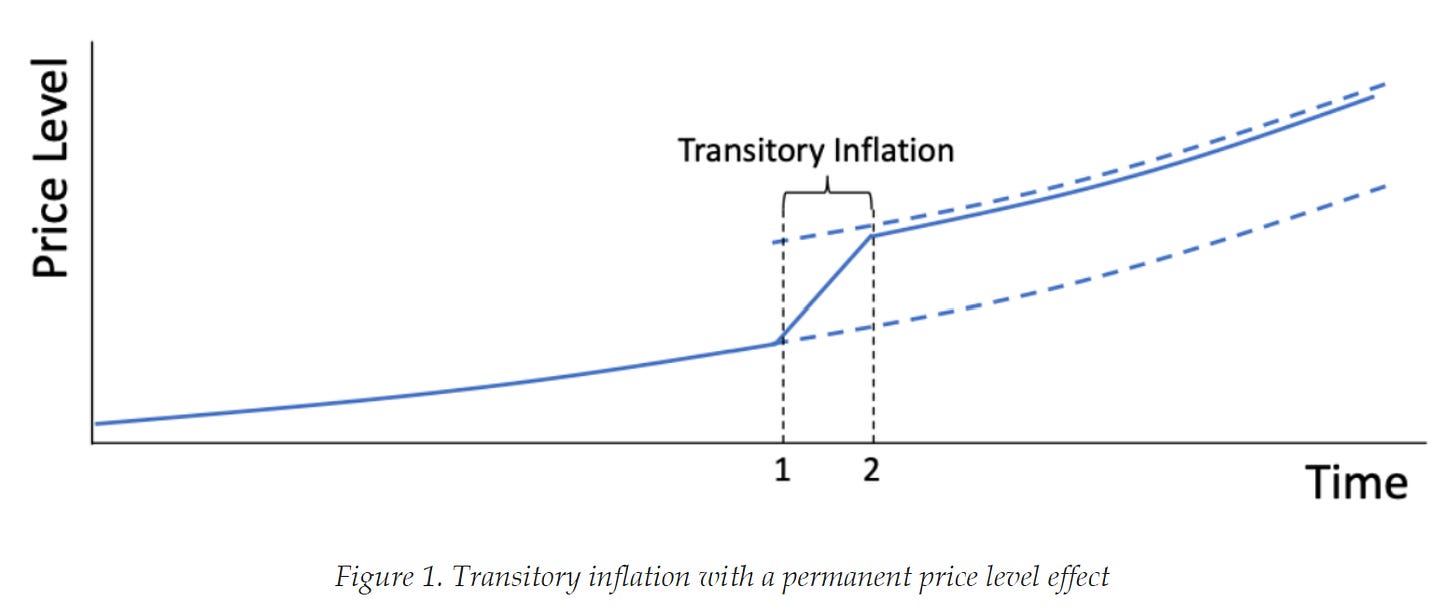

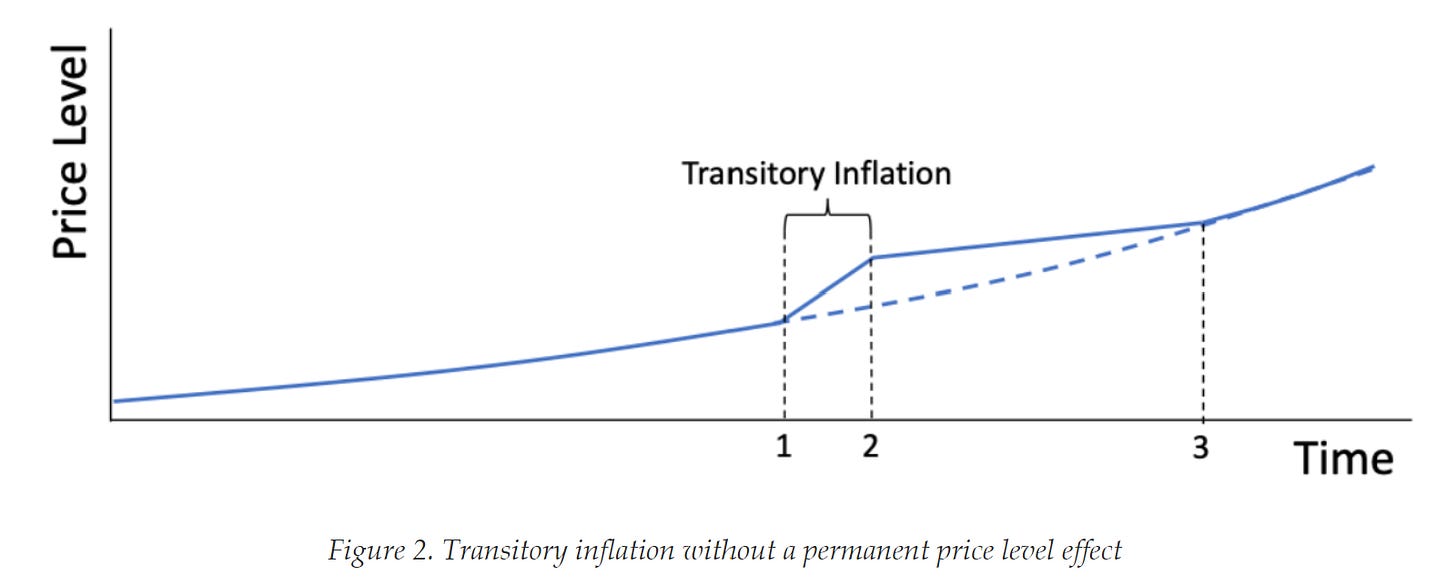

As my partner Harley Bassman likes to point out, “everything is transitory if you wait long enough.” And to be fair, the Fed never provided us with an explicity, helpful chart like the two below to determine whether their objective was to return the inflation rate to trend OR to return the price level to trend.

