Elastic Man

How will Microstrategy pay its bills? And miscellaneous thoughts on employment and markets.

Since very little has actually changed over the past few weeks, I figured it was worth exploring what has:

Brilliant. We are approaching the endgame as we always do — projections of future asset appreciation have facilitated the inclusion of leverage that relies on future asset appreciation, not cash flow generation.

There is nothing new about the Microstrategy (I refuse to call it “Strategy”) approach. It’s identical to the manner that closed end investment funds raise non-dilutive capital (from Grok):

Closed-end funds (CEFs), unlike open-end mutual funds, have a fixed number of shares outstanding and trade on exchanges like stocks. To obtain leverage—essentially using borrowed capital to amplify investment returns—they can issue preferred shares as a senior security. This process works as follows:

Issuance of Preferred Shares: The fund issues a single class of preferred shares (as permitted under the Investment Company Act of 1940). These shares are sold to investors, raising additional capital. For example, a fund with $500 million in net assets from common shares might issue $250 million in preferred shares, bringing total assets to $750 million.

Use of Proceeds: The capital raised from preferred shares is invested in additional portfolio securities, such as bonds or stocks, increasing the fund's overall asset base without issuing more common shares.

Leverage Effect: This creates leverage for common shareholders because the fund's total investments are larger relative to the equity from common shares. The leverage ratio is typically calculated as the amount of preferred shares divided by net assets (e.g., 50% in the example above). Common shareholders benefit from gains on the entire portfolio, but preferred shareholders receive fixed or variable dividends (similar to interest payments) and have priority claims on assets and income.

Non-Dilutive Nature: The funding is non-dilutive because it does not increase the number of common shares outstanding. Common shareholders' ownership percentage and voting control remain unchanged, unlike if the fund issued additional common equity, which would spread earnings across more shares.

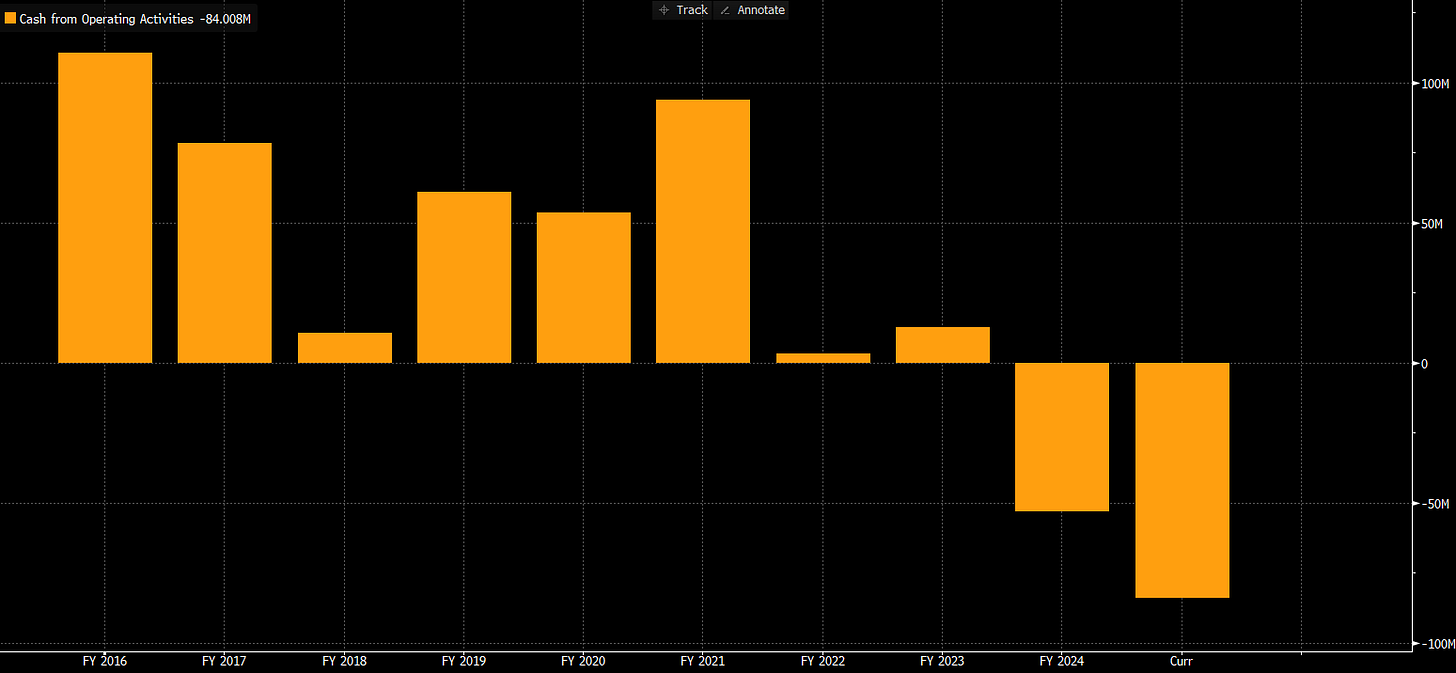

But this has the practical effect of creating a HUGE cash need for Microstrategy going forward. The combined debt and preferred equity dividend payments now exceed $500MM a year. Starting next year. No problem. Pay it out of cash flow, just like a closed-end fund gives first priority to the pref dividends from all earned dividends (of portfolio companies) and proceeds from sales of portfolio companies:

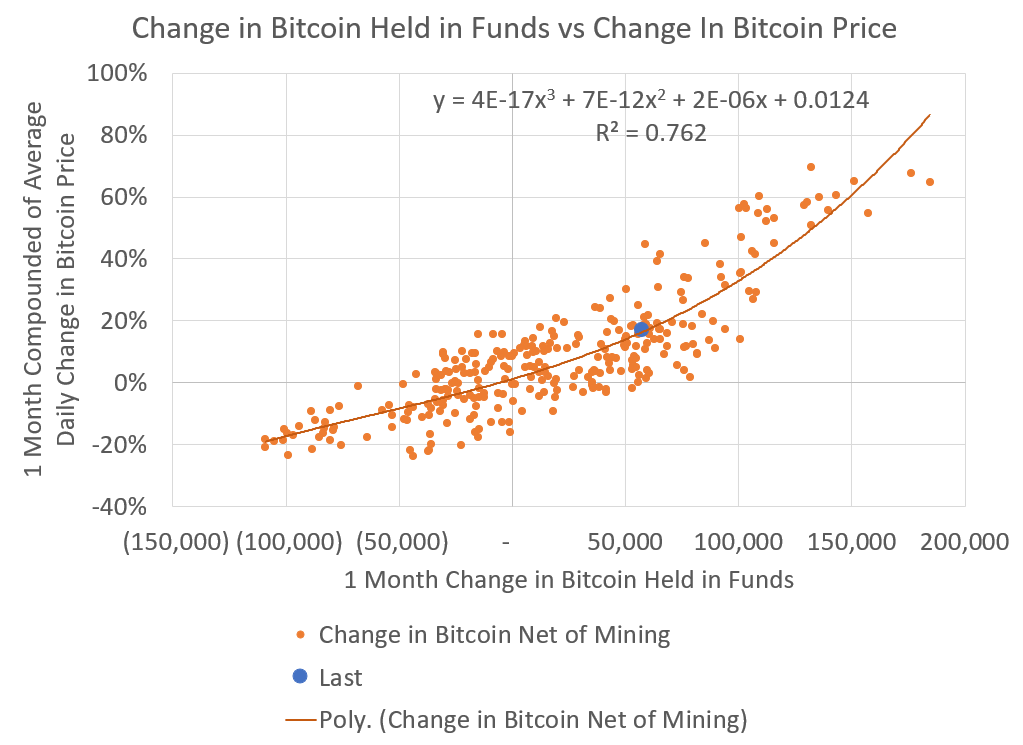

Except Microstrategy has no cash flow. And all of its cash has been spent on bitcoin. So Microstrategy’s “strategy” is to perennially issue more preferred stock to generate cash flow to buy bitcoin… raising the price of bitcoin and facilitating more issuance. So we can actually model this out. Thanks to the transparency of ETFs, we now know the elasticity of bitcoin — buying 50K bitcoin in a month raises the price of bitcoin by about 18%, or $6B in creates aggregate market cap gain of $500B (at current prices):

Microstrategy now owns approximately 3% of Bitcoin outstanding (about 600K Bitcoin) which means the “value” of their Bitcoin stake rises by $14.5B under that scenario. So for every $6B in, Microstrategy gets $14.5B “out.” Sounds great!

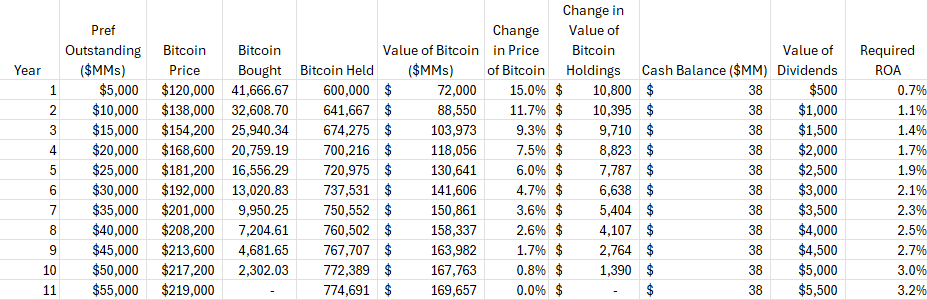

Except there’s that pesky cash dividend expense at ~10% that accumulates over time. To service this debt, Microstrategy will have to continually issue more convertible preferreds. It has explicitly stated that this is its strategy. So we can model it out:

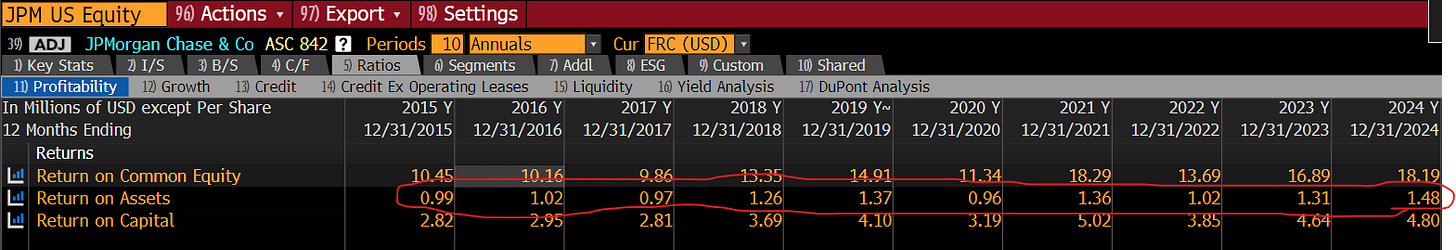

This strategy results in fewer and fewer Bitcoins being purchased as more and more shares are issued. Yes, the price of Bitcoin will rise (assuming no other sales), but the required ROA generated from that Bitcoin (not price gain, cash generated) rises as well. A 3.2% return? That should be easy… just lend the Bitcoin out like a bank. Yep… just like a bank, where the world’s best bank earns 1.5% ROA:

This is before we consider debt refinancing, etc. In other words, Microstrategy just told us they are a bitcoin seller.

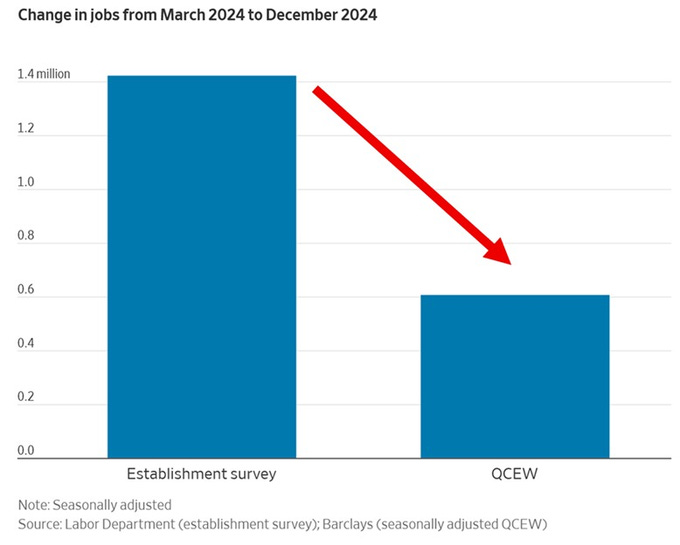

In the past few weeks, we obtained a final QCEW (Quarterly Census on Employment and Wages) for Q1-2024. Preliminary data is available through December 2024. Ewe may have seen the headlines: