Exit, Voice, and AI Barricades

Why Youth Pessimism Signals a 21st-Century 1848

Giving Credit

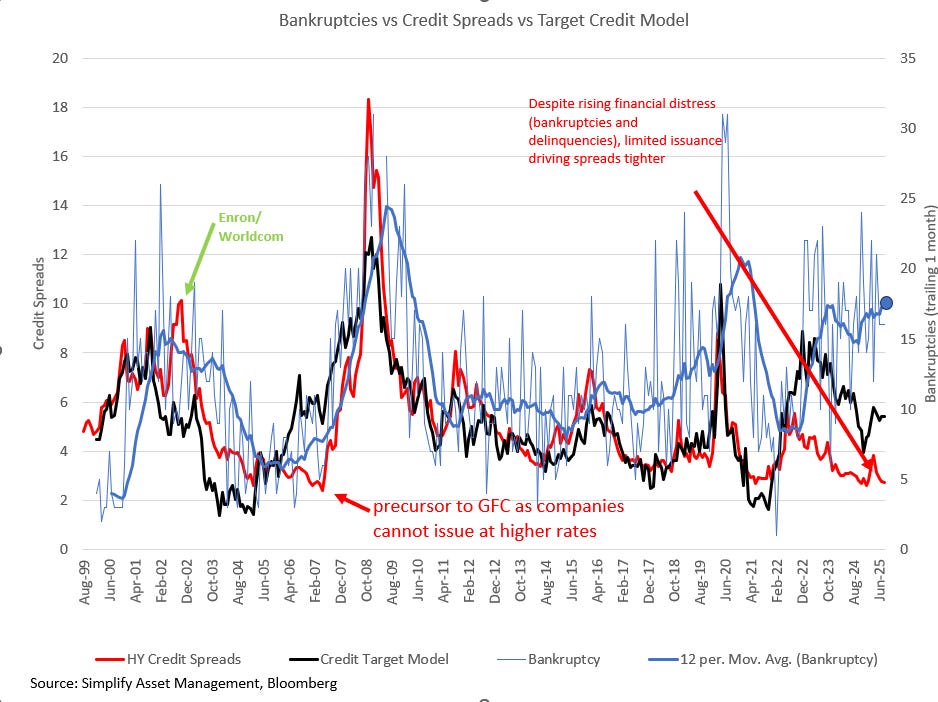

Two weeks ago, I wrote about the deteriorating credit quality amongst the Mag7, focusing on Meta. This past week, Meta issued nearly $40 billion in debt contracts, fully erasing its net cash position. Next week, we’ll get the final inputs to my credit spread model to update it for August, but the early read is that we have again begun widening in target spreads. Bankruptcies (not included in the model, but used as a check) have been rising, with the twelve-month moving average hitting a new cycle high:

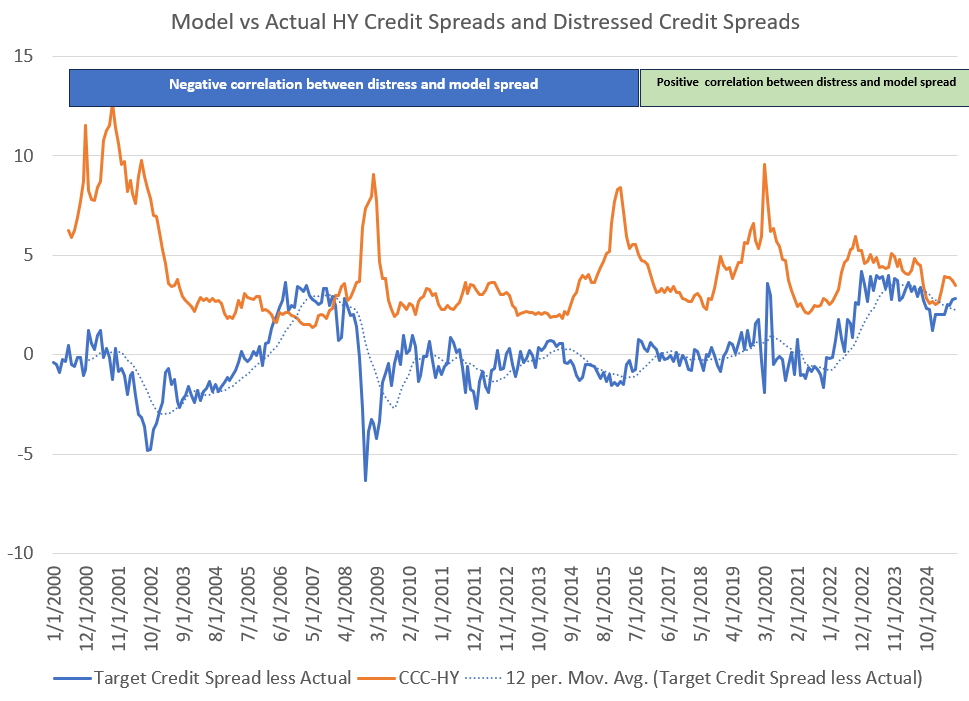

The measured spread between target credit spreads and actual hit a near-cycle high, suggesting that, at least on my models, credit has rarely been meaningfully tighter. Unlike prior periods, the tightness has been positively correlated to richening (tighter spreads) of the riskiest credits, a pattern that has been largely intact for the past decade:

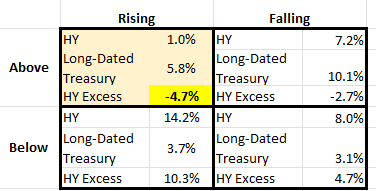

Historically, periods of widening credit spreads, while credit spreads are below the target level, have been very poor periods to invest in high yield:

Got a credit hedge?

The Inversion of Optimism

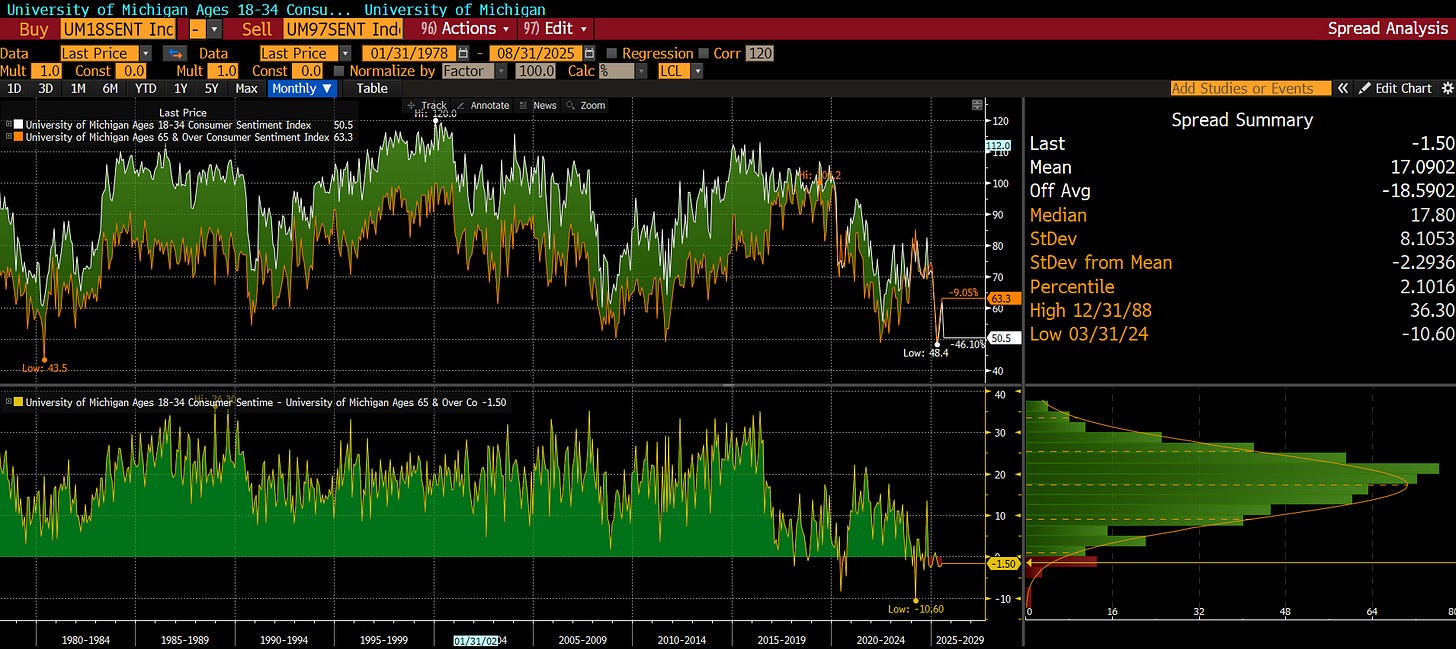

According to the University of Michigan’s Consumer Sentiment Index, millennials and Gen Z report lower expectations for the future than retirees — the first such sustained inversion in the survey's half-century history.

It is profoundly destabilizing. Youth, with decades of earnings and potential ahead, should be the most hopeful. Retirees, with limited horizons, should be the most cautious. That this logic has flipped tells us something fundamental: the social contract has cracked. I experienced a variant of this firsthand during my summer retreats, listening to senior business founders describe their harrowing experiences during the GFC and their children’s key takeaway: “Never use debt.”

In 1848, a postwar youth bulge ran headlong into mechanization of farms and bureaucratic gatekeeping. Farm laborers and artisans were displaced; educated young professionals saw their ambitions blocked by legacy elites. Today, AI and passive investing threaten to turn capital into labor itself — algorithms replacing workers, index funds replacing investors — funneling rents upward to older asset holders.

The question is not whether this matters. It is what comes next.

Can We Inflate Away the Debt?

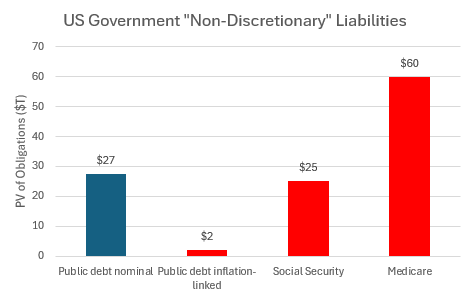

My partner, Harley Bassman, often relishes in Chicago School diatribes about inflation being a monetary phenomenon with the objective of lowering the government’s nominal debt load. Like many Friedman-inspired rants, “it’s a nice story that has little basis in fact.” The reality is that over 75% of the US government obligations are inflation-protected, either explicitly or through market pricing:

This is the sort of nonsense that leads to Social Security recipients getting an 8.7% raise in 2023, while workers received a 5.3% raise on average. This is why the U.S. fiscal challenge is fundamentally structural, not cyclical. It’s not a “debt/GDP” problem fixable by inflation; it’s a demographic-claims problem that requires:

Cutting benefits (check)

Raising taxes (tariffs, check)

Re-engineering the system (establish clear priorities towards growth)

The Trump administration, for all its failings (and they are legion) HAS begun the process of addressing these issues proactively; unfortunately, the retained priority of protecting asset values to preserve electability suggests it will be too little, too late.

Hirschman’s Lens: Exit, Voice, Loyalty

In the late 1960s, Albert Hirschman offered a simple but powerful framework: when people lose faith in institutions, they can either: