Out of Sight, Out of Loan

Hidden Leverage and Non-Depository Financial Institutions

Summary

Shift in Leverage from Traditional Margin Debt to NDFIs:

Despite equity markets reaching new highs, traditional margin debt has not recovered. Instead, leverage has shifted into non-depository financial institutions (NDFIs) like private equity firms, private credit funds, and derivative-based ETFs/mutual funds.

SEC Rule 18-f facilitated the growth of leveraged ETFs and mutual funds, enabling institutions to access cheaper leverage (e.g., 5% vs. 12% margin rates), effectively replacing retail margin lending with institutional leverage inside NDFIs.

Massive Growth of NDFI Credit Creation:

Over the last five years, NDFI credit creation has averaged 10% real annual growth, while traditional bank lending has declined in real terms.

Regulatory Wake-Up and Potential Impact:

Recent regulatory actions in late 2024, such as the OCC limiting collateral treatment for single-stock ETFs and crypto assets, and the Financial Stability Board (FSB) requiring increased reporting for NDFI lending, indicate a growing focus on the risks posed by NDFI leverage.

These measures could have significant long-term effects on market dynamics, potentially reducing leverage availability and tempering market exuberance, though enforcement and adaptation will take time.

Top Comment

Gina comes in with words of appreciation: “Appreciate the drill down into a great diversification topic. For older head of household finance managers such as myself this helps me rationalize keeping a percentage in market/S&P because the music is still playing and large percentages in TIPS, gold, etc. I “missed” bitcoin but don’t regret it. The advice to worry about your own needs vs jealousy over your perceived neighbors’ profit is excellent. Wall Street wins on our fear and greed. Rational non-exuberance is the way.”

MWG reply: Gina, thanks for the kind words. Adding fuel to the fire this week by highlighting the undisclosed leverage that is permeating the system. If there’s rational non-exuberance at play, it’s eluding me!

The Main Event

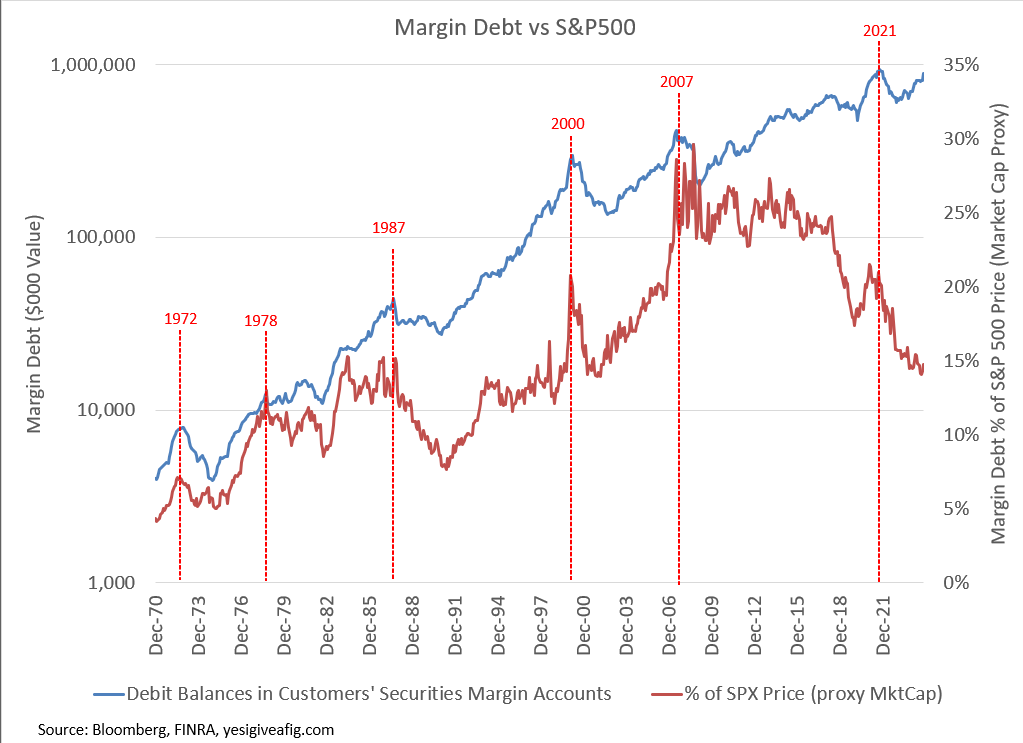

One of the more bullish arguments that can be made is that investors are not adding leverage as they did in prior cycles. One clear example? Margin debt. Despite the S&P500 moving to new highs, margin debt has failed to recover. Without debt-fueled animal spirits, can we really have a bubble?

As they like to say, “Corpus delicti” — where is the body of the crime?

Well, in this case, “I am Spartacus!”

Fine, I’m not ACTUALLY Spartacus… but like many of the significant financial events of the last thirty years, I’m “Spartacus-adjacent” meaning my role in financial markets has meant that I am participating (albeit in a “schoolboy in the back of the photo holding up a goofy V-sign” way) in the very behaviors that are pulling financial markets into a precarious position. We all are — Wall Street is no place for morality and, as the scorpion said to the frog in the classic tale of innate character and the consequences of our actions:

It turns out the “body” is likely contained in the “Non-Depository Financial Institutions” (NDFIs) of the world. While the general perception is that liquidity abounds, we have seen a contraction in bank lending ex-NDFI that is consistent with every prior recession in history:

But within NDFI, credit creation has been huge, averaging 10% real over the last five years while non-NDFI lending is down in real terms:

What’s an NDFI? Thank you, Robot Overlords:

A non-depository financial institution is a financial entity that does not accept deposits from customers as part of its core business. Instead, these institutions focus on providing specific financial services such as investment, insurance, credit, or other financial products. Unlike traditional banks or credit unions, which take deposits and may offer loans or other services, non-depository institutions operate primarily through fees, premiums, or the sale of financial products.

Examples of Non-Depository Financial Institutions

Insurance Companies

Generate revenue through premiums rather than customer deposits.

Investment Companies

Include mutual funds, hedge funds, and private equity firms.

Pool funds from investors to invest in securities, real estate, or other assets.

Revenue is typically derived from management fees and performance fees.