Be Intentional

This dollar rally is gonna be Hugh

My Twitter break is going well, at least for me. It’s remarkable how little I miss it. When you have a somewhat obsessive need to correct the nuance, the existence of errors on the internet is a reminder that (1) the internet will always be wrong somewhere, (2) you can’t correct it all, and (3) trying leaves you drained + distracted. Freedom comes from accepting imperfection and redirecting that energy into deeper, lasting work.

I spent the last week at Hugh Hendry’s “Acid Capitalist” camp at his wonderful home in St. Barth’s, where I was fortunate enough to travel with my oldest son. While Hugh and I could not appear more different, we are in fact kindred spirits when it comes to humanity and markets — appreciating that they are at once wonderful and cruel, beautiful and broken, understandable and unknowable. The chance to enjoy a few days of relative quiet, even as looming September and October deadlines kept me productive, was deeply fulfilling. Or perhaps it was just the rum. Regardless, it was a fantastic event and following near back-to-backs in Maine at David Kotok’s “Camp Kotok” and Hugh’s Acid Capitalist, my mind is feeling flush with ideas.

Hugh made the point at the opening of the conference that St. Bart’s was not a place you visit casually. From Annapolis, it was a solid twelve-hour journey using cars, planes, and boats. Camp Kotok no different. They are intentional choices. I encourage you to spend some time evaluating this “intentional” vs “casual” dilemma. Twitter is casual interaction. St. Barts was intentional. And I enjoyed it very much.

Before I left, I had the opportunity to sit down with a younger RIA for a discussion of Bitcoin. I’m going to share that this week and ask that you please take a look. My hunch is that things are going to get weird relatively soon, and an understanding of WHY you believe what you do may well become more important than WHAT you believe.

Almost exactly six months ago, Trump and Zelensky had their little exchange in Washington. The narrative changed almost overnight from the “Golden Circle” of George Soros, which anticipated dollar strength on the back of stimulative fiscal policy, restrictive monetary policy, and a reshoring of globalized production, to an accelerating move away from the dollar.

This is a wonderful narrative that naturally resonates with Americans, who feel a relative loss of influence and power around the globe as their faith in US institutions decays. Unfortunately, it’s simply untrue.

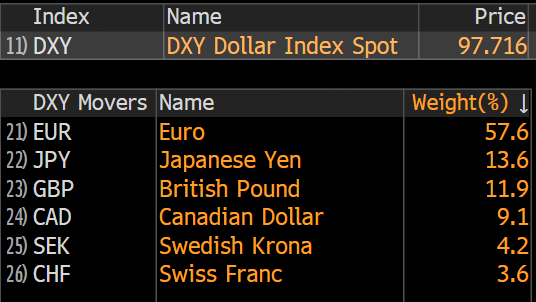

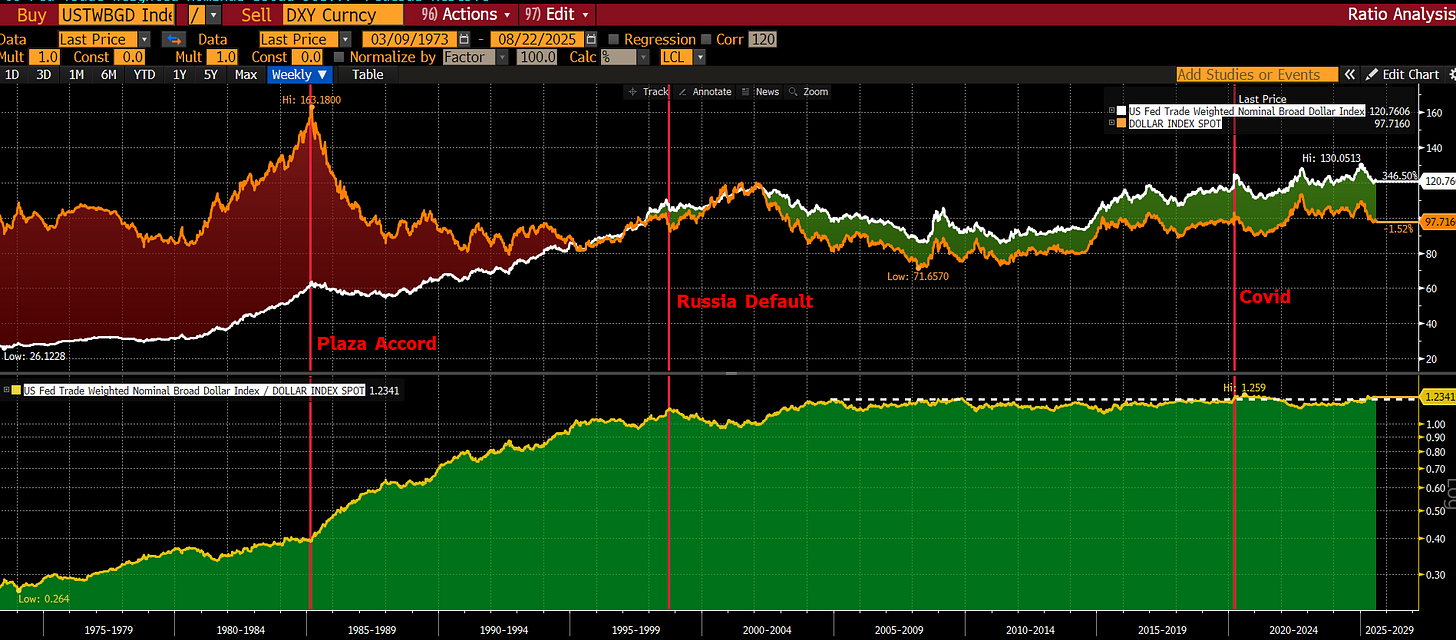

First, let’s define “the dollar.” Lazy commentary often refers to the “dollar” as the DXY index (ETF is UUP). This is not “the dollar” — it’s a basket of six major market currencies and is dominated by the Euro:

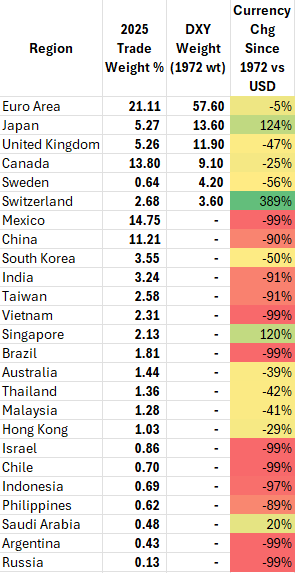

How were these weights generated? Well, that was roughly trade-weighted in 1972 and then the Euro countries were aggregated when the Euro was established in 1998. What has happened to the share of US trade with these countries? It has fallen markedly. The Eurozone and British Pound accounted for roughly 50% of US trade in 1972. Today, they have fallen to 16%. A far more interesting analysis exists in the modern US trade-weighted dollar, which makes clear that the vast majority of currencies have fallen precipitously against the US dollar:

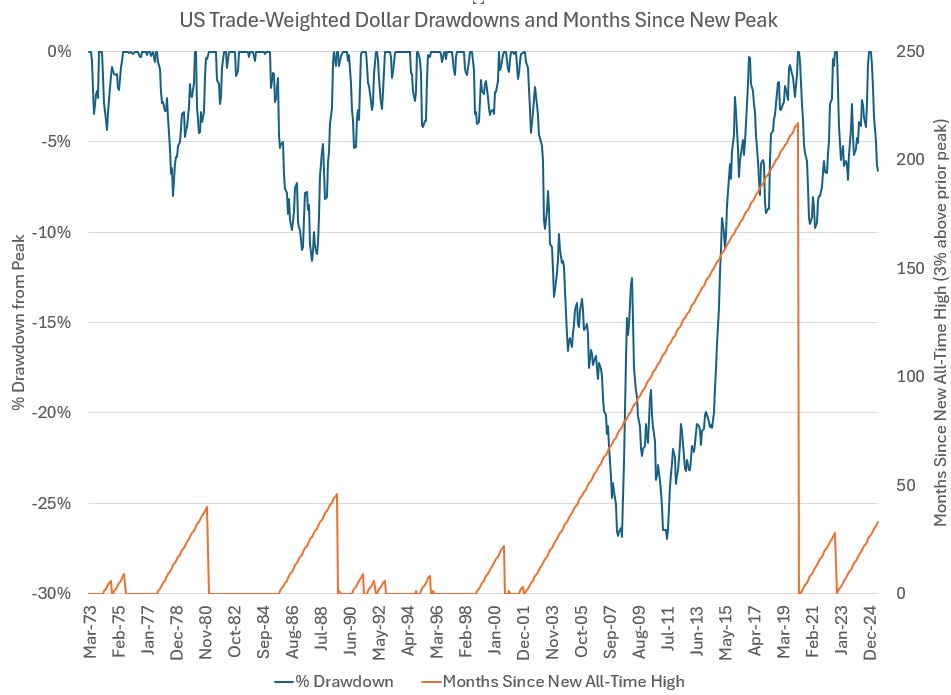

Why is this relevant? Well the simple answer is, “That’s quite enough of that!” Considering that the 2002–2010 drawdown brought the double-barreled impact of the euro’s launch and China’s WTO-era ascent as the world’s mercantilist hub, today’s slide looks far less like a regime break and more like a late-cycle purge of dollar strength on the back of anti-Trump sentiment (and tariff-evading pre-buying). The preconditions for a ‘big one’—a rival currency with trillions of freely-floating safe assets, open capital accounts, deep global repo/derivatives, and rule-of-law credibility—still don’t exist. The euro is fragmented; the RMB is not convertible; the yen is policy-capped. Until those plumbing facts change, drawdowns tend to stall roughly where they always do.

The more interesting question is why are developed market currencies “breaking out” vs the broader index?

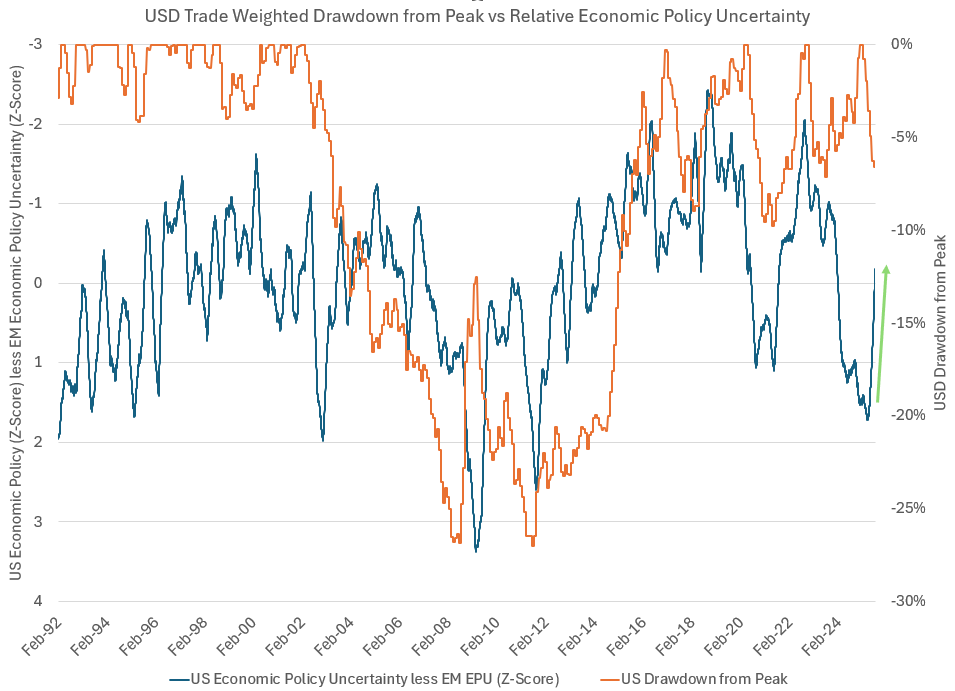

The answer, quite simply, is emerging emerging market chaos. For all the uncertainty about economic policy in the US (and to be clear, we could be doing much better), the uncertainty is even greater in the emerging markets:

YIGAF has often ridiculed the comparison between Smoot-Hawley and the current tariffs for the simple reason the US is the world’s importer today while they were playing the China role (world exporter) in 1930. You don’t retaliate against your customer — you retaliate against your competitors. I hope they are taking notes:

As always, questions, comments, and discounted Canadian, Japanese and European exports are always welcome. We’ll decide on Chinese imports in two weeks.

Mike

Excellent point on the USD losing strength vs the Euro while remaining strong on a trade-weighted basis.

I recently went on a family cruise from Boston to Quebec, and we really enjoyed Canada. Not only was the food fantastic, but the cities were clean and the dollar was very strong. I could suddenly see why the narratives persist about Canadians not visiting the US, because the CAD was only $0.70. No one discussed politics on the trip, which was also refreshing. We’re actually planning to go to Montreal over Thanksgiving this year to take advantage of the 4 day weekend.

I haven’t seen anything from Hugh Hendry recently, but last I saw he has been on your side, meaning disinflation/deflation and bullish on treasuries. I lean that way as well with the old bonds/bullion barbell idea, but I’m slowly shifting my gold & uranium mining gains into TLT.

Another excellent post Michael! Here’s hoping it moves the broader audience on X to adopt a less Mad Max more Jason Bourne approach