So I Can Clearly Not Choose the Wine in Front of Me

A Not-So-Subtle Whiff of "Giddyness" Suggests it May be Corked

Summary

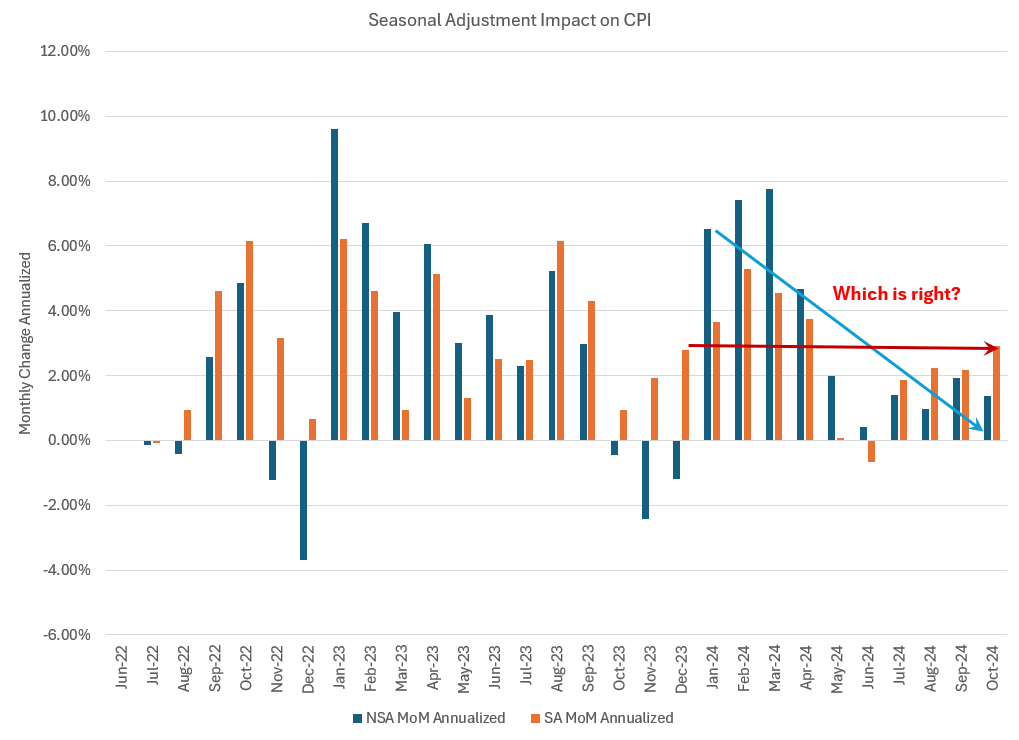

Flawed Inflation Metrics and Fed Risks: As expected, seasonal adjustments in CPI are distorting inflation measurements, potentially misleading the Federal Reserve into policy missteps, similar to errors seen in the 2008 financial crisis.

Housing and Rent's Role in Inflation: Declining rental inflation, driven by increased housing supply and reduced mobility, is expected to significantly lower CPI inflation by 2025, offsetting any potential inflationary pressures from tariffs or goods prices.

Skepticism of Economic Optimism: While some predict explosive economic growth on the back of “animal spirits”, structural weaknesses, particularly in housing and consumption, suggests a more tempered outlook — there is no “easy” fix to what ails us

Top Comment

Nick Ballesteros lobs in from left court:

Mike, I'm a leftist - and I can tell you that people in my circles are utterly demoralized, shocked and broken. I don't think they have the will right now to muster some kind #resist mobilization. Maybe it could come later. That said, I would very much prefer unity and hope the Trump administration will deliver on some of the promises of economic justice. If you have any influence over that process at all, I hope you will use it.

While I fear that Trump is somewhat intoxicated with power, I am not so hyperbolic or hyper-identitarian to think we are now doomed because Trump is some mixture of George Wallace and Mussolini.

Moreover, I am truly upset at the Democratic establishment for essentially abandoning working-class politics. While, I've tended to view both Republican and Democrat as far too collaborative with the economic elites and corporate predators - and as having colluded in eroding checks and balances and lodging too much power in the hands of unelected bodies and private interest groups - many Democrats are strangely convinced we need even more of this. Harris' economic plans were appalling. $25,000 dollar down payment assistance (I don't own a home and myself would've benefited from this) is just another huge government cash transfer to the rich. And the price caps are just another short-term band-aid solution with potential negative consequences further down the line. I don't agree with everything Stephanie Kelton promulgates, but when she criticized the Democrats for their obsession with "targeted, temporary, and timely" programs that require the already insecure to run the bureaucratic gauntlet to receive a modicum of support,” I wholeheartedly agree this gets at the truth and reveals the extent to which the Democrats have become increasingly paternalistic (and off-putting).

Final remark. Many, if not all, of my liberal ilk are losing their minds over Trump's trade policies. It's so ironic to me that progressives, who decades prior were the bulwark of anti-deindustrialization, a la WTO protests, etc., are now vehemently defending strict free-market rhetoric. It would help, at the very least, if you could do another, perhaps deeper explainer on tariffs and why we have the framing of the problem all wrong.

MWG: Unfortunately, I have very little to add, so I’ll try to add more to tariffs. Thanks for the comment. Shame Agassi flamed out.

The Main Event

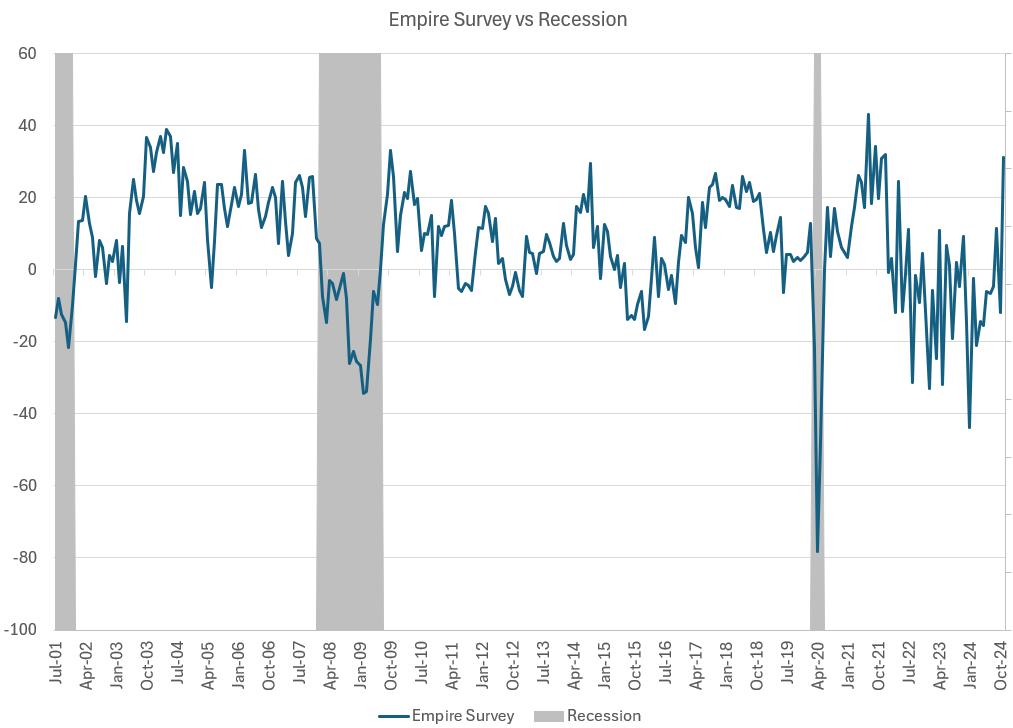

You might think I’d be happy. Donald Trump has won the US election and animal spirits are again our friend. The Empire Fed jumped by the second-highest amount on record:

And Bill Ackman sees that happy days are here again:

“Growth is about to explode.” A very concrete projection. It’s also one that I do not believe. Let’s dig into the why…

Back on the East Coast, with a degree of sedentism, seasonality takes on a bit more meaning. I came back from a NYC trip to discover a nearly six-inch deep carpet of leaves had fallen overnight from our white oak. Soon after, the CPI report made it even more tangible.

Regular readers may recall I worried that seasonal distortions in CPI would lead to a rethinking of the Fed’s rate path — a concern that is now becoming a reality:

However, I also think Powell’s pusillanimity (to steal from Michael Kao, who disagrees with me and whose Twitter account and Substack are must-follow/reads) will rear its head this fall as seasonal inflation adjustments are likely to result in a “resurgence” of inflation just as Powell makes his first cuts. Similar issues in 2008 led to Bernanke (and Trichet) failing to realize the severity of the deflationary pressure. To help gauge the possible impact, recognize that these seasonal distortions could raise reported inflation in December by several percentage points on an annualized basis. BLS smoothing techniques are the “gift” that will keep on giving, which should be a warning for future “data dependent” central planners.

As expected, we are now seeing the flipside of the favorable summer seasonality. Remember that high non-seasonally adjusted (NSA) prints, e.g., summer gasoline prices, are reversed via seasonal adjustments in the monthly reports. The asynchronous behavior around the pandemic led to these distortions being “reversed” versus normal patterns. As a result, the early summer prints in CPI for the past two years were far too favorable. Those we are receiving now are incorrect in the opposite direction—and about to get worse.

Through this magic, we can simultaneously experience inflation and deflation in the same month, as we did this past June when NSA CPI rose from 314.069 to 314.175 (first line below) while CPI printed negative -0.1%. To be perfectly clear, there is nothing wrong with seasonal adjustments. The issue is when those seasonal adjustments become corrupted by past aberrant data.

And those adjustments are now contributing to the perception that forward progress on the inflation front has paused and that nominal growth is again accelerating. It is a (somewhat) genuine question as to which is the correct line for inflation prints from here:

Fortunately, we have a bit of a crystal ball. The single most significant component of CPI, “Owner’s Equivalent Rent,” has received far too many mentions in my analysis. Candidly, I’m sick of it. But it does sit at the center of the inflation debate. The lagging nature of this metric got misinformation on the way up (no, OER does not “rely on surveys to estimate inflation”), but at least everyone acknowledged it was NOT accurately measuring inflation: