The Rent Is Too Damn -- Part 1

Fun with math is coloring the CPI debate

Note: This week’s message went on too long, so I’m splitting it into two pieces. This allows me to incorporate PCE data next week (Thursday) that will partially validate or disprove the core thesis. Paid (and scholarship) subscribers will receive a mid-week update.

Also, an apology to my institutional subscribers for the delay in getting posts into the database. It is coming ASAP. Also, please remember the Zoom call on Tuesday at 4:15-5:15pm ET. It will be recorded, and a link will be distributed if you cannot attend. Please feel free to reach out directly if you have unanswered questions.

Summary:

Parlor tricks around CPI “easy” comparisons have persisted since the beginning of the pandemic inflationary episode. None have proven remotely accurate.

In contrast, fundamental measures of excess CPI have been predictive, even if the phrase “transitory” is now toxic. The San Francisco Fed estimated that global supply chain disruptions accounted for roughly 60% of the inflation increase. Now that the same metrics predict a significant deceleration of inflation, they are being ignored.

As of July 2023, there is little evidence of above-trend demand, with core sectors like housing and utilities retreating from their 2022 excess highs. Importantly, the full impacts of the negative supply chain shocks are yet to be seen.

The housing market has shown significant weakness, with home sales declining to 2008 levels and oversupply becoming a concern. Forward-looking metrics suggest significant deflationary impacts in late 2023 and potentially beyond

Meanwhile, the Philip’s Curve model of inflation, which suggests that tight labor markets drive inflation, is total garbage.

Top Comment:

This week’s top comment is another long one, but it’s worth reading in its entirety.

Peak Advisors: It is deeply ironic to hear that Charles Goodhart's book is being used as the intellectual underpinning for the secular inflation narrative. Because that same economist lent his name to Goodhart's Law which says "when a measure becomes a target, it ceases to be a good measure"“ Put another way, tightening monetary control loosens the relationship between money and what central bankers care about. Or more broadly, any economic indicator becomes unreliable as soon as it becomes the focus of policymakers.

MWG: I couldn’t have said it better, or more verbosely, myself!

The Main Event

The first example I can find of the latest inflation narrative, “If CPI only rises by 0.2% per month…” is back in 2021. Economist Marc Goldwein observed in June 2021 that the loss of the early pandemic deflationary prints meant that we were almost sure to hit a YoY CPI level nearly double the target of 2%. While Marc expected we would get back to 0.2%/month, he was wrong. The lowest print over the next six months was 0.4%.

With hindsight, it was clear that the supply chain disruptions created by the pandemic would result in price increases as companies and consumers scrambled to allocate scarce resources. The San Francisco Fed has written extensively on the impact of the global supply chain (GSCPI) shock, estimating that it accounted for roughly 60% of the increase in inflation above baseline. As of March 2023, that share had grown as demand-related influences began to wane on the failed China-reopening thesis.

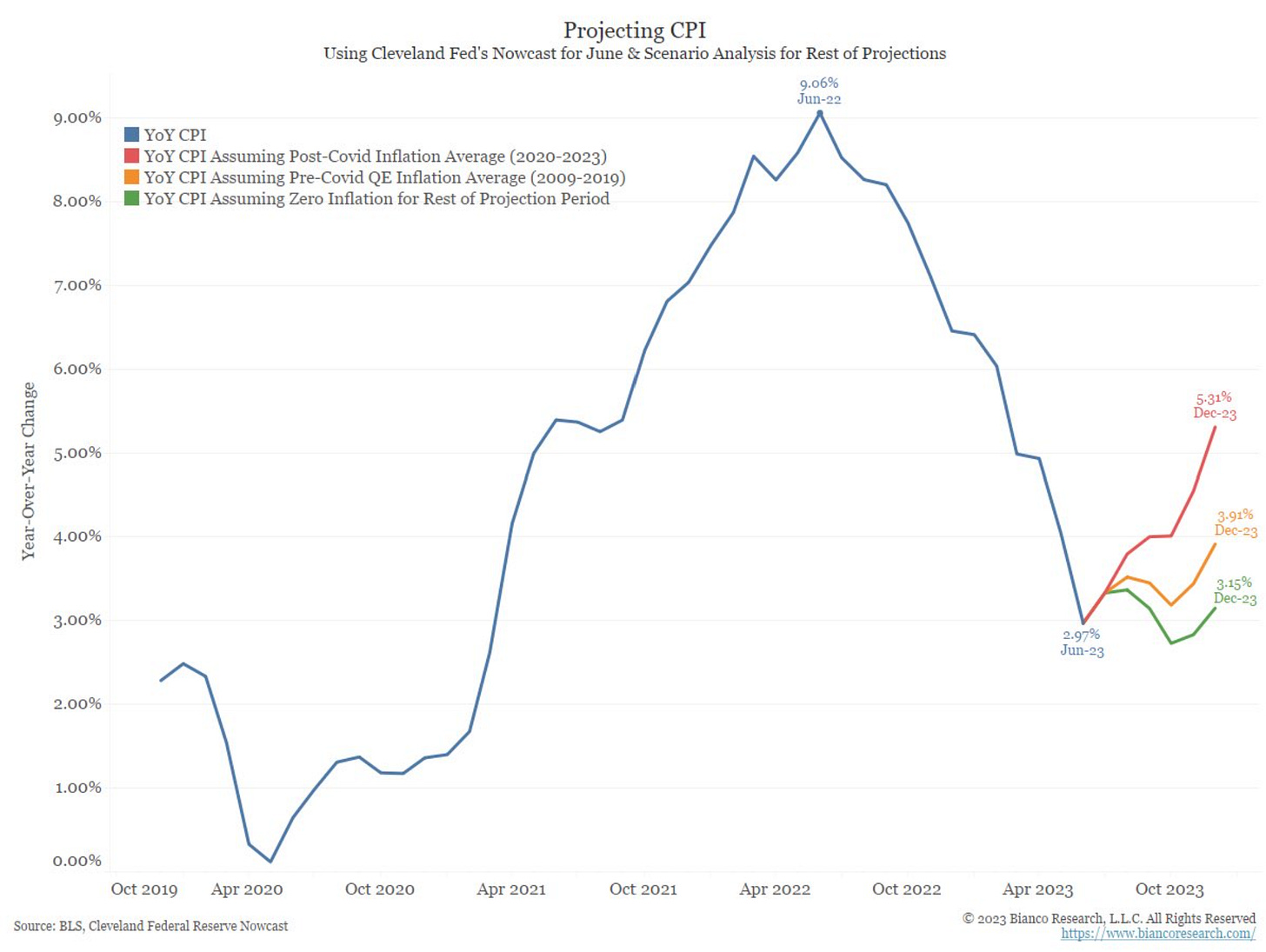

However, despite the supply chain improvement, many in the macro community are playing a variant of “fun with numbers” to suggest that this is the bottom in CPI:

The accompanying chart illustrates the straightforward math.

Fortunately, or unfortunately if you believe as I do that Jerome Powell is relying on this type of backward-looking analysis, there is no reason to believe this is the likely outcome. We already have the CPI numbers for June that reinforce this analysis, but it’s helpful to switch over to PCE, where we can forecast June based on the SF Fed’s analysis.