French Kiss

Did Volatility in France Reveal a Credit Issue in the US?

Summary

Political Unrest in France: Snap elections in France led to a major political shift with the right-wing National Rally party of Marine Le Pen gaining significant power, resulting in the French parliament becoming non-functional. The political turmoil triggered a significant selloff in the CAC40, causing a 9.5% drop. This selloff spread to other major markets, with most down 5-7%, highlighting the interconnectedness of global financial markets.

Credit Market Repercussions: The turmoil significantly affected credit markets, particularly French CDS and high-yield CDS. The selloff was exacerbated by momentum-driven strategies from CTAs selling CDS, pushing spreads and credit risk higher, while high yield issuance rose due to looming maturities and tight spreads. A momentum extension may be underway.

Top Comment

Long-time reader, Menachem asks:

“If passive flows are already in the process of reversing, why is the S&P500 persistently pushing new ATHs? Wouldn't your explanation of it's mindless impact on price mean that clearing prices should reflect flows in (roughly) real time? Does the persistent trend in price give you pause to consider that net contributions remain positive for some reason (despite the already weakening labor market)?”

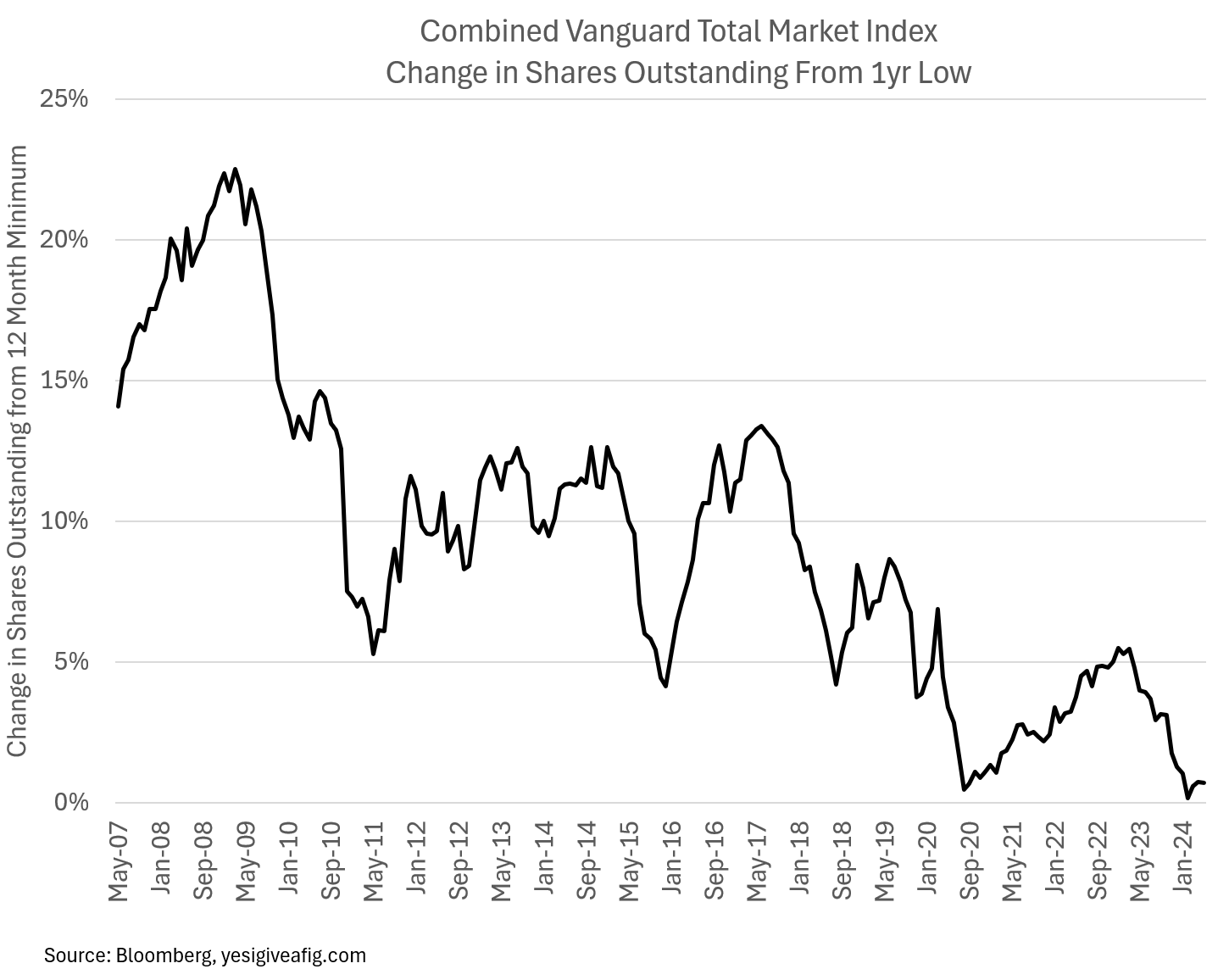

MWG: Menachem, I look forward to spending more time on this question in an upcoming piece, but the simple answer is that flows remain positive but they are narrowing. Increasingly, the flows are being directed to “tech” like 1999 rather than broad markets. In particular, we’re seeing a dramatic slowdown in flows into “total market funds” even as tech-related flows remain strongly positive.

In my view, this is why equal weight has diverged so sharply from market-cap wtd in a manner similar to the late 1990s:

A Bit of Housekeeping

As we’re hitting the one year anniversary of YIGAF going paid, I am encountering a number of issues on credit card processing. This creates two issues. First, if your credit card has expired or is out of date, your subscription will not renew. Second, if you do NOT want to resubscribe (I’m hurt, but I’ll survive) and you dispute the charge rather than cancelling, I am charged for the privilege of writing for you. This seems a bit unfair, and I’d simply ask that you cancel (or request a “scholarship” if you no longer can afford to pay).

The Main Event

“One of them was next to the trunk, holding the trunk of the tree. I’ll never forget that because the tree was a huge black shape too, and his hand touching the black trunk anchored him, if you see what I mean, to something solid in all the bright fire they were standing in up there. And the other one was a little farther out on the limb.”

“Then what happened?”

“Then they both moved.”

— A Separate Peace, John Knowles, 1959

While I look forward to continuing my series on Roaring Kitty, the events of the past week take precedence. In particular, a series of events have set off a bit of a scramble to reduce risk and purchase insurance that is a good reminder of how tightly we are all connected.

If you’ve been hiding under a rock, the French Connection roared to life this week with unexpected snap elections. Befitting a country where the national children’s song involves plucking a songbird to death, Macron was stripped of a functioning parliament by the ascendant right-wing National Rally party of Marine Le Pen. The French, like many Americans supporting Donald Trump, are "Fou de rage et je ne vais plus le supporter" (mad as hell and not gonna take it anymore).

The CAC40 took notice:

Now the sight of a major stock market falling 9.5% from peak should not be particularly shocking. But as the selloff accelerated, it began to spread. As of Friday, major markets have diverged with only the S&P 500 and the Nasdaq up for the quarter. Most are down 5-7%:

But it wasn’t the move in equity markets that mattered. It was credit. Witness French CDS:

Like the opening quote, sovereign CDS is often anchored in financial risk. If France is going to fail, how can Banque Paribas survive? The answer, of course, it cannot:

And so while the spread between French CDS and BNP CDS contracts, the cost of protection on BNP CDS must expand. And what of those whom BNP underwrites? Well, they must expand as well:

And so on…

Now High Yield CDS is an interesting one, not least because I’m directly involved through one of the portfolios I manage at Simplify, but also because this has been an interesting beast. Many of you have been exposed to the “puzzling” divergence (spreads too low) in high yield spreads versus both my credit models AND realized bankruptcies: