This is Going to Hurt Me More Than It Hurts Ewe

A hypothesis on bond market volatility

Top Comment

Octavian ascends the throne as First Citizen of YIGAF:

Email from Vanguard received on Thursday below. In summary "don't sell". So "Why are we reading this now?".

--------------------------------------------------------------------------------

The US tariff announcement on 2 April may lead to increased stock market turbulence in the coming days. It's natural to feel unsettled when markets are choppy, but we would caution against making short-term changes to well-considered investment plans.

Sticking to your plans is even more important right now, as the current tax year ends at midnight on 5 April. You have only two days left to maximise your allowances and get closer to achieving your goals. If you're concerned, consider parking any remaining allowance in a low-risk

MWG Comment:

I am a bit surprised these came out as fast as they did, but the note on tax impact is worth considering. We are getting reports of record hardship withdrawals. Fear from overexposed Boomers is likely high, although my MIL indicator has not yet triggered.

Also I touch on Vanguard flows in the main section. It’s worth pondering whether something bigger is at hand. But it’s pondering for now, as we simply don’t have the data yet.

Book Update

A DRAFT manuscript has been sent to my publisher. Roughly 500 pages of garbage you’ll never read. But out of it will rise roughly 290 pages of pure gold. I’m referring, of course to my dog-eared version of Henry James, “The Turn of the Screw.” My own writing is “not good” I’m told:

But he’s a fan, so we’ll try. Now comes the fun part — remembering what we forgot to include, editing, more editing… probably still more editing (see above). I’m hoping to have pre-prints ready in late May for reviewers. Volunteers solicited. I’m looking at you, Paul Isaac.

The Main Event

It’s been a wild few weeks to cap a wild year. For those who ignored Barack Obama’s… sorry, I mean, Donald J. Trump’s suggestion to buy stocks, don’t you feel foolish:

"What you're now seeing is, profit and earning ratios are starting to get to the point where buying stocks is a potentially good deal if you've got a long term perspective on it” — Donald J. Trump

Crap… that was Obama.

I’m just glad I helped elect such an articulate young man. But I do see a method to his madness…

Eh, screw it… it’s just madness.

But nobody was following the stock market this week anyway. Bond, stirred AND shaken, took the center screen:

While the decline in bond prices was notable, the real outlier was the range in yields. Approaching the highs from Covid was not something I had on my bingo card for the week. To put this in context, it was the 6th wildest week in the bond market since 1998. I was still single, the kids had no claim, and Brandy & Monica’s hit “The Boy Is Mine” sat atop the charts. Good times.

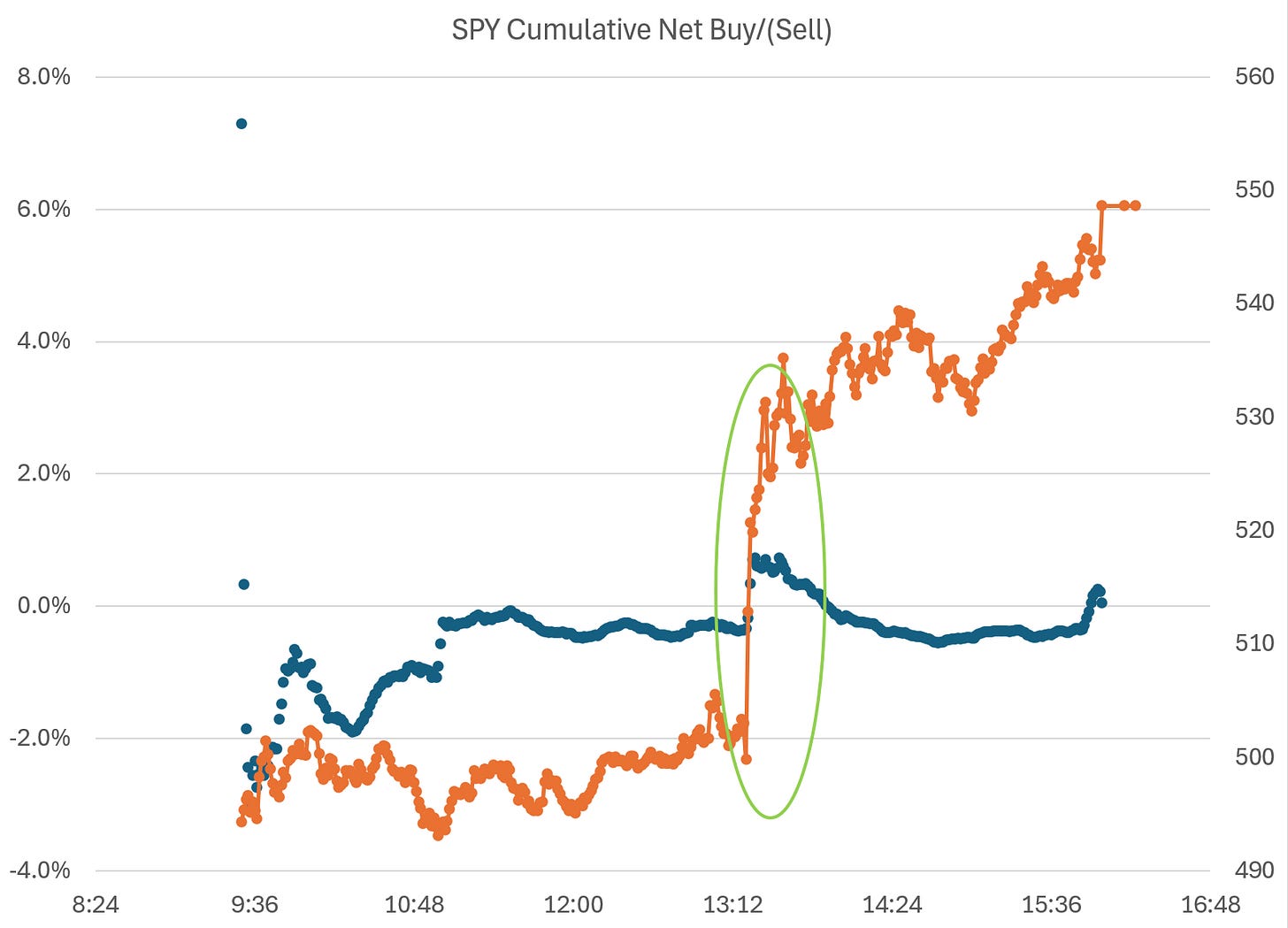

DJT’s admonition to “Buy! Buy! Buy!” lit up the charts on Wednesday and highlighted a dynamic I rarely see — market makers retreating so fast they run ahead of the market. How do I know this? Well, let’s take a look at “Buying at Ask” — a metric I track that measures the fraction of daily volume against the Bid (typically selling) and the Ask (typically buying). Here’s the SPY. You can clearly see Colt45s magnum impact (I know… I know… but it works better with 45). Note that orange is price (right axis), blue (left) is % of cumulative volume. The green oval is painted by elves:

Lest you think small caps got left behind, here’s the IWM. By the way, for both charts notice the accumulation of buy orders that characterize the open in SPY while not so much in IWM — this is my leading contender for the “overnight effect”:

And, of course, the QQQ: