Pusillanimous Powell

A dilemma awaits

What I’m Reading Now

Alice Evans on Substack provides an excellent summary of a recent paper by John Minnich. I’d start with the Substack and if you’re suitably curious, make your way over to the paper.

Both are excellent descriptors of how (and where) China has been able to exploit Western capital to advance its objectives in a predatory manner. To be clear, I have no issues with the Chinese people raising their living standards and in fact strongly applaud it. I also understand that Western bodies, like the IMF, are often predatory and extractive in their treatment of countries that “play by the rules” and pay full freight for Western technology, which typically requires the assumption of an external currency debt.

But I live in the United States and my loyalties are aligned first with my family, then with my nation (deeply flawed though it may be). And the Substack and paper are excellent illustrations of Lenin’s flawless observation: “The Capitalists will sell us the rope with which we will hang them.”

Top Comment

Marcus Young felt my pain:

Probably, reluctantly agree with you. It's hard when all choices are poor and the goal is to find the best bad choice. Trump is unpredictable as a narcissist, he scares me. But the marxist-ish policies of Kamala's team I think scare me more at the moment. Two things I think you didn't mention that bother me: I understand powerful people have alway controlled media but we are in an area where most corporate media controls lean left. We aren't teaching people how to think through dialectic dialogue but rather what to think thru propaganda. Secondly, the democrats have drifted into feeding the international war machine as it is tied to big corporate money and outdated post war policies. Even though Trump is admittedly a loose cannon, he is a mercantilist and appears less prone to war. Either path we take is a dicey one. Appreciate your take and risk in putting it out into cyber space.

MWG: Thanks, Marcus. I’ll return to many of these points in future posts, but I agree. Given two unattractive options, I have chosen what I believe to be the lesser of two evils.

Wrapping Up “I Choose to Believe”

Wow, did I kick the hornet’s nest… I made a concerted effort to answer (mostly respectful) comments with (mostly respectful) replies. For those who cynically thought I was either (a) phishing for engagement or (b) rationalizing my already transparent decision, I can offer no other rejoinder than, “You’re wrong.” I presented my thinking as transparently as possible.

Many criticized the “science” behind my decision. Unfortunately, the scientific method requires the ability to hypothesize, test, and replicate. I tried to communicate this was a choice of belief and may have failed. An election can be alt-historied ad infinitum, but we cannot replicate the initial conditions, test, and repeat it. What flows from this election is inherently uncertain; anyone telling you otherwise is advocating “Science!” not science.

Some seemed to literally interpret the inspiration from RFK, Jr.’s speech. I might have been unclear, but it was literally the phrase, “I choose to believe” that inspired me. We have to “choose to believe” in SOMETHING when confronting genuine uncertainty. I am choosing to believe that disrupting the status quo offers greater opportunity than preserving the veneer of respectability that fronts an increasingly bureaucratic and intrusive state.

I think the majority of RFK’s views are of dubious merit as he has presented them. That is irrelevant, as most of mine probably are as well. What he forced me to consider was under which candidate I think we would make more progress on the matters I consider of critical importance — antitrust, China, energy, and reigning in the bureaucratic state. Many raise the excellent point that Lina Khan was appointed by Biden and her work may continue under Harris. This may be true. But I believe that train has left the station, and it was, in fact, the Trump administration that started the ball rolling (admittedly in an erratic, Trumpian fashion) after a laissez-faire Obama administration.

I disagree with many of the proposed Trump policies and loathe the man. I expect continued divided government with excessive executive orders under either administration. This week’s top comment summed up my views pretty well.

I am again going to leave this post open so that recent readers can more accurately understand what this Substack is actually about. Thank you for your patience!

The Main Event

"I love deadlines. I love the whooshing noise they make as they go by." — Douglas Adams

Many casual readers often confuse my views on Powell’s forthcoming rate cuts. I do not want him to cut interest rates to support asset prices. I frankly don’t think rate cuts (or hikes) have the influence that Powell (and many others) believe. I generally subscribe to the view that our systemic allocation of portfolios increasingly drives market pricing. With US bonds near the lowest allocations versus equities in decades, my bias is “bonds higher, equities lower”:

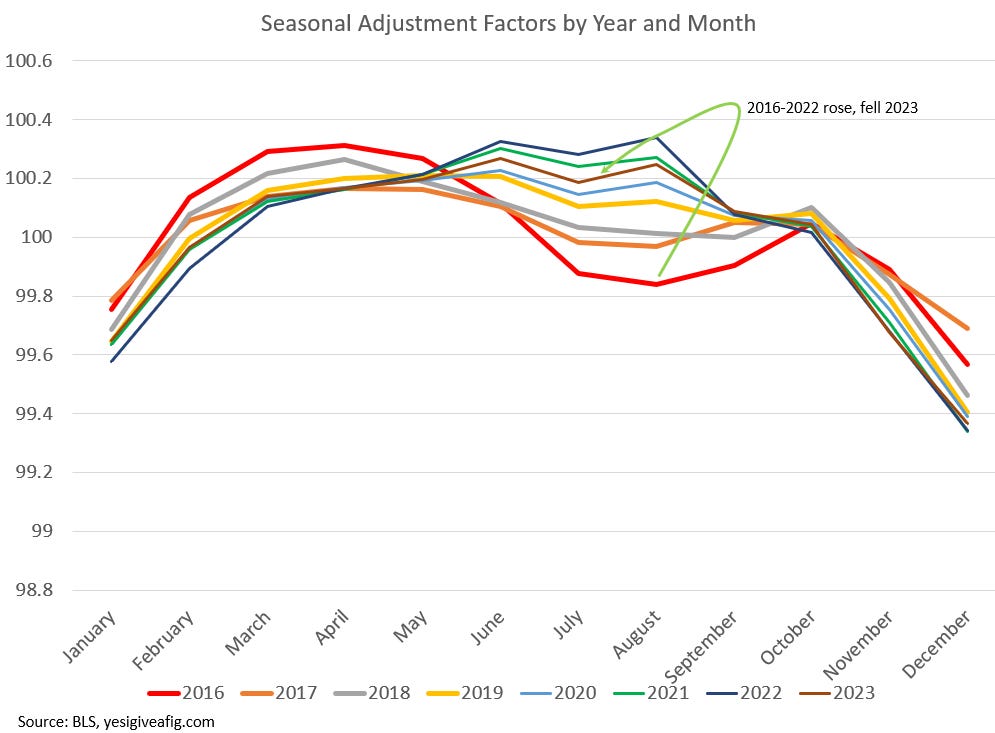

However, I also think Powell’s pusillanimity (to steal from Michael Kao, who disagrees with me and whose Twitter account and Substack are must-follow/reads) will rear its head this fall as seasonal inflation adjustments are likely to result in a “resurgence” of inflation just as Powell makes his first cuts. Similar issues in 2008 led to Bernanke (and Trichet) failing to realize the severity of the deflationary pressure. To help gauge the possible impact, recognize that these seasonal distortions could raise reported inflation in December by several percentage points on an annualized basis. BLS smoothing techniques are the “gift” that will keep on giving, which should be a warning for future “data dependent” central planners.

My analysis suggests Powell has created a trap for himself—cutting interest rates modestly from these levels will not help the indebted and will harm the wealthy. A seasonal resurgence of inflation (which has HELPED the transitory case over the summer, but will reverse into Q4) will lead him to be less aggressive in cutting rates, further increasing the risks of the “phase change” of credit defaults. Once the indebted default, they become economic pariahs for the proverbial “seven lean years.” And those most at risk are again the young:

Powell’s failure was in raising rates too far, too fast. His misguided assault on transitory inflation has bifurcated our economy into a condition that will be difficult to recover from. Like a parent punishing an intransigent child, he has reached the point at which credibility is lost:

Powell: Go to your room

Inflation: No

Powell: Go to your room, now!

Inflation: No

Powell: If you don’t go to your room right now, so help me god I’m going to kill the labor market to make you go to your room.

Inflation: Have at it

Powell: Ummm….

Powell (and frankly almost all of us) misjudged the impact of his rate hikes given the terming out of financial liabilities in the economy. Bonds issued in 2020 have cratered in value, but that has no impact on the issuers (including US households) who are benefitting from low coupons (mortgage payments). Meanwhile, nearly all new issues of debt with high coupons are either (a) taken on by the young who need capital assets to participate in the economy or (b) short-term government paper supporting incomes and spending for the old and resource-endowed. Cutting rates will not help the former, but it will impair the latter. Traditional models of credit risk/financial conditions generally do not consider the LEVEL or CHANGE in risk-free rates. And for all the charts showing loan officers no longer tightening, I have to present the converse — while they have modestly eased for the largest firms with no need for capital, that easing is not happening for small businesses. The same conditions that preceded the GFC, just longer:

As realized defaults continue to rise, credit is likely to become impaired, and inflation, seasonally adjusted or not, will take a back seat. And THEN he’ll cut in earnest, impairing the incomes of the wealthy. The “wealth effect” is roughly accepted at ~2.8 cents per dollar increase in wealth. This would explain an additional $250B in aggregate personal consumption since 2022. The total increase has been $1.6T.

While it will be reserved for future academics to break down the impact of the increase in interest rate payments on consumption, studies from the “quaint” period pre-2006 suggest the propensity to spend dividends is nearly 100%. Anecdotal discussions with wealth advisors suggest it is similar for interest income. Combined private sector income gains from the Fed’s rate hikes now total nearly $670B annually ($7.1T in reserves x 5% + $6.3T in money market funds x 5%). Increased earnings on savings deposits, CDs, etc, compound that. Oh, and let’s consider the synthetic income created by option overwriting…

Any way you slice it, the income effect is MULTIPLES of the wealth effect.

Now run it in reverse.

As always, comments and questions appreciated.

A Bit of Levity

Reading the comments on my prior post, I was reminded of a scene from part three of Douglas Adams, five-part trilogy, The Hitchhiker’s Guide to the Galaxy, “Life, the Universe and Everything”:

He waited for a reaction from Arthur, but Arthur knew better than that. “Carry on,” he said levelly.

“The point is, you see,” said Ford, “that there is no point in driving yourself mad trying to stop yourself going mad. You might just as well give in and save your sanity for later.”

And for those assuming I was merely attempting to inflame, another, relating the tale of Wowbagger the Infinitely Prolonged, an alien unwillingly gifted with immortality:

“In the end, it was the Sunday afternoons he couldn’t cope with, and that terrible listlessness which starts to set in at about 2.55, when you know that you’ve had all the baths you can usefully have that day, that however hard you stare at any given paragraph in the papers you will never actually read it, or use the revolutionary new pruning technique it describes, and that as you stare at the clock the hands will move relentlessly on to four o’clock, and you will enter the long dark teatime of the soul.

So things began to pall for him. The merry smiles he used to wear at other people’s funerals began to fade. He began to despise the Universe in general, and everyone in it in particular.

This was the point at which he conceived his purpose, the thing which would drive him on, and which, as far as he could see, would drive him on forever. It was this.

“He would insult the Universe.”

Anecdotally I can attest that my boomer relatives have been treating their "new" interest income as fun money. Powell will find himself pulling that money dollar for dollar out of the economy to "prop up the labor market".

And what I've heard less about of late is the windfall of silent Gen and oldest boomer inheritances to their later in life (and already financially secure children). Purchases with this money may be few, but I see them skewing LARGE.

I truly hope my response to your prior post did not come across as disrespectful; I was really just playing devil's advocate. Like many of the respondents, I might have been guilty of initially missing one of the core theses (I think...) that choosing to believe in the lesser evil is not a delusion making that lesser evil become comparatively virtuous. However, there seems an implicit axiom behind the post that voting for neither party isn't an option. Why so?

But then again, most of us don't live in swing states and even those that do, don't *really* matter in a close-call where gerrymandering makes the electoral votes be what matter over the popular anyway and where the counting/recounting mechanisms of the popular remain comically archaic. IDK man... I truly hope yours and RFKJ's choice to believe works out well for society, I just kinda think that realistically we're all gonna be dissapointed again no matter what.