Nothing to Fear But Fear Itself

And fElon... fear him too

“The Fear & Greed Index is a way to gauge stock market movements and whether stocks are fairly priced. The theory is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.”

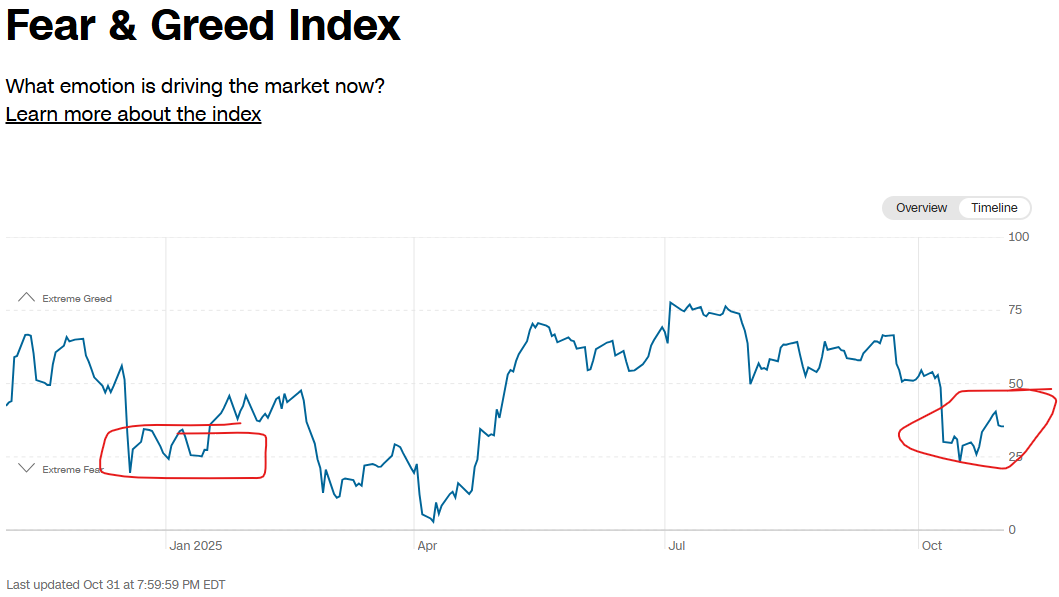

One of the more confusing aspects of today’s market environment is the gas-lighting. CNN has been proudly displaying its “Fear & Greed” index for over two decades, but in the past few months it has been firmly wedded to “Fear” even as markets make continuous new highs — a pattern it showed in early 2025 as well.

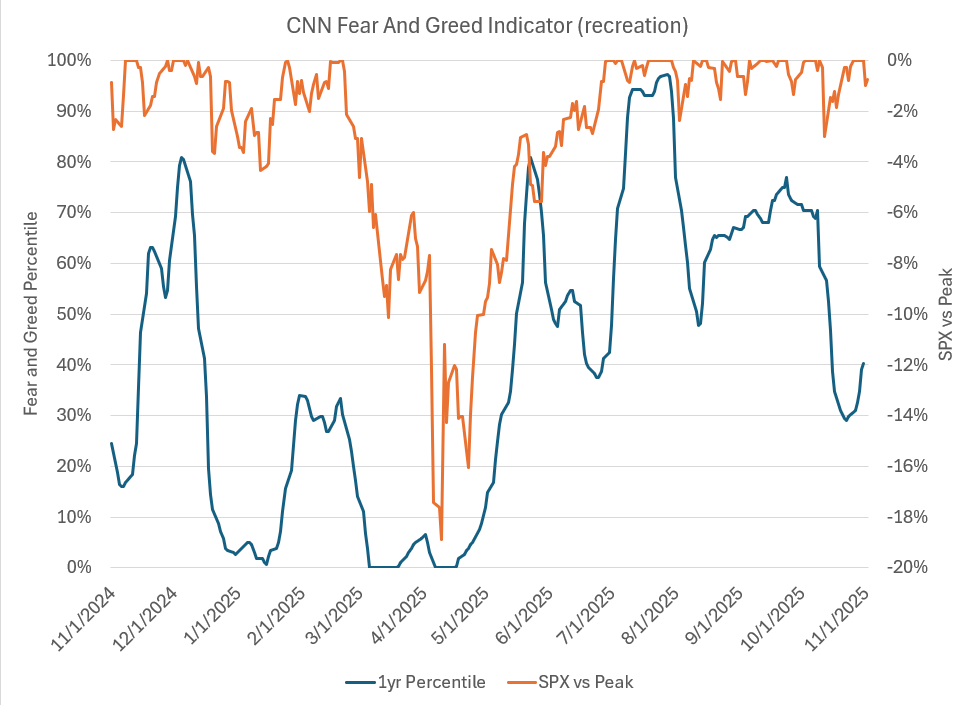

Now I don’t have a great explanation for this — in part, because I can’t replicate the F&G results. My models, constructed from the exact same components, show the market well above levels from January on the “greed” metrics:

So I can’t really explain something I can’t recreate, but let’s be very straightforward — there IS tangible fear in the market now; but it’s fear of the FOMO and the crazy moves we’re seeing in the largest stocks:

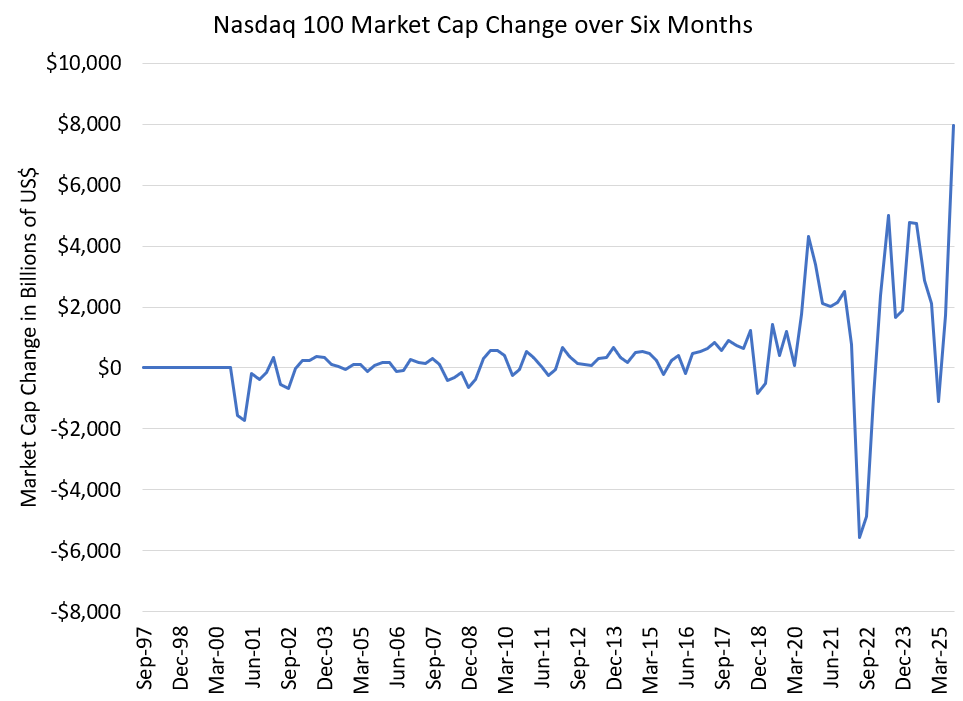

Unfortunately, as we’ve discussed ad nauseaum, the only information contained in these results is not “fear” or “greed” — it’s the Price-Weight Spiral as introduced in Pay Attention to Our Privates.