Oops, We Did it Again...

Once again, credit sits at the center of the universe

Top Comment

Menachem comes in hot with a hypothetical:

Ok, let's imagine future success here that passive start being real responsible stewards, the implication is that [equity] price goes down to reflect Buffett/Graham style fundamentals. Holistically, all we would've accomplished is to inform society at large that it isn't remotely as wealthy as it thought (not to mention the industrial impacts of a market liquidity crisis). I humbly suggest that distorted price signal in markets isn't actually the core problem with passive; it is perhaps more key to connect market failure to the real economy implication. Distorted market price is the self-referential means by which we're promising Main St their retirements. We've accidentally created a Wall St Ponzi that uses inflated numbers to trick future retirees into believing that their future consumption needs can be met by current productive capacity. It can't. I don't see how making Blackrock and Vanguard do XYZ fixes the ever looming issue of tomorrow's consumption>production. My simple-minded intuition is that if we can start making and distributing enough cars and houses and food and energy, then later we can figure out a way to to shuffle the numbers, otherwise, we're gonna be screwed regardless of how efficient financial markets will be.

MWG Response:

Menachem, I somewhat agree. The unfortunate reality is no ONE individual needs a car, a modern house, or even modern energy. As any number of survivalists can tell you, 40 acres and a mule will make you self-sufficient… as long as you have some chickens, a well, solar panels, a couple of cows, a nearby general store, etc. That would allow roughly 30MM households to live moderately better than they did in 1865.

But given we have 132MM households in the United States the issue of “sustainable” levels of production are important to 102MM households — and the 30MM households they would kill to get their stuff should probably care as well. The requirement of division of labor to maximize production has never been greater (and will be greater still tomorrow).

As now discredited SEC Chair Gary Gensler once observed:

“Since antiquity, finance has been about the pricing and allocation of money and risk throughout the economy. There are those who have money who want to invest it. Others need money to fund good ideas, buy a house, or help get through life’s inevitable challenges. There are those who have risk but don’t want to bear it, and others willing to take on that risk.

Finance sits in the middle, like the neck of an hourglass whose grains of sand are money and risk.

Finance depends on data.

It’s with data that investors and issuers on either side of the hourglass participate in markets. It’s with data that the intermediaries who sit at the neck of the hourglass help price and allocate money and risk. Intermediaries don’t just sit passively passing the sand through the hourglass. They become important market participants themselves. They retain and transform money and risk. They also accumulate significant amounts of data on markets, pricing, and risk.”

And so you are right… it’s not the finance that matters, it’s the real world implications of bad data.

The Main Event

This is going to be a ridiculously long piece. Feel free to split it into two parts. Or simply not read it at all. I’ve included a full note discussing the incredibly important data that is FINALLY emerging on household credit. I’ll discuss corporate credit probably next week, but that looks little better. At the heart of every great fortune lies a great crime… and at the heart of every great credit crisis lies a great lie. The “cleansing” of credit records and credit reporting associated with the Covid pandemic was our great lie. Without bad behavior reported, as any resident of a major American city can tell you, bad behavior multiplies. And boy do a lot of people need a good spanking. Don’t be too eager to celebrate their comeuppance. They’re coming for you as well.

Part 1 is the traditional note; Part 2 is the book. Part 1 is timely; Part 2 is…

And with that, let’s dig in…

Listen, my children, and you shall hear

Of the midnight ride of the Tariffs near,

On April 2nd, expect fiscal gloom,

When the markets return to the trading room.

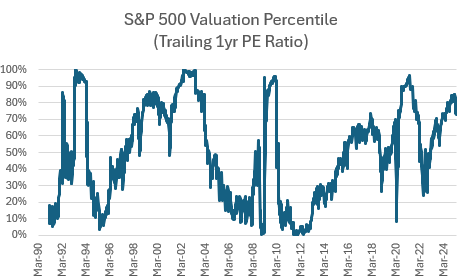

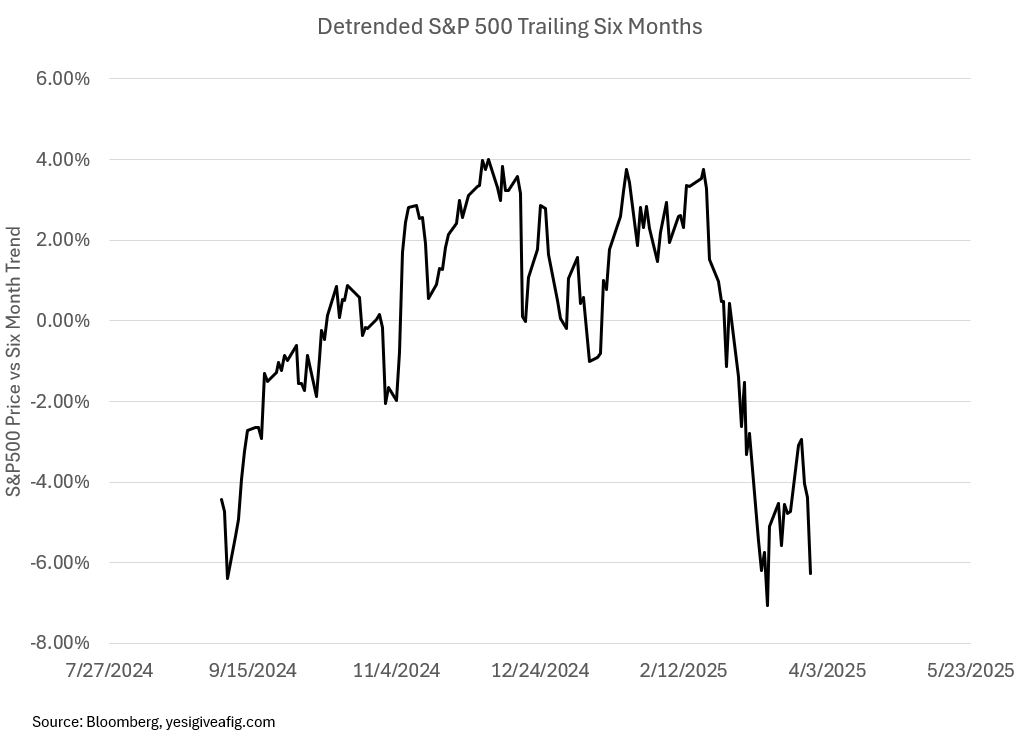

Well, the moment of truth has arrived. This week, we get the tariffs (we think) and Wall Street is in a panic. Valuations have plunged at a pace unseen in the modern era. Children have again begun hiding behind their mother’s pantsuits.

“Don’t worry, child… it will be OK… We own a village”

Occasionally the world seems far too inevitable. A Republican president advocating for retaliatory tariffs on exporters as a mechanism to offset rising unemployment concerns within the American heartland? What could possibly happen next? It seems so obvious. Oh, I’m not talking about 1930…

This was the actual headline from the March 31, 2007 business section of the NY Times. We obviously remember the housing crisis in 2007. But we forget the rationale for why “Subprime was contained.” By summer 2006, homebuilders were down nearly 50% from highs, and it was “obvious” to many of us that the economy was headed into a recession. Delinquencies were mounting in the household sector, especially in subprime. Danny and Porter began touring real estate, sweating their asses off in the Florida heat and waving hello to crocodiles invested in abandoned swimming pools (a growth biz for 2006):

Lest you think this is a post that “Tariffs won’t be too bad” (possibly because I voted for Trump and therefore must believe everything he does is correct), New Century Financial became the face of the subprime crisis two days after that headline. Greenspan’s “flaw” in his economic philosophy became the centerpoint of later evaluations of subprime:

"I have found a flaw," said Greenspan, referring to his economic philosophy. "I don't know how significant or permanent it is. But I have been very distressed by that fact." "I made a mistake in presuming that the self-interests of organisations, specifically banks and others, were such that they were best capable of protecting their own shareholders and their equity in the firms," said Greenspan.

In other words, “We should have known better.” Fortunately, nothing like that is likely to happen this time:

What? But I thought we were getting Fannie and Freddie out of conservatorship!?!? Nah… the credit quality of the FHA won’t allow it. No matter what Mr. Ackman believes. Let’s dig in…

The story from the post-pandemic period was that “housing was remarkably fine.” and that none of the bad behavior from 2005-2006 reared its head. For heavens’ sake, just look at household debt service ratios — they couldn’t be stronger:

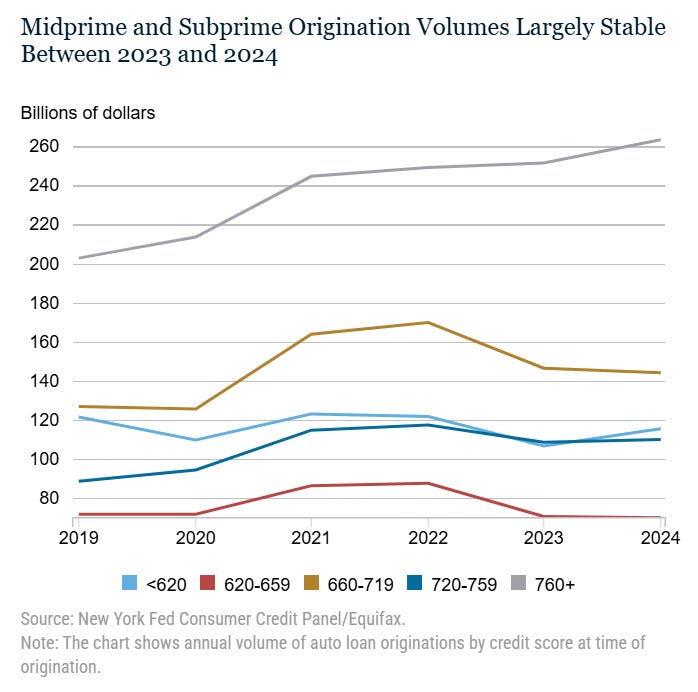

And if we looked at WHO was borrowing in 2020-2023, it was all “higher quality” — in fact, auto loan origination FELL for the lowest credit quality households. Clearly the transfer of income worked and all was well!

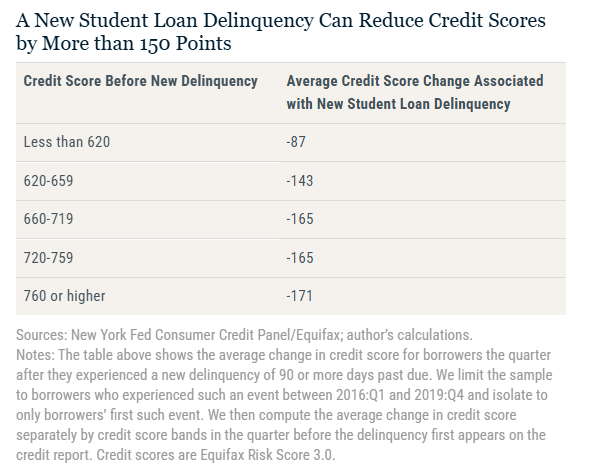

Except now, like Jean-Claude Juncker, we’ve admitted that “When it’s really important you have to lie!” This past week saw one of the most important releases of information since the pandemic with the NY Fed sharing just how fraudulent ALL the data we received over the last five years has been. Those credit scores that were being reported as the “score at origination”? Yeah, they were fake:

The 2020 forbearance marked all delinquent (but not defaulted) loans as current, causing a jump of 74 points, from 501 to 575, in the median score between 2019:Q4 and 2020:Q4 for those borrowers who were previously delinquent but not defaulted. Since then, scores continued to rise for previously delinquent borrowers (as their negative remarks aged) while scores for previously current borrowers remained relatively flat.

Defaulted borrowers saw a gradual rise in credit scores as their negative marks aged and as some borrowers voluntarily rehabilitated their defaulted loans. However, in the fourth quarter of 2022, the Fresh Start program marked all defaulted loans as current, increasing the median score for those with a default in 2019 by 44 points, from 564 in 2022:Q1 to 608 in 2023:Q1. By the end of 2024, those borrowers with loans in delinquency or in default saw scores that were 103 and 72 points higher, respectively, than at the end of 2019.

So those sub-620 households? They went away. Literally disappeared into the 700 club. And yet, guess what? Despite them being labeled “Good Credit” it turns out they had no realistic plans to pay those loans back — unsurprisingly a 600 rechristened as a 650 defaults like a 600, especially after exhausting their newfound credit limits and paying much higher interest rates. A 650 rechristened a 700 behaves like… you guessed it… a 650:

And unfortunately, that’s not the only source of fraudulent credit reporting. The FHA has now informed us that they MIGHT have been modifying mortgages without telling us… for must read reporting on this topic, check out John Comiskey’s recent post. As an aside, the next two Simplify “Keeping it Simple” podcasts will be on the subject of household credit with John Toohig (Raymond James) and John Comiskey himself. Don’t miss them!

The serious delinquency rate for loans that experienced modifications (meant to bring them current) has now exceeded 30%! For reference, the peak in subprime serious delinquency was 27% in the GFC.

And while it may seem that this is an isolated problem, delinquencies have begun to surge for the non-modified mortgages as well. For reference, as of March 2007, the SDQ was 2% for these mortgages — exactly where we are now. It eventually rose to nearly 7%.

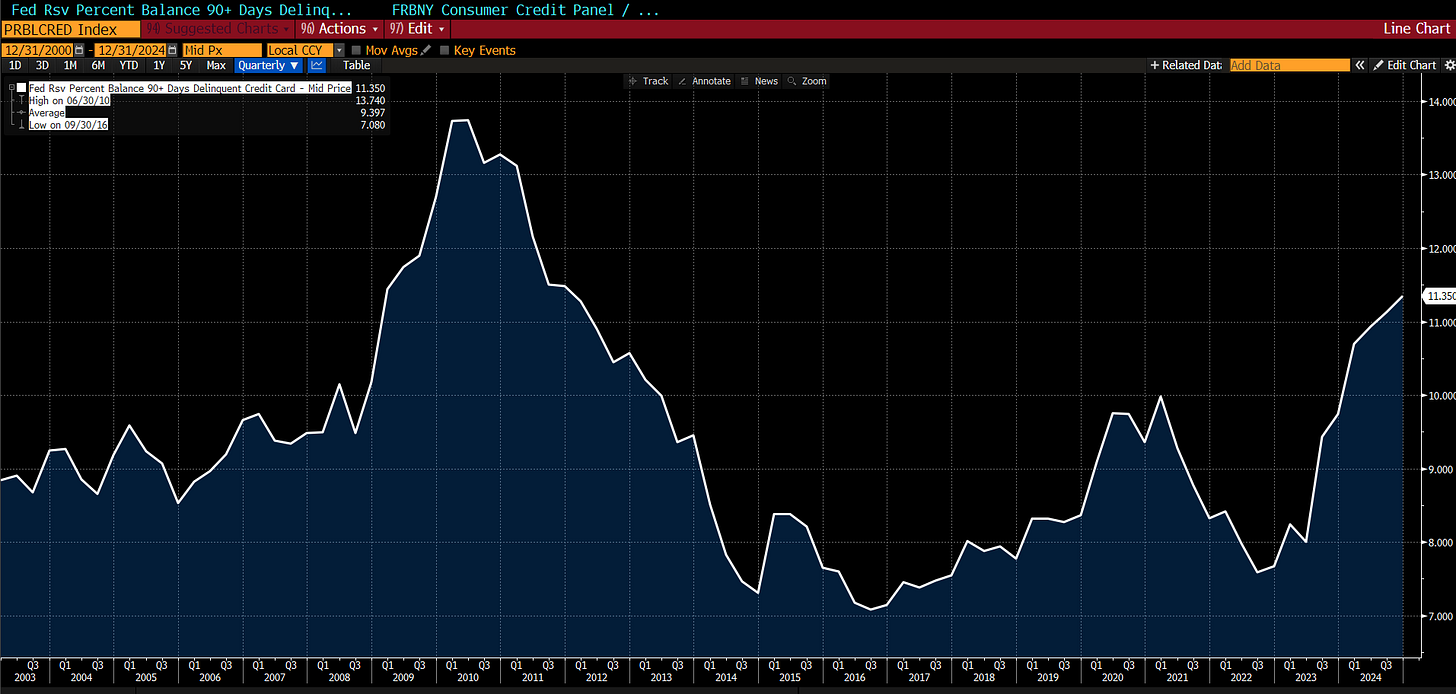

Credit card delinquencies? Nothing to see here. I’m sure they’ll dig themselves out quickly without any help from the government:

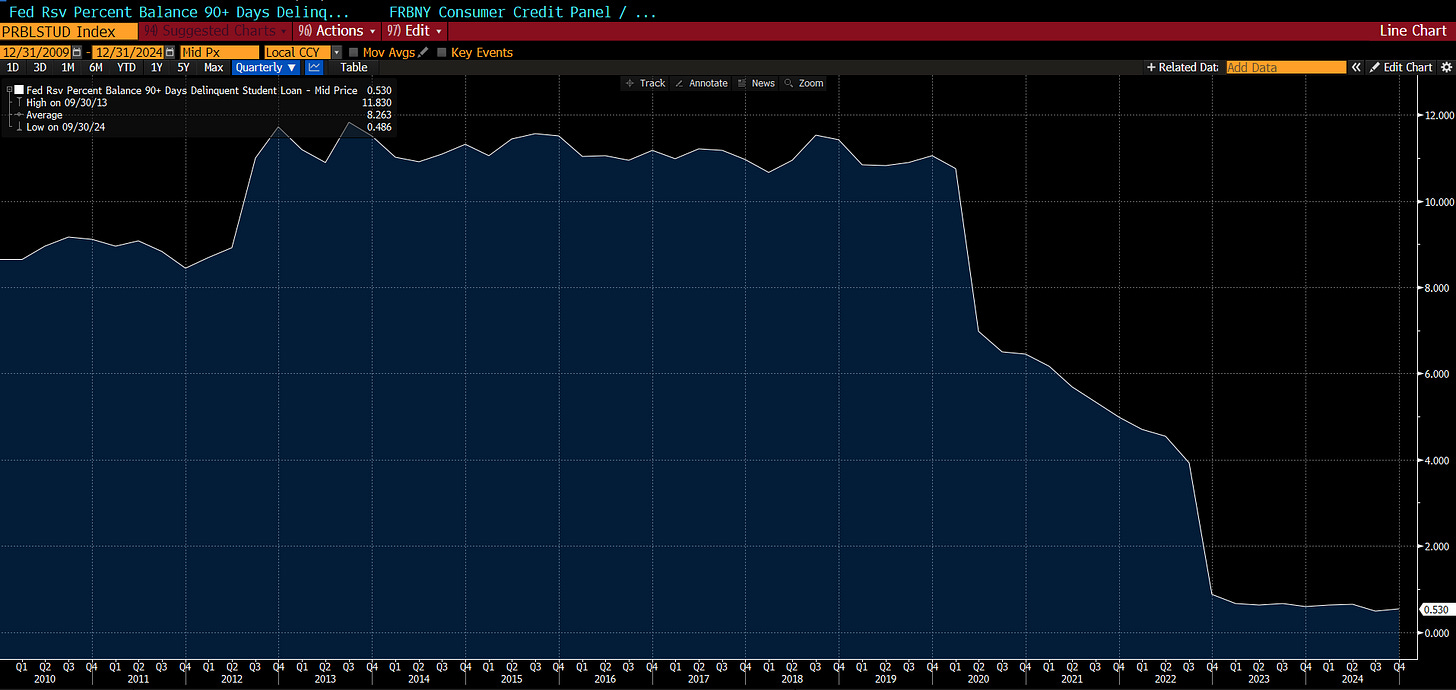

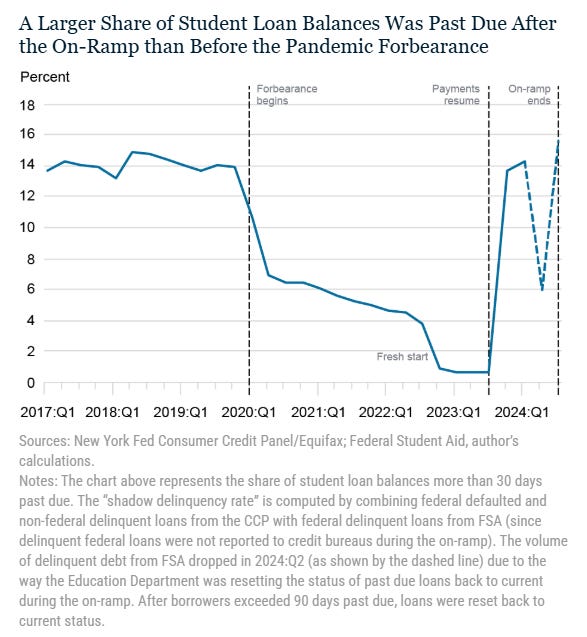

Fortunately, student loan delinquencies remain low:

Ahh… about that… yeah, that’s a lie too:

And that very important piece from the NY Fed outlines the ramifications of JUST the student loan portion coming back into credit reporting:

Can’t be that big of a problem, can it?

Given these estimates, we expect to see more than nine million student loan borrowers face substantial declines in credit standing over the first quarter of 2025. — NY Fed

Now add new reporting from FHA, new reporting from auto lenders, rising economic uncertainty, and… of course… tariffs.

What happens when an economy rechristened “Good Credit” suddenly begins to exhaust that credit and become “Bad Credit”? We’re about to find out. Look out below!