Deficits DON'T matter

Breaking down GDP into drivers raises red flags to the deficit theory of "never recession"

Summary

Debate and Key Perspectives:

A recent interaction with Warren Mosler provides an opportunity to frame the tension between government deficits and growth in GDP

Economic Implications and Inflation:

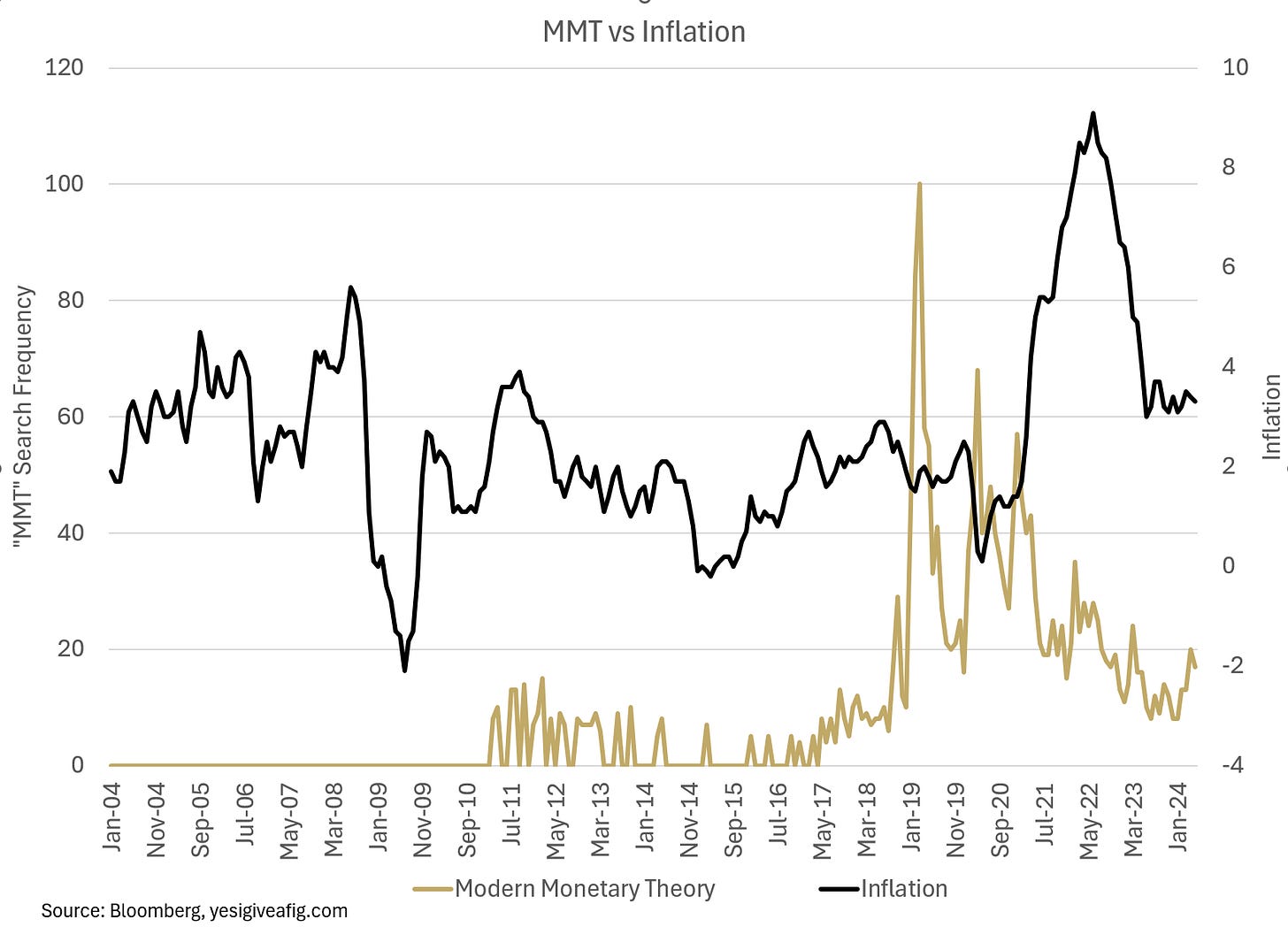

The release of Stephanie Kelton's "The Deficit Myth" coincided with a significant rise in inflation, which has led to skepticism about MMT and likely challenges in obtaining support for future fiscal policy expansion.

Credit Creation and Economic Growth:

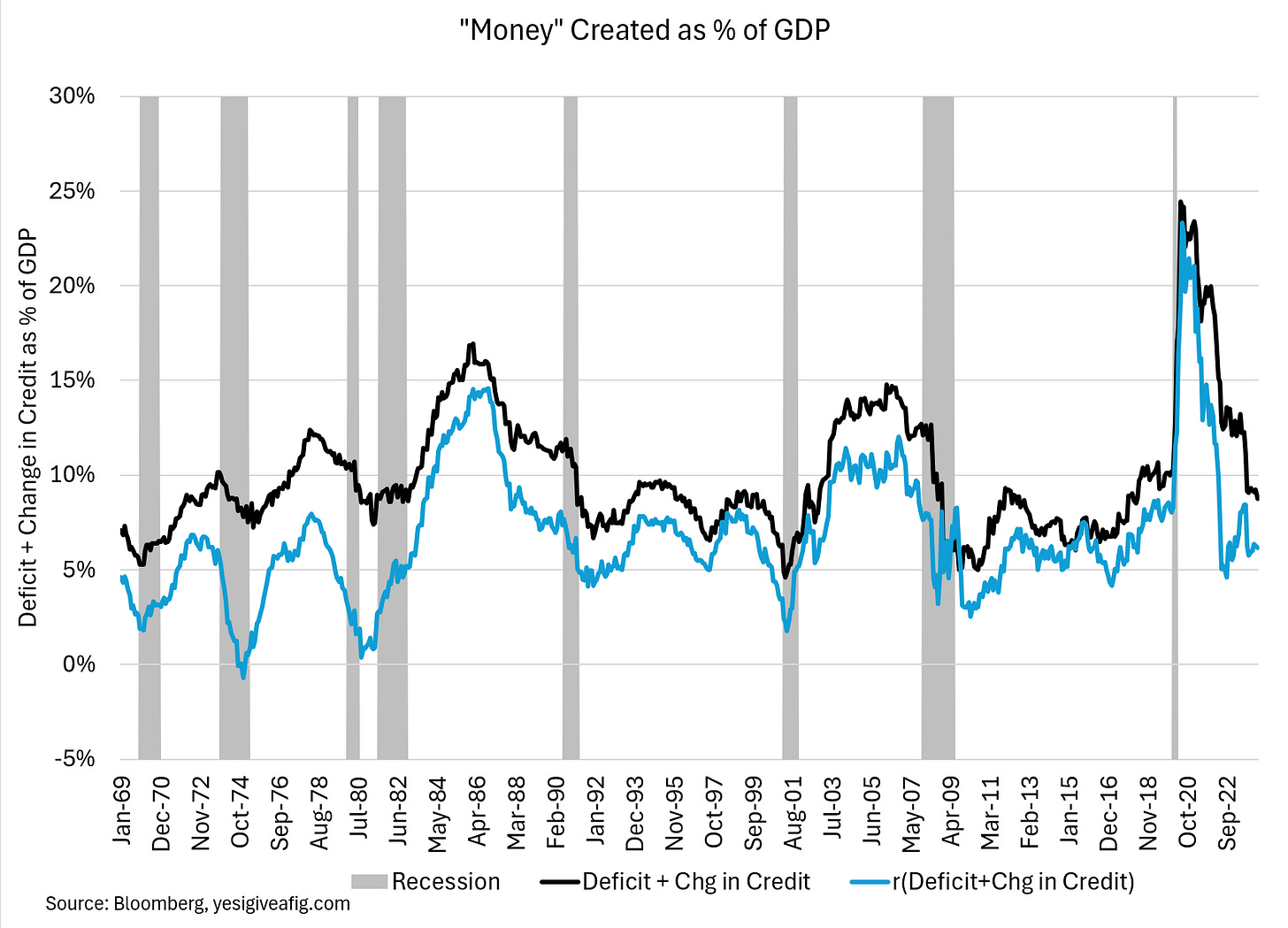

The dual nature of money creation, vertical (government) and horizontal (private credit) is a key input. Contractions in net credit as a percentage of GDP have historically preceded recessions.

The traditional economic view is that credit provision drives demand. An empirical study suggests instead that credit often supports supply, which aligns with Mosler and Green's perspective on labor and consumption.

Labor Force Growth and Policy Misunderstandings:

Green emphasizes that labor force growth, rather than credit creation, has a more significant impact on inflation, contradicting conventional economic teachings.

He argues that current financial theories misinterpret the roles of taxes, interest rates, and labor, leading to policy errors. He concludes that while government deficits measure income provided to the private sector, their impact should be assessed by examining other income sources, particularly worker compensation.

The Main Event

I had an exchange with Warren Mosler this week on Twitter that I figured is worth expanding. Warren, is a great friend and a true intellectual godfather. Many are aware that I sought Warren out after the 2008 GFC to help understand why so many models failed. Back in 2013, then a wee lad, I attended an amazing debate Warren held at Columbia University with Robert Murphy, an Austrian. If you’ve never watched the debate, it’s worthwhile. Skip to 1:29 to see a young(er) Mike Green ask a question.

I’ve never forgotten Warren’s response, “Either you believe in representative government or you don’t. You either believe that runs best with an informed electorate or not.” This can be directly contrasted with my discussions with Peter Thiel as I educated him on the “accuracy” of MMT (I actually brought Warren in to meet with him) in 2017. Peter’s response was equally memorable — “This may be correct, but if the populace ever learned that it worked this way, it would break the system.” My libertarian leaning readers will immediately identify the similarity between Peter’s perspective and the oft-repeated misattribution of Benjamin Franklin:

"when the people find that they can vote themselves money, that will herald the end of the republic" — paraphrase of Alexander Tytler, misattributed to Benjamin Franklin

I err (perhaps error) on Warren’s side in this debate. While a subset of the electorate unquestionably supports greater government spending, it would appear the majority (for now) still understand the risks. Fortunately for monetary conservatives, the ill-timed emergence of Stephanie Kelton’s “The Deficit Myth” coincided with the largest inflationary increase in the US since the 1970s. In a matter of months, inflation surged and Kelton became somewhat of a laughing stock:

Getting the public to support a meaningful expansion of the deficit seems challenging; the debate, unfortunately, may be whether the public has a choice. A popular meme summarizes the current political environment well:

Many, including Warren, effectively assume that the US government will continue to stimulate. Imho, this is a blind spot, albeit not a particularly large one. In the debate above, Warren acknowledges that he failed to anticipate the GFC precisely because he expected the US government to stimulate (jump to minute 1:34).

I have conceded that I have been early (therefore wrong) in calling for a recession in 2023, although I ultimately expect revisions will support this call. But it surprises me that Warren is insistent that the government deficit can prevent a recession at a fixed level of GDP. Remember that MMT has two separate forms of “money creation”:

The vertical money channel (government)

The horizontal money channel (private credit, primarily originating with banks which play a unique role in the economy ignored by traditional economics). It has long since been proven empirically that banks do not LEND deposits; they create deposits by lending. This can take the form of direct lending (the plain boring stuff) or collateral lending to the non-bank private sector. As an aside, we are already seeing warning signs that QT is approaching its logical limits with recent spikes in repo rates.

While the deficit has remained “robust” (a technical term defining French gastronomy and public sector profligacy), the combination of these two has seen the greatest contraction in history as a percent of GDP. While there is not a “level” that guarantees recession (a bit more on this later), this type of net credit contraction has preceded every recession: