There Will Be Math

A new paper further validates some of my work on fund flows

Summary

Flows drove ARKK performance: My analysis of ARKK's performance was driven by three components: a negative alpha (poor stock-picking skills), a greater than 1.0 beta to the QQQ (market beta), and a significant flows beta, indicating that new investor inflows significantly impacted returns. The analysis results have now been almost perfectly replicated by academics as part of a broader “flow impact thesis”

Impact of Flows on Returns: The recent paper by Van der Beek and Bouchaud confirmed the substantial role of flows in driving returns, particularly in thematic, concentrated ETFs like ARKK. Their findings showed that large inflows could create a positive feedback loop, leading to significant price impacts due to the high concentration of holdings.

Active vs. Passive Fund Dynamics: While active funds, like ARKK, are more affected by inflows and outflows compared to passive funds, their size and concentration makes them the exception. Passive funds, despite their large market impact, have more stable flows and are less likely to experience accelerated booms and crashes, but the evidence is that the inelasticity for these funds is LARGER as we aggregate identical style strategies.

Top Comment

Matt D takes issue with my support for Rick Rieder’s hypothesis:

I think Rick’s thesis is completely wrong. It just doesn’t have a direct impact like it did in the past. If the Fed was serious about getting rid of inflation they would sell bonds and MBS. It’s that simple. Until asset prices come down or the long end of the treasury curve goes materially higher we will continue to have inflation that won’t die. Especially with easier compares and things like commodities moving higher OER bottoming I don’t see a scenario where inflation is dead unless the long end goes to 5.5% and stays there for several months.

[The bottom income cohort] always has problems and it’s nothing new. Those dynamics aren’t going to improve regardless this cycle. The unfortunate reality is a lot of people have to lose their job for a period of time (I am not going to play conspiracy theory with the job numbers I know they are wrong but that is also nothing new). That’s the way you get inflation down and keep it down. Pick your poison. The reaction function of easier financial conditions, as reflected in the stock market, are now even more direct mechanisms to future inflation now that there’s minimal productivity growth.

MWG: Obviously I disagree and have the modest benefit of the most recent PCE data to support my bias towards continued improvement. FWIW, OER is one of the key areas where we’ve seen nearly continuous improvement:

The mechanical effects that Rieder describes are literally mechanical. We KNOW that interest rates are raising key areas of inflation metrics, and once (if) cutting begins, these will retreat (alongside interest income). Whether this proves to durably lower inflation remains to be seen.

Unfortunately, the job losses continue to mount everywhere except unemployment claims. I have shared my hypothesis there, but only future history will tell us if it’s right. In the meantime, war, pestilence, and political actions remain key risks to the disinflationary thesis. On the flipside, we ARE making more progress than press headlines would have you believe. And thank you for the pushback!

The Main Event

Back in early 2022, ahead of the broader market selloff, but after the ARKK/meme stock selloff of 2021, I noted that the performance of Cathie Wood’s ARKK funds was poorly understood:

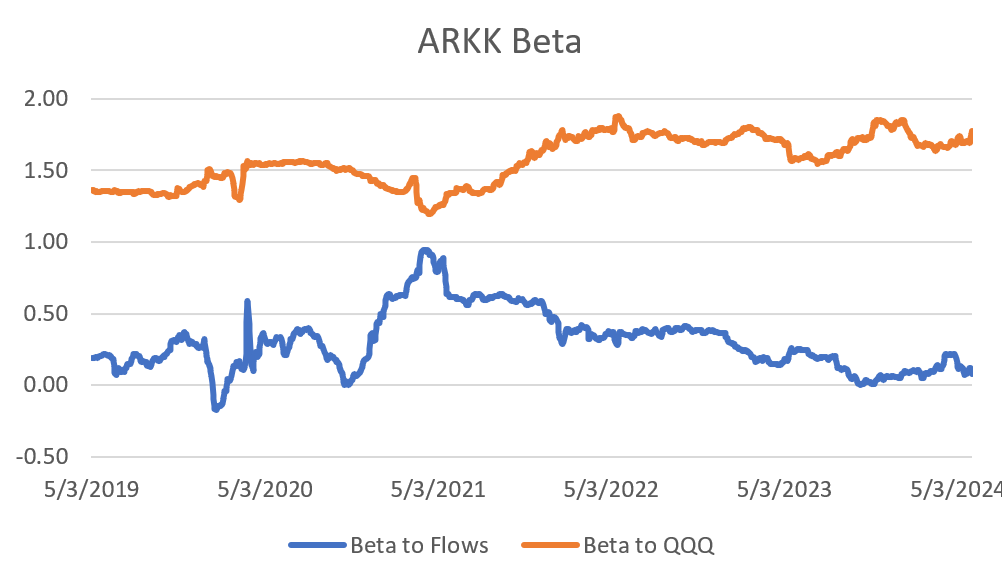

In a very simple analysis, it was clear that we needed to disaggregate the performance of ARKK into three components — an “alpha” return, a “market” (NDX) beta, and a FLOWS beta that measured the impact of new buyers entering ARKK and providing capital to buy the underlying names. My analysis looked like this (updated to present):

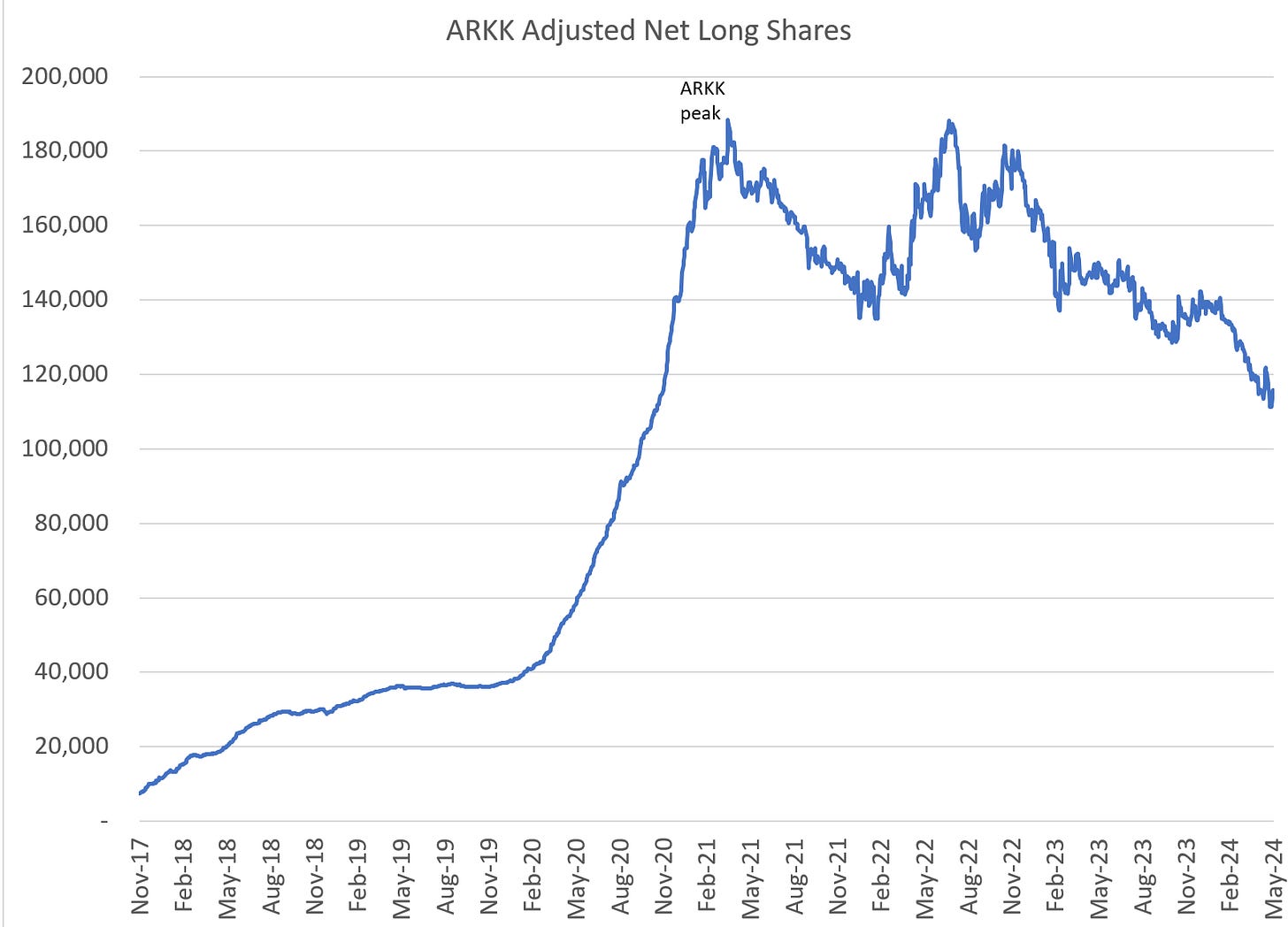

It was painfully clear that the “skill” (alpha) at ARK funds was negative, even as outperformance had been driven by a greater than 1.0 beta to the QQQ. As tech stocks soared from 2017 and rebounded sharply in 2020, that 1.5x beta more than offset the negative alpha, and funds raced into ARKK:

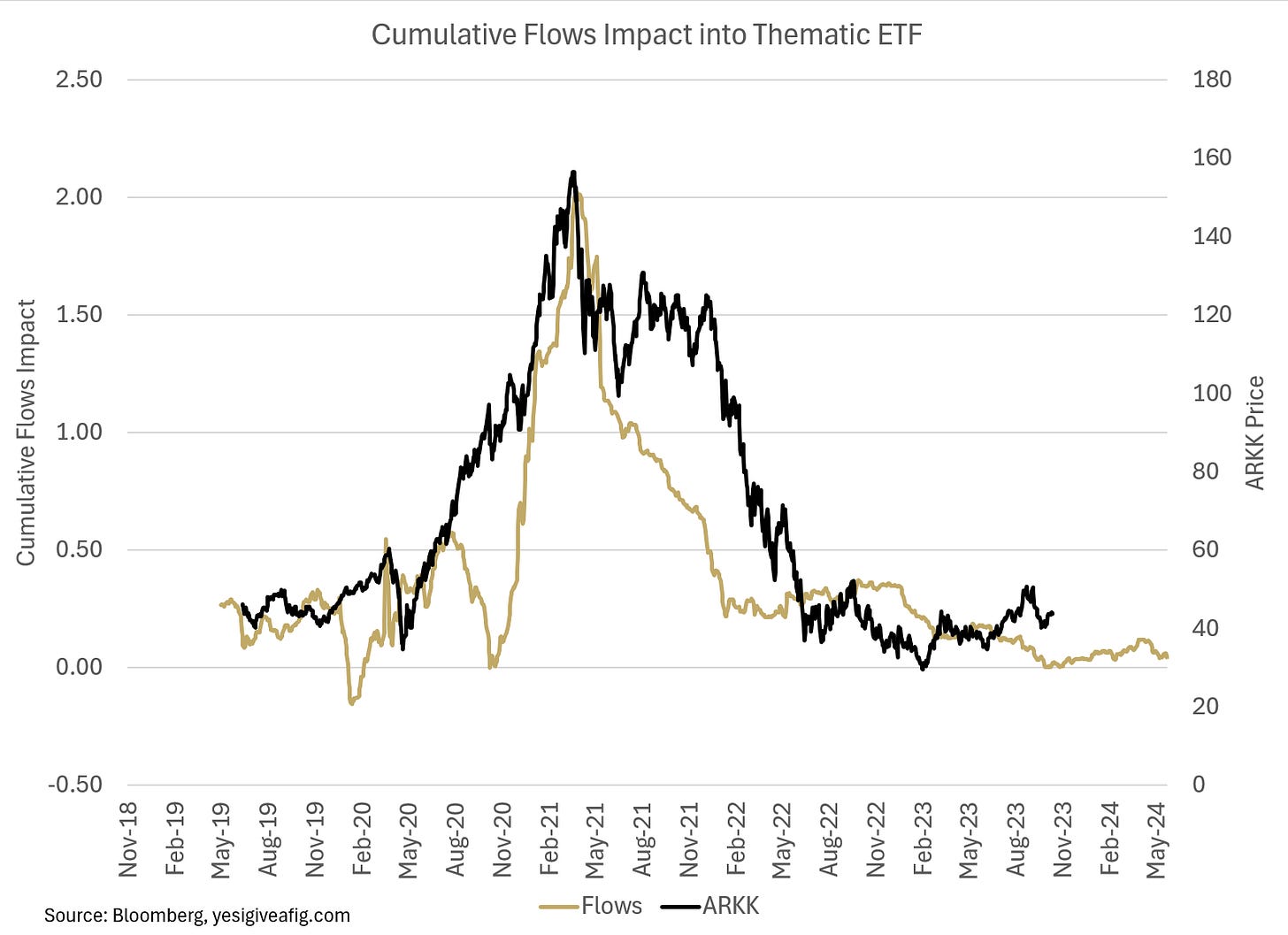

When I evaluated the aggregate source of returns, it was clear that the source of the returns in 2020 was the FLOWS, not the stock picking:

Ponzi Finance

Last week, this analysis received a vote of support from a new paper by Phillip Van der Beek and JP Bouchaud. Regular readers will be familiar with Bouchaud, who’s masterful extension of Gabaix & Koijen’s “The Inelastic Market Hypothesis” is one of the best papers I’ve ever read. The new paper, provocatively titled “Ponzi Finance” evaluates the role of flows in determining returns. Not coincidentally, they chose to focus their analysis on a “thematic concentrated ETF” — the not-so-innocent shall not be named. To cut to the chase, using far more sophisticated methods, they come to almost the exact same conclusion: