It's a Crap Gig...

But at least it comes with influence(rs)

Summary

Powell was misleading: real private-sector job creation is much lower than the headline figure and upcoming data and revisions will almost certainly send the data much weaker.

Real earnings are falling: While hourly wages have risen, average weekly hours are down, leading to lower real weekly paychecks.

Gig economy distorts unemployment measures: Widespread availability of gig work (e.g., driving for Uber) keeps unemployment claims artificially low, obscures actual job-market weakness, and points to an unemployment rate possibly more than one percentage point higher than official figures.

Top Comment

Tchampion is back with a series of questions. Rather than answer separately, I’ve included my comments inline in bold:

Wouldn't liquidity be the first order effect and passive a second order effect? If Bogle were never born, we would still have a bubble. The popping of it might be less spectacular, but we'd probably have elevated median S&P P/E nonetheless.

MWG: Yes, imagine liquidity is the wave and “passive” (or inelasticity) is the steepness of the shoreline. A highly inelastic (steep) shoreline will send the water soaring upwards. A gently sloped beach leaves the waves breaking gently. Rogue waves (bubbles) can still build, but they are less frequent and of lower magnitude. I’m not blaming Bogle, I’m blaming the regulatory push for the product.

In a slightly different vain, Natural and socioeconomic systems tend to have self limiting / self correcting features. Just as any number of things could trigger a correction, any number of things could limit the magnitude of the aftermath. If there's a severe correction, there will be intervention (again, is liquidity the first order effect?). When valuations get crazy(ier), would even "passive" investors tweak their allocations as things get crazy. AAII points to it even now, as one example. Would private capital dampen the fall? Agreed, these could be exacerbating factors but they could also be dampening factors.

MWG: This is the debate — are passive investors TRULY passive in their allocations? All the evidence is “NO!” — they are PROCYCLICAL. When valuations get higher, they ADD to equity allocations. Is there some point at which they decide valuations are “high enough”? Not that we’ve seen. The rise of products like Target Date Funds are designed to encourage inattention. In some ways, this is good — it means that outperformance by equities leads to diversification into bonds. It ALSO means that bonds are purchased in the same quantity when they yield 5% as when they yielded 0%. Makes sense, right?

Why does structural flows abatement have to be a secular change as your statement implies? A spate of states just announced they're starting auto IRA programs. Interestingly not only blue states but red states as well. A wall of QDIA money waiting to come into the market but it'll take a year or two to get here, but the ones that started last year, should be getting here sooner. What does a stop / start of flows mean for your colorful lines? The green line breaking into giant red squiggles?

MWG Comment: Welcome to my world. When I began this work in 2016, I anticipated that Q4 2018 was the “tipping point” — and it was. Q4-2018 was all about passive outflow that was apparently structural. And then they changed the rules… and changed them again… and again. The states adding auto-IRA programs (examples can be found here) are doing so to provide tax-advantaged retirement vehicles to employees whose employers do not provide 401Ks. It’s a VERY marginal group, but “yes” I expect these programs will expand and create more challenges. No surprise, the lobbying for these programs appears to be coming from Vanguard. But don’t worry, they are pushing it for DEI reasons… after all, Malvern lives matter, too.

The Main Event

This was one of the more interesting employment reports, especially given the sanguine comments by Mr. Powell in the hours after its release:

Many indicators show that the labor market is solid and broadly in balance. The jobs report released this morning showed employers added 151,000 jobs to payrolls in February and the unemployment rate was 4.1 percent last month. Smoothing over the month-to-month volatility, since September, employers have added a solid 191,000 jobs a month on average. The unemployment rate remains low and has held in a narrow range between 3.9 and 4.2 percent for the past year. The jobs-to-workers gap has narrowed, and the quits rate has moved below pre-pandemic levels. Wages are growing faster than inflation, and at a more sustainable pace than earlier in the pandemic recovery. With wage growth moderating and labor supply and demand having moved into better balance, the labor market is not a significant source of inflationary pressure. — Jerome Powell

In simple terms, this is wrong.

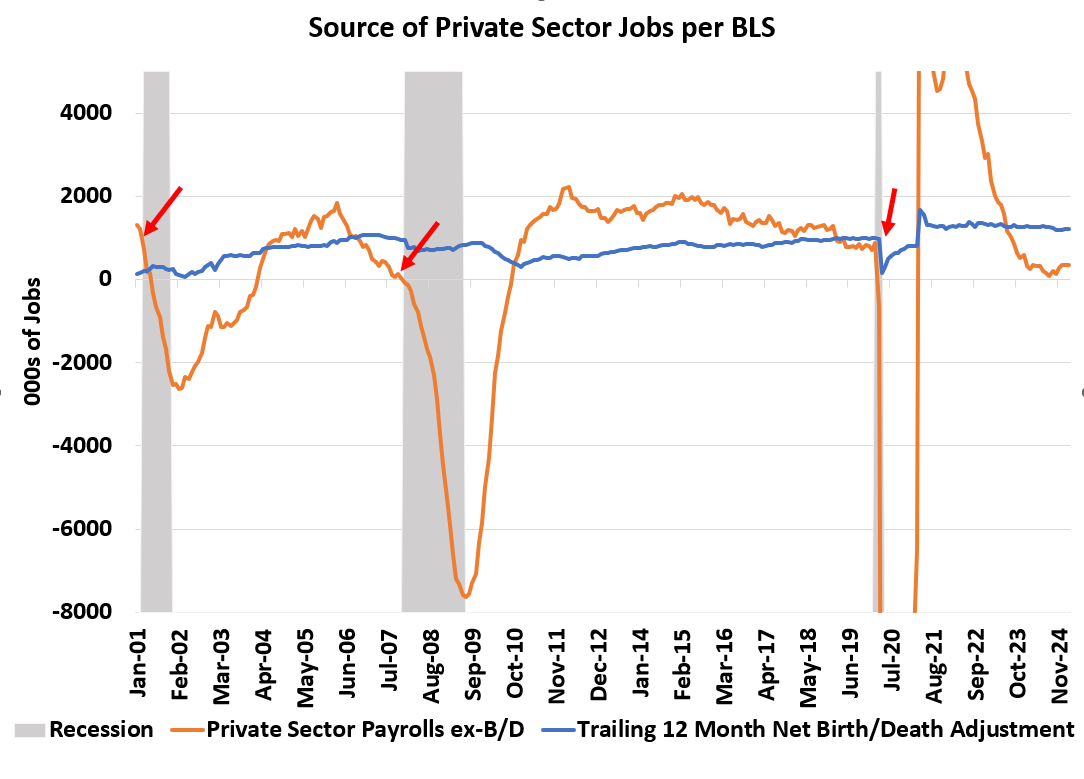

First, “employers” have not added 191K jobs a month. Adjusted for the completely discredited Birth/Death model, which will be mechanically revised starting with the March employment report to more closely reflect the structurally lower rates of business formation we have seen from the QCEW/Business Employment Dynamics surveys, private sector job creation did pick up slightly — to ~41,500 per month, not 191,000.

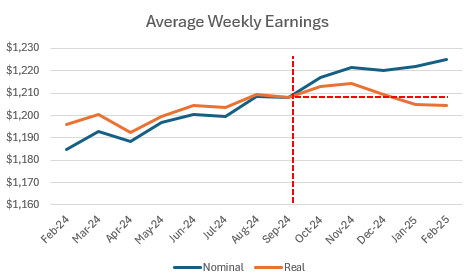

Second, it takes a special talent to misrepresent facts with a straight face, but Powell has that down in spades. Yes, HOURLY wages are rising. But HOURS are falling more rapidly:

And as a result, real WEEKLY earnings (you know, “paychecks”) have fallen in real terms since September.

What did this jobs report miss due to sample dates? Oh… just this… Federal Worker Unemployment Claims. Unsurprisingly, this group of employees was less likely to take advantage of the Uber Unemployment Service. Assuming Trump does not flip, this will hit the March unemployment report next month… alongside a downgraded Birth/Death model. Should be fun.