The Greatest Story Ever Sold

Sometimes they do ring a bell

First things first. Thank you for all the feedback on going paid. Many very thoughtful responses. I’m still thinking, but leaning toward $10/month or $99/year with a 50% discount for Simplify investors (anonymized screenshots of a brokerage account accepted). There will also be a higher tier for institutional subscribers with additional multimedia/access content. I’m also totally serious about YIGAF “scholarships.” If you can’t pay, I understand, and don’t judge. Keep the feedback coming. yesigiveafig@regmanagement.net

This week’s note is a bit briefer due to Mother’s Day. Mostly pre-written as I’ve got an empty-nest wife whose thoughtless children have succeeded at leaving the nest and abandoning their amazing mother, and my own mother without whom none of “this” would be possible. Mom and Alexander Fleming — roughly on par in the history books to me. Fortunately, the past week has been relatively uneventful in markets which has left me free to ponder one of the most insane articles I’ve ever read:

I wrote a tweet thread this week that references it, but I’d like to expand on this topic this week. Please read the article (it shouldn’t be paywalled, but I apologize if it is) in its entirety. I will liberally extract it in this week’s note if you have no patience for unintentional irony. Here at YIGAF, we strive for righteous anger. And this fawning piece of drivel certainly stokes those fires:

The soft-spoken 47-year-old’s funds lured $31 billion last year, even as active managers posted unprecedented outflows amid the worst year for bonds since at least 1977. In fact, he now controls nearly as much US debt — including Treasuries, agency and corporate bonds — as China, America’s second-largest foreign creditor.

For those who have not suffered through my numerous diatribes, I will lay out the very simple hypothesis on why passive is not passive and is instead the greatest con ever pulled on investors. Jack Bogle got one thing right — at scale, active managers overcharged investors. Unfortunately, those surplus margins are a somewhat required subsidy to attract new entrants (who operate at a loss) and are offset by diseconomies of scale that accrue to all investors. With passive, the diseconomies manifest as a Ponzi-esque transfer of wealth from future generations of investors to current generations rather than deteriorating performance. I’ll discuss these dynamics in a future note, but for now let’s focus on the article at hand.

Let’s start with the definition of “passive” from Bill Sharpe’s 1991 paper, The Arithmetic of Active Management:

A passive investor always holds every security from the market, with each represented in the same manner as in the market.

Now let’s add the rationale for passive as articulated by William Sharpe in his seminal paper:

If "active" and "passive" management styles are defined in sensible ways, it must be the case that

(1) before costs, the return on the average actively managed dollar will equal the return on the average passively managed dollar and

(2) after costs, the return on the average actively managed dollar will be less than the return on the average passively managed dollar

Now this is only true if we define the universe of possible securities as identical between Active and Passive managers. While some arguments can be made for this case in equities (not really, but let’s roll with it), the Bloomberg article makes clear this is NOT the case for bonds:

Indexes are made of tens of thousands of over-the-counter bonds, many of which are so illiquid they won’t change hands for weeks at a time. It’s hard to buy the entire market the way equity investors can buy every stock, making it more difficult for an index fund to track the performance of its benchmark closely.

100% agree. The US stock market has roughly 4,000 common stock securities listed on exchanges with greater than $25MM in market cap:

Vanguard’s Total Stock Market Index holds roughly 3,950 securities — almost exactly in line:

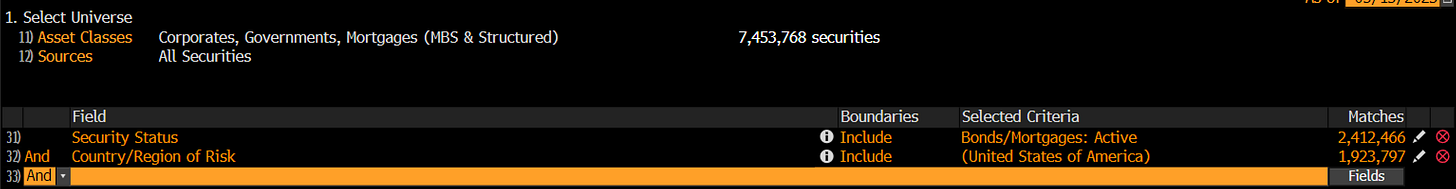

In contrast, the bond market has a nearly infinite number of United States securities. Well, maybe not infinite, but how does 1.9MM different securities sound?

The Vanguard Total Bond Market Index Fund holds less than 18,000 different CUSIPs (~tickers), approximately 1% of the possible universe. Feeling passive yet?

Let’s keep going with Sharpe:

Over any specified time period, the market return will be a weighted average of the returns on the securities within the market, using beginning market values as weights. Each passive manager will obtain precisely the market return, before costs. From this, it follows (as the night from the day) that the return on the average actively managed dollar must equal the market return.

OK, so clearly, this cannot be the case for strategies that hold only 1% of the securities in a market. And, our breathless reporter reveals this:

“Tracking is job one, two and three,” he [Josh Barrickman, Vanguard PM] said, adding “if we can have a basis point a year, that’s a lot of real money.”

The job of the trillion-dollar man is to manage tracking error. Not credit risk. Not bond return. Not duration risk. Tracking is “job one, two and three.” Fortunately, his light touch leaves the active market participants to set prices:

“We have to be, by definition, overweight some places and underweight others to build a sample,” Barrickman said. “We’re dealing in a market that forces us to take some active positions.”

Gang Hu, managing partner at Winshore Capital Partners, which specializes in inflation-protected investments, said passive funds, particularly those run by Vanguard and BlackRock, have become so big and influential that he keeps a spreadsheet tracking their daily flows. Their impact is particularly significant toward the end of the month, when funds move large swaths of securities around to accommodate investment flows, new issuance and maturing bonds as their benchmarks rebalance.

“Everyone watches their flows,” Hu said. “They could easily move the market. You have to anticipate their moves.”

I think I’ve seen this story before… ah yes:

Out west, near Hawtch-Hawtch, there’s a Hawtch-Hawtcher Bond-Watcher. His job is to watch… is to keep both his eyes on the lazy town bond. A bond that is watched will yield higher you see.

Well he watched and he watched. But in spite of his watch, that bond didn’t yield any higher. Not mawtch.

So then somebody said, “Our bond-watching man, just isn’t watching as hard as he can. He ought to be watched by another Hawtch-Hawtcher. The thing that we need is a bond-watcher-watcher!”

But back to our original story…

“There used to be a time in the bond market when a lot of funds would move on the last day of the month,” he said. “But because they are so large now, they have to move days before month-end,” which means their position adjustments affect yields for a longer period.

Oh… perfect… so there’s not even a debate that “passive” bond funds are influencing the market. At least they offer superior performance…

Ironically, the increasing penetration of passive investing in the bond market has come as active managers have had some of their best years in recent memory relative to their benchmarks.

Over the past five years, 65% of actively managed bond funds tracking the Bloomberg USAgg Index have outperformed the gauge, according to data compiled by Bloomberg. The analysis includes 72 funds with assets of at least $1 billion.

Wut? Active managers are outperforming? And they are posting outflows? Well… how bad can it be?

Hey! That’s not FAIR! No, dear reader, it is not. Because this was never about what you were told. It’s “The Greatest Story Ever Sold.” The Vanguard and Blackrock story is about marketing. Listen as I shake poor Bob Pisani’s world by explaining that he was being “sold” by Saint Jack:

Bob Pisani: I'm an index guy by and large… uh ever since Bogle Jack Bogle was the biggest influence of my life. Meeting him in 1997 changed my life, and he helped open my eyes. He was quite insistent that CNBC was spending too much time with stupid superstar investors like Bill Miller from Legg Mason.

He was very professorial. He kept… he talked like Jack Bogle, you know. I didn't realize it then but he talked like Jack Bogle and he said, “You've got to emphasize, Bob that these people come and go there's nothing wrong with them but they just come and go” … and he was just very pleasant, but professorial with me like, “You don't get it, Bob, you know this is the mantra of Vanguard”; and eventually I came to believe that”

Mike Green: You just said something that I thought was actually really fascinating. You said he talks like Jack Bogle. All right, Jack Bogle was marketing. He may have actually had good intentions, and he may have very well believed what he was saying but he absolutely was marketing. And so the question I guess I would ask you is,”Why are the rules different for Vanguard in that perception versus anybody else?”

Bob Pisani: You say he's marketing, yes. Jack Bogle ran a mutual fund company, yes; but he was marketing an ideology and that's what was different

Mike Green: It's interesting, though, because when you ultimately talk about it, what he's describing there is outperformance by that particular ideology. I would argue that Cathie Wood has the same ideology right? She just has a different approach to it.

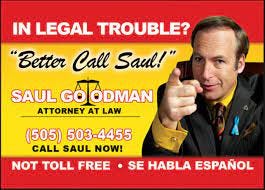

Meet Jordan Belfort:

In the ultimate Kaiser Soze move, Vanguard has managed to convince everyone it doesn’t “sell”… it doesn’t “trade”… “it doesn’t influence markets”… it doesn’t exist. It’s “passive.” It is not. Once more into Bill Sharpe:

A passive investor always holds every security from the market, with each represented in the same manner as in the market. Thus if security X represents 3 per cent of the value of the securities in the market, a passive investor's portfolio will have 3 per cent of its value invested in X. Equivalently, a passive manager will hold the same percentage of the total outstanding amount of each security in the market.

An active investor is one who is not passive. His or her portfolio will differ from that of the passive managers at some or all times. Because active managers usually act on perceptions of mispricing, and because such misperceptions change relatively frequently, such managers tend to trade fairly frequently -- hence the term "active."

And as we’ve discussed previously, passive managers trade EVERY DAY. OK, so clearly, there are no passive investors in bonds (or in equities). It’s all active funds, some just operate off of simpler rules than others. And by extension, Target Date Funds (TDFs), the “qualified default investment alternative” (QDIA) mainstay of the American 401K, which include these bond funds alongside “passive” equity funds MUST be active. It’s simple logic: if A is active and B is passive (which it’s not, but let’s roll with it), A+B MUST be active.

Now one of the “fun” cottage industries is law firms filing lawsuits against corporate 401K sponsors for offering actively managed products. A simple Google search for “active management lawsuit 401K” will find countless examples. A good example is the 2020 lawsuit against Costco:

Why the lawsuits? Follow the money. This case was settled by Costco for $5.1MM, with lawyers receiving $1.5MM. The class action representative (the named plaintiff) received $10,000.

Fortunately, the tide is starting to turn. In recent decisions, courts are slowly starting to recognize that active management deserves consideration. In Smith vs CommonSpirit Health, decided in June 2022, the judges found that:

It is possible indeed that denying employees the option of actively managed funds, especially for those eager to undertake more or less risk, would itself be imprudent.

So if it would be “imprudent” to deny employees actively managed choices AND passive bond funds are underperforming active funds, how are investors streaming into passive bond funds?

Because they’ve bought the Saint Jack story, hook, line & sinker. Lord, give me strength.

Next week I hope to touch on how this flow into passive bond funds is meaningfully distorting the message we are receiving from credit spreads. Pray for low vol.

As always, comments much appreciated.

There is another part to the passive story that I witnessed when I used to sit on my former employer's Deferred Comp committee for many years, before retiring. We always hired experts to give us advice and our plan's offerings changed over time from all actively managed funds when I started working there in the early 80s to slowly incorporating more passive funds in this century after the dot com bust, as passive started to gain traction. Then there was a big change a year or two after the GFC. I remember it had to do with some sort of change in ERISA that resulted in our expert advising to start offering target date funds, more low cost passive and also reduce the overall number of choices we had previously offered, which ended up as reducing actively managed funds with higher costs (but we kept a few, particularly in the bond funds, to keep old timers like me happy). If I recall correctly, this had something to due with changes in how the plan sponsor's fiduciary duties were defined by the Labor Department in new regulations. One thing that struck me was when our expert was asked why we should do these things, his reply was that it was what the majority of other plans were doing and we were less likely to get sued for breach of fiduciary responsibility, if we followed what the majority of other firms were adopting as "best practices". In other words, just follow the crowd and you are less likely to get sued.

You would laugh if you saw the investment vehicles offered in my employer 401k lol. I’ve been thinking about it for months and it’s pretty frustrating.