The Valley of Despair

A Few Thoughts on Bank Runs

Well, I did say I’d keep writing on passive IF I didn’t get distracted… and unfortunately, in our ADHD world, we had a busy week. I got back from Europe late last night (really this morning) and this week’s note is briefer than I had hoped due to time constraints. I know… excuses excuses… everyone has them. I absolutely promise I’ll keep writing on passive, and I very much appreciate the feedback in the comments last week — especially the skeptics. Your pushback is invaluable in helping me formulate my work in a manner that conveys the depth of the analysis that has been done.

However, this week I’m going to spend time on the “most important story” (Silicon Valley Bank) with hopefully a somewhat different angle from most commentators.

The Silicon Valley Bank (SVB) story moved from an “interesting” story on Thursday that SVB would be issuing new equity to offset realized losses in their hold-to-maturity portfolios to an FDIC/California Department of Financial Regulation takeover on Friday. The 16th largest US bank by assets disappeared in only a few days.

This has resulted in breathless commentary about poor underwriting, terrible risk management, etc. While all of these observations have an element of truth, the facts are a little more complicated. A brief explanation of what transpired as I understand it.

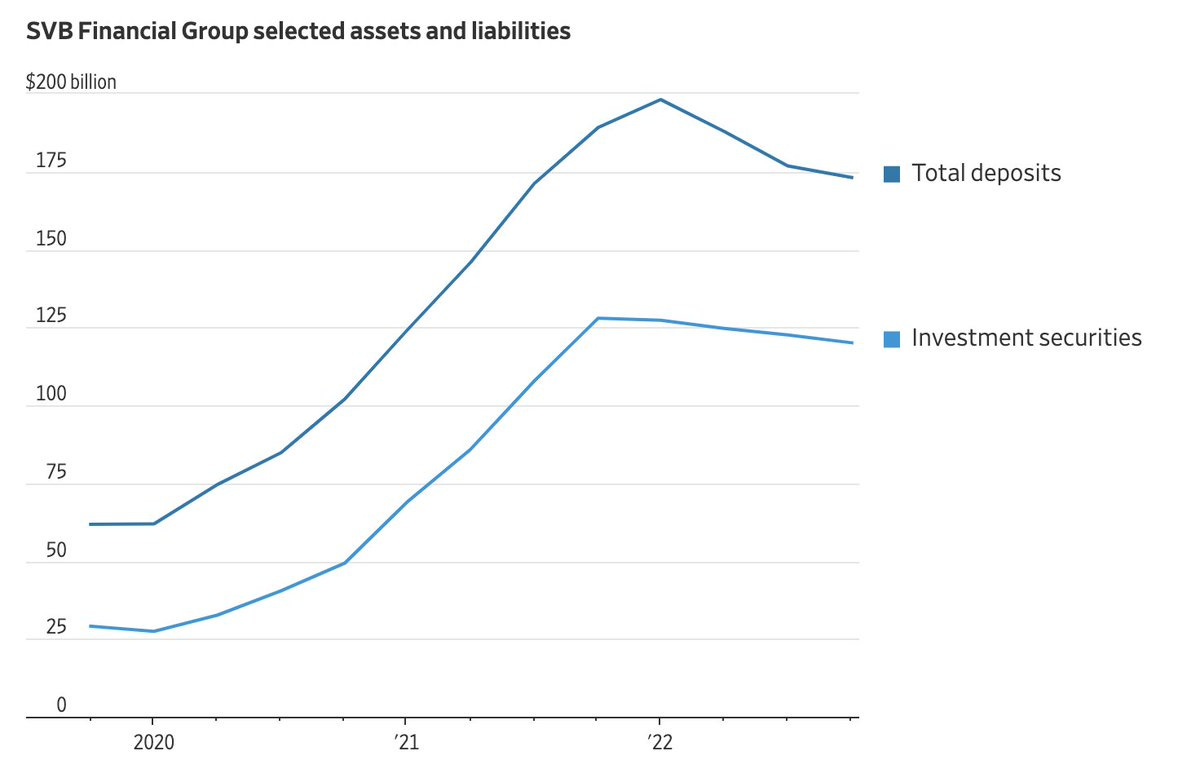

During 2020 and 2021, SIVB was uniquely well-positioned to take in cash deposits as a combination of PPP loans, equity investments in VC, and cash from new issues (including SPACS) flooded their clients’ bank accounts. Faced with explosive growth in deposits, SVB had to find a quick and safe way to deploy these funds in money-making assets. Given front-end yields were only 25bps, the management team naturally sought to make a bit more by tapping into longer-dated bonds which offered yields slightly above 1%.

In spring 2021, the “disruptive growth” bubble had popped, and high-flying meme stocks took over from Cathie Wood’s ARK funds as the market darlings. IPO and secondary issuance began to fall sharply from the post-Pandemic highs, reducing the cash inflows. SVB’s pattern of deposit accumulation closely followed the pattern of IPO activity, which exploded in 2020-2021 after languishing for the past decade. SVB deposits more than tripled.

At this point, nothing unusual has occurred. A bank has borrowed short (deposits) and lent long. This is what banks do. There was no bad underwriting, etc. as they bought high-quality liquid assets.

By Fall 2021, the pace of deposit growth slowed to a crawl, and many of SIVB’s money-losing VC startups began to draw down their cash balances to fund operating losses. This part was likely predictable but it is where the problems begin. Faced with rising interest rates and likely realized losses on the securities purchased in early 2021, management made the critical decision to designate the securities as “held to maturity” where mark-to-market losses would not flow through the income statement. Unfortunately, this meant that they no longer had a CHOICE about hedging. As PwC notes in their online analysis of hedging:

Now we can debate the wisdom about moving that much duration sensitivity into a classification that does not allow hedging of interest rate exposure, but nothing has been done outside of the public eye. If regulators, or analysts, wanted to object, they certainly had the opportunity to speak up at this point. They did not.

SVB noted that the instruments moved into held-to-maturity (HTM) were typical mortgages with contractual lives of 10 to 30 years. And like all mortgages, they expected the actual life to be far lower as mortgages are typically refinanced frequently and/or prepaid as the homeowners move, on average, about every 7 years:

“MBS classified as HTM typically have original contractual maturities from 10 to 30 years whereas expected average lives of these securities tend to be significantly shorter and vary based upon structure and prepayments in lower interest rate environments. The expected yield on MBS is based on prepayment assumptions at the purchase date. Actual yields earned may differ significantly based upon actual prepayments.”

Unfortunately, those expectations ran into the buzzsaw of Jay Powell:

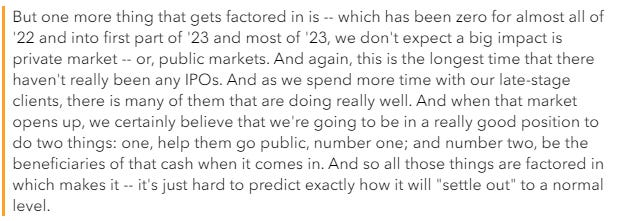

As mortgage rates began to rise in a truly unprecedented manner, SVB became trapped. The unhedged HTM portfolio began to fall in value while the deposit base began to fall in a historically unprecedented manner. Once again, SVB’s reliance on the IPO market for cash proceeds was critical. Note the 2022 annual report investor call… “The longest time that there haven’t really been any IPOs”:

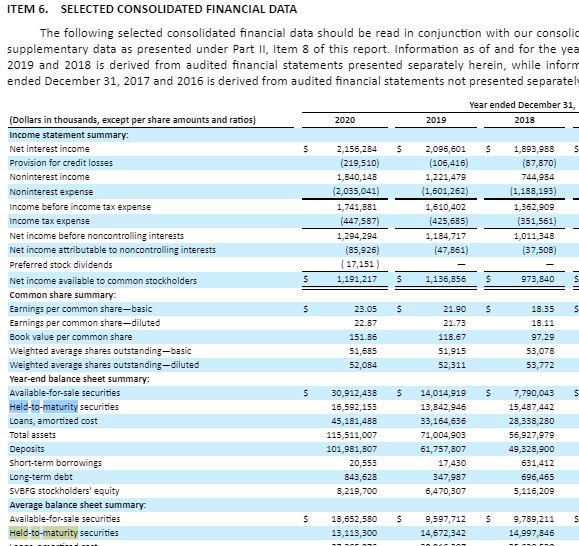

And in my opinion, we see some evidence of deception by SVB management over this period. Note the 10-K of SVB in 2020 contains a helpful table that clearly lays out held-to-maturity securities in the context of the aggregate balance sheet. This “Item 6” is prominent in all prior 10-Ks:

But the 2021 10-K shows a new designation: “Reserved”

And if we go to that section of the 10-K, we notice the helpful summary is no longer available.

To be fair, I can dig into the footnotes and discover that held-to-maturity jumped 491.8% percent over 2021!

In the 2022 10-K, for the second year in a row the data table is missing:

And again, I can dig for the data; the good news is that there was a paydown of the portfolio of nearly 10% over 2022, suggesting a weighted average life of 10yrs is a reasonable expectation.

For the first time in history, an analyst asked a question about the held-to-maturity portfolio on the Q4-2022 call that happened in January 2023.

“That’s it for me”… “Great quarter guys”

In early 2023, the drought of IPOs continued. Cash drain from deposits by negative cash flow clients began to take a backseat to cash drain as deposits sought higher-yielding alternatives like money-market funds. With deposits cratering, SVB is forced to begin selling the HTM portfolio to obtain liquidity. This action will push the unrealized losses from the HTM portfolio onto the income statement and impair SVB’s equity. Hence the need to raise equity capital. They never stood a chance.

The truly unique feature of SVB was its deposit profile, not its investment profile. Because SVB was not a retail bank, but rather a corporate bank focused on serving the startup and VC community, it had the unique deposit profile in that the vast majority of its deposit accounts were corporate in nature and well above the FDIC-insured limits. As news began to percolate that SVB was raising equity capital to offset losses in a HTM portfolio, the small VC and startup community in Silicon Valley scrambled en masse to withdraw. An unbelievable $42B in deposits flowed out of SVB in the last two days. Roughly 25% of total deposits in two days. There is no bank that can survive this.

You will read many stories about the “idiocy” of SVB management team in failing to hedge their interest rate exposure. It’s certainly true that they took a risk by moving too large of an asset pool to HTM and failing to consider the potential for the Federal Reserve to hike interest rates in a truly unprecedented manner. It was OBVIOUS after all:

These are bad takes. First, by this point, SVB management had already moved the assets to HTM and hedging was NO LONGER AN OPTION. Second, the expectation of rate hikes at the time was for something that looked like 2018 which had very little impact on mortgage rates. As the exact same account noted in the “not benefitting from hindsight” March 2022 period, mortgage rates up 120bps reflected “expectations of the full path of hikes already priced into markets.” In other words, mortgage rates above 5% were unthinkable.

Think again.

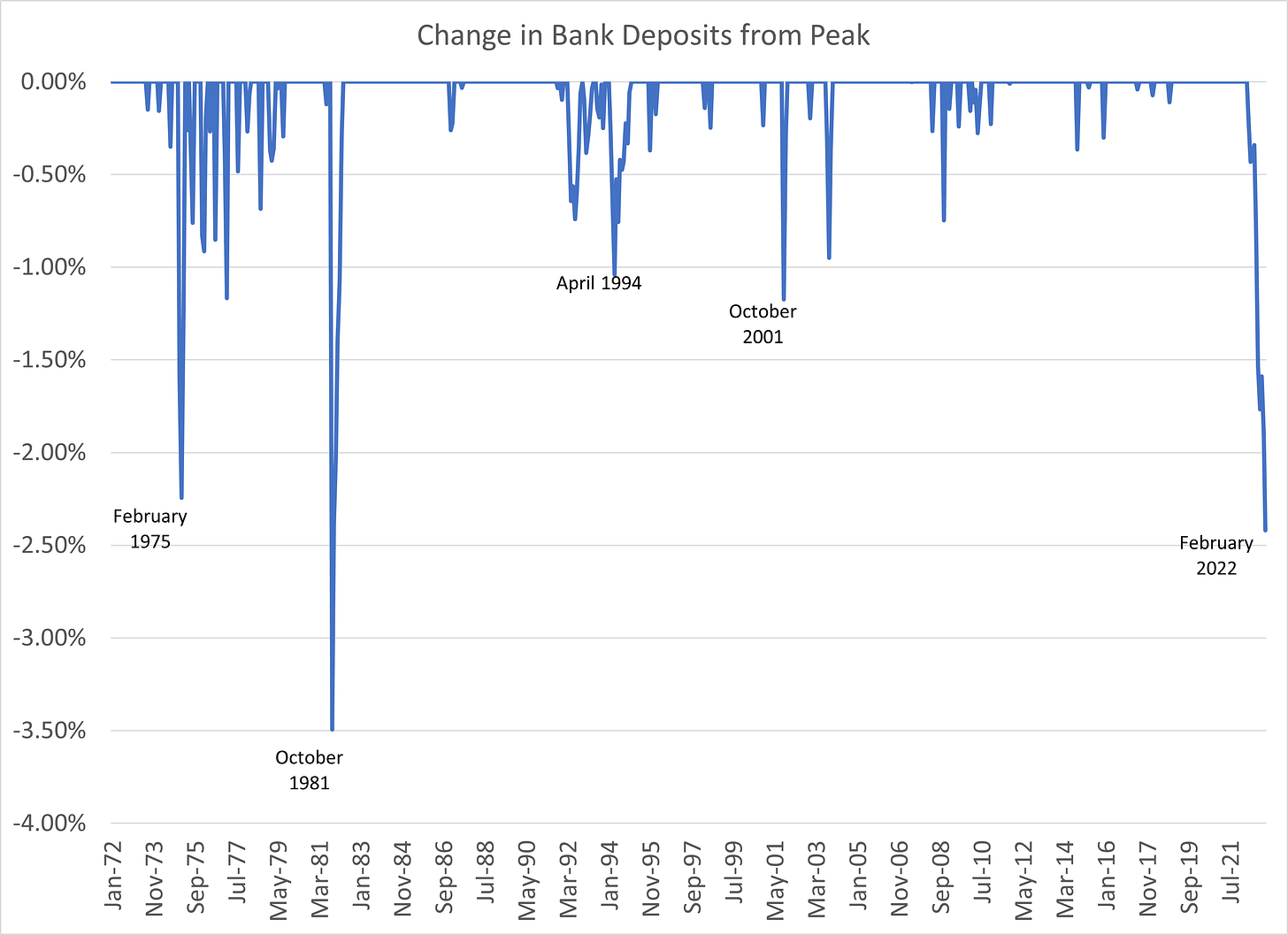

So who really owns the failure of SVB? The Fed. By hiking rates in a totally unprecedented manner less than a year after assuring market participants that they were NOT going to hike rates until 2024, they created conditions that predictably led to the second-largest bank failure in US history. And managed to drive stimulus to the economy even as they claimed to be fighting inflation. Is SVB management blameless? Of course not. But unfortunately, they are far from the only bank management team that is seeing deposits collapse as banks struggle with rising competition from money market funds. In fact, the system-wide collapse in deposits is approaching unprecedented levels:

And they want to keep going. Got popcorn?

Comments appreciated.

Maybe the original sin was a decade of "front-end yields" being 0-25bps. Also, clearly, bank supervision is not a priority at the Fed.

I agree with you that sitting around and calling SVB "idiots" is extremely one-sided. I begin to involuntarily smile every time I think of the Fed's promises and what they have done, and if you take that into account, then SVB is understandable. It was interesting to read your article.