For your information

"Market Efficiency" is not the question

Note: On November 7th, I’ll host my second institutional investor call available to premium subscribers. If you are an institutional subscriber OR you are interested in becoming one and have not received the Zoom details, please reach out to yesigiveafig@regmanagment.net.

Summary

Ben Felix's views on passive investing contains gaps and oversimplifications that betray an agenda. Felix himself does not strictly adhere to a passive approach, but leans toward systematic value investing. Rules for thee, but not for me at its finest.

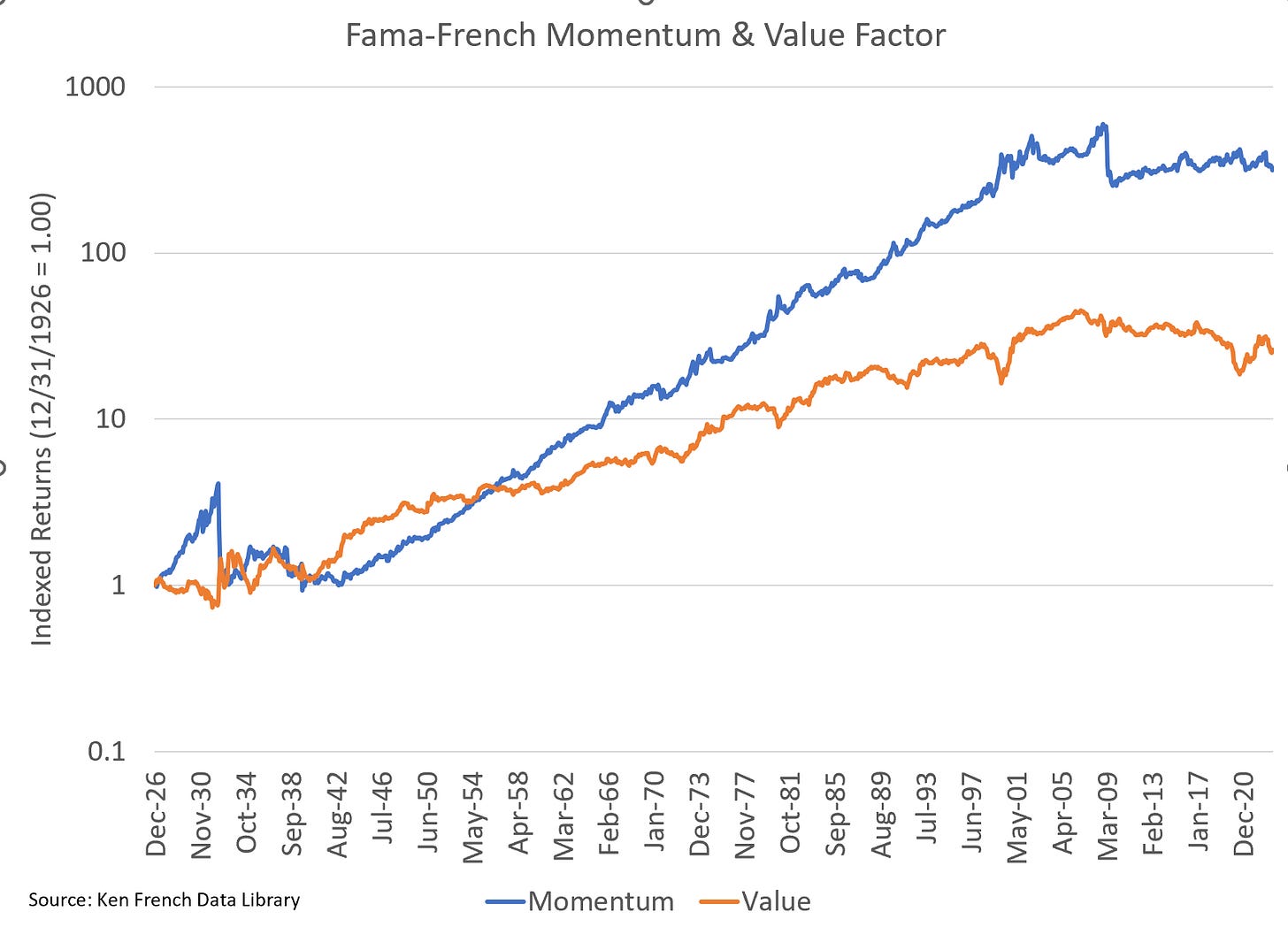

Felix’s arguments rest on a simplified presentation of Grossman-Stiglitz model and various Fama-French papers, often with what appears to be a disingenuous attempt to mislead. These often-quoted models are criticized for not adequately accounting for market realities and various inefficiencies.

Ralph Koijen's work is cited, stating that the composition of investors in the market matters significantly. For instance, the growth of passive investing has led to a noticeable rise in valuations, especially among larger stocks, which counters Ben Felix's argument that the growth of index funds won't affect markets.

Citations of measures of "price informativeness" as a measure of market efficiency may be missing out on nuanced factors that affect the market, such as feedback loops created by passive investing strategies.

Let’s get ready to rumble

Top Comment

After some back and forth, Alejandro Sanz threw out the white flag on supply-driven inflation:

Alejandro: That's absolutely true, and the only explanation I can find is the creation of OPEC in the 60s having been effective at regulating supply.

For other commodities I checked, you're right that the lags are very modest between price of the commodity and supply.

MWG: Yes, it’s frustrating as everyone gets very excited about the idea of dying of starvation and cold. It’s unlikely to happen. Far more likely is that well-intentioned public servants kill us... or even more likely they kill those who can’t afford to adjust to their poorly-informed policies.

The Main Event

Setting the Stage

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” — Upton Sinclair

This past weekend, when I was theoretically taking a break from markets, @benjaminwfelix, a Canadian podcaster and financial advisor released a tweet that highlighted a section of his interview last year with Ralph Koijen, of “Inelastic Markets” fame:

It’s important to watch the clip. Ben makes a very key assertion:

“A lot of people seem to worry that the growth of index funds is going to make markets less efficient, which is not good for anybody, including the index investors. But the ONLY way this is a problem is if assets flow from the most informed active managers into index funds.”

Know Thy Enemy

Now Ben is an indexing acolyte. His podcast and website is a paean to the virtues of passive investment allocation, although ironically they appear to be acolytes to the Dimensional Fund Advisors (DFA) approach of “index” investing. You know, the “well markets are efficient and reflect all available information, but there are exploitable edges available to investors who are willing to screen on two of the most easily available pieces of information” school of thought. Why? Because, silly, people are stoopid.

For regular readers of YIGAF, you’ll recognize all the red flags…

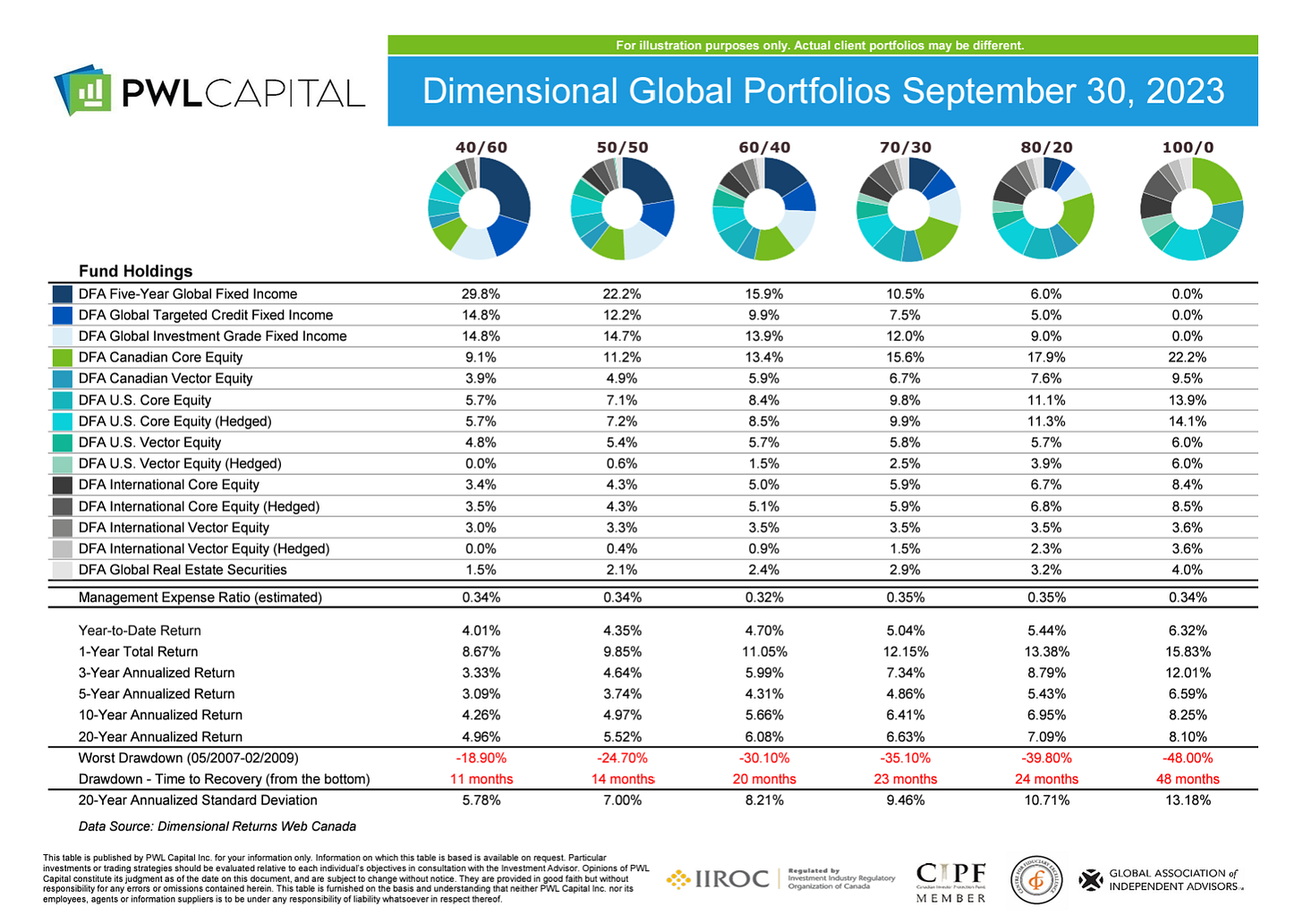

Model portfolios with no discussion of conditional valuation? Check

Historical return profiles presented as “well not exactly the future, but, wink-wink, pretty darn close to what you should expect”? Check

The Dimensional Global Portfolios have relatively short track records in Canada. However, these funds follow rules-based indexes which have longer histories. Where fund return data is not available, we have used index data adjusted for the current management expense ratio of the applicable fund. All returns are in Canadian dollars. The index returns consist of the average return of four quarterly staggered indexes which are reconstituted annually, while the portfolios are rebalanced on a continuous basis. The index returns include the profitability filter since inception, while the portfolios were in transition to applying the profitability filter in 2014. Index returns do not reflect the momentum screen that is used in live trading for the portfolios.

Past performance does not guarantee future results. The historical performance of indexes is illustrative only and is not necessarily a reflection of the future performance of any fund tracking that benchmark.

And, of course, as the Director of Research, Ben’s very first article on his PWL website is on the Grossman-Stiglitz Paradox in which he states the PWL philosophy:

At PWL, we often cite efficient markets as one of the building blocks of our investment philosophy. We believe that because all available information is included in the prices of securities, and new information is random, we are better off capturing the performance of the market rather than trying to identify which company, asset class, or region will be the next big winner.

Complete with snarky barbs at active managers:

“I love the idea of active management. It is flashy, glamorous, and exciting. Nobody wants to accept being average, but it is far better to be consistently average over the long term than to outperform the market one year and underperform the next.”

And a link to Bill Sharpe’s “The Arithmetic of Active Management”:

“Statistically, it is very unlikely that anyone will consistently beat the market over a long period of time, and remember: whenever one active manager beats the market, another must underperform.”

Standard pseudo-intellectual early 1990s stuff…

“What Was The Middle Thing You Said?” — A Fish Called Wanda

Notably missing? Any discussion on the assumptions of the mental models… like the definition of a passive investor:

“A passive investor always HOLDS every security” How do they get in? Magic. Out? That’s also magic. Flows from investors? Magic!

Oh, it’s not magic… it’s just occurring outside the boundaries of space-time:

“We assume here that passive managers purchase their securities before the beginning of the period in question and do not sell them until after the period ends. When passive managers do buy or sell, they may have to trade with active managers, because of the active managers' willingness to provide desired liquidity (at a price).”

Or the market map assumption from Grossman-Stiglitz. From ChatGPT:

The Grossman-Stiglitz model assumes that all investors start with an identical endowment of a risk-free asset and a risky asset. This assumption helps simplify the model and focus on the central issue it aims to address: the paradox of information efficiency in financial markets. By assuming identical initial endowments, the model abstracts away from the complexities introduced by differing wealth levels, risk tolerances, or other heterogeneities among investors.

We Hold Some Truths to Be More Evident

And of course, the greatest irony is that Ben himself acknowledges that he DOESN’T invest in “passive” index funds… he’s a systematic value investor. More precisely, small and value.

Oh goodie… an “evidence-based” investor who pursues a lower return, higher risk approach to investing:

“I would argue that anyone who believes in the market risk premium has to believe in the size and value premiums. They are all based on markets being efficient” — Ben Felix, April 2019