People Are Crazy (Final)

It's Finally Time to Test the Theory this Week

Summary:

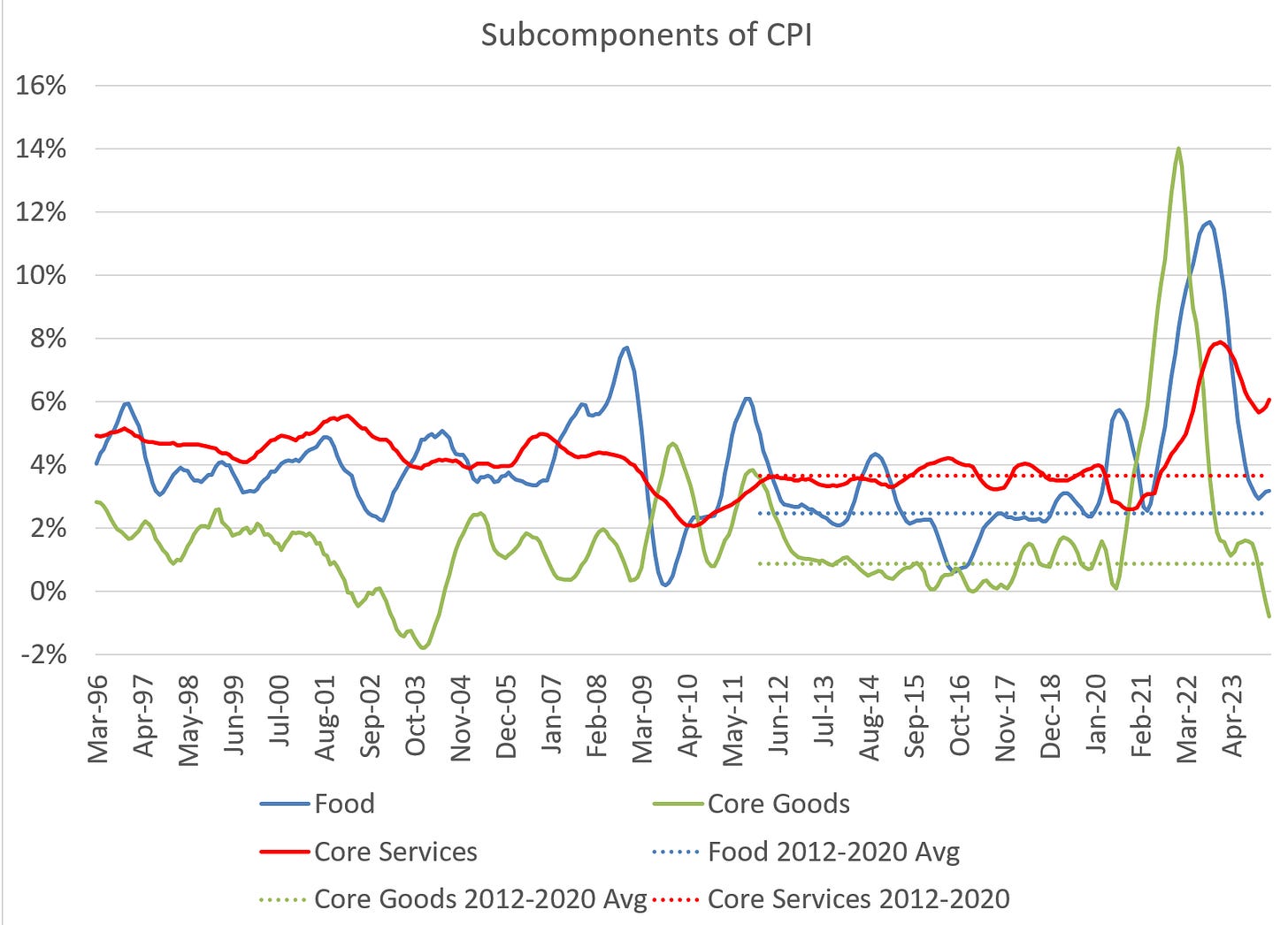

Despite headline CPI staying above 3% due to energy price spikes and insurance increases, other inflation components show different trends: goods inflation has dropped below 0%, food inflation is stabilizing, and core services (excluding shelter) are returning to pre-2020 levels.

The persistence of high inflation in certain areas like insurance and shelter is due to past events and is unlikely to continue at the same rate.

No significant "catch-up" is necessary to align with CPI rent. While shelter inflation remains high, it's on a decelerating path

Top Comment

Mike (hopefully unrelated) notes a possible flaw in my CVNA analysis:

Your analysis is spot on regarding CVNA, however it might not account for CVNA market share expansion and used car dynamics given inflation and EVs. Our family utilized carvana twice in the past 6 months. We recommended it to a neighbor and a couple of friends who all used it also. When I spoke with the local manager who delivered our vehicle, he said they are expanding in the local market quickly. Great customer service and very easy to transact. Removes transaction friction. I despise dealerships and Craigslist et al are fubar. CVNA fills a niche rap for sellers. The stock is near term overbought and will correct when consumer and credit croak.

MWG: Mike, it’s a very fair comment. Unfortunately, cutting SG&A and advertising spend make this plausible, but unlikely. It also raises the question of “How can they simultaneously offer low prices and much higher than industry gross margins? (adjusted of course)” It’s possible they have stumbled onto a much better business model in a largely mature industry that just happened to require a transformative acquisition two years ago, but it’s more likely they simply aren’t recognizing impairments in their financing. From reviews and speaking with customers, it seems that the experience varies widely (as you’d expect). But it’s a worthwhile point to emphasize. I might even try buying a car through them as a test!

The Main Event

With CPI coming next week, I have to confess I’m growing “nervous” about this CPI print. Not because I’m particularly concerned that it will prove momentously important in either direction, but more because “the” test is finally here where we find out whether the “pause” in inflation persists or whether the frustratingly persistent shelter component finally begins to retreat. While there is plenty of commentary out there about the “easy compares” that become less easy in MoM CPI prints, these reports all use some variant of headline MoM changes projected forward. For example:

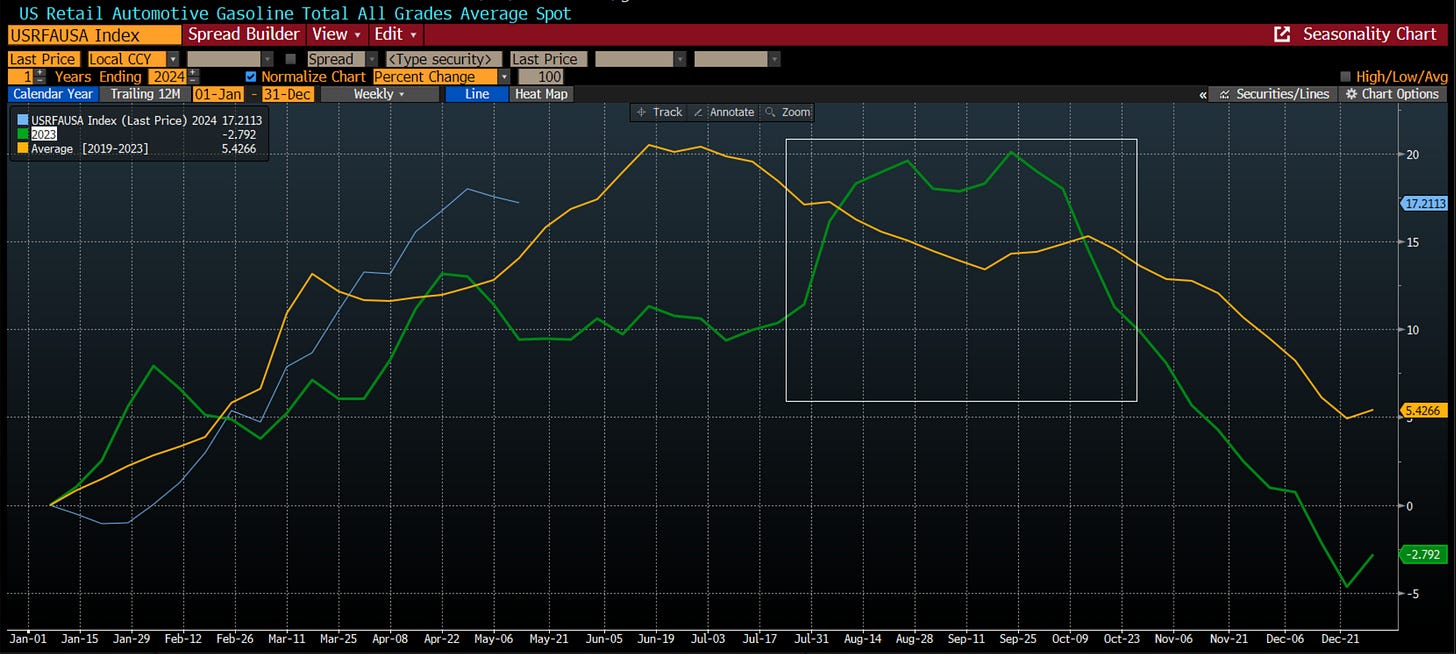

Now note the fairly obvious — there is no real attempt to forecast inflation in this model. It simply suggests that higher MoM averages than target will eventually lead to (surprise) higher than target outcomes. Genius. This approach carried the day last year as many pointed out that the composition of inflation prints suggested June 2023 would be the low in inflation. Jim Bianco did a good job of highlighting this dynamic. Unfortunately, that’s not what ended up frustrating the markets. Instead, we had an atypical late summer spike in gasoline prices tied to Saudi production cuts and refinery “maintenance” leading to a surge in crack spreads.

And then the insurance bill hit. Over the past year, auto insurance accelerated to over 20% and home insurance bills (on average) rose by nearly 5%, as I exhaustively detailed in the post that led to this series:

WHEN these insurance increases retreat (and they will), the same observation can now be made in reverse — what’s going to be the driver that maintains the above trend and allows CPI to maintain above 3% given we are now dropping the next four months of above average readings (3.6% annualized) with no apparent catalysts to replace the insurance components.

Meanwhile consensus has firmly shifted to sticky inflation in the >3% range:

While this is true at the headline level due to a spike in gasoline price, none of the other components of inflation turned higher from that point despite the previously noted insurance.

As should be clear from that chart, “energy” inflation is inherently unstable. You shouldn't bother reading my work if you can predict gasoline (or oil) prices. Get busy getting rich(er)! But digging into the remaining components (which make up 93% of the Core CPI) leads to a very different picture: