Leading Lambs

In a passive world, stocks no longer qualify as leading economic indicators

Summary:

All aboard “No Landing”: The Conference Board no longer anticipates a recession for the US economy, shifting its forecast to a slowdown in consumer spending growth and an overall GDP growth deceleration to under 1% in Q2 of 2024

Historical Data Anomalies: Despite the Leading Economic Index (LEI) falling below the typical recession threshold, coincident indicators and the National Bureau of Economic Research (NBER) have not confirmed a recession. This scenario is unique in historical datasets, making current predictions particularly uncertain. Past misjudgments, notably the 2008 recession forecasts that were significantly revised over time, highlight the challenges of relying on initial data and forecasts.

Concerns Over Market Signals and Economic Indicators: Increased reliance on certain economic indicators like stock prices and credit spreads are increasingly dubious due to the growing impact of passive investment strategies. This shift may distort traditional leading indicators, complicating policy decisions.

What I’m Reading/Listening to Now:

Bari Weiss’ latest with Abigail Schrier is a must listen, IMHO. Like all parents, my wife and I made more than our fair share of mistakes. But one constant in our household was a recognition that building resilient kids required NOT coddling them. I taught each of my three to swim; all became ranked age-group swimmers before moving on to various alternative sports (rowing and volleyball). The last one stuck with it and is on the cusp of Olympic Trials.

When they were very young and would come up spluttering in the pool, my response was not “Are you OK?” It was “Are you drinking MY pool?” They would laugh and move on.

As a teacher, my wife consistently shares with me the devastating impact of “mental health awareness” in schools. As Abigail Schrier points out, the “rumination” on “How are you FEELING?” is both a symptom and a cause of depression. Give it a listen with an open mind:

Top Comment:

I’m actually stealing a Twitter DM without attribution to further share the message:

Mr. Green,

I’m reaching out with a more personal question this time for which I believe you just might have some insights on. I feel that in many ways the current market is not too dissimilar from the dotcom bubble, and having been called „the dumbest man alive“ then, I wonder how you lived that period and managed to keep your composure when everything screamed against what you believed. Personally I have been appalled with what has been going on particularly since the introduction of the BTFP facility, and despite having full conviction that these violent delights will face violent ends one way or another, I must admit that I’ve been struggling to hold on during this period and keep any faith in the world. I appreciate any possible advice or thoughts you might be able to share, and wish you a pleasant weekend ahead!

MWG: I sympathize. Remember it’s not “you vs the world.” It’s usually “you versus yourself.” Whether the market goes up or down is irrelevant. Give yourself the grace to be both right AND wrong. Mike

And with that, on to

The Main Event

A few weeks ago, the Conference Board released their February forecast for the US economy which abandoned calls for a recession:

“While we no longer forecast a recession, we do expect the consumer spending growth to cool and for overall GDP growth to slow to under 1% in Q2 and Q3 2024. Thereafter, inflation and interest rates should normalize and quarterly annualized GDP growth should converge toward its potential of near 2 percent in 2025.”

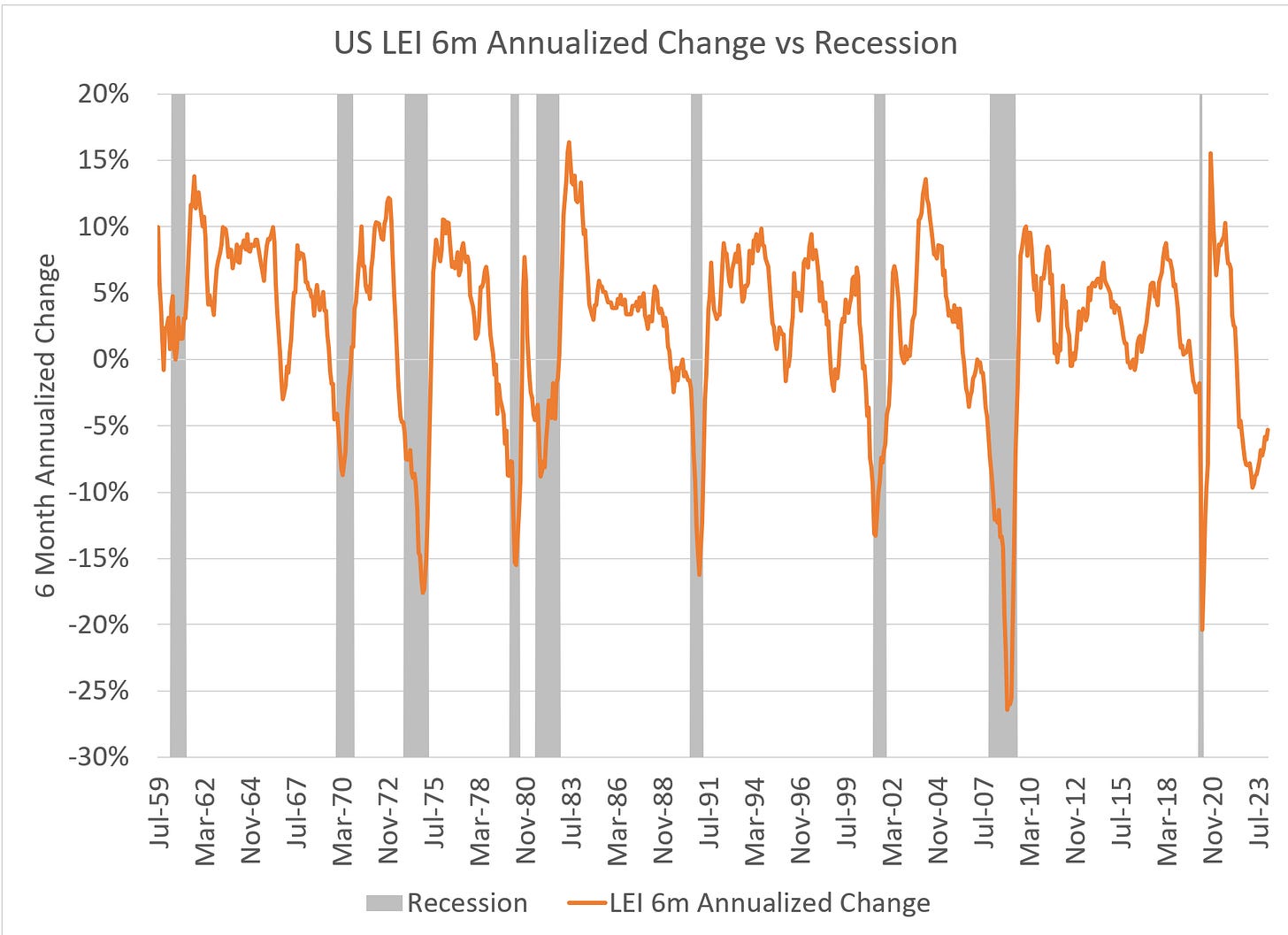

Despite the empirical fact that the LEI had fallen far below the recession threshold, the data has failed to be confirmed by coincident indicators and the NBER.

Extending the data series back over time, there is simply not an equivalent experience. While I warn that this is exercise is somewhat fraught with risk as the datasets for both GDP growth (and recessions) are subject to exceptionally long lags and revisions, once again we discover that “we live in interesting times.”

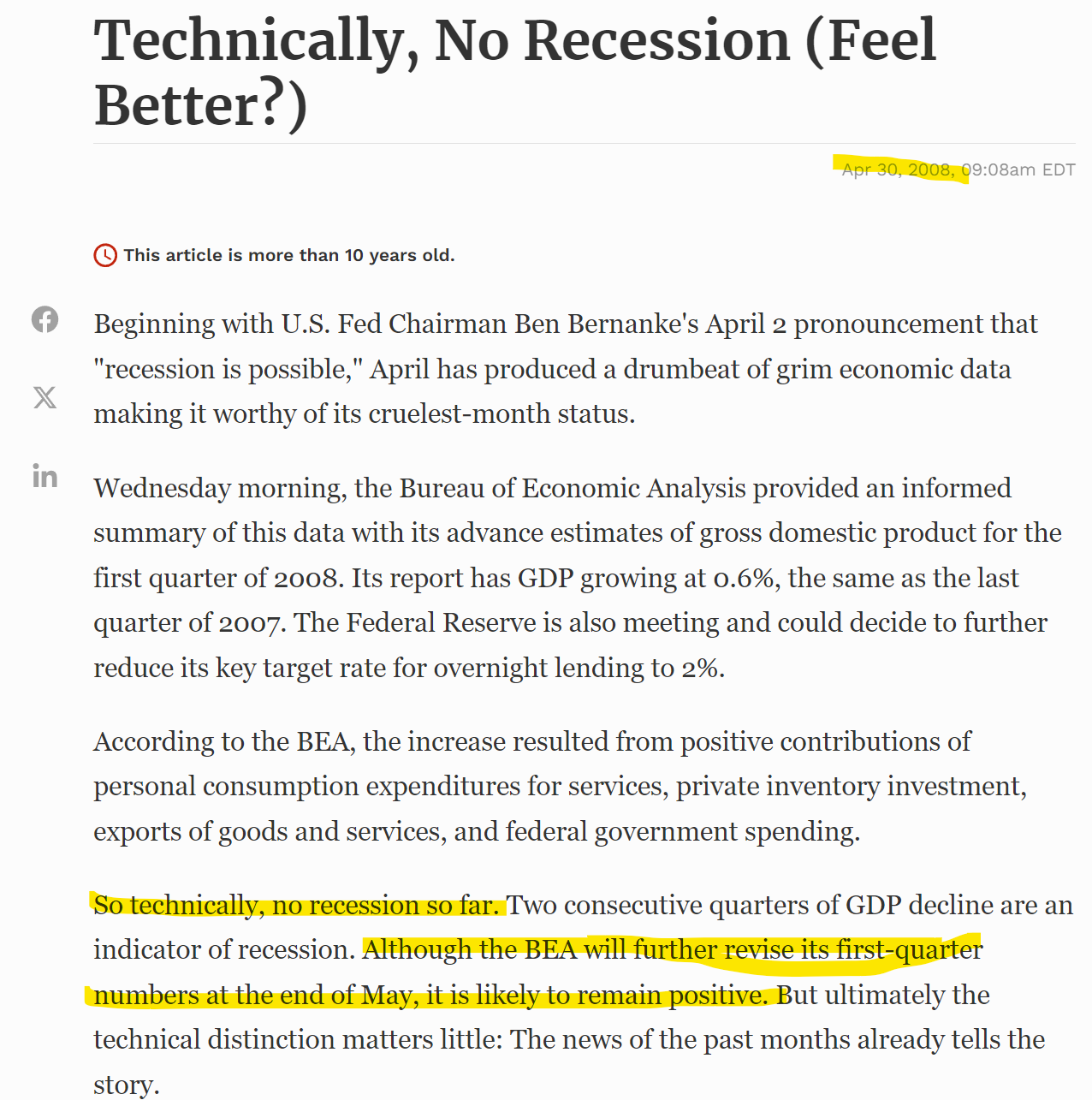

On the subject of revisions, as many have highlighted, as late as April 2008 the NBER and BEA were suggesting that a recession in 2008 was going to be avoided. And while they noted that revisions were likely, they expected Q1-2008 to remain positive.

In fact, those early revisions remained positive and revised UPWARDS to nearly 1% growth for Q1-2008. It wasn’t until Q3-2009 that the quarter was revised negative — to -0.73%… and then lower… and then lower… until finally troughing at -2.73% in Q4-2014. Over six and half years later. And then, of course, it was revised higher as we discovered that previous quarters were worse than expected!

Why does this matter? Because when we steer by the faulty r-stars, we decide that we’re data dependent to data that might well be drastically wrong. And if we are convinced that “everything is fine” even as we steer into an traffic jam of commercial real estate, high yield maturities, auto loans, U-6 unemployment, etc then like an inattentive driver we’re likely to end up in pretty rough shape.

It’s particularly egregious when we consider that the components of the leading economic indicators that turned up, driving the abandonment of the recession call, were stock prices and “Leading Credit Index” (which is just shorthand for credit spreads). If we exclude credit spreads and stock prices, the signs for the Leading Economic Index remain as negative as ever.

It is evident why stock prices and credit spreads are included as leading economic indicators. Forward-looking equity and credit investors are ostensibly incorporating future data in their investments. Unfortunately, as readers of this substack are almost certainly aware, the vast majority of incremental investments in equity and credit markets no longer incorporate forward-looking information — instead they simply ask a very straightforward question: “Did you give me cash? If so then buy.” In other words, they now largely reflect employment. And employment is a coincident indicator, not a leading one.

Coincident indicators: payroll employment, personal income less transfer payments, manufacturing and trade sales, and industrial production

Is there any evidence that passive (or another unidentified force) has changed the leading economic indicators? Unfortunately, yes. Looking at recessions since 1929, the pattern of stock sell-offs has shifted markedly. There is evidence that this is also true for credit spreads, although we have less data. Note the remarkable difference in the S&P500 sell-offs pre & post passive, with the pre-passive declines nearly double those of the post-passive declines: