The Undead Among Us

And who, shall I say, is calling?

Summary

The rise of corporations as "immortal persons" began with 19th-century legal innovations, granting them rights and lifespans far beyond human limitations, creating entities with increasingly unchecked power and influence.

Deregulation and policy changes in the 1970s-1980s, including perpetual trust laws and tax reforms, entrenched elite wealth and prioritized corporate interests over societal equity and economic fairness.

These systemic shifts, largely unnoticed by the public due to their technical complexity, have led to a society dominated by "vampires" (corporations and trusts), challenging the principles of fairness and resource distribution.

Top Comment

Sandy joins us as a first-time commenter:

Regardless of what really smart peeps like yourself say… here is how the rest of “Real America thinks/operates…so I follow this guy online (YouTube) very similar in age (early 60s/working class on a night job)/assets acquired and investment horizon same as me. The methodology he uses if one instrument…$TQQQ/$SQQQ. He and his wife have amassed close to $750,000 in IRAs/Taxable accounts…he trades 100% of those funds into one play (TQQQ), he has doubled his money, he is ALL-IN w/Trailing Stops…his hold time can be months. (He also has learned he only makes money in UP or DOWN trending markets….Consolidation/Range-Bound = No Play, sit in bonds/MM until the market regime changes)

He has learned that over time Dollar Cost averaging in index’s does not move the needle fast enough, and considering for most people, it takes decades of saving/scrimping/investing before real compounding of large #s begins…so again, his mindset is I have to move the needle NOW, I am ALL-IN and its worked so far…sooooo No Body Knows Anything! Thats Real America Mike…its not changing… even more so as the environment increases to one of the “Haves -vs The-Have-Nots”.

MWG: Sandy, I fully recognize this. I emphasize, “Invest for what you need, not what your neighbor wants.” We have become a nation of degenerate gamblers for the self-evident reason that we’ve seen such gamblers bailed out repeatedly. And it’s possible (likely) that it happens again. BUT the bailout happens after the losses, not before.

I am not offering investment advice as it relates to these strategies, but understand what you “own” with TQQQ — a daily rebalanced, 3x levered exposure to an index trading at 33x P/E. Can it go higher? Of course. But the reason it has gone higher is not because of bailouts, or low interest rates, or even AI (where the business model appears to be imploding before our eyes)… it’s because we’ve unintentionally created a passive Ponzi scheme.

The Main Event

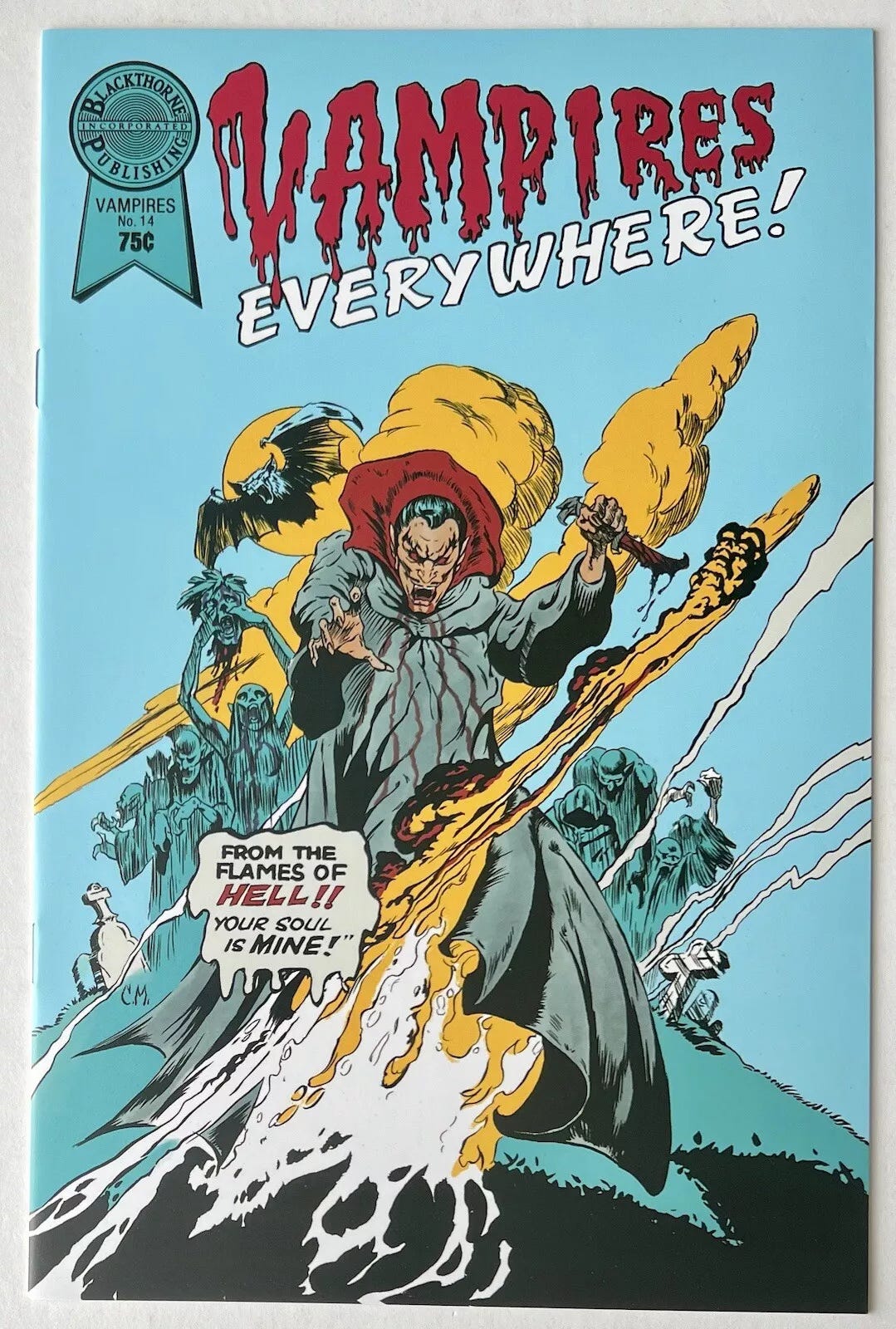

“Don’t ever invite a vampire into your house, you silly boy… it renders you powerless.” — The Lost Boys, 1987

I recently appeared on a Wealthion podcast with Anthony “The Mooch” Scaramucci. Anthony introduced the idea that the US went astray in the early 1990s in reaction to the independent campaign of H. Ross Perot that threatened the Republican and Democrat duopoly. While I accept that some of that is true, the far more important changes occurred over a century ago when we invited vampires into our homes. Vampires? Yes, vampires are everywhere.

We tend to imagine history as largely a technologically primitive version of modern times. The ready access to colorized historical fiction, think Bridgerton, with diversity, cleanliness, and well-lit ballrooms galore, helps to reinforce this. But the reality is more Thomas Hobbes — “nasty, brutish and short.” We are all familiar with the graphic of human life expectancy:

As can be seen, the 19th century began a slow, methodical climb in human life expectancy as modern sanitation took hold and limitations on urbanization were lifted with the advent of plumbing, remote landfill trash disposal, and the transition to fossil fuels (far less polluting than wood fires). The world continues to get better on this front, with America generating LESS landfill today than in the late 1980s when the news was filled with the Mobro 4000 garbage scow from NYC unable to find a landfill. If you want to be encouraged, an excellent documentary is The Fresh Kills Story: From World's Largest Garbage Dump to a World-Class Park, highlighting how the country’s largest dump became a park.