The Modern Medici?

Everywhere I look, Citadel is playing the anti-Bogle

This weekend, while chugging away on Bloomberg, I ran into data limitation issues with my $35K subscription. Unfortunately, with no senior Bloomberg personnel working the weekend, there is no one to grant me extended data usage — apparently downloading details on 2,000 govt bond issues with five data fields each was enough to send me over my monthly limit of 500,000 data points. First world problems…

But it gave me time to ponder the role of monopoly players in the current system… something deeply on my mind since news of Morgan Stanley’s exit from options market making:

Within the article is an “astonishing” admission:

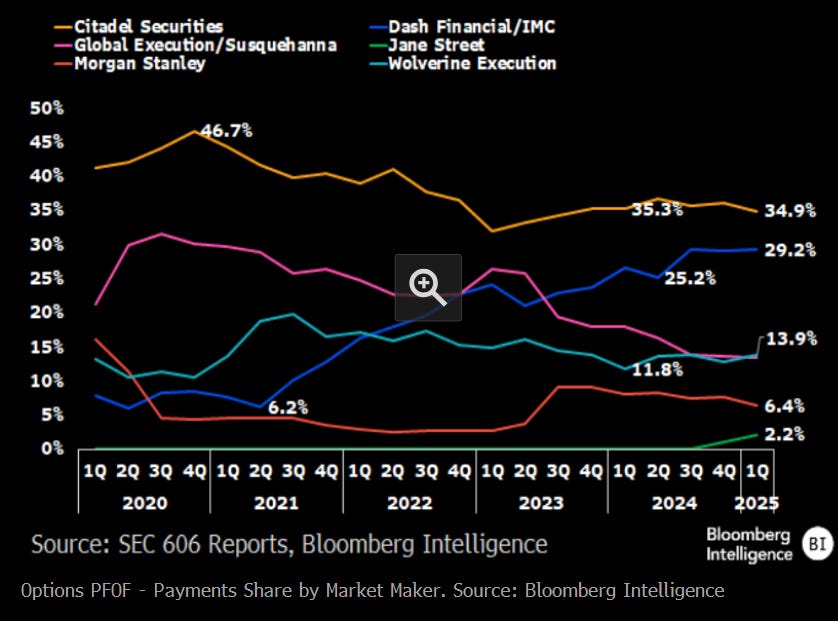

The firm has been the last major bank still in the business of paying retail brokers for options order flow, something that’s now largely the preserve of high-frequency trading institutions. In one indication of its share of that market, Morgan Stanley accounted for 6.4% of such payments among market makers in the first quarter, Bloomberg Intelligence’s analysis of regulatory filings show. The top four firms, led by Citadel Securities, were all principally proprietary firms.

As we’ve discussed repeatedly, the modern market-making industry has become the dominant source of trading, and payment for order flow (PFOF) is the window of insight into the speculative trading platforms. In other words, a seat at the options market making table is increasingly expensive and also increasingly the cost of entry — much like a seat at the NYSE in the pre-2000s era:

With Morgan Stanley exiting, the big banks are nowhere to be found in these markets; it’s almost like the Volcker Rule changed the game: