It's Not Just the Crypto Crowd

While AI spending is goosing GDP, it's got companies by the short & curlies

The Illusion of Limitless AI-Driven Growth is Not “Loose Financial Conditions”

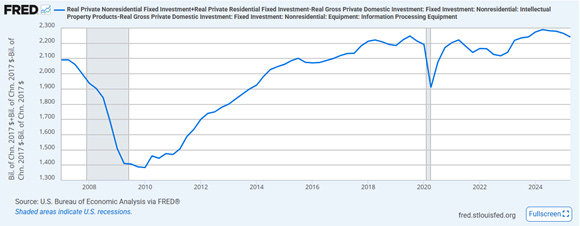

Over the past year, the market has crowned artificial intelligence the most important economic driver of the next decade. It’s not just hype — AI-related capital spending added more to U.S. GDP growth last quarter than consumer spending did. That’s a staggering data point.

But more remarkable is the absence of investment outside this narrow category. Private fixed investment (including residential) is unchanged in real terms since 2018 – and within 5% of 2007 levels despite a 25% increase in population.

This highlights just how weak the economy truly is behind the AI narrative. The surge is intoxicating: AI will supercharge corporate productivity, open new revenue streams, and lock in monopoly-like profits for the firms who dominate the space.

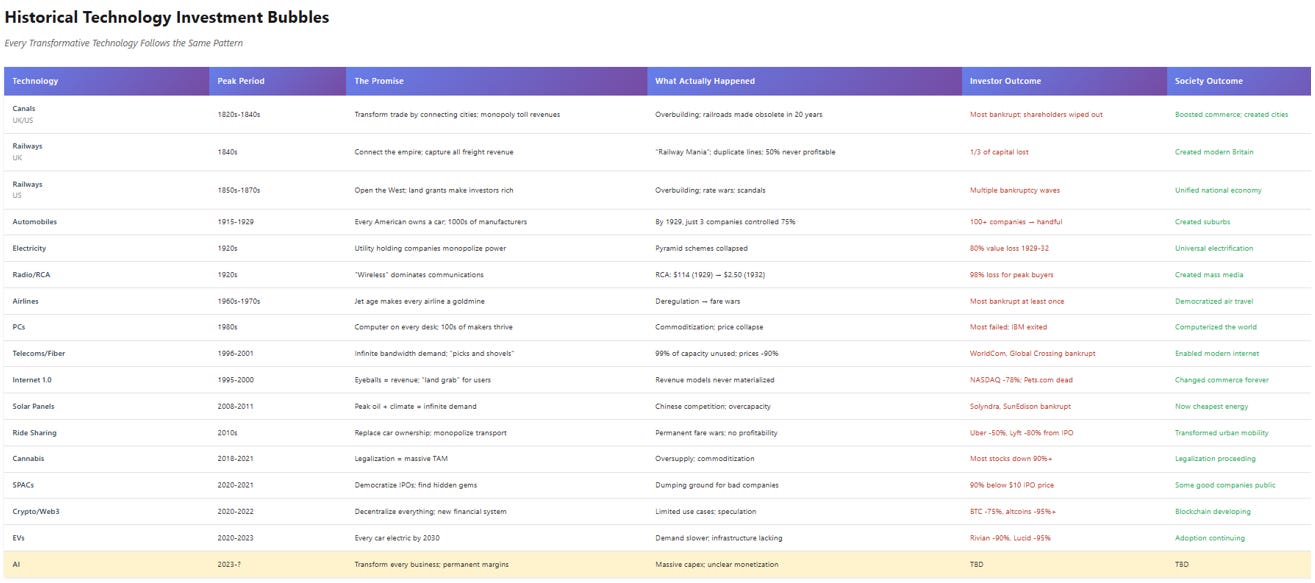

Unfortunately, the same sobering historical parallel exists for canals and toll roads in the 1820s, railroads in the 1850s, automobiles and electrification in the early 20th century, and the fiber optic build-out of the late 1990s.

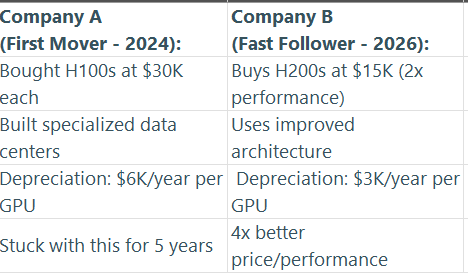

Why does this always happen? Because fixed investment is not truly fixed, particularly in an evolving technology. The datacenter built with Nvidia A100s needs to be replaced with a datacenter using H100s, then B200s, and so on. There is a first mover advantage in market share, but also a first mover DISADVANTAGE in technology in cost. Or as we used to yodel, “Yahooooo!”

The Market Reality: Both selling the same commodity (compute), in a competitive market, the price is set by Company B's marginal cost; therefore, Company A is underwater on every transaction.

The Fiber Optic Parallel

In the late 90s, the world was certain the internet would change everything — and it did. Global demand for bandwidth exploded exactly as predicted. Yet a wave of capital rushed in too quickly. Telecom companies laid hundreds of thousands of miles of fiber, far outpacing short-term demand, while new technologies expanded the capacity of the existing fiber.

Global Crossing and others built their business models on bandwidth pricing of hundreds of dollars per Mbps, based on the theory that “data is more valuable than voice.” By 2002, prices had collapsed by over 95%. Today, wholesale bandwidth costs less than $1/Mbps - a decline of 99.9% from peak assumptions.

The technology’s utility wasn’t the problem; overcapacity was. The firms that financed it — often with leverage — went bankrupt in droves. Their equipment and fiber was bought out of bankruptcy auctions at pennies on the dollar and new entrants like Cogent Communication competed brutally with a dramatically lower cost structure. As late as 2005, when an upstart YouTube emerged, skeptics argued YouTube was hemorrhaging cash calculating burn rates of $500MM a month! The real number? $500K a month over Cogent fiber. The internet survived and thrived, but many investors didn’t – both bulls who believed in stable pricing… and skeptics who missed many of the new internet models built on low bandwidth costs.

Total U.S. Telecom Services Revenue:

· 1998: ~$200 billion

· 1999: ~$220 billion (peak growth)

· 2000: ~$235 billion (PEAK)

· 2001: ~$230 billion (decline begins)

· 2002: ~$210 billion

· 2003: ~$195 billion

· 2022: ~$118 billion