Part 2: The Door Has Opened

A discussion on the real word has begun. It's about time

The wealth you’re counting on—the retirement accounts, the home equity, the “nest egg” that’s supposed to make this all worthwhile—is just as fake as the poverty line. But the humans behind that wealth are real. And they are amazing. — Part 1

Wow, was I right for once. You people are amazing. The outpouring of love and support I received over the last week was incredible. Comments here on my Substack and on Twitter, the Free Press, the Washington Post, YouTube, Fox News, CNN, etc. were massively favorable. The Washington Post ran its piece on Saturday, nearly a full week after the initial Substack post. We’ll use their AI summary of nearly 1,500 comments to capture the mood:

I think this is a very fair summary, complete with a conclusion that absolutely catches the key point: “the discussion underscores the need for a re-evaluation of poverty metrics to better reflect contemporary living costs.” What we measure determines what we care about. And what we care about determines who thrives. And now we’re talking! As my fan Matt Darling noted:

Of course, there were haters, but we’ll focus on hating “their game” rather than hating the players. I know a few of the players personally; they’re actually quite sweet. Add a little salt, butter, and a hot pan, and they’d make a lovely fricasee. Best with Chianti. For new readers, you should expect this. Cogent analysis combined with cannibalism jokes. You’ll get used to it… I hope.

I took heat for using “AI”. Let’s head that off at the pass — of course, I use Large Language Models (LLMs). In case you’re wondering, I also use electric lights, Excel, and Bloomberg. It’s amazing to me that we can simultaneously argue that AI is the future productivity miracle while decrying its use. You can’t have both! There are understandable concerns that LLMs can be used to generate “slop” thrown at the wall in the public forum; I’d suggest these fears largely reside in a class that has been throwing slop at the public for years. As I made clear in the original article, the point was not the accuracy of the actual $140K claim. The POINT was the “Valley of Death”:

This mathematical valley explains the rage we see in the American electorate, specifically the animosity the “working poor” (the middle class) feel toward the “actual poor” and immigrants.

Economists and politicians look at this anger and call it racism, or lack of empathy. They are missing the mechanism.

Altruism is a function of surplus. It is easy to be charitable when you have excess capacity. It is impossible to be charitable when you are fighting for the last bruised banana. — Part 1

And it resonated. I am incredibly thankful for that.

So we’re going to try to do FOUR things with this piece. First, I’m going to address a few of the legitimate issues raised with my initial piece, which was never intended to go viral and was written for my existing audience that tends to be pretty understanding that I don’t do this for a living, but rather as PART of my living. Second, we’re going to return to a theme from my piece, “Are You an American?” examining the “Mockery Machine” of the cognitive elite (the game the haters are playing) to expose the narratives that will be used to suppress your new found knowledge. Third, I’m going to venture into a discussion of wealth and examine the belief that “wealth transfer” will save us. FINALLY, I’m going to tease at solutions. The actual proposals will wait until next week. I’ve built some models and need to run them by actually smart people. They will not be policy-ready, but they will introduce you to just how easy fixes CAN be if you avoid institutional capture. Let’s get going, America!

Part 2: The Broken Balance Sheet

1) A Note on the Numbers: The Bark, The Tree, and The Forest

The response to Part 1 was overwhelming and almost universally positive from individuals; the pushback from institutions, like the American Enterprise Institute, was instantaneous and coordinated. Clearly, I hit a nerve. Some of the pushback was understandable — as I did not intend the post to go viral, I didn’t bother to source all the data or stress test to the degree I could have were I interested in producing “the definitive study of poverty in America!” which I have no interest in doing. For this, I was accused of plagiarism, etc. When asked for sources, I happily provided them immediately. But that, of course, didn’t stop the innuendo:

Finally, I have to say that it is remarkable that of the 3,000+ counties Green could have chosen, he found one that reinforced his $140,000 poverty line claim from his separate (also flawed) analyses. — Scott Winship

For those that are new to my Substack, the reason for the focus on Essex County, NJ was because I was studying Caldwell, NJ (in Essex County) for the prior post, Are You An American? There was no intended subterfuge, nor can I imagine the motive that is supposedly behind such a choice. The data came from the MIT Cost of Living project, as I immediately disclosed when asked.

But the reaction from the establishment WAS impressive. AEI trotted out Scott Winship and Kevin Corinth, CATO brought some guy named Jeremy Horpedahl, who apparently lobbies for tax policy favorable to the Waltons in Arkansas, Alex Tabarrok of George Mason showed up, and Noah Smith vied for attention as well.

To understand this reaction, we must establish three distinct layers of the argument: Layer, Concept, and Meaning. Using “forest for the trees” analogy — the bark, the tree, and the forest.

The Bark: The Specific Number ($140,000)

This number, sourced from the MIT Living Wage analysis for Essex County, NJ, is the trigger. As noted, I used Essex County, NJ, because it is the county for Caldwell, NJ, the subject of my prior article, Are You An American?

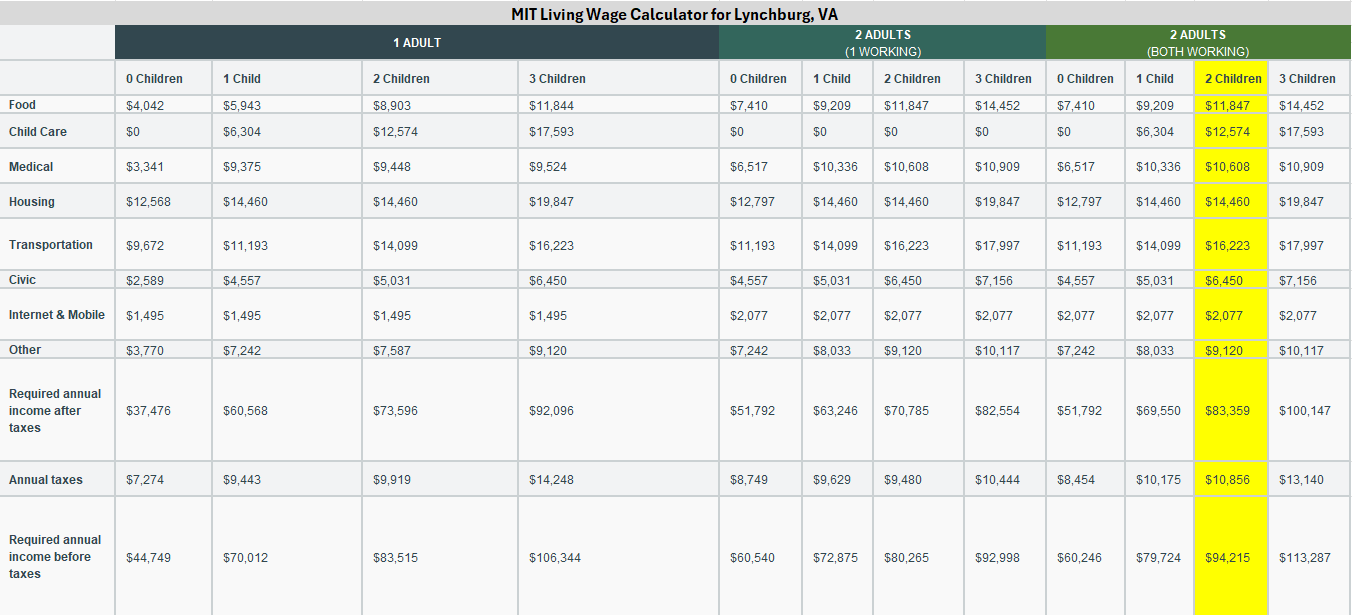

It was used to demonstrate that the official poverty line is arithmetically bankrupt. We can debate whether Essex County, NJ is typical, and I concede it is indeed a higher cost of living region. If we use the most statistically average city in the United States, typically cited as Lynchburg, VA, the level is $94,215 as of December 2024. Roughly 3x the official poverty line.

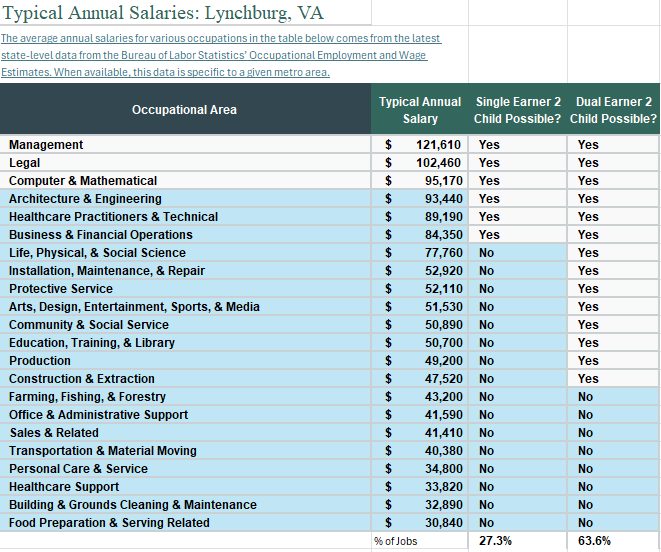

The Tree: The Precarity Threshold

The fundamental truth is that the cost of participation in modern life has become near impossible for a single earner with children, forcing a two-income precarity model on most households. In both Lynchburg, VA and Essex County (Caldwell), NJ, only 27% of occupations generate enough on average for single earner households with two children; in Lynchburg, 64% of occupations (and a higher fraction when we consider combining high and lower income careers) provide adequate income in dual earner households with two children. With that additional worker, comes the additional expenses discussed — a second car, childcare, etc.

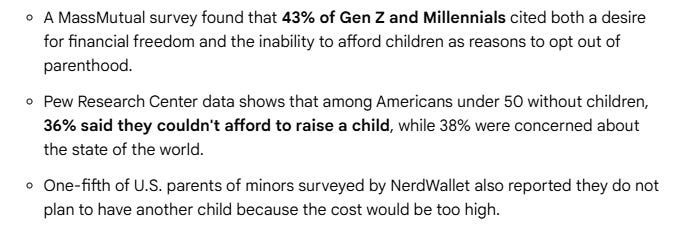

One unfortunate reality that emerges from this is the “ghost households” concept best articulated by Adam Butler — yes, the median income for two-children households is much higher than the median household. But this is not because having two children magically confers additional income; it’s because many are choosing NOT to have children, because they can’t afford it.

The Forest: The Valley of Death

This is the policy failure that was actually at the heart of Part 1: We have created benefit cliffs and income phase-outs that systematically capture the working poor, ensuring that climbing the ladder only leads to loss of essential benefits and permanent financial fragility.

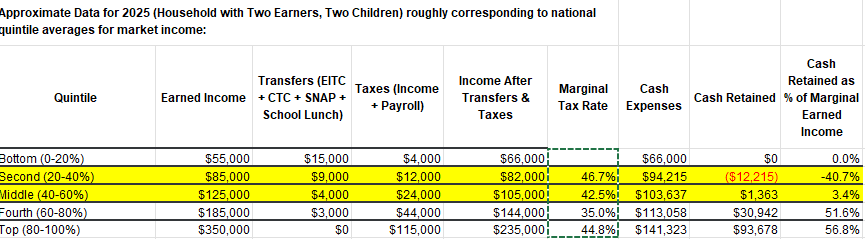

If you want to argue that the real “Bark” is the $94,000 Lynchburg number or the $136,500 Essex County, NJ number, fine. The Tree remains the core economic reality — both of these numbers are so far above the current poverty line as to render it absurd. Let’s use the data from Lynchburg, VA against national average data for TWO INCOME, TWO CHILD families (in caps just to make it clear). These are rough estimates of transfers and tax burdens, but are directionally correct. Note the “Valley of Death” — the negative cash savings for those transiting from “true poverty” where privations are genuine to “lower middle class” where the living wage budget becomes real. Even those making it to the bottom of the fourth quintile are struggling to save any money. Remember, we are NOT calculating 401K or IRA withholdings that often lower current cash incomes by another 6%+; these savings are a good thing, but against negative cash income, food takes priority over retirement.

This is why the debate is not about the number — it is about the structure of the income statement. Ironically, this Valley of Death, the punitive nature of benefit cliffs, has been the subject of a number of articles, including those by my fiercest critics. They know this is true; that’s why they had to engage the Mockery Machine.

I don’t want to confuse the official machine with any critique offered; they are not the same. The most common layman's critique is that the middle class has always complained about how hard it is to get ahead. “Every generation struggles.” The distinction today, however, is not the presence of the struggle, but its nature. In past generations, the challenge was typically about effort, saving, and time—the arithmetic of one income versus core expenses was generally possible, a child could go to state college and advance, a second income could be added to generate surplus. Today, due to the more rapid inflation of non-discretionary costs (housing, childcare, healthcare, unadjusted for quality to reflect actual cash outlay) and the truly perverse benefits cliffs, the challenge is an arithmetic failure. The necessary monthly cash outflow exceeds the income available for far more families, making the promised middle-class outcome almost impossible, not just difficult. Try explaining this to Boomer parents without them getting angry; I’ll wait.

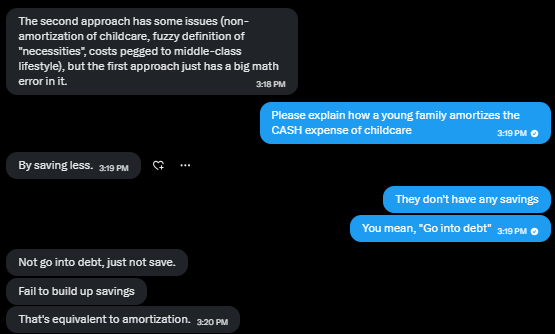

The question we are increasingly asking is, “Why aren’t we having more families and procreating?” The answer, largely, is that we are asking families to make an investment in children that becomes a future common good and penalizing them for doing so. A side conversation with Noah Smith, whom I do consider a friend, was revealing:

As others, including myself, have noted, I am not Christopher Columbus sailing into terra incognita. These are well-explored topics as the MIT Living Wage project demonstrates. The Cost of Thriving Index (COTI) from Oren Cass confirms this income statement failure by comparing the raw, inflationary pressure of essential goods against the income of the median full-time male worker expressed in “weeks of work” required:

Year Weeks of Median Male Earnings Required for COTI Basket

1985 30.1 weeks

2000 41.8 weeks

2010 50.2 weeks

2024 62.7 weeks

Note: AEI has also attacked Oren’s work with analyses that suggest the median actual expenditure is closer to 50-52 weeks of median income, but this relies on using CPI to deflate costs, which inaccurately conflates the aggregate cost basket with the “cost of participation” as I detail below.

2) The Mockery Machine — Calling Out the New Balph Eubanks

In Are You an American?, I described “The Mockery Machine”—the ritualized pattern in which elites respond to legitimate grievances by distorting them into absurdity, ridiculing the distortion, and then shaming the “complainer” for even noticing the decline. I thought of it as a cultural reflex, a defensive maneuver performed mostly by Twitter avatars and partisans. I was wrong.

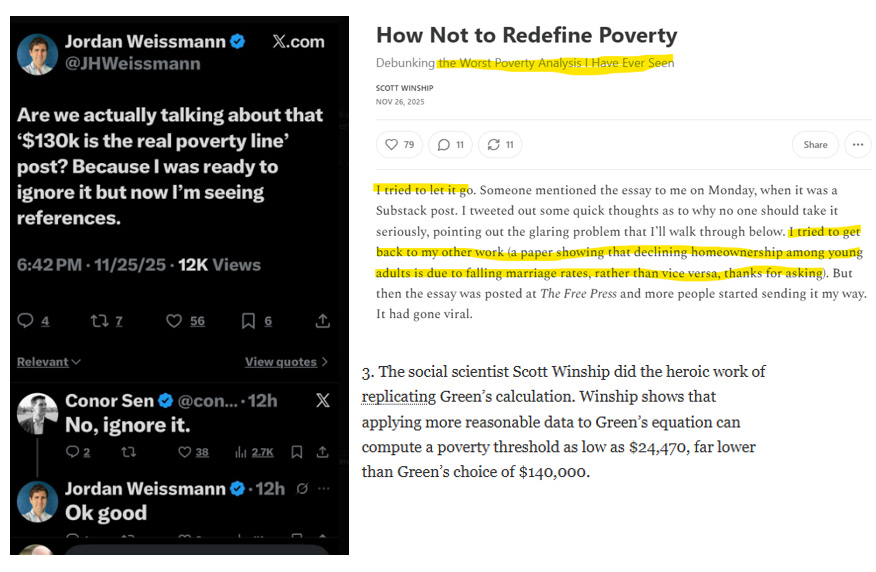

The coordinated response to my Part 1 analysis—especially from Scott Winship, the Director of the Center on Opportunity and Social Mobility at the American Enterprise Institute—reveals something deeper and far more revealing. What I witnessed this week was not debate. I would gladly have made myself available for discussion. It was narrative discipline. First, they tried to ignore it:

Then reluctantly, they lumbered into battle. AEI’s champion, the “Black Knight” of Monty Python’s Holy Grail, performing his required professional function. I showed the public that the median family’s income statement was increasingly challenged, and they responded not by addressing it, but by remaining defiant on the path, bleeding profusely, and insisting the systemic dysfunction was “just a scratch.” Their entire professional existence is predicated on denying the wound. They cannot concede the math because their job is to defend the castle.

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.” — Upton Sinclair

It was the déjà vu of a scene from Atlas Shrugged I had never fully appreciated until now: the role of Balph Eubank, the subsidized intellectual whose job is not to think, but to reassure the powerful that everything is fine.

“Our culture has sunk into a bog of materialism. Men have lost all spiritual values in their pursuit of material production and technological trickery. They’re too comfortable. They will return to a nobler life if we teach them to bear privations. So we ought to place a limit upon their material greed.”

— Balph Eubank, Atlas Shrugged

“The link between poverty and income is overstated… the real issue is behavior.”

— Scott Winship, U.S. House testimony, 2013

Just like in Atlas Shrugged, all the sycophants wanted to display their loyalty to Balph. Check out the brutal assault on my childcare figure — “It’s not $32K — it’s $25.7K!!!!”

This is the policy-intellectual echo chamber of the Mockery Machine. Eubank provides the moral justification to inaction in Atlas Shrugged — people are “too comfortable” and must bear “privations.” Winship provides the modern, data-backed policy verdict for the same — that income is secondary to “behavior.” The conclusion is identical: The Problem is not the system’s mathematics, but your moral character.

Winship’s central thesis, which anchors his entire body of work as the AEI’s Director of Social Mobility, is that American poverty and economic insecurity are vastly overstated, and that, once we “adjust X, Y, and Z” (namely, non-cash benefits and headline inflation measures), things have, in fact, never been better. His attack essay, How Not to Redefine Poverty, exemplifies the Mockery Machine perfectly. Kind of fun to note (above) that I distracted him from proving the problem is not declining homeownership, but falling marriage rates, which are leading to declining homeownership. Oh, for the ivory castle…

The Mockery Machine at work:

Start with a legitimate claim: The cost of participation in the modern economy is far higher than the official poverty line admits.

Exaggerate it to absurdity: Insists—repeatedly—that I believe “every family under $140,000 is starving,” a claim never made. He “runs the numbers himself” using the multiplier for “food at home” against the total food budget, deliberately choosing a multiplier that suggests the poverty line should (could?) be $214,200, simply to make the structure of the argument appear ridiculous.

Treat the absurd version as the real argument: He writes, “No one in their right mind should think that a meaningful poverty line can be set at $140,000,” as though the point were the number, not the structure of the transition through the Valley of Death.

Blame the claimant for entitlement: He nods approvingly toward economists who insist Americans “have never had it so good.” And suggests that “rich” Michael Green thinks poverty is reflected by the inability to afford $10 bananas.

Reframe the grievance as unserious, unrigorous, un-American: He dismisses the entire analysis as “hot garbage” and “the worst poverty analysis I have ever seen” then pivots to telling readers that the real problem is not the economy, but their perception, which is “fed by inaccurate...claims.”

This is not economic argumentation. It is the rhetorical equivalent of slamming the castle gates and telling the villagers that the portcullis is down only in their imaginations.

Winship spends thousands of words defending a system no family actually lives in—one where the cost of housing is acceptable, the $32,000 cost of childcare is ignored, and the middle class has never had it better. It is a portrait of an America that exists nowhere except in think tank spreadsheets, and certainly not in the experience of the people these institutions claim to speak for.

The irony, of course, is that the “libertarian” think tanks delivering these defenses are no longer libertarian in any meaningful sense. Libertarianism once meant freeing markets and empowering individuals. Today, these institutions function as aristocratic libertarianism: freedom for capital, discipline for labor, abundance for the donor class, austerity for everyone else. This purpose is served regardless of the researcher’s political history (Winship was a Democratic strategist) because of the institutional necessity of defending the financial status quo that funds the think tank. The left and the right elite have come together to defend themselves against the deplorables whose dubious moral character is the source of their failings. It was imperative to be able to respond to donors confronted with the piece that the answer to the question was, “No, you’re not the baddies.”

This is why Winship’s piece goes out of its way to insist that poverty has plummeted, that only 1.6% of Americans are truly struggling, and that rising asset values are a sign of prosperity rather than a sign of exclusion. That 1.6% figure comes from Burkhauser et al., who achieve it by imputing the cash value of non-cash benefits (like SNAP and Medicaid) received by the officially poor. Ironically, it is precisely the methodology that creates the Valley of Death: by adding the value of benefits received by the poor, it proves those working to escape poverty—who lose those benefits entirely—are, in many ways, financially worse off than those who accept their lot and rely on the state to supplement their incomes.

The Mockery Machine was invoked to erase the contrast between your grandparents’ one-income middle-class stability and your two-income precarity.

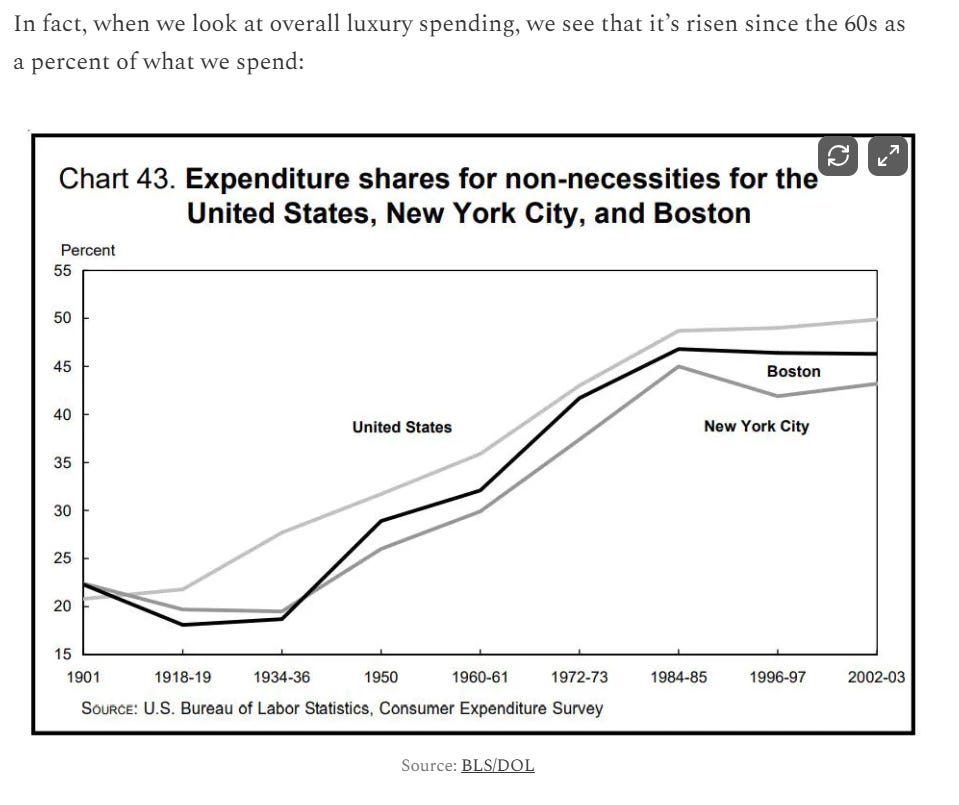

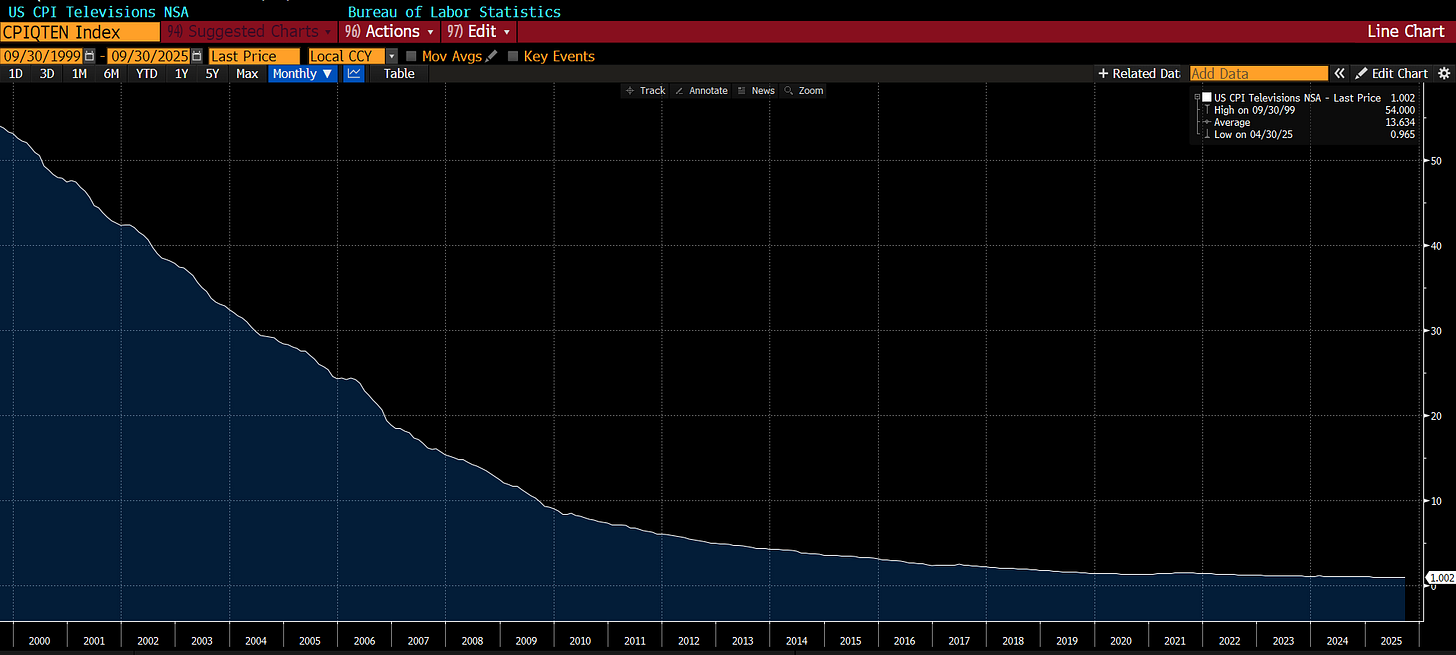

Winship’s most aggressive attack hinges on Engel’s Law—the empirical observation that as people get richer, the percentage of their income spent on food falls. He argues that the declining food share proves America is richer. This is fatuous. It is not an argument against the multiplier, it is an argument against the Consumer Price Index (CPI) fitness for this purpose. The CPI is not designed to measure the cost of middle-class participation; it measures price changes in a shifting basket of goods, not the cost of entry into stability. The CPI index that is used to update the poverty line systematically understates the cost of middle-class existence because it is heavily weighted toward tradeable manufactured goods (like TVs and apparel) whose prices have collapsed due to the diffusion curve of technology. These goods enter the market as luxuries whose prices must fall for broad adoption, thereby lowering the CPI denominator even though the poor do not benefit until much later. Noah Smith helpfully illustrates this in his post:

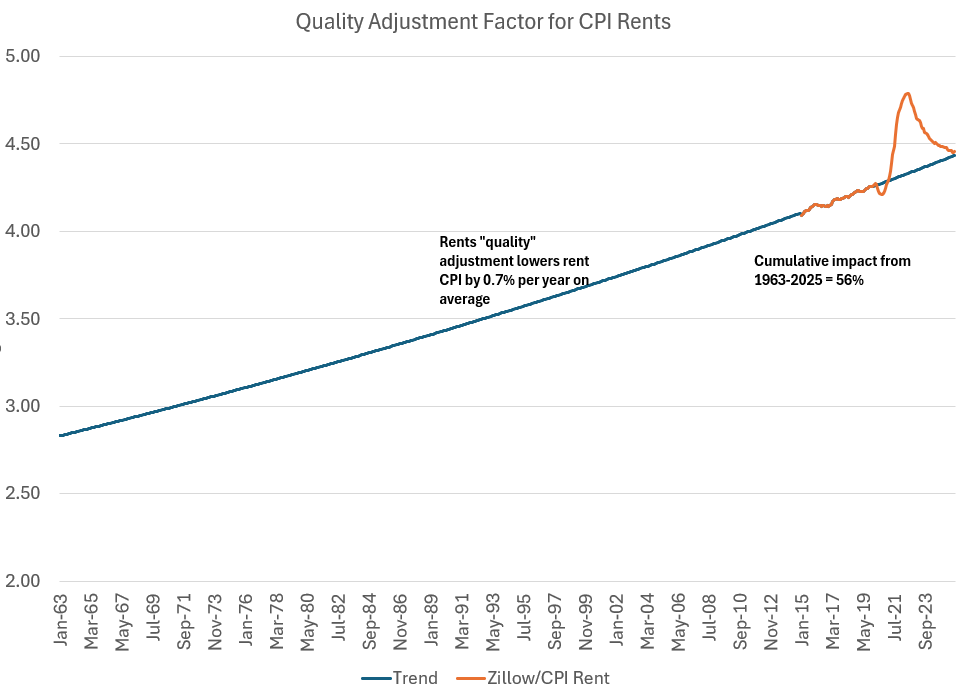

That is absolutely correct. Luxuries like air conditioning, which were not common in 1960, became common by 2002. But poor people who didn't have air conditioning in 1960 didn’t benefit from the decline in price. Instead, the BLS adjusted “rents” CPI lower to reflect that more units had air conditioning (and extra bathrooms, larger size, etc). While I agree that these quality improvements benefited the rental EXPERIENCE, they did not actually lower the COST for consumers. We can see the empirical evidence in the difference between the short history of Zillow’s measure of rents (which ignores quality adjustments and the lagging character of owner’s equivalent rent) and CPI Rent of Primary Residence, which rises more slowly with that hedonic adjustment. You can see the wild variation with Covid and the aftermath, but the trend difference over time is simply this quality adjustment the BLS makes. Critically, there is no “CPI conspiracy” — the BLS is not trying to lie to you. They are just different measures for different purposes. Zillow is tracking ACTUAL rents for industry purposes; the BLS is tracking IMPUTED rents to evaluate economic activity. The think tank insistence that the CPI is the “right” methodology for these purposes simply does not hold water.

A flat-screen TV that cost $5,000 in 2000 costs $300 today, and CPI calculations include this decline. But no lower-income family was buying $5,000 flat screens in 2000. In fact, I distinctly remember choosing NOT to buy a 32” flat panel in 1999, because the 32” Sony Trinitron tube TV was a “mere” $599. Last year, I paid $599 for a 65” 4K flat panel TV. According to CPI, my TV costs 1/54th as much; according to my checkbook, it was the same.

As others have noted, it’s great that the 1963 basket is so much higher quality than the 2025 basket that it’s “worth” much more, but it’s illegal to buy the 1963 basket. Seriously, try buying a car that uses leaded gasoline and bias-ply tires without power steering and anti-lock brakes at your local dealer; your local inspection station might have some thoughts on that as well.

No amount of cheap electronics can afford a family a house in a good school district. The non-tradeable, gatekeeping costs of stable participation—housing in a functioning school district, healthcare, and childcare—have inflated at rates far above CPI. Engel’s Law is thus evidence for my thesis: the food share collapsed because the denominator (total household consumption as measured by the CPI) was distorted by increasingly cheap luxuries, while the numerator (the essential cost of survival and stability) exploded relative to wages. Winship is defending a measurement that substitutes a powerful smartphone for a landline and concludes that I can afford a home.

Scott DOES have an important point. To Scott and his acolytes, we offer this bridge: We agree that work should be the primary engine of mobility and that stable families are the bedrock of a functioning society. We do not seek a future of permanent dependence on the state. However, Winship’s work relies on a fundamental assumption: that the math of the sequence still works. When the cost of basic participation (the Precarity Line) exceeds the median wage, work ceases to be a pathway to autonomy and becomes a pathway to burnout (”Operational Insolvency”). You fear that unconditional aid will destroy the will to work; we are telling you that the broken balance sheet has destroyed the perceived reward for work. If you truly want to incentivize labor and marriage, you must stop tweaking tax credits to distract from our regressive tax system and actually dismantle the gatekeeping costs—housing, childcare, and healthcare—that have turned the American Dream into a financial trap. We cannot “nudge” families into solvency when the price of admission is structurally insolvent. Fix the floor, and the incentives will follow.

3) The Wealth Lie

Your primary house isn’t an asset. Your degree isn’t an education. And the “Great Wealth Transfer” is a hospice bill.

Up to this point, I’ve audited the Income Statement of the American Middle Class. We crunched the numbers and found that the “Real Poverty Line”—the cost of basic participation in the economy—is roughly $100,000.

Because the Income Statement is broken, and people aren’t THAT stupid, the system had to shift the narrative to the Balance Sheet. To hide the decline in the standard of living, they pointed to the rise in asset prices.

“Don’t worry that you can’t pay the bills with your salary,” they said. “Look how rich your house is making you!”

This is the second, and perhaps more dangerous, lie.

They are confusing Inflation with Wealth.

If you own a painting and it goes from $1,000 to $1,000,000, you are now wealthy. You do not need the painting to survive. You can sell the painting, buy a house, and live off the proceeds.

But if the home you live in goes from $200,000 to $1,000,000, you are not wealthy, because the replacement home also costs $1M. You are trapped. You cannot sell the house and take the profit, because you still need a place to sleep, and the house across the street also costs $1,000,000.

You haven’t gained purchasing power. You have simply experienced a revaluation of your Cost of Living.

We are going to Mark-to-Market the “assets” that the middle class thinks they own—Housing, 401(k)s, and the future inheritance from the Boomers.

And we are going to discover that what we call “Middle Class Wealth” is actually just a capitalized liability.

The Housing Trap: Mark-to-Market Misery

Economists love the “Wealth Effect.” They believe that when Zillow says your house you bought for $200,000 is worth $800,000, you feel rich and spend money.

Let’s look at that $800,000 house.

If you sell the house to “realize” your wealth, you are homeless. You must enter the market to buy a replacement machine. But because all the machines repriced in correlation, your $600,000 gain is immediately consumed by the purchase of the new, equally expensive house.

The only way to unlock that wealth is to:

Die.

Downsize (move to a cheaper region, sacrificing income/opportunity/quality of life).

Borrow against it (HELOC or reverse mortgage), which turns your equity back into debt.

All three represent either a loss of utility or a conversion back into debt.

For the middle class, rising home prices are not “Wealth Accumulation.” They are Asset Price Inflation. We have confused the capitalized cost of future rent with an asset. When housing prices triple relative to wages, we haven’t made homeowners rich; we have made non-owners poor. We pulled up the ladder and called it “Net Worth.”

The “Great Wealth Transfer” Lie (You Won’t Inherit the House)

Whenever I point out that the young are broke, economists point to the “Great Wealth Transfer.” They tell us that Baby Boomers hold $78 trillion in assets, and soon that money will flow down to Millennials and Gen Z, fixing their balance sheets.

This is the biggest lie of all.

That wealth is not going to you. It is going to the healthcare system.

In 1955, elder care was “non-market” labor. Grandma lived in the spare bedroom. The cost was space and food.

In 2025, elder care is a financialized product.

Assisted Living: $5,500 – $8,000 per month.

Nursing Home Care: $9,000 – $12,000 per month.

Memory Care: $10,000+ per month.

That $800,000 house your parents own—the “nest egg” you are counting on as you count out cyanide pills — isn’t paying out. If your parents require memory care or skilled nursing for five years (not uncommon), that costs roughly $600,000 to $700,000 ($657,915 is the national median).

The house doesn’t go to you. It gets sold to pay the facility.

And if they run out of money and go on Medicaid? The government aggressively recovers costs from their estate. In many states, Medicaid puts a lien on the house. When they pass, the state takes the equity.

The truly affluent, those with complex estate planning and multi-million dollar portfolios, are skilled at this game; they shift wealth into perpetual trusts or transfer assets outside the five-year Medicaid look-back window. But we are speaking of the American middle class. For the vast majority whose net worth is illiquid home equity—and who lack the millions for complex legal planning—their home is the asset targeted first by long-term care costs. For the plurality of Boomers, they are too wealthy to qualify for full Medicaid support but not wealthy enough to afford the long-term care insurance or sophisticated legal strategies that would insulate their primary residence. Their home equity is not a legacy asset; it is simply a timing risk waiting to be triggered by a single catastrophic health event. The Great Wealth Transfer isn’t a transfer from Boomers to Millennials. It is a transfer from Boomers to Private Equity-owned Healthcare REITs. You aren’t inheriting a fortune. You are inheriting a hospice bill.

The 401(k) Mirage: Exit Liquidity for the Rich

Then there is the stock market. “The S&P 500 is up 25%! Americans are prospering!”

Who is prospering?

The Federal Reserve’s data on “Corporate Equities” shows that the Top 10% hold roughly 87% of business equity. The Bottom 50% own roughly 1% of corporate equity.

The middle class doesn’t own “The Market” in the way the wealthy do. They don’t own controlling interests or private shares. They own Target Date Funds. They own a 401(k)—a vehicle designed to replace the defined-benefit pension.

Pension: A promise of future cash flow, backed by the employer’s balance sheet. (Asset: Security).

401(k): A promise of future volatility, borne entirely by the employee. (Asset: Hope).

For the working class, the 401(k) is not capital. It is Deferred Consumption. It is wages you were forced to save, flow-weighted into passive indices, gambling that the valuation in the year 2040 will be high enough to sell to the next generation.

But it gets worse.

The financial industry is working aggressively to get Private Equity into 401(k) plans.

They need a buyer who doesn’t ask questions. They need a buyer who buys automatically every two weeks, regardless of valuation. By stuffing Private Equity into 401(k)s, they are solving their liquidity problem with your retirement money. You are serving as the direct exit liquidity for the ruling class.

We have built a retirement system that requires the next generation to be rich enough to buy our assets, while simultaneously building an economy that ensures they will be too poor to afford them.

That isn’t a retirement plan. It’s a Ponzi scheme running out of new entrants.

The Real Asset: The Rise of “Caste”

If housing is fake wealth (pre-paid rent) and the 401(k) is concentrated at the top, what is the actual asset that differentiates the winners from the losers in 2025?

It isn’t money. It’s Access.

In the old economy (The Ladder), you could get rich by building a better mousetrap. In the new economy (The Castle), you get rich by getting permission to enter the gate.

This is why the “Harvard Put” is the most valuable option in America. College is no longer about education. It is about sorting.

The State School Degree: Signals “Worker Bee.” You get a job, you pay your taxes, you stay in the Valley of Death.

The Elite Degree: Signals “Prince.” You get access to High Finance, Big Tech, Big Law—the sectors where the currency is equity, not wages.

The “Asset” is the credential. The Insta photo from Meadow Lane grocery in NYC. The Wharton degree. The Birkin bag. And the cost of acquiring that asset has hyper-inflated faster than housing or healthcare. And it’s not just the sticker price — it’s the club sports, tutoring, test prep, afterschool activities, parentally-sponsored charitable activities to pad the resume, the global travel to build perspective, the brand clothing to signal affiliation, the therapist to address smartphone and social media-induced mental health issues… “Don’t worry, you got this. We’ll be on the golf course. Call us only if it’s an emergency.”

A family earning $150,000 can afford “survival”. They cannot afford to buy their children a seat at the table.

From Class to Caste

We are witnessing a phase transition in American society: The shift from Class to Caste.

Class is defined by income. It is fluid.

Caste is defined by credentials and access. It is sticky.

The “Wealth Lie” is the story we tell ourselves to hide this transition. We point to the rising home prices of the Boomers and say, “Look, the middle class is rich!” But that Boomer wealth is trapped. It cannot be used to buy entry into the new Caste system for their grandkids, because the price of entry (The Elite Credential) has risen faster than the price of the house.

The $140,000 income line in Part 1 was just the entrance fee.

The American Dream wasn’t about “Net Worth.” It was about Mobility.

By inflating asset prices, we didn’t create wealth; we destroyed mobility. We turned the ladder into a drawbridge, raised it up, and told the people stuck outside to be grateful that the castle looks so expensive.

The Conclusion: Unwinding the Trade

So, we have a broken Income Statement (Part 1) and a fake Balance Sheet (Part 2).

We have a population that is cash-flow poor and asset-rich on paper, trapped in a Caste system that is calcifying rapidly, while the decay is defended by the cognitive elite. They are the ones taking the actual story and flipping the headline:

The anger you see on Twitter, the populism you see in the voting booth—it isn’t “vibes.” It is the rational reaction of market participants who realize the game is rigged.

But rigged games can be fixed.

We have audited the books. Now it’s time to restructure the company. To steal from another billionaire turned philosopher, “It’s time to build.” We are a nation of builders.

End