Part 1: The Summer Slide Economy

Why Talent Goes Extinct on a Dirt Road

It’s been a busy week, and we’re going to leave this one above the paywall again. I think I’ve earned it.

There are FOUR parts to this piece, the first three are brief, but important.

(1) An update on the search for candidates with a follow up discussion with Phil Andrew, who remains the sole candidate I’ve found that I can completely endorse. Several of my readers went to Phil’s congressional campaign site and came back complaining about his concerns on ICE. Long before the current headlines, Phil made a prescient call regarding the degradation of training standards at ICE. He warned that you cannot slash training curriculums—reducing months of instruction to mere weeks—and expect a professionalized force capable of handling complex enforcement scenarios. We are now seeing the results of those decisions. Phil breaks down exactly why "enforcement" without "professionalization" is a liability, not an asset.

Competent expertise proves prophetic. Funny how that works. Check out my most recent video, and please, please help. We face an uphill battle in restoring our Republic. We will NOT keep it under the current trajectory. One voice can make a difference. If you know anyone in Chicago, and remember it’s Chicago, so both the living and the dead vote, please forward the video.

(2) A brief update on markets

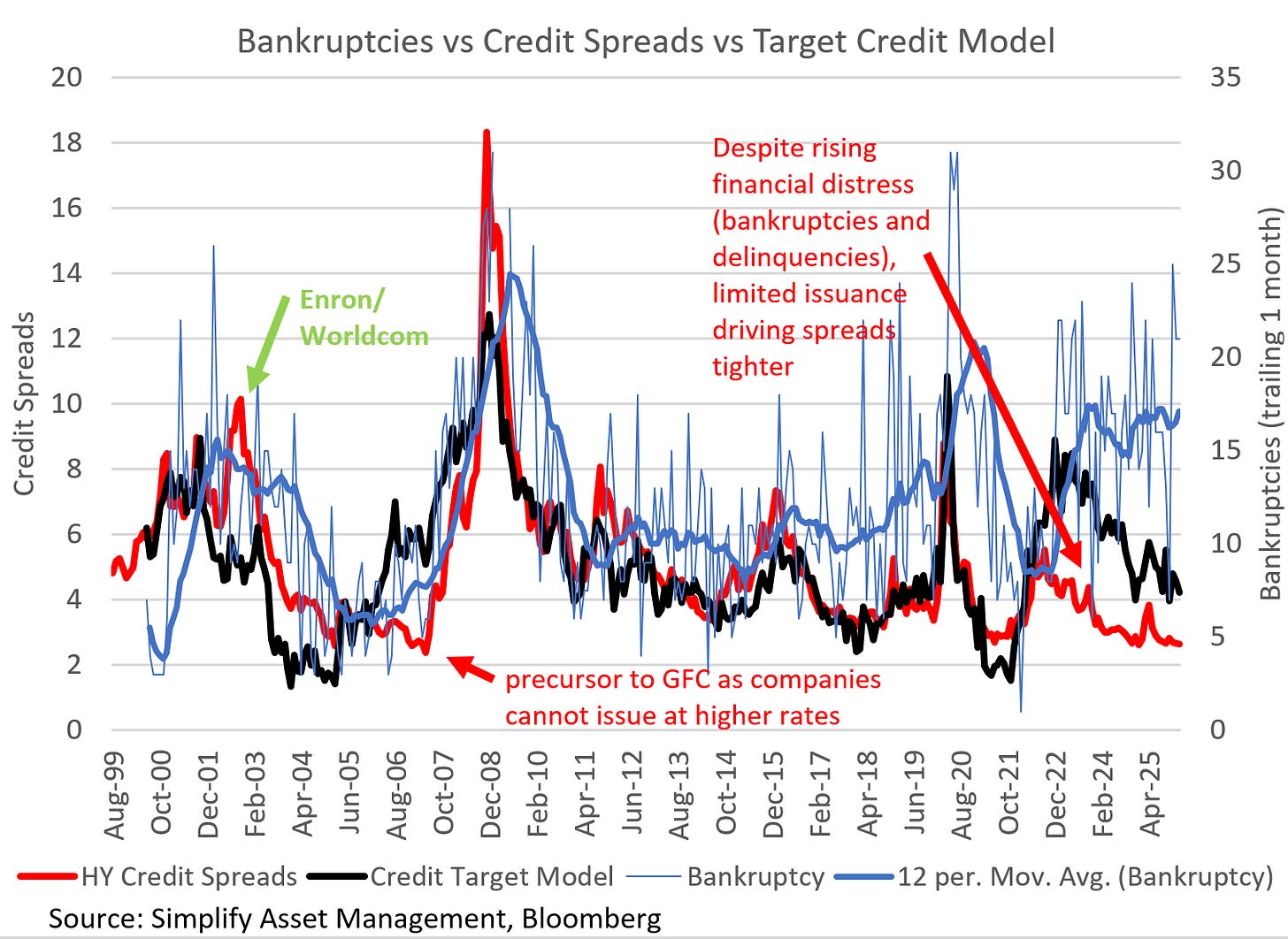

What I am watching VERY closely is the uptick in credit spreads as we see growing awareness that lending to the SAAS/software complex is metastasizing. Credit spreads ticked higher this week even as the cyclical elements of the economy are showing signs of life. I continue to think we’ll see the economy turn lower, but at least headline data says I’m wrong (PMI rebounds). Bankruptcies, credit card delinquencies, auto delinquencies, etc continue to march higher.

(3) A full-throated endorsement that ALL readers check out Marco Rubio’s speech at the Munich Security conference. There are adults in the room and this articulation was brilliant.

For the last few decades, we have lived under the “End of History” delusion—the idea that unfettered free trade and financialization would inevitably lead to global peace. Rubio’s speech was a systemic dismantling of that failure. He didn’t just offer “America First” slogans; he offered a coherent, intellectual rejection of the policies that deindustrialized the West and hollowed out our middle class.

Rubio explicitly linked the “euphoria” of globalization to the fragility we face today. This is the exact argument I have been making regarding market structure and labor arbitrage: when you prioritize efficiency over resilience, you lose your sovereignty. To hear this articulated from the podium in Munich—framing America not as a separate entity but as a “child of Europe” that must save the West from its own managed decline—signals a return to competence in US foreign policy that is deeply aligned with my own views.

Which brings us to the main event. As compensation to paid subscribers, the full code for all simulations is below the paywall. Have fun!

(4) The Achilles Heel — the domestic economy. I am not worried about our ability to win based on capacity. Nor am I quite as hyperbolic as Alex Karp (I have my own special hyperboles). Like most “foes”, China’s strengths are overstated. Their vulnerabilities are often ignored. We can win, but only if we build a system at home that utilizes the best of all of my fellow citizens. And to do that, we have to stop gaslighting. Milton Friedman, The Chicago School, and the Business Lobby took us on a fifty-year detour that threatens the foundations of our society. We can reclaim it, but first we must understand what we have lost. So let’s slide into summer…

Part 1 (of 3): The Summer Slide Economy

We tell ourselves a comforting story about success. It goes like this: The economy is a sorting mechanism. “Talent” (intelligence, grit, risk-tolerance) naturally rises to the top. If you are smart and unafraid, you will win. Everyone else is just drafting off your wake.

It is a seductive narrative. But it is physically wrong.

I didn’t arrive at this conclusion by debating philosophy. I arrived here by looking at the data—specifically, by trying to understand why poor kids fall behind rich kids, even when they are just as smart.

The “Twin Study” Sleight of Hand

To sustain the meritocratic narrative, defenders often point to Twin Studies. They cite data showing that identical twins have similar IQs, and then, in a magician’s sleight of hand, insist this proves that Wealth is genetic.

They are conflating the engine with the road.

While IQ has heritable components, Wealth is not a biological trait. It is an environmental condition. The most rigorous recent work on this, such as Fagereng, Mogstad, & Rønning (2020), uses adoption data to sever the biological link. Their finding is stark: Genes explain very little of who gets rich. Inheritance—specifically the ability to accumulate assets without interruption—explains almost everything. A more accessible version that extends the dataset to the UK is available here.

Same Salary, Different Outcome

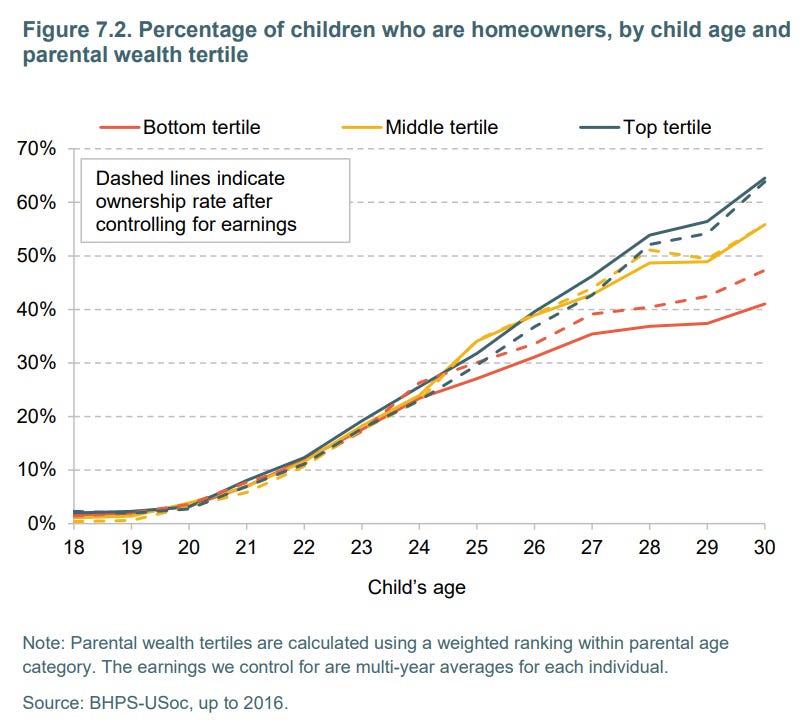

Consider homeownership rates in the UK. When we compare children from wealthy families against children from poor families, we see a massive divergence.

The solid lines show reality: Rich kids buy houses; poor kids rent. But the dashed lines are the smoking gun. They represent a simulation where we control for the child’s income.

The result? Take two 30-year-olds with the exact same job, the exact same salary, and the exact same “grit.” The one with wealthy parents buys a house. The one with poor parents rents. The “merit” (income) is identical, but the outcome is strictly determined by the starting condition.

The Clue: The Summer Slide

This dynamic isn’t limited to housing. Years ago, education researchers stumbled upon a “natural experiment” that explains this perfectly.

They tracked the learning growth of students—high-income vs. low-income—over a calendar year.

During the School Year: When structure, meals, and supervision (buffers) were provided by the state, the learning growth rates of poor kids and rich kids were statistically identical. The “Talent Gap” vanished.

During the Summer: When those buffers were withdrawn, the divergence exploded. Rich kids continued to grow (camp, books, travel). Poor kids stagnated or regressed.

The “Achievement Gap” wasn’t a measure of intelligence; it was the mathematical sum of volatility shocks accumulated over twelve summers.

This led to a terrifying question: What if the entire economy is just one long Summer Slide?

The Simulation: A Thriller in Two Acts

To test this, we built a simulation of the US economy. We didn’t program it with ideology; we programmed it with the physics of Geometric Growth subject to Volatility.

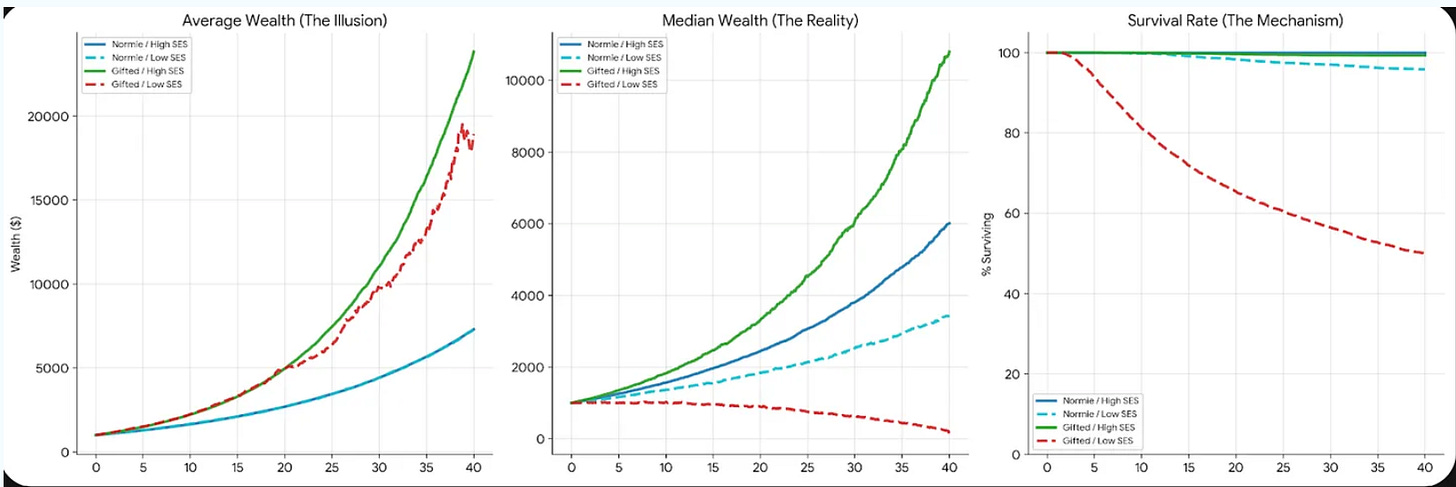

Phase 1: The “Talent” Extinction Event We started with a world of “Pure Meritocracy.” No taxes, no safety nets, just raw probability. We created “Gifted” agents (High Return/High Risk—think Ferraris) and “Normie” agents (Low Return/Low Risk—think Camrys).

The Result? The “Gifted Poor” went extinct. While the Average Wealth of the talented group skyrocketed (driven by a few lucky survivors), the Median Wealth told a horrifying story. The typical “Gifted Poor” agent ended up poorer than the “Normie Poor.”

Why? Because high-risk strategies are geometrically unstable. Without a buffer to absorb the shocks, the “Gifted Poor” hit zero (bankruptcy) at nearly 25x the rate of the “Normie Rich.” The market didn’t select for Talent; it selected for Low Variance. The Ferrari breaks an axle on a rough road.

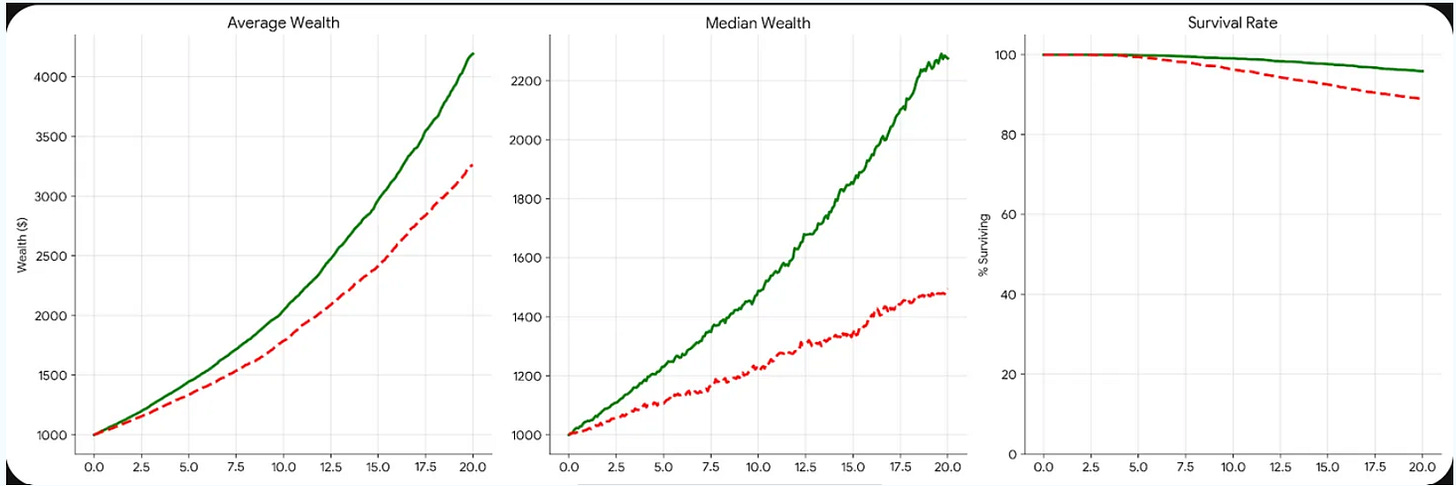

Phase 2: The “Volatility Tax” Next, we modeled the impact of random life shocks—unemployment, health crises, or family emergencies.

High SES (Buffered): When a shock hits, they pause. They rely on savings or family support to smooth the blow.

Low SES (Unbuffered): When a shock hits, they crash. They are forced to liquidate assets, take predatory loans, or move homes.

The result was a divergence engine. Even with identical talent and identical income, the Unbuffered group fell permanently behind. Inequality wasn’t driven by who worked harder. It was driven by who paid the Volatility Tax.

The Cliffhanger We had proven that volatility kills talent. But our simulation was still missing the most expensive parts of real life: Eating and Children.

When we added those to the model, the results went from “unfair” to “catastrophic.”

Part 2: “The Rise of the Gerontocracy” next week.