Blue Hawaii

A somewhat sober tour

I apologize for the delay in today’s note, but I wanted to make sure I sent a brief note as the week was replete with information, and I have been neglecting my already abused audience.

This past week was an interesting adventure as I traveled from Annapolis to Minneapolis to Honolulu, meeting with clients and “clients.” I was fortunate to join the U.S. military command in Hawaii to discuss economic tools of statecraft; with a son in the Navy (headed to submarines), this trip hit different. While many Americans are itching for a fight with China, I have no such desire. I’d much rather know my son is coming home than face the prospect he might not. As a tour of the U.S.S. Arizona memorial reminded me, there were countless young men (and at least one father-son duo) who did not make that trip home:

The young men on that wall were meritorious and full of promise. Bad luck, rather than a lack of skill, put their names there. Something to keep in mind as we count our financial gains over the last decade and plot our FIRE (financial independence, retire early) objectives. As Wilfred Owen eloquently wrote over a century ago in the then Great War to end all wars:

If in some smothering dreams, you too could pace

Behind the wagon that we flung him in,

And watch the white eyes writhing in his face,

His hanging face, like a devil’s sick of sin;

If you could hear, at every jolt, the blood

Come gargling from the froth-corrupted lungs,

Obscene as cancer, bitter as the cud

Of vile, incurable sores on innocent tongues,—

My friend, you would not tell with such high zest

To children ardent for some desperate glory,

The old Lie: Dulce et decorum est Pro patria mori. (MWG: “It is sweet and fitting to die for one’s country.”)

As Von Clausewitz noted, “war is diplomacy by other means.” It introduces real costs and uncertainty that can be modeled, but never confirmed until they have been realized. The objective of a standing military is deterrence, not perpetual victory. Something to keep in mind as diplomacy appears to be failing, and the reality of a Chinese assault on Taiwan appears increasingly likely. Unlike our recent wars, this will not be an exercise in regime change or nation-building. A victory likely involves a retention of the status quo — a bitter pill for many families whose status quo will be irrevocably shattered if foreseeable events come to pass. I would encourage all of my readers to consider that a conflict like this has no winners and that making personal choices to reduce the odds of conflict (e.g., accepting that there must be some economic disentanglement to maintain the capacity of the United States to credibly conduct deterrence) and to present a unified front if it does come to pass will be far more important in this “extended diplomacy” than in other recent conflicts. This is less an admonition to those likely to supply the “blood” than for those who may see economic interests threatened. If a war develops, economic resources must be commandeered to be redeployed — a reality that will prove far more shocking in our passive-dominated investment world than in the investment world of prior conflicts. If the dominant expression of investment is “If you give me cash, then buy” there is little room for thoughtful discounting of future events. That lack of economic signal will likely play a role in fanning the flames rather than encouraging thoughtful diplomacy.

I continue to hope we will avoid conflict even as I acknowledge it is increasingly likely. And I pray for all of us that I am right in the former and wrong in the latter.

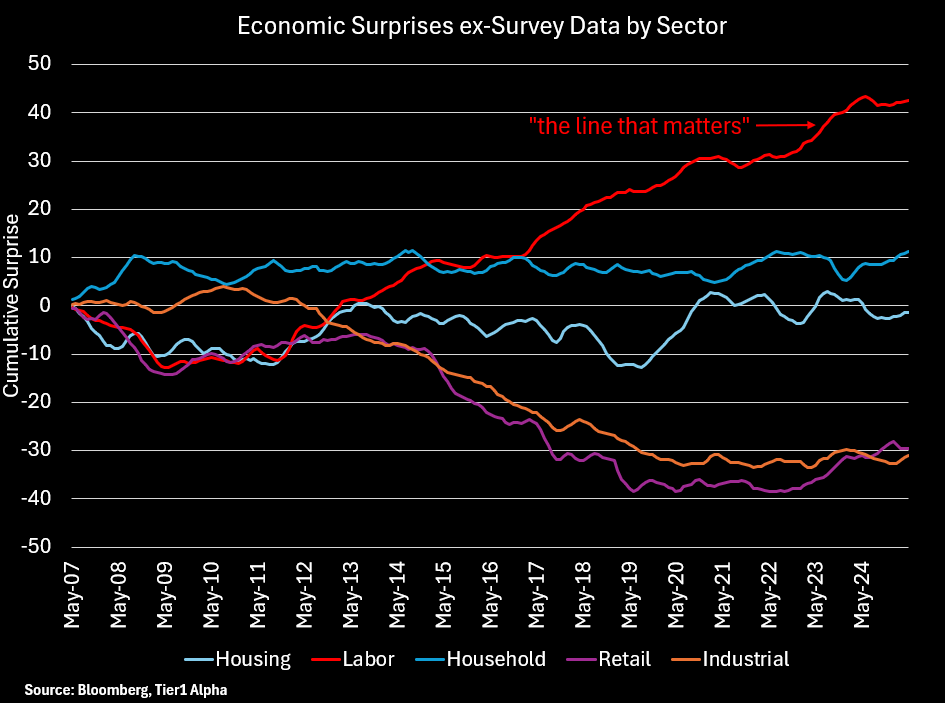

The Worst Strong Employment Report

The past week was replete with economic data, but the data that mattered was once again the labor market. While ADP missed and came in barely positive, the “unrevised” first print of Non-Farm Payrolls was “fine” — at 140K vs 120K expectation. We, of course, ignored the downward revision of 95K jobs from the prior two months, which will likely impact this print upon revision as well.

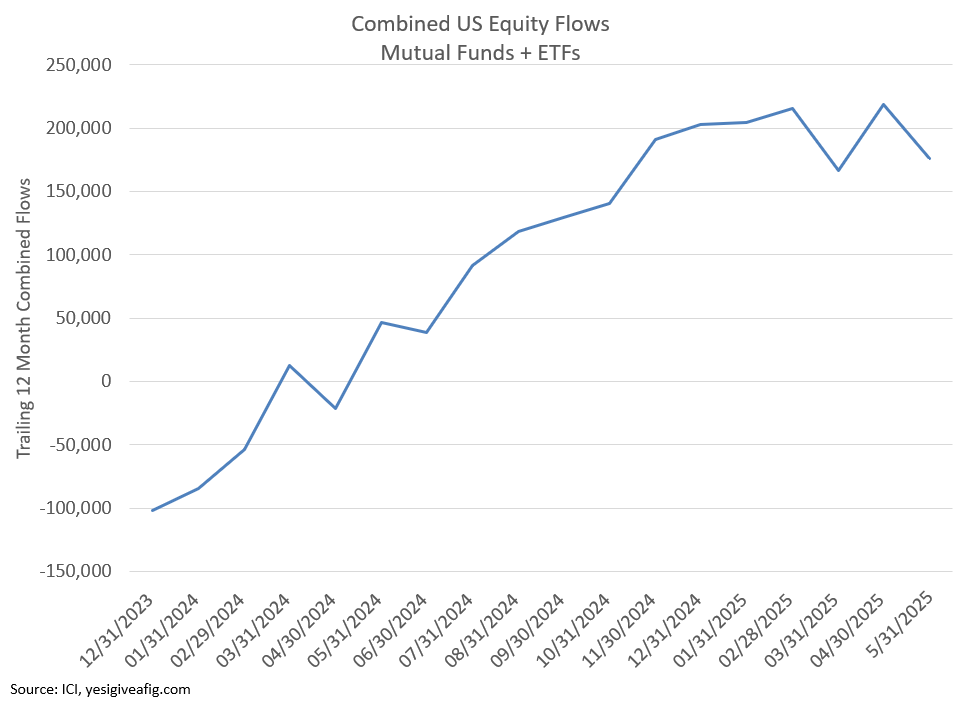

And while we continue to see strong inflows into equity ETFs tied to employment, the character of LONG-TERM flows, combining both mutual funds and ETFs, are unquestionably slowing alongside the employment market. While shorter-term products, for example levered ETFs, have continued to see very strong flows (with the attendant 2+x multipliers as discussed in prior posts), the overall picture is weakening.

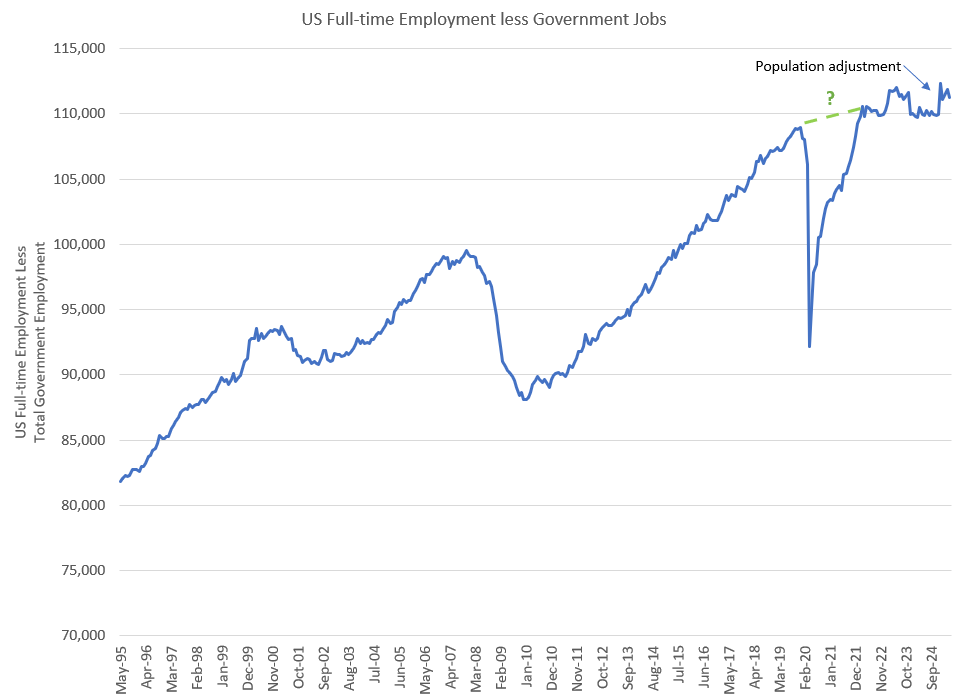

We’re still far from the point at which I’ll adopt the Bill Paxton motto (“Game over, man!”). But the excitement with which the market greeted a modest beat in NFP, while full-time jobs continue to decline, tells me far more about the “BTFD” environment than it did about the actual economy. We’re now a solid TWO YEARS into a basically stagnant labor market:

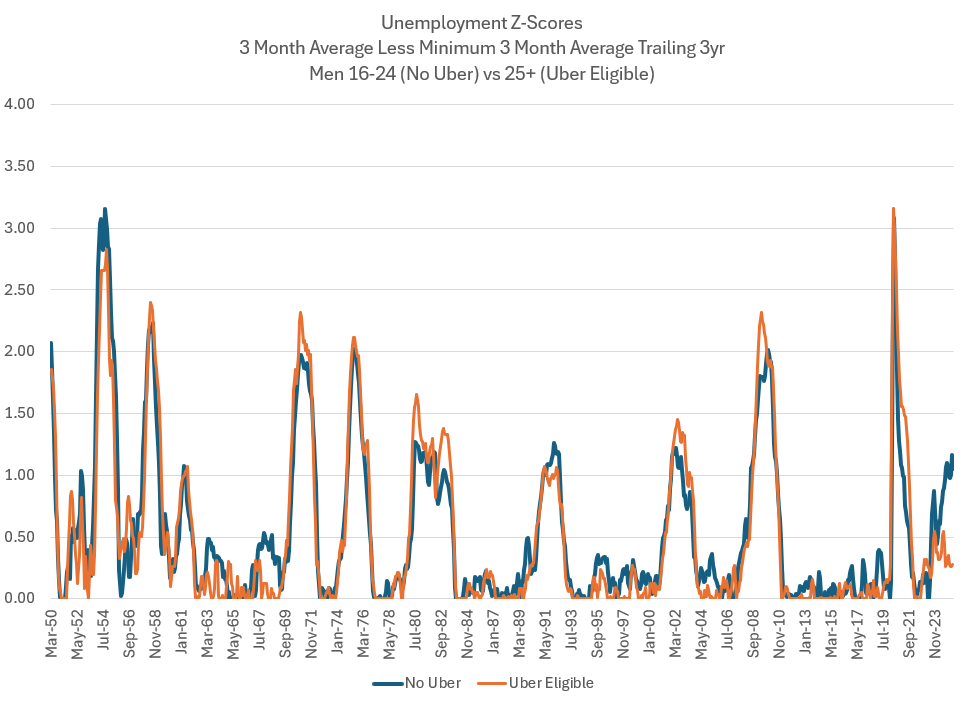

Again, one of the key tells remains the incredible divergence that has emerged between unemployment for those eligible to drive for Uber and those ineligible due to age: