The Death of Bonds?

Payoffs patterns, not returns, is what matters

Summary:

Beware long-term forecasts of asset class returns, but don’t IGNORE them

GMO's 7-year asset class forecasts in June 2013 predicted dire returns for US equities and negative real returns for bonds, leading to headlines about the "Death of Bonds As An Asset Class.” The errors in these types of forecasts have largely led investors to abandon them in favor of “endogenous” return forecasts. This is absurd.

Misjudgment of Commodity and Market Trends:

Many forecast inaccuracies arise from the assumption that current technology will remain dominant, neglecting the impact of technological advancements on efficiency and commodity consumption.

Most determinants of real commodity prices are driven by global demand shocks rather than commodity supply shocks. The current cycle of rising oil prices is being driven by artificial restriction of supply by Saudi Arabia — this is likely to speed up the process of fossil fuel replacement

Bonds and Equities Dynamics:

Bonds and equities are fundamentally different in their payoff structures, with equities representing an expanding cone of possibilities and bonds a concave termination.

There's a growing narrative that demand for bonds is decreasing, yet the rising demand for strategies converting equity uncertainty to bond-like certainty suggests otherwise.

Despite prevailing sentiment, bond allocations are likely to see a resurgence in the future, especially as inflationary pressures continue to decline. Equities are the obvious source of this increased demand and will likely come under pressure.

Advance Warning: Next week I’m taking a break from YIGAF. My travel schedule is starting to go bananas, and I need a weekend to recharge and NOT think. I appreciate your understanding. Regular editions will return the subsequent week.

Top Comment:

Sergey writes: The most likely scenario I have for how the repricing happens is that at some point the Treasury market will break in some way, and the Fed will have to step in and buy lots of Treasuries.

But it's also possible that something else will break, the Fed will buy something else, and crowd out a different trade, making Treasuries more attractive by comparison.

Either way, the repricing happening without some form of Fed intervention seems unlikely to me.

MWG: I think this is a valid observation. My hunch is that the Fed breaks something, starts cutting rates and suddenly the world reawakens to the reinvestment risk of cash. As the yield curve re-steepens, it becomes easier to finance long-dated bonds, further raising demand.

The Main Event

Let’s take a time machine back to June 2013. The venerable (no sarcasm) GMO’s asset class forecasts drew notable concern:

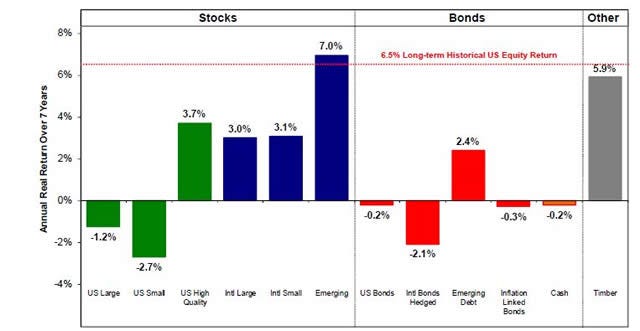

GMO Asset 7-year Class Forecasts (June 2013)

While the forecasts for US equities were dire, the forecast for negative real returns for bonds was the real kicker. Predictably, the headlines blared “Death of Bonds As An Asset Class”, reminiscent of the infamous “Death of Equities” headline in Businessweek August 1979.

The relentless rise of China from MFN inclusion in 2000 until the ascendancy of Xi in 2013 had broadly felt like a blur of accelerating commodity demand. With the S&P 500 price level having just (barely) exceeded its September 2000 peak in June 2013, commodities had returned 8% a year over a time period where the S&P 500 delivered nada.

A few years before, in 2011, Jeremy Grantham himself had opined that “This time IS different,” arguing that his new passion project for greening the earth was a byproduct of a new incipient age of scarcity and that we had all better “woke up”:

The appeal to authority was clear:

My firm warned of vastly inflated Japanese equities in 1989 — the grandmother of all bubbles — US growth stocks in 2000 and everything risky in late 2007. The usual mix of investor wishful thinking and dangerous and cynical encouragement from industrial vested interests made these bubbles possible. Prices of global raw materials are now rising fast. This does not constitute a bubble, however, but is a genuine paradigm shift, perhaps the most important economic change since the Industrial Revolution. Simply, we are running out. — Jeremy Grantham, 2012

By 2013, some concern had begun to grow about the lack of forward progress in commodities, but it was still broadly accepted that “number go up” was the most likely path. After all, it was clear that the Central Bank money printing would eventually end in tears...

Bonds had delivered 5.7% a year over the same time period, but with yields now below 3% and inflation poised to move ever higher with commodity prices it was clear that this asset class was going to emerge a loser.

And as bizarre as it may now feel, equity investors were struggling with low valuations and little apparent interest in the companies they had identified as likely winners. David Einhorn was bemoaning the lack of interest in Apple, then trading at 6.5x ex-cash 2013 net income of $40B.

Apple (AAPL) completed its assessment of its capital management policy and decided to return $100 billion to shareholders over three years in dividends and share repurchases. At quarter end, AAPL’s market capitalization was $372 billion, implying a 9% annual return of capital to shareholders. Sentiment towards the stock is incredibly bearish. Early in the quarter, the concern was that AAPL was losing market share to Samsung. When Samsung’s latest Galaxy phone failed to impress, rather than re-assess AAPL’s better competitive position, the consensus story shifted to concerns about market saturation of high end phones. Sometimes, you just can’t win. AAPL was our largest loser in the quarter falling from $442.66 to $396.53 per share. Unless operating results are about to head off a cliff, we expect the shares to stage a recovery. Greenlight Capital Q2 2013 shareholder letter