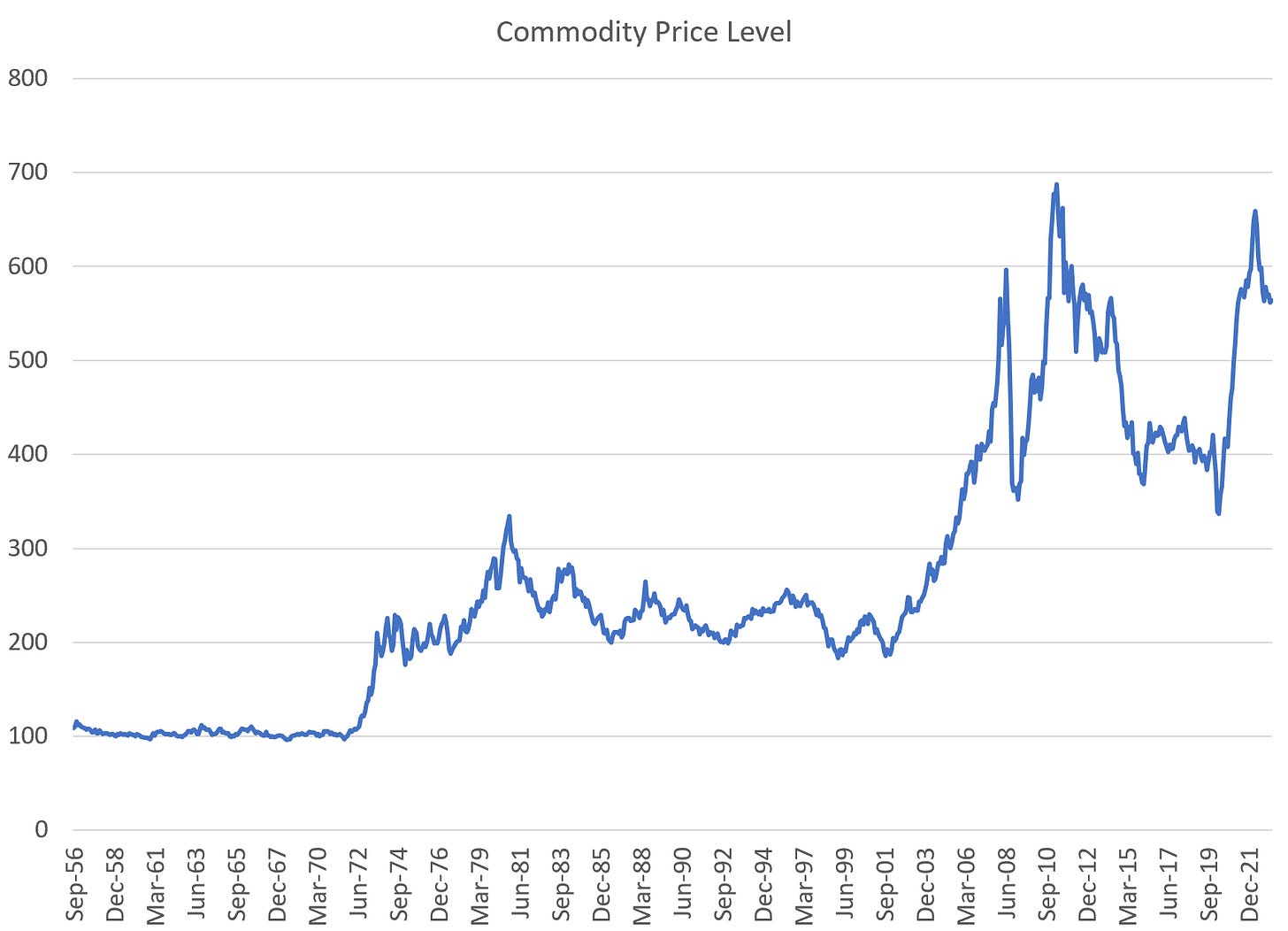

Certainly, in the commodity markets, the early indications are that we never achieved a new high price level and are likely heading right back down to the 2008 and 2019 lows. OPEC+’s recent production cuts have accomplished almost nothing — in fact, they’ve likely lowered prices in the long-term by increasing oil substitution as Mike Kao highlighted in his recent Substack. Proceed with caution in this space.

For the past fifteen years, we’ve been told inflation was too low and the objective was to get inflation above trend to help resolve the overhang of the GFC. “Mission accomplished” sounded so much more convincing in June 2003:

As noted above, the rate of inflation, ex-shelter, has largely normalized. “Sticky” CPI metrics have begun to predictably fall as “Flexible CPI”, which leads by roughly 9 months has already turned substantially negative over the last three months. With those results before the failure of SVB (due to its poor understanding of terminal rate apparently), it is reasonable to expect inflation metrics to fall further still. In other words, the deflation is here.

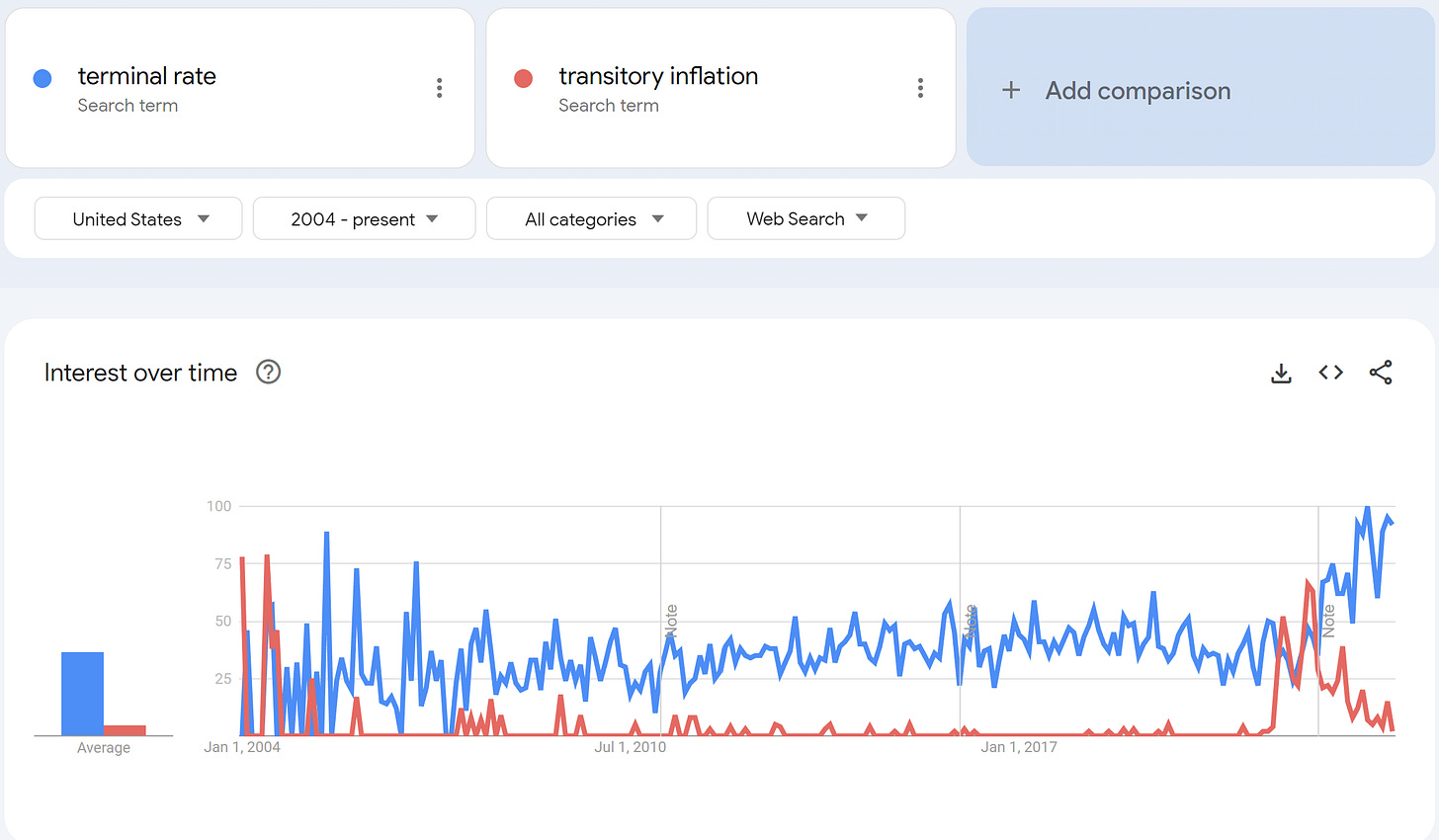

With transitory now fully ignored, despite being correct, we can move on to “terminal.” Prepare for more skewering.

Our increasingly short attention spans means there really has been a substantive shift. Forgotten is “transitory inflation” replaced by a new obsession with “terminal rate”:

The Oxford dictionary defines “terminal” as either an adjective or a noun, referring to a potentially benign end state OR something predicted to lead to death. With the popularity of the phrase “terminal rate” exploding in Central Bank lexicon, what does this compound phrase mean?

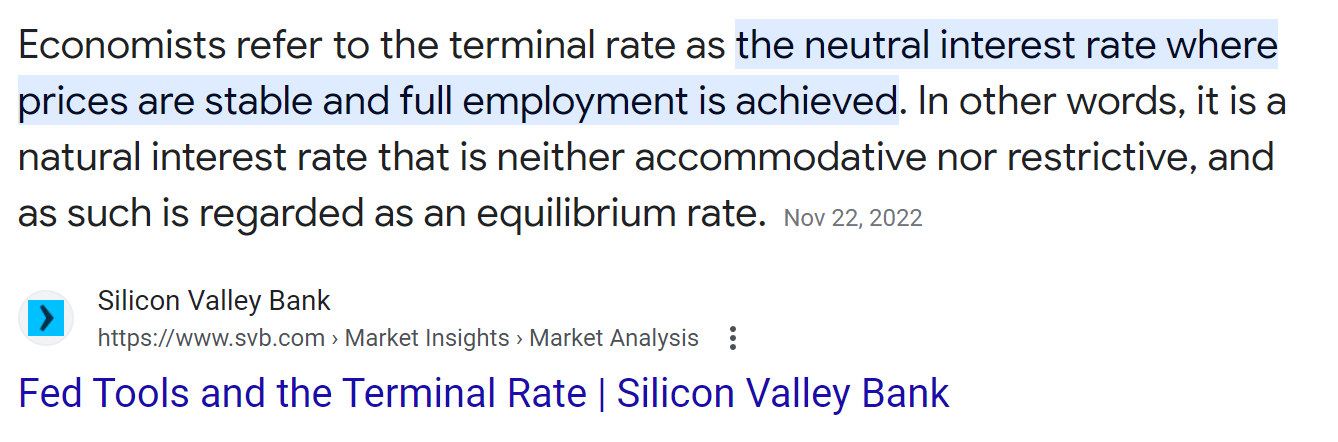

I shit you not, the very first explanation that occurs in a Google search for “definition of terminal rate” is from Silicon Valley Bank:

Our master communicator-in-chief, Jerome Powell, did nothing to dispel this notion in 2020:

“The so-called terminal rate, the rate at which the economy can operate and not create inflationary pressures, is low and is much lower than in the past” — Powell Dec 16, 2020

Somewhere in the past year, this definition has been lost, replaced by a newly redefined “terminal rate”:

Note that nowhere in this definition is there a consideration of what’s appropriate for the US economy. It’s all about what the Fed decides. Central planners of the world rejoice.

The Fed is relying on the most lagging of signals — employment and prices. This was noted by Congressman Bill Foster, likely the most intelligent member of Congress (the only Congressional representative with a PhD in science), who challenged Powell to more deeply consider leading versus lagging indicators. It’s worth listening to this exchange, if for no other reason than to consider the relative value of Bill Foster, not only a scientist but also a very successful entrepreneur, versus his peers:

Foster: Are there structural things you can contemplate or after action reviews to say what would have happened if we would have paid more attention to the leading indicators or in engineering terms improve the bandwidth of your feedback regulator that you know this is this is something if you want to get the best result you know you need a high bandwidth feedback in in the system even when there's averaging on the back end.

Powell considered it appropriate to dismiss this concern with a joke.

Powell: So this is something we only think about during waking and sleeping hours as you can imagine. It's it's really hard to know what the lessons are again… If we ever see this pitch again we'll know how to swing at it but we'll now recognize a bunch of firsts.

He took on a far more serious tone when assuring Congress that the banking system was extremely well capitalized — a full eight days before the bloodbath of multiple bank failures, including the 16th largest by assets.

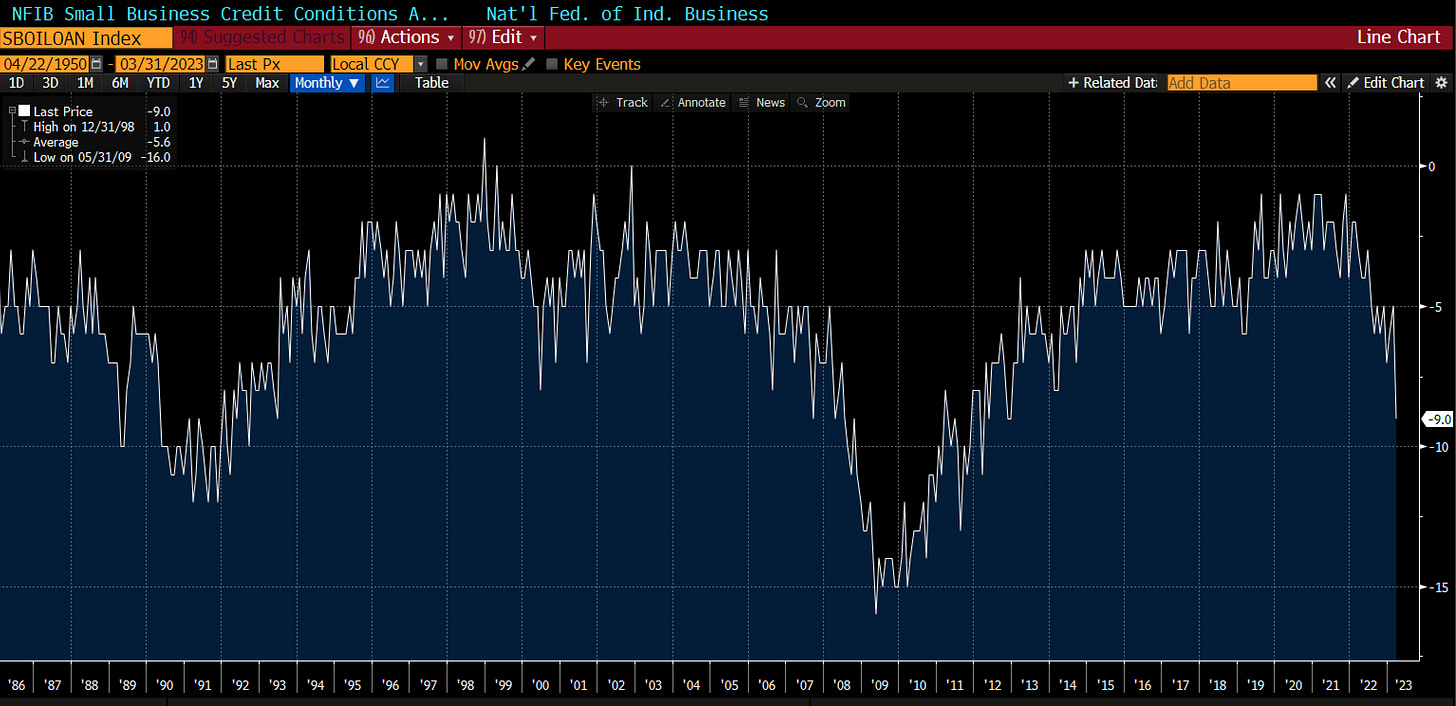

Unfortunately, Powell’s arrogance and desire to achieve immortality as the second coming of Paul Volcker means we now have an unelected bureaucrat apparently on an unannounced mission to “end the Fed put” as discussed in last week’s note. In the very brief dataset since that event, we’re seeing credit availability collapse for small businesses in the second largest decline in the NFIB’s credit availability conditions index history — tied with the events of 9/11:

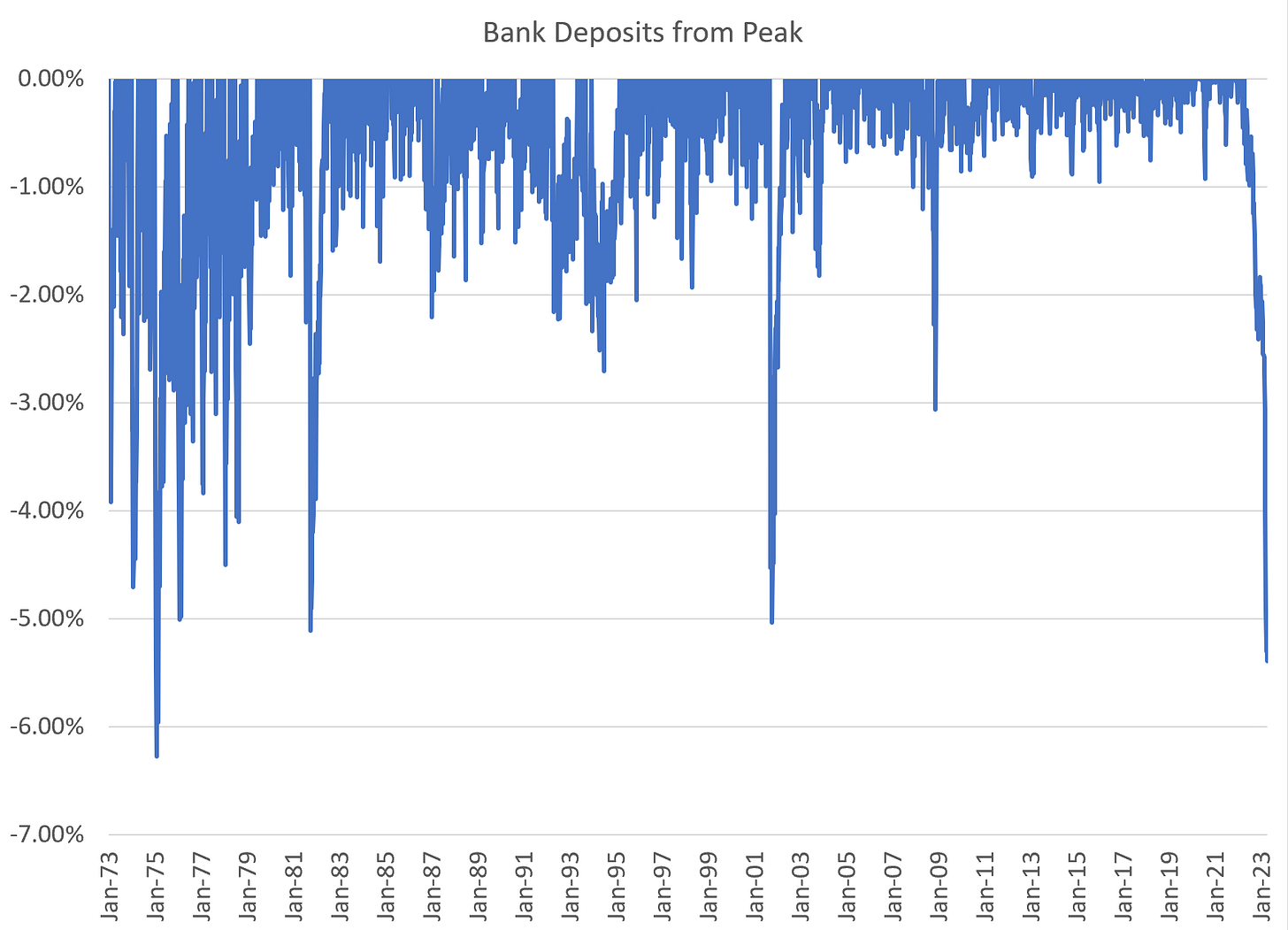

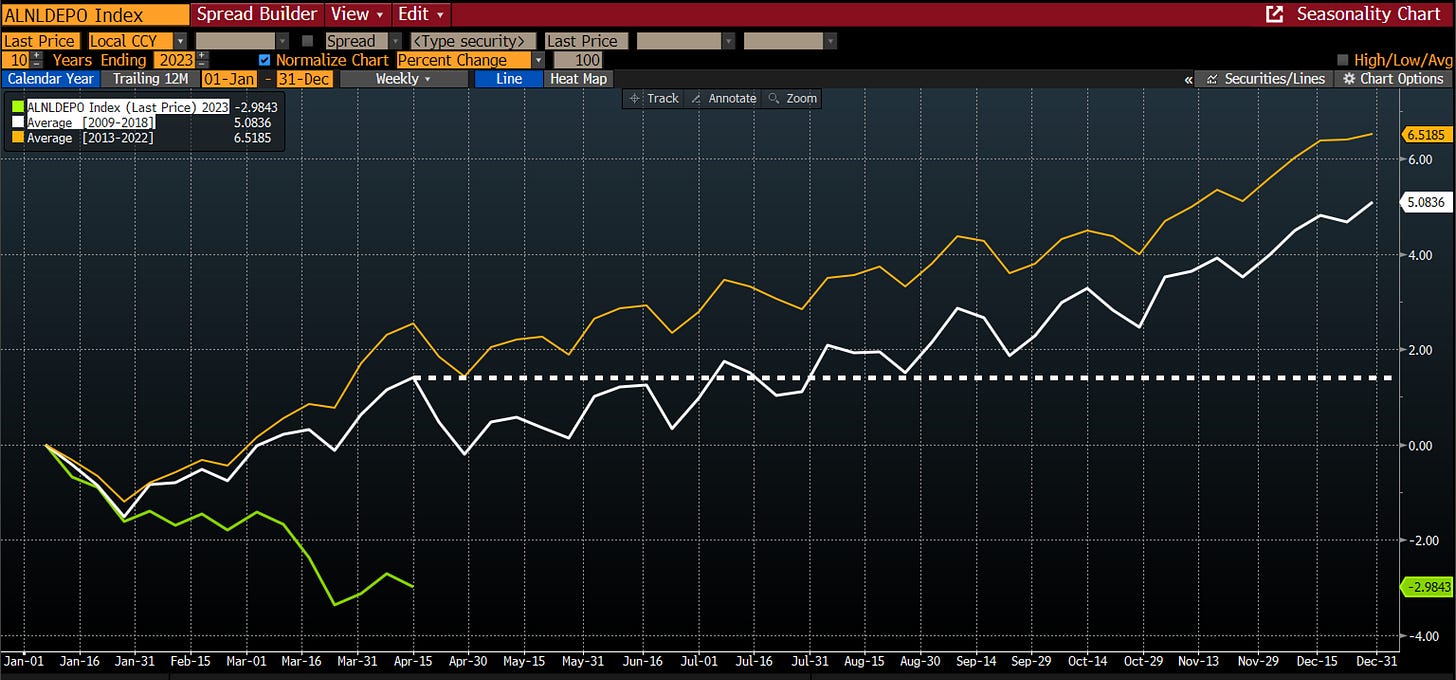

Deposits in the banking system are continuing their unprecedented collapse:

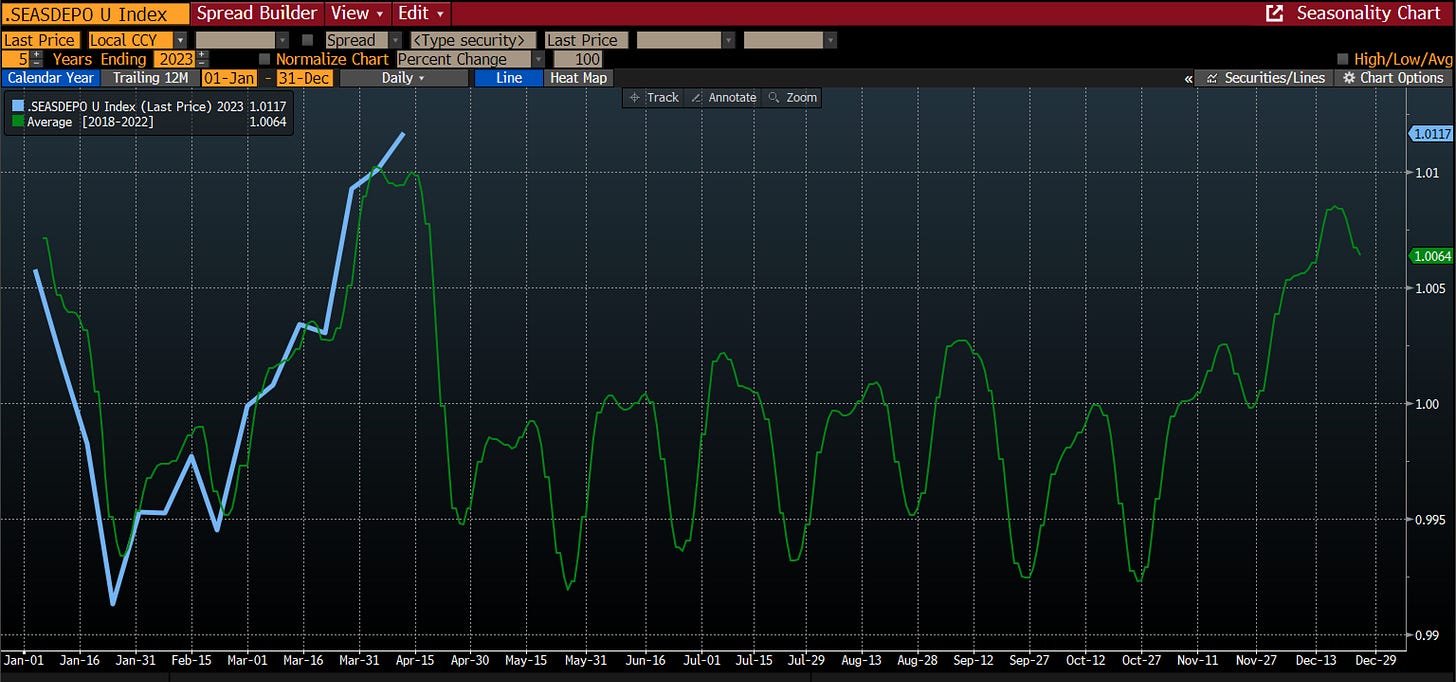

And an important wrinkle is that these deposit drawdowns are in the context of seasonally high levels due to tax season. In actual terms, April 15th - July 31st tends to see zero deposit growth.

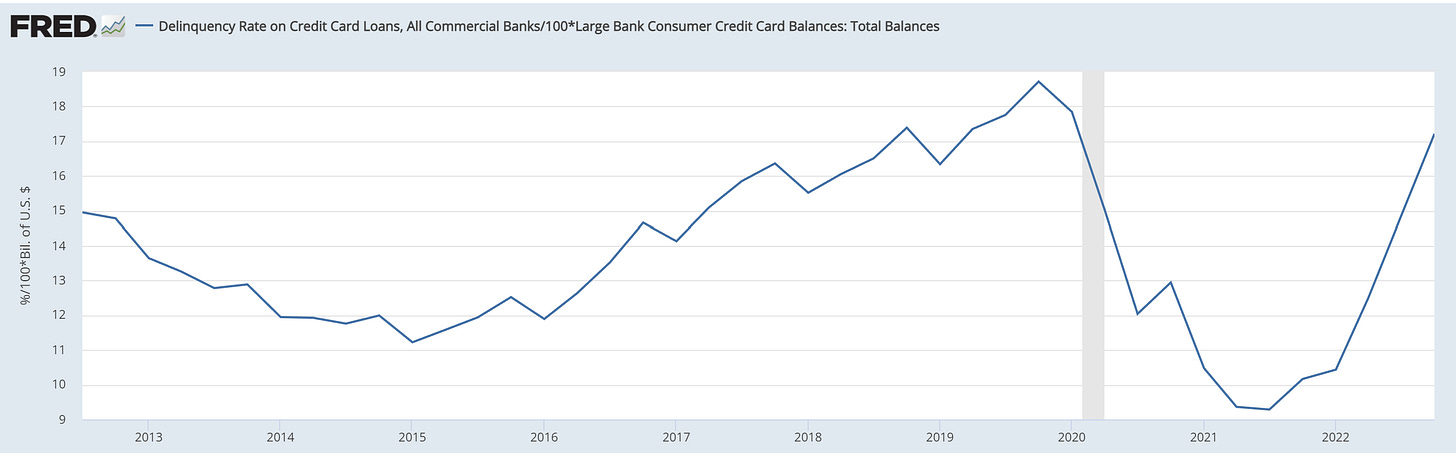

Against this pattern of historical growth, the current decline in deposits is even more extreme, and a reasonable hypothesis is that we’ll decline at an accelerating rate from here. On the credit front, bankruptcies are beginning to rise sharply, and commercial real estate is in the toilet; credit card delinquencies are now lifting rapidly. Those bullish on the economy will correctly note that these delinquencies are occurring from a low level, but with balances dramatically higher, the absolute LEVEL of delinquencies is approaching a recent record and rising at a record $ pace:

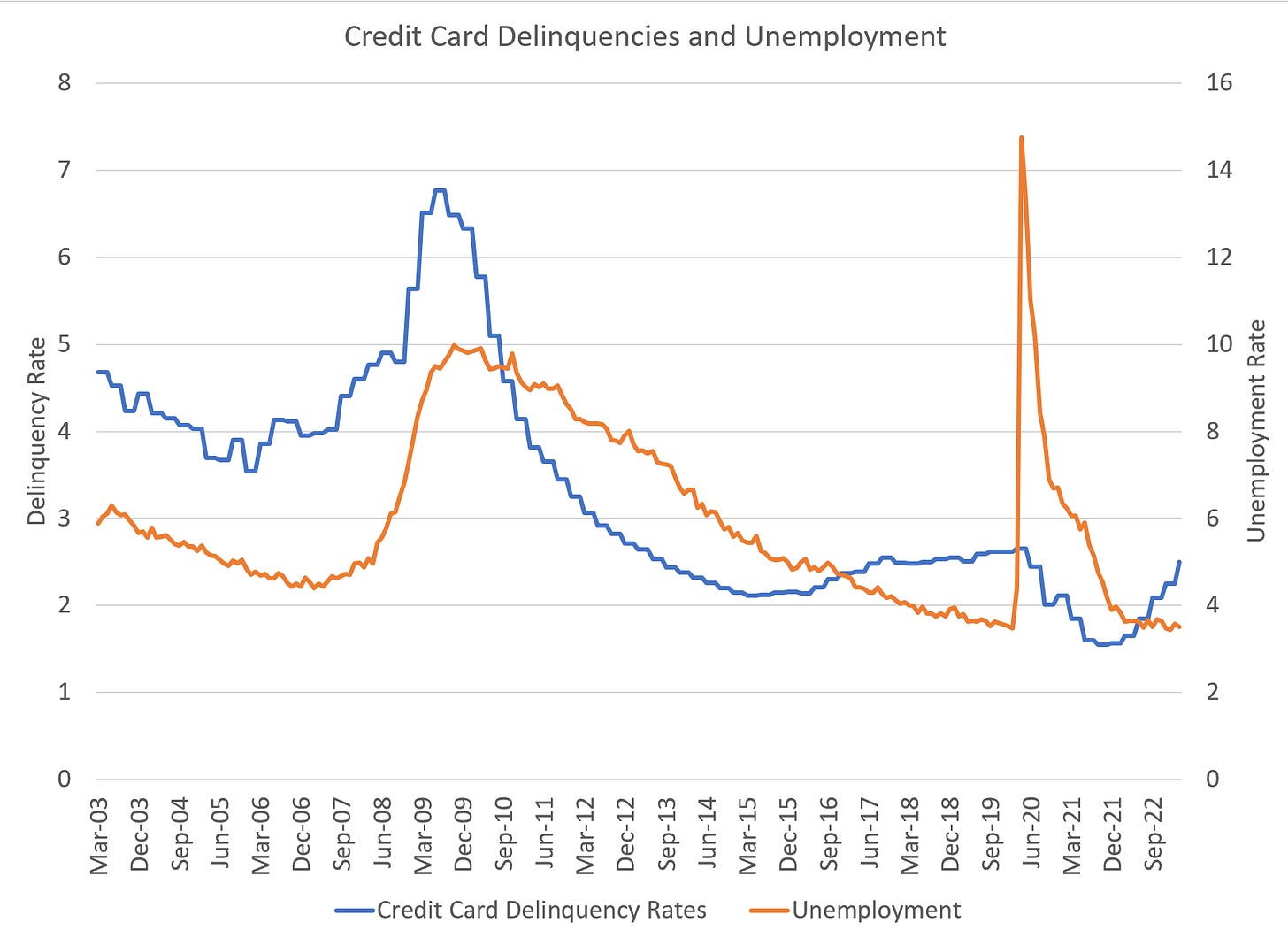

When unemployment begins to rise, these delinquencies will mushroom. That it is already rising sharply ahead of the increase in unemployment suggests the 2008 model remains valid:

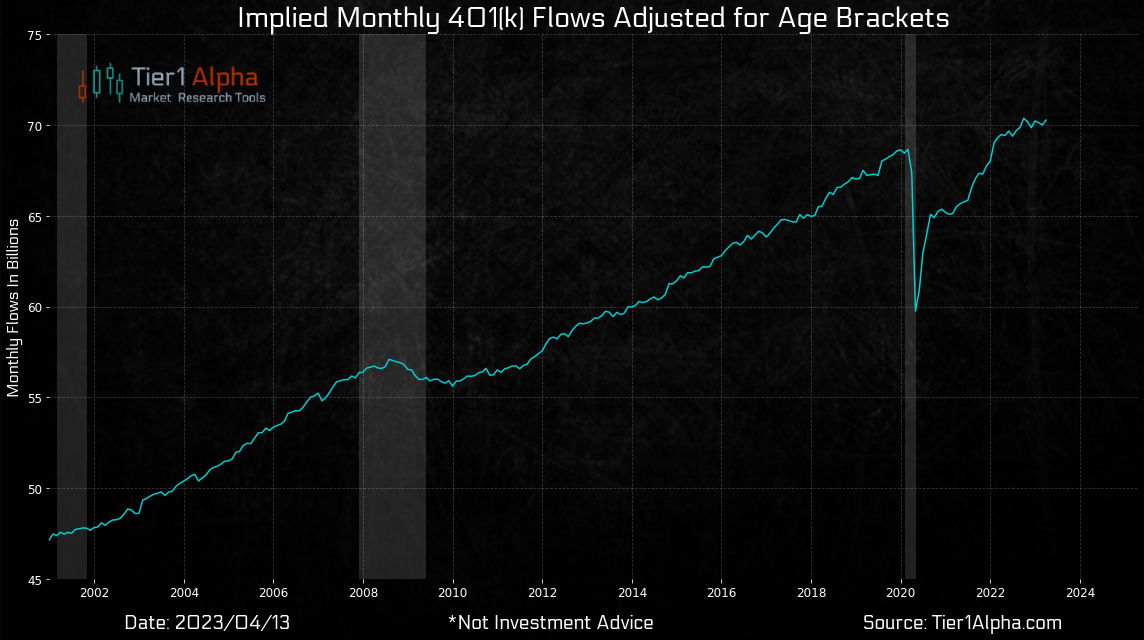

Meanwhile, equity markets are largely incapable of looking forward due to the constant flows into passive funds from 401K contributions — this flow is starting to falter with layoffs in the high-wage technology sector lowering contributions:

The second definition of “terminal” is the right one — we’ve signed a death sentence for the US economy.

The idea that inflation could ever possibly be transitory is to completely ignore what inflation is. Inflation is NOT the YoY change in price level. Inflation is the lasting trend of the price level in response to the trend in the level of money and credit. PERIOD. Ergo, it is impossible for a fiat currency under a fractional reserve banking system to ever have transitory inflation. Inflation is an inexorable march higher, every year, at varying degrees of severity. There is NEVER a correction in the general price level. There will never be a restoration of value in the unit of account. Transitory? HAHA NO

Thank you for another thoughtful piece. However, I have a bit of a bone to pick regarding rent, and not OER, but actual rent. At this point, why would anyone expect rents to decline at all? Consider, landlord's expenses have clearly risen sharply over the past several years, Unemployment remains extremely low, although I grant the weekly claims data is starting to point to a bit more slack, and there is not, as yet, an overabundance of rental units available in most cities. As such, what would incent landlords to cut rents? Even if housing prices are beginning to decline, the lag between house price changes and rental rates is pretty substantial.

Add to this the idea that rent has a built-in 12 month lag based on the BLS methodology and it feels to me that it will be quite a while before the rental piece of CPI starts to decline in any meaningful way. Given that the Fed is focused on these lagging indicators, I would not be optimistic that they are going to be concerned about a housing crisis anytime in the near future.