Post-Capitalism is Dead, Long Live Capitalism

The rising tide of scarcity economics and what it means for 2026

Apologies for the delay… it’s Tuesday on Mars.

When I think about the future, I try to separate it into “destination” vs “path.” There are only two certainties in life — death and taxes. A destination AND a path. Both are going to increase over the coming decades.

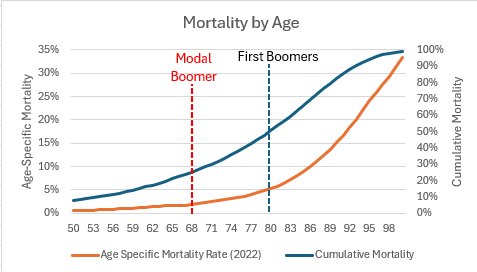

Death rates are rising globally as the global Baby Boomer cohort, first born in 1945, begins to exceed life expectancy.

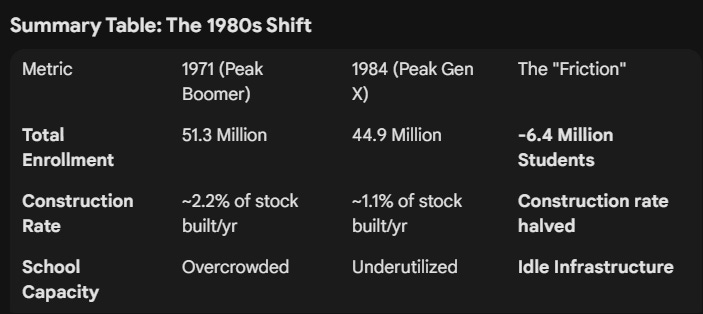

Once life expectancy is passed, age-specific mortality begins to rise dramatically. At 80, the age-specific mortality is 5%. At 90, it’s 15%. Over the next decade, roughly 35% of the Boomers will move on to the next life. Over the next 15 years, over half “disappear.” This is a period of unprecedented change in global demographics. The closest analog is high schools from 1982 to 1996, where the population of high school students collapsed by nearly 12%:

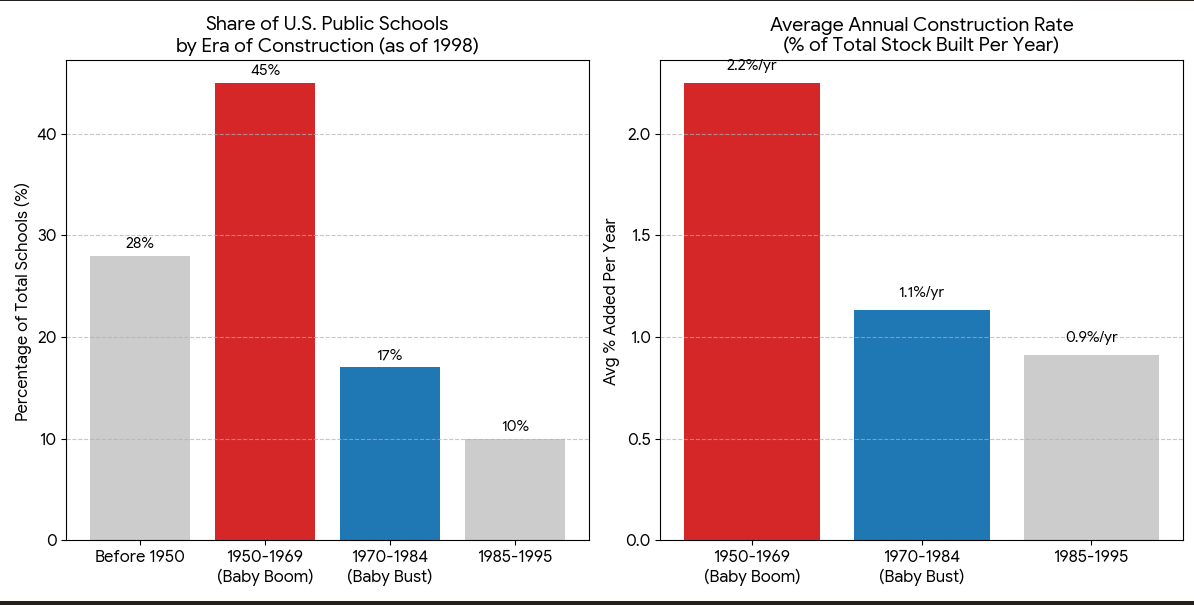

With the collapse of growth into decline, the construction of educational infrastructure collapsed:

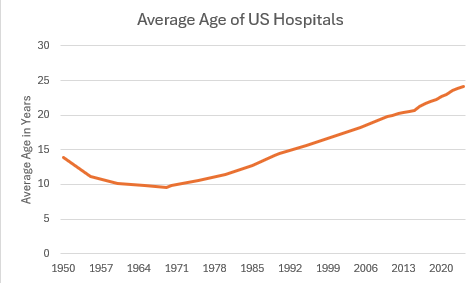

With declining high school populations, the issue was one of neglect. But a much bigger problem faces us for the rapidly aging (and dying) Boomers — we also built hospitals for their BIRTHS (peak hospital construction permits in 1964), but now expect those same deaths to occur with aging hospital infrastructure:

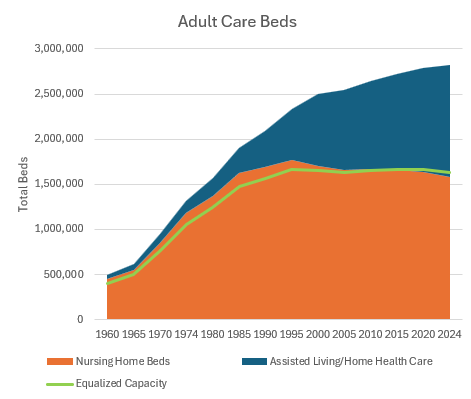

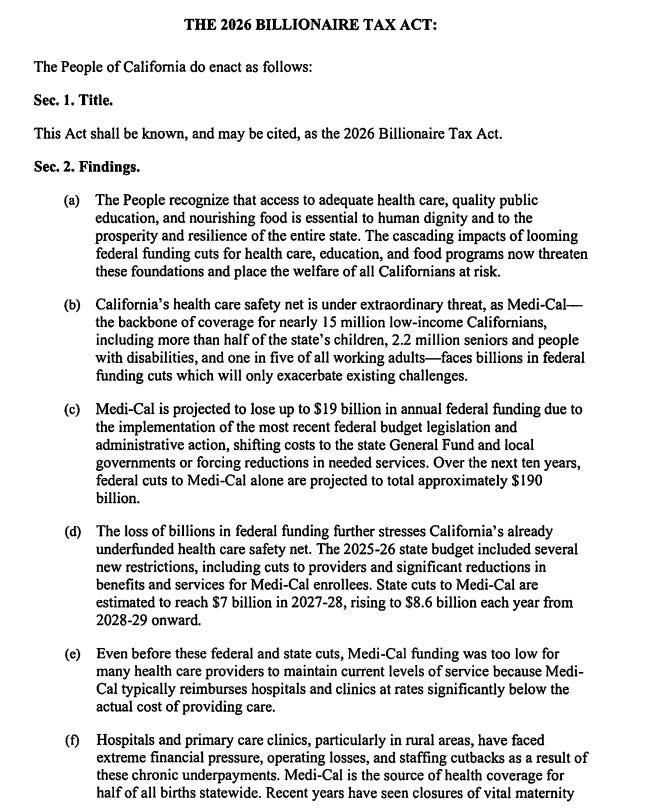

These facilities were built with expansive maternity wards, not for extended convalescence. While the Boomers are ready to critique the Millenials for their “entitlement” in wanting modern homes (as we’ve demonstrated, this is untrue), it is the Boomers themselves that are shunning the extended care facilities of 1950s in favor of “aging in place” or luxury retirement communities, consuming vastly more resources per capita than the “nursing homes” that were “enough” for their parents. Average length of stay in a nursing home bed is 13.4 months (median 5 months); for assisted living it is 29 months (median 22 months). Normalizing capacity by median stay (the right figure for cohort analysis), it has been shrinking even as forward demand is exploding:

The net impact is a looming senior housing crisis that will necessitate a radical rethinking of end-of-life care. But first, we will face a capacity crunch that will force aging Boomers to pay for the labor needed to age in place, because there will be nowhere for them to go.

Yes, EVENTUALLY we will get Optimus-type robots to care for Grandma, but like all innovations, its adoption will be driven by necessity. And the net beneficiaries of the capacity increase will be GenX — who were also the beneficiaries of the high school and college construction booms (“You think I’d get in to Penn today?” is the enduring refrain of my classmates as we fight for our children’s right to party like it’s 1989). The offset? They are politically weak enough that they will likely see heavy restrictions on “senior entitlements” while Boomers are grandfathered in. Doesn’t really matter; many GenXers won’t get to be grandfathers anyway (due to falling birth rates).

It is unlikely we will see a surge in construction to provide low-end end-of-life care from the private sector — the end customer is literally dying out; government is likely to step in, eventually, as they did in the 1960s.

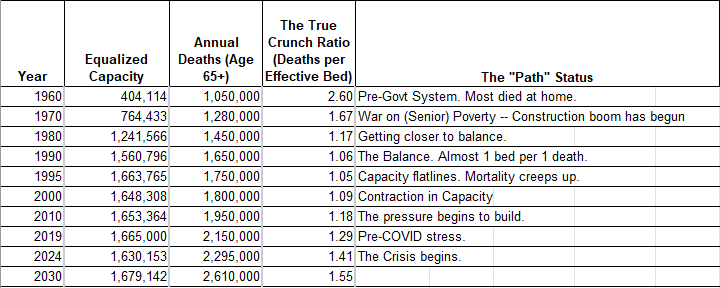

Just like senior housing, a capacity crunch is emerging in health care workers per Social Security beneficiary. As those SocSec beneficiaries age, the intensity of demand will rise, and the implications of the worker shortage will become more pronounced:

For the Boomers, Rich Grandma will initially get the immigrant to change their bedpans until Optimus arrives; Poor Grandma will negotiate with her children. Aren’t you glad we raised them so well?

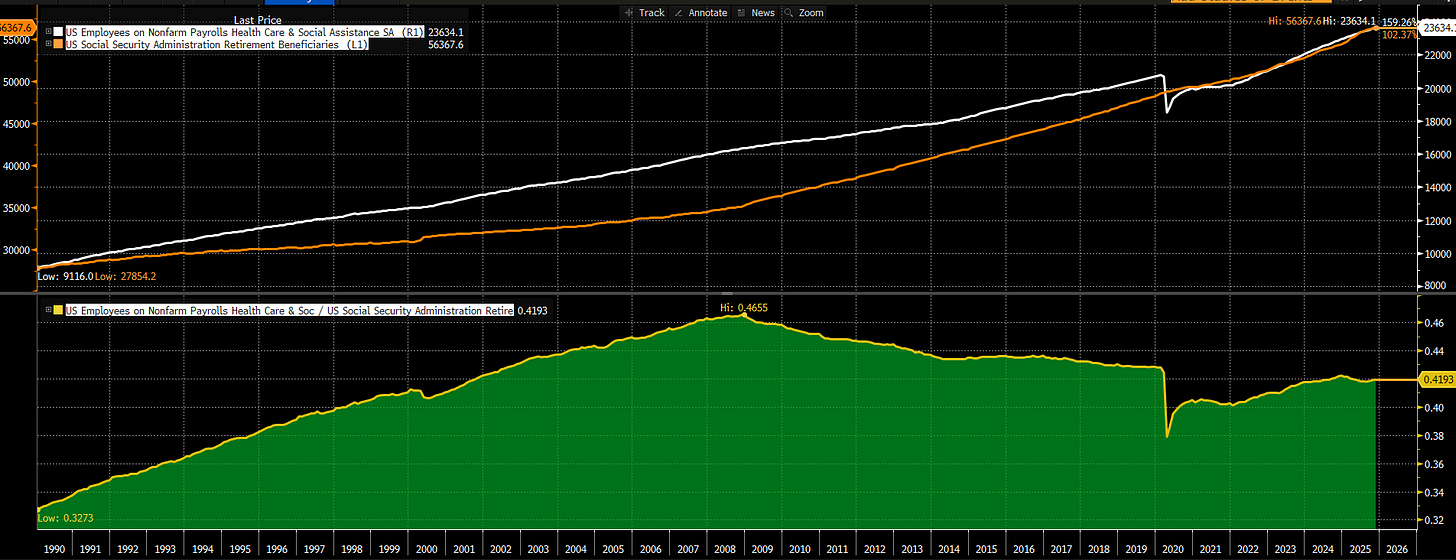

Of course, this will be politically unacceptable, at least initially, so the government is here to help. As always, California is leading the nation on the “path” — higher taxes:

Wealth taxes to fund health care for seniors while cloaking it in a pitch to expand maternity wards… will hypocrisy ever find bounds? (No) My expectation is that the California initiative will fail. As framed, it is an overt violation of takings clauses and restrictions on individual taxation, AND it is opposed by Governor Newsom. BUT it is the opening salvo in a war in which there will likely be no victors — like passive investing, we made the easy choices for too long, and now it’s likely too late.

And this “real world” capacity crunch is going to manifest itself across nearly every sector as the surge in capacity created by globalization (logistics, communications, trade) continues to reverse under the breakdown of the post-Cold War peace dividend. The emergence of a “war dividend” — in the form of nuclear power, humanoid and other robots (including drones), and advanced security technology (effectively proto-digital IDs) for military applications (initially) — will emerge, but the uncertainty is whether that dividend will require a down payment in the form of physical war that can further deplete existing infrastructure and labor supplies.

So welcome to the “Fourth Turning” — the capacity crunch across multiple “real world” sectors created by the nonsense of “post-Capitalism” in the 2010s that will endure as the aging Boomers and the emergence of their electronic “workers” drives increased demand for service labor automation — robots, AI, self-driving cars — AND increased demand for service labor itself.

Why “Zero Marginal Cost” is an Accounting Error

The theory of “Post-Capitalism” — championed by thinkers like Jeremy Rifkin and Peter Diamandis — rests on the seductive idea that technology is driving the marginal cost of production to zero, inevitably birthing a world of abundance where the price mechanism collapses.

This theory collapses the moment it encounters the physical world. It is not a prediction of the future; it is a fundamental misunderstanding of the present, reliant on three structural fallacies.

1. The “Cloud” is Heavy Industry (The Rivalry Fallacy)

Post-capitalist theory relies on the “infinite reproducibility” of digital goods. This is a category error. While code is non-rivalrous, the means of execution are intensely rivalrous.

The Reality: There is no such thing as “the cloud”; there are only other people’s computers. These computers require rare earth minerals, silicon lithography, massive energy inputs, and LAND (including the real estate in front of your eyes).

The Trap: As long as the hardware (GPUs, Servers, Land) is scarce and privately owned, the “free” software layer is merely a lure. The “Digital Commons” does not liberate the user; it serves as unpaid R&D for the hardware monopolists (Microsoft, Amazon, Nvidia) who charge rent on the physical bottlenecks.

2. The Thermodynamics of “Free” (The Entropy Fallacy)

The concept of a “Zero Marginal Cost Society” is essentially accounting fraud. It can only be sustained by ignoring Depreciation and Entropy.

The “Turtles” Problem: Proponents argue that automation eliminates labor costs. But machines degrade. A solar panel decays; a robot wears out. The cost of replacing the machine (CapEx) is the hidden “marginal cost” of every unit it produces. It’s “turtles all the way down.”

The “Sharing” Lie: Rifkin’s vision of “sharing energy” across a grid ignores the Second Law of Thermodynamics. Transmission is not free; it incurs resistance. The grid is not a magical internet of electrons; it is a physical system where moving energy costs energy.

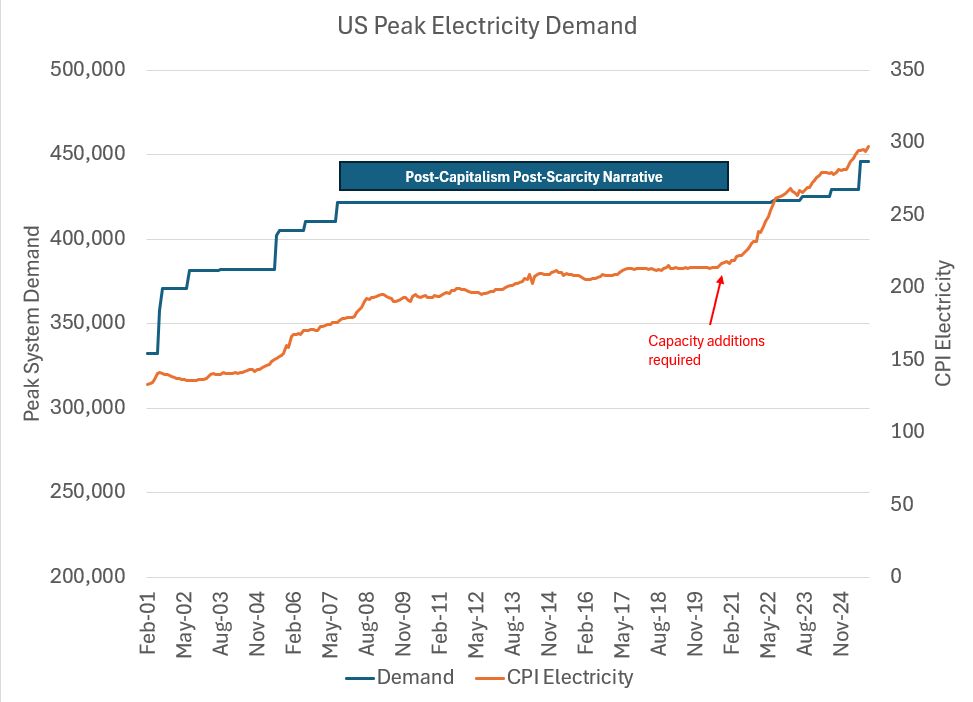

The “Local” vs “Global” cost curve: The idea that “marginal energy is free” once you install solar panels is a reflection of a local cost curve, not the global cost curve. If I install a 10kW panel array, 0-10kW is “near zero marginal cost.” But 10.0001kW is HIGH marginal cost. As a society, we experienced a period where the local curve did not need to shift to obtain new capacity and we mistook it for “post-scarcity”

:

3. The Capacity Cliff (The Curve Fallacy)

Rifkin and Diamandis conflated a local segmented curve with a global curve.

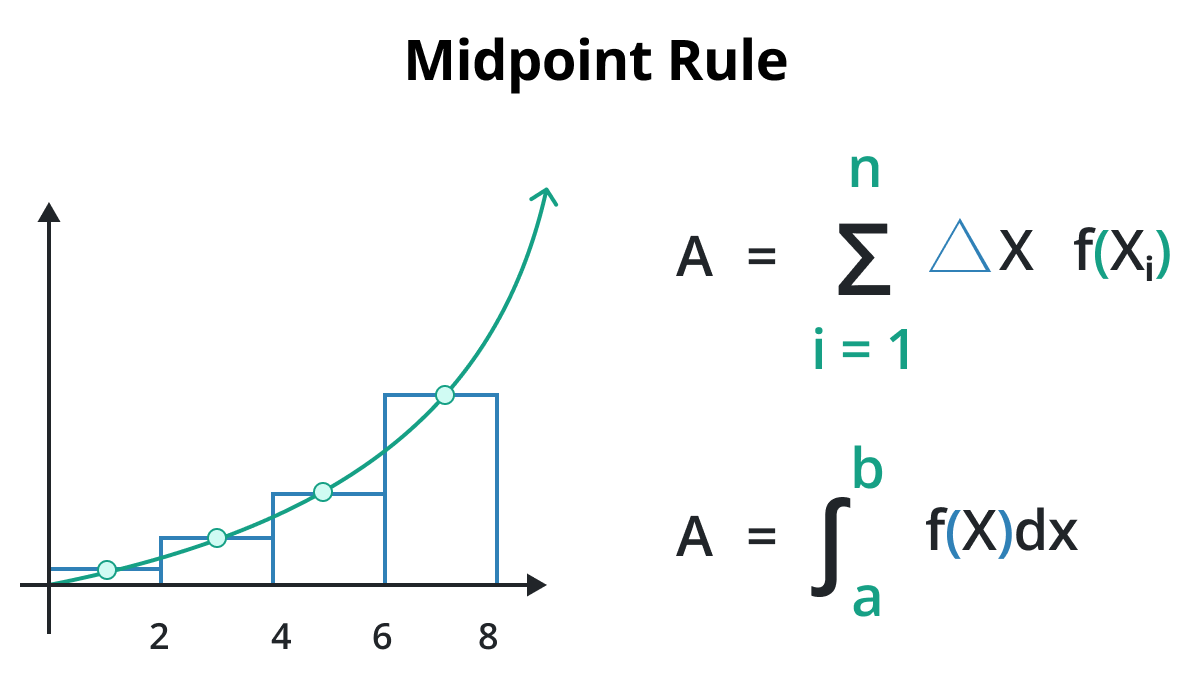

The Step Function: Energy is only “free” up to the limit of current capacity (e.g., the max output of a solar panel). The moment demand exceeds that limit by a single watt, the marginal cost explodes, requiring massive new capital investment for a second panel or battery.

The Conclusion: We are not on a smooth path to post-scarcity; we are trapping ourselves on a jagged step-function of constraints. The ‘Zero Marginal Cost’ narrative relies on a calculus flaw: it assumes the cost of the next unit is effectively zero. But in the real world, capital is ‘lumpy’ and discrete. We don’t buy capacity in single watts; we buy it in billion-dollar blocks. We never conquered scarcity; we simply hit a larger-than-normal Riemann rectangle segment.

Hyper-Capitalism in Disguise

What proponents call “Post-Capitalism” is merely monopoly extraction optimized for the digital age. By relying on unpaid “peer production” (identical in function to the unpaid domestic labor that “goosed” GDP as women moved from non-market to market economy), the system offloads costs onto the user while privatizing the profits of the infrastructure. This game is coming to an end.

Far from escaping the market, the “Post-Capitalist” economy is simply a new way to sweat the assets of the physical world while pretending the limits of physical reality don’t exist. In the 2020s, we’re discovering that assumption is wrong.

Investment Implications

The “Pig in the Python” Problem (The Mismatch)

The Riemann sum chart shows that to meet demand, we must step up to the next massive rectangle of capacity (e.g., building a new fleet of nursing homes or power plants).

The Conflict: Infrastructure is amortized over 30–40 years.

The Reality: The “Boomer Bulge” (the Pig) only needs this capacity for ~15 years (2025–2040) before they exit the system (mortality).

The Trap: If we build the “Red Step” (new capacity) to accommodate the peak, we will be left with a massive Stranded Asset in 2045 when the demographic curve collapses behind them.

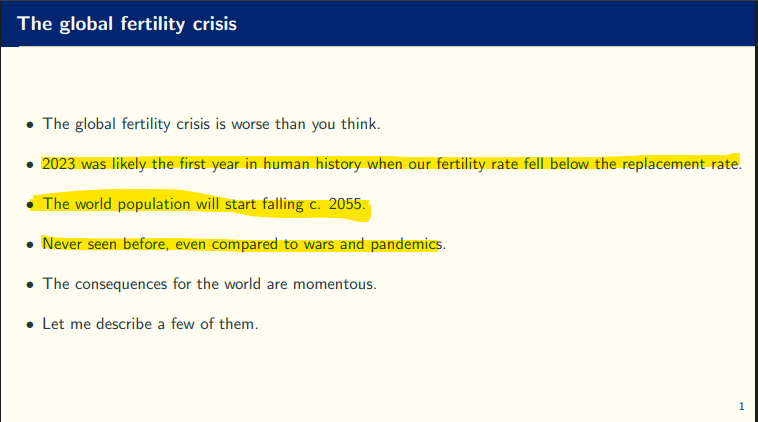

The Data: The “Global Peak” is Already Baked In

After the Boomers, the “population growth” narrative is dead. The demand curve isn’t just flattening; it is set to invert. I have discussed this previously, but I encourage you to evaluate the slides of Penn professor (but would he get in today?), Jesus Fernandez-Villaverde. We can call him Professor Jesus for short.

Replacement Rate Breached: “2023 was likely the first year in human history when our fertility rate fell below the replacement rate”.

The “Extensive Margin” Collapse: Future growth is incredibly challenging, if not impossible, because the “feeder system” (births) has broken. The source of immigrant labor/demand is drying up even before we consider immigration restrictions.

The Implication: The “Step Function” of inflation we are seeing now is the premium capital markets demand to build assets for a dying civilization. Why would I lend you money for 30 years to build a hospital for a population that will be 20% smaller when the bond matures?

The “Inflationary Span” (2025–2040)

This explains why inflation is “sticky” now but “deflationary” later.

Phase 1: The Squeeze (Now - 2035): The “Pig” (Boomers) is wider than the “Python” (Infrastructure). We hit the Riemann Cliff. Prices explode because we must squeeze them through. We are forced to build capacity at maximum cost.

Phase 2: The Glut (Post-2040): The Pig exits. The population drops. We are left with the “New Capacity” we just built, but the demand line crashes. Prices likely collapse.

Implications for Investors: The Terminal Value Trap

The Thesis: We are facing a “Local” Capacity Crisis (The Boomer Bulge) within a “Global” Demographic Collapse (The Fertility Crash). This creates a specific financial trap: Overbuilding for the Bulge.

Investors must distinguish between Structural Scarcity (assets the shrinking young cohort will always need to survive) and Temporal Scarcity (assets the dying old cohort needs right now).

The Commodity Split: Machine Food vs. Human Food

Do not buy “Commodities” as a monolithic asset class. In a depopulating world, the correlation between Energy and Agriculture breaks.

Long “Machine Food” (Structural Scarcity): Copper, Uranium, Natural Gas, Compute.

The Logic: As the ratio of Workers-to-Retirees collapses, civilization must substitute human labor with machine labor. A shrinking workforce requires more energy and compute per capita to maintain GDP. Demand is anti-correlated to population.

Short “Human Food” (Accelerated Deflation): Wheat, Corn, Soy, and Farmland.

The Logic: You cannot automate calorie consumption. Farmland acts as a leveraged short on demographics: demand for farmland shrinks faster than population because the least productive “marginal acres” are abandoned first. Unless the land can be converted to energy production (solar/biofuels), it is a deflationary trap.

Markets have BEGUN to price this in — but just barely. It shouldn’t be that HARD to find a commodity strategy or CTA strategy that recognizes the difference:

The Duration Mismatch: “Riemann” Assets

We are hitting a “Capacity Cliff” for many assets — housing, energy, medical care — forcing prices higher. However, building new capacity into this spike is suicide.

The Trap: Financing a 40-year hospital or nursing home to service a demographic wave that will crest in 2035 and vanish by 2045.

The Trade: Own (or rent) the Incumbents, not the Builders. The most profitable asset is the existing, fully depreciated facility running at 110% capacity. It has pricing power today but no “Terminal Value” risk tomorrow because it requires no new CapEx. But nearly all equity assets (including private equity) have giant terminal values. BUY THE DEBT — but recognize it’s a rocky road and many assets will fail (and you may end up owning a new low-cost competitor if you pick carefully). A hedge might be appropriate if you don’t have this skill set. I know a guy…

The “Growth” Audit

Standard DCF models assume a “Terminal Growth Rate” of 2–3% into perpetuity. This makes no sense in a world where profitability can collapse in 15 years.

The Reality: For mass-market consumer businesses (Housing, Retail, Autos), the Terminal Growth Rate is negative.

The Action: Audit your portfolio for companies priced on “infinite customer growth.” If they sell to humans (rather than to the machines that replace humans), their terminal value is possibly zero. Even if you find the “low cost” providers (who are likely to survive), multiple contraction is the fundamental story.

The Passive Overlay

And none of this will matter in the near term as we continue to drive assets into passive strategies. But when the flows slow and reverse, and they must, as seniors confront these shortages that will drive end-of-life care cost surges and 100% taxation on “inheritable assets,” the next bid will likely be much, much lower.

I still don’t see that happening in 2026, but it’s growing increasingly stochastic. Watch the flows!