Causation is Not Correlation

It should be a warning sign that there's no time to talk Keith Gill

Keith Gill and GameStop: Keith Gill's return and the GameStop ($GME) response illustrate how passive-facilitated share shortages can be resolved by companies issuing shares. GameStop raised $3B in less than a month despite terrible earnings.

Impact of 0DTE Options: The rise of 0DTE (zero days to expiry) options has disrupted traditional correlation models, shifting hedging and speculation patterns. Demand for short-term index protection has surged, while 30-day tenor protection has decreased, affecting VIX behavior and implied correlation.

Concentration and Implied Correlation: Increasing concentration in the S&P 500's largest stocks has led to a collapse in implied correlation. Despite high levels of single-stock volatility and persistent comovement trends, the concentration of portfolio weights is driving down implied correlation, indicating a potential spike in correlation and volatility ahead.

A Brief Summary on Keith Gill

Despite promising to spend more time on Keith Gill, the story is rapidly losing interest. Others have discussed it ad nauseaum to this point, but I’ll highlight my last two remaining points and then move on:

Gill’s return, and the Gamestop ($GME) response, is a phenomenal introduction to an upcoming paper from Marco Sammon, one of the upcoming stars in academic finance. I’ll discuss his paper upon publication, but suffice it to say that Gamestop using the passive facilitated bubble to raise $3B in less than a month WHILE missing earnings is a brilliant example of how passive-facilitated share shortages are typically resolved by companies issuing shares. As a reminder, capital markets exist to facilitate the allocation of capital. If we abuse them, it ends with profitless retailers of second-hand video games receiving unrestricted funds for speculation. All else equal, this is inflationary for risk assets and deflationary for consumer prices (as retail operations are subsidized). Could this end well for Gamestop investors? Sure, perhaps Ryan Cohen is the 2nd coming of Warren Buffett. That he has done nothing so far with the $1B already in the bank is perhaps a warning against this… or maybe he just needed to start at scale… or maybe… The answer, unfortunately, is we can’t know. In the meantime, GME has become $3.5B in net cash attached to a $10B equity market cap. Operating losses of ~$50MM per year are easily covered. It’s going to be here for awhile now. Unfortunately the same thing I said in Jan 2021:

I’d also note that most estimates are that Keith Gill is now worth ~$200MM with his ownership of 9MM shares of $GME. That’s about 5% of the $4B in cash he’s raised them. Roughly on par with underwriter’s fees. Bravo.

While it’s possible that Gill returned purely to pump the stock and turn an estimated $35MM into $200MM, my general read was that he desperately wanted to reclaim something he had lost — a community. And FWIW, this is the much more interesting angle. Everywhere I turn, I see people trying to connect and rebuild communities. I find this exciting, but also caution that this is “the uniquely dangerous period” where community formation doesn’t necessarily mean a kumbayah moment. Remember, if you want to join the People’s Front of Judea, you must hate the Romans AND the Judean People’s Front… a lot. Let’s try to remember that the Russians love their children, too.

The Main Event

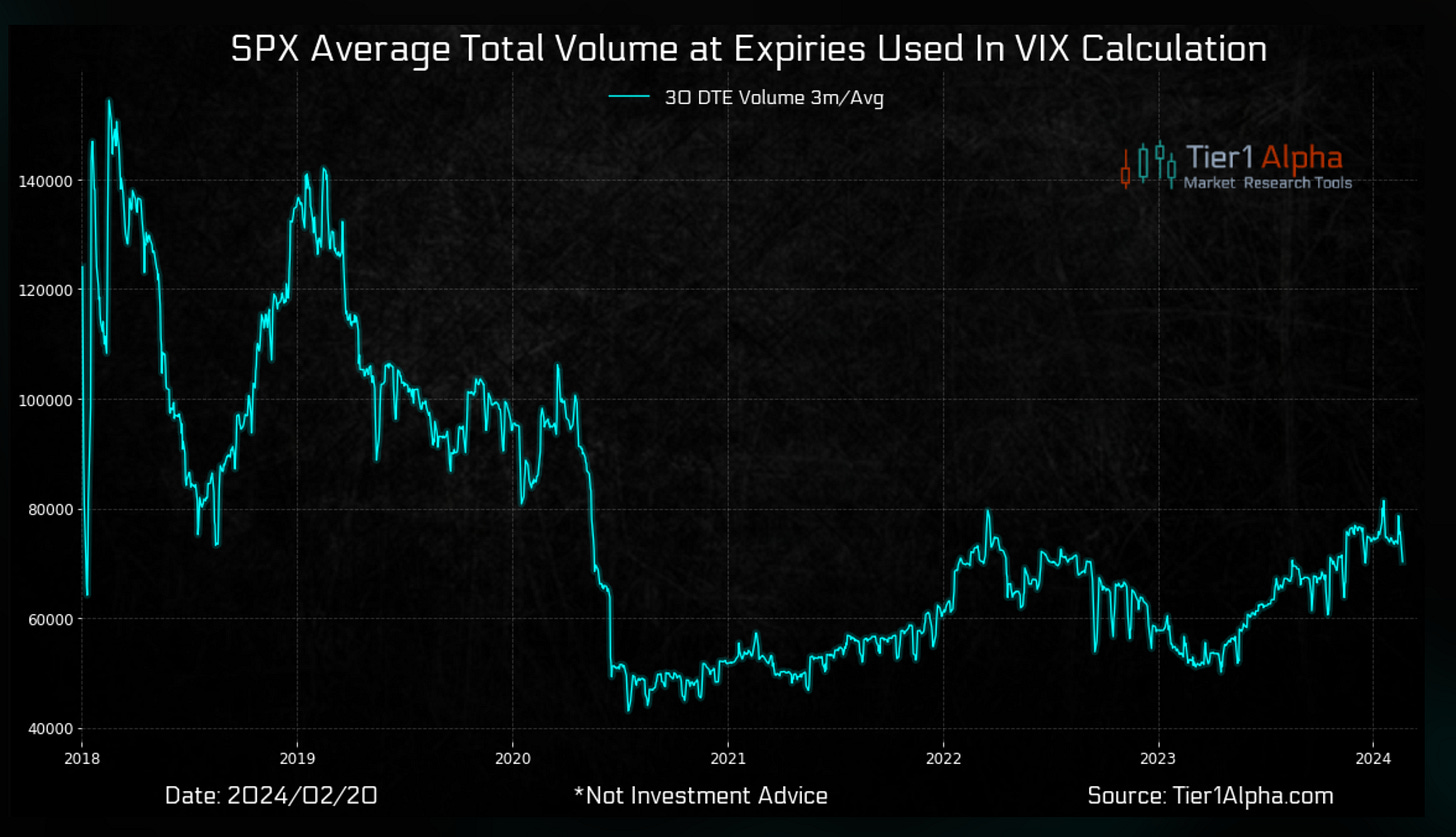

My models of correlation have broken down since the advent of 0dte options. This appears to be driven by a structural change in how hedging (and speculation) is conducted. The absolute demand for index protection at the 30-day tenor (VIX) has collapsed relative to demand on single-day events. “Why pay for 30 days of vol when you can buy tomorrow’s Fed meeting?” While the CBOE has tried to downplay the importance of this shift, at Tier1 we’ve made it painfully obvious that while absolute option volumes are way up, volumes at VIX expiry dates are way DOWN from pre-2020:

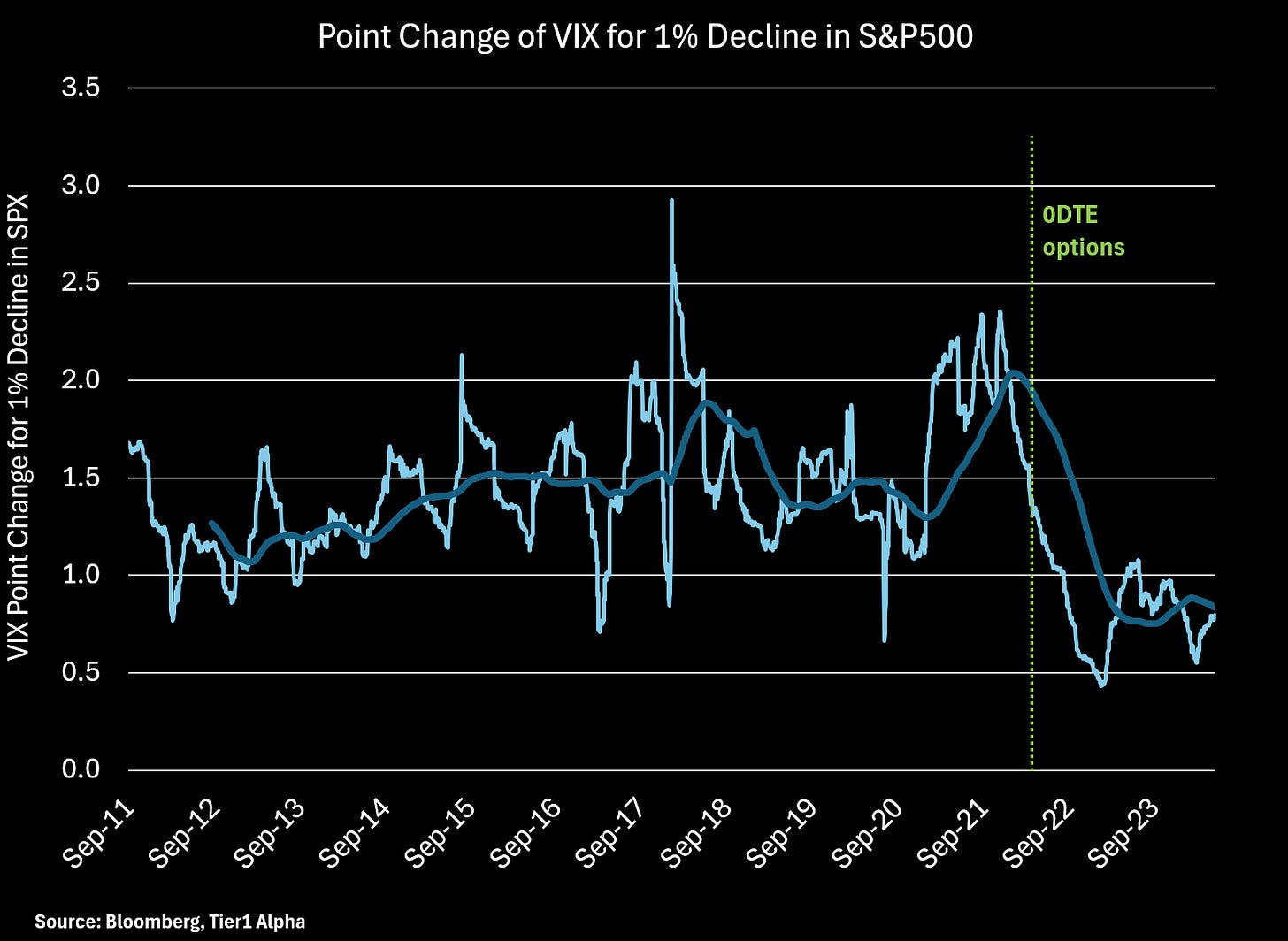

We can see this manifested in a major reversal in the trend of VIX “beta” to the S&P500. Most of you have seen my analysis of the Volmaggedon events of 2018. These were “predictable” to the extent that beta of the VIX had been rising against the S&P500 as the trade became crowded. A momentary flirtation with similar conditions in 2021-2022 ended with the growing popularity of 0DTE:

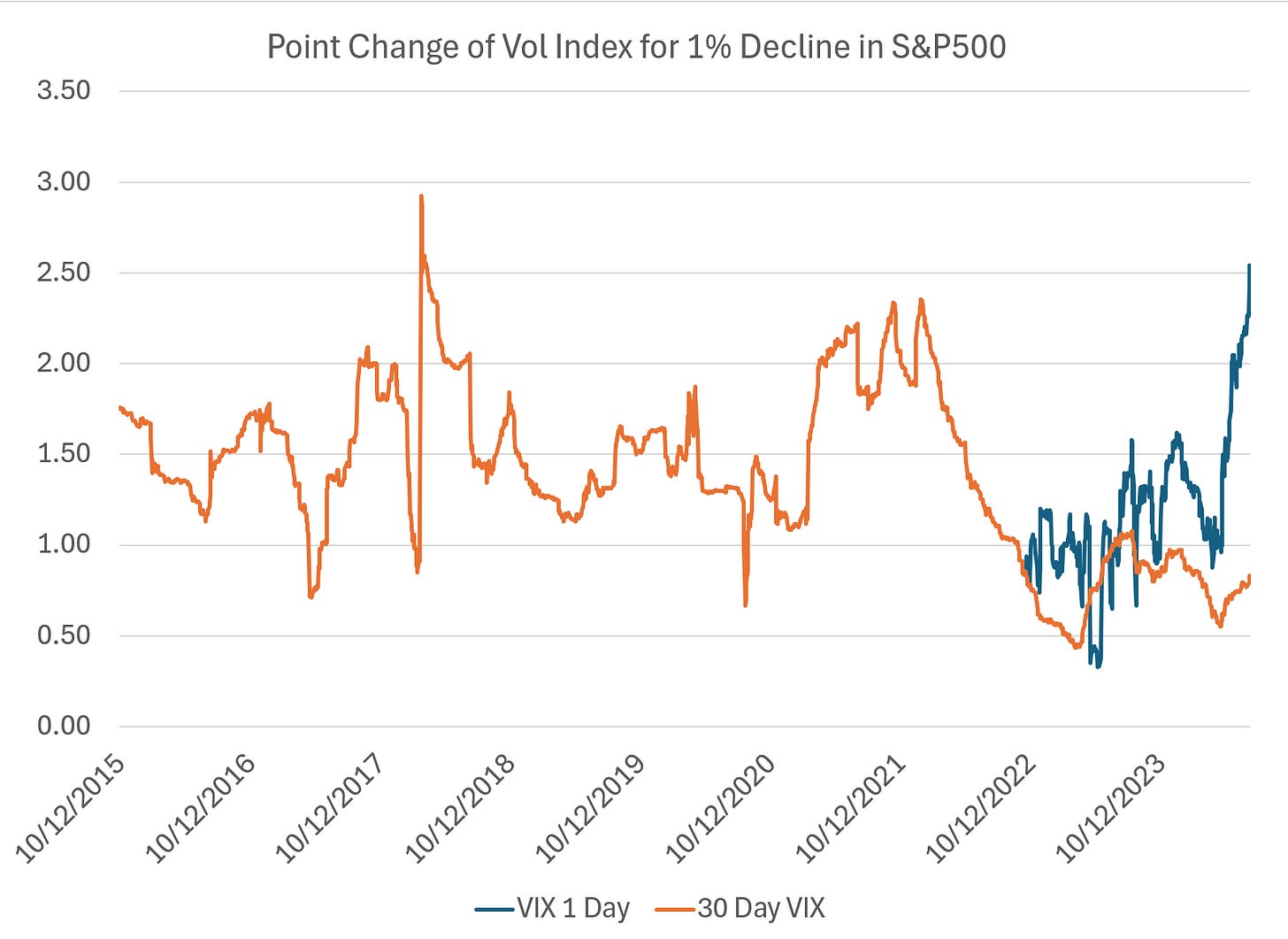

And so today, when I’m asked, “Doesn’t this look like 2017?” the answer has to be a touch of “No… but…” because we ARE starting to see an increase in responsiveness of the 1-day VIX. Whether the traditional VIX follows remains to be seen, but the odds are growing:

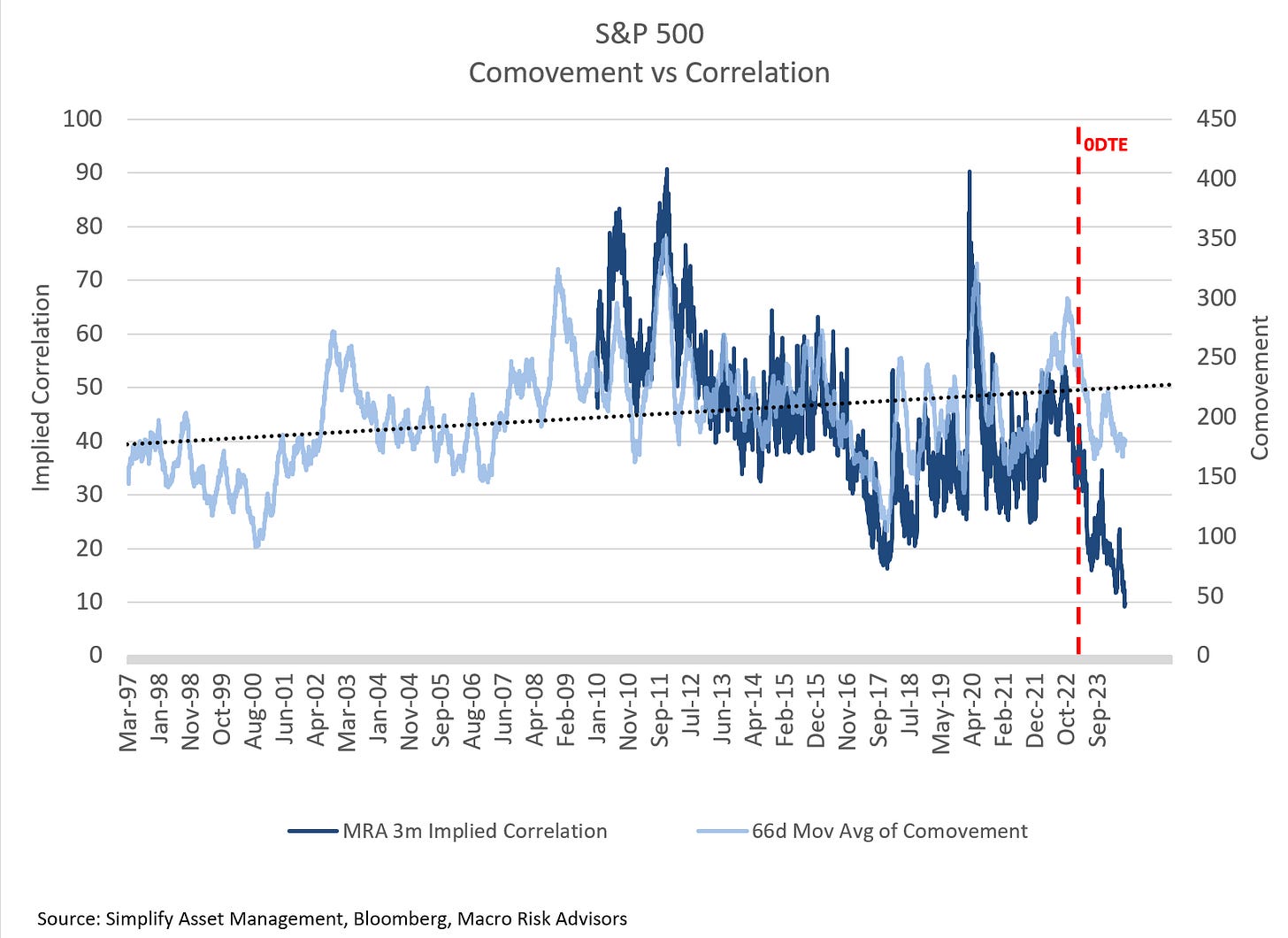

Why do I say that? We’ve reached an absurd level of implied correlation for the S&P500 relative to other metrics of correlation. For example, many of you will be familiar with my historical models which used “binomial correlation” to estimate a long-term trend in correlation in the S&P 500 — far beyond levels that can be derived form a full correlation analysis. Note that the available history of “comovement” (binomial correlation or the net number of stocks moving in the same direction each day regardless of weight or amplitude of move) closely tracks implied correlation until very recently